Hey there! If you're looking to streamline your financial processes, understanding the importance of an invoice audit trail is essential. An organized audit trail helps ensure transparency and accuracy in your transactions, making it easier to verify expenses and prepare for tax season. Curious about how to create an effective letter template for requesting this audit trail? Dive in to discover tips and examples that will simplify your request!

Contact information of requesting party

Contact information is vital for the invoice audit trail request process. Essential details should include the name of the requesting party, such as John Smith, the position held (Accounts Payable Manager), organization name (ABC Corporation), complete mailing address (123 Business Rd, Suite 456, Cityville, ST 78901), email address (john.smith@abccorp.com), and phone number (555-123-4567). Additional context may involve the relevant department within the organization that deals with finance, ensuring the request is directed accurately for prompt handling. Providing a clear reference number for the related invoice can also assist in the efficient retrieval of needed documents.

Specific invoice details (invoice number, date, amount)

An invoice audit trail request requires specific details to ensure accuracy and efficiency. The critical components include the invoice number (an alphanumeric identifier assigned to the invoice for tracking), the invoice date (the date the invoice was issued, impacting payment timelines), and the amount (the total monetary value due, often reflecting the services or products provided). Collecting this information enables the financial department to trace the invoice's journey through accounting, verify transactions, and confirm compliance with financial regulations and agreements. Such a systematic approach is essential for maintaining financial transparency and accountability within organizations.

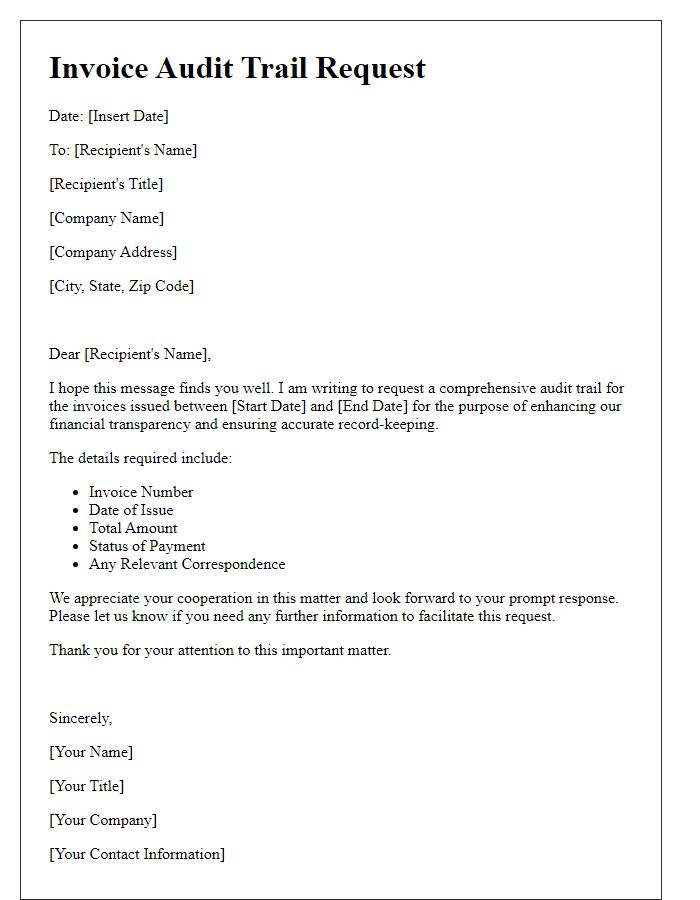

Clear request statement for audit trail

An audit trail request for an invoice involves a systematic review of document trails to ensure accuracy and traceability in financial transactions. This request typically includes details such as invoice numbers, transaction dates, vendor names, and amounts involved, which are essential for identifying specific invoices (e.g., Invoice #12345 dated January 15, 2023, for $2,500 from XYZ Corporation). Additionally, it requires specifics on the system used for tracking (like SAP or QuickBooks) to facilitate easy access to pertinent records. Proper documentation retrieval enhances transparency in financial auditing and ensures compliance with regulatory standards. Such a request may also necessitate a timeline for response, demanding timely cooperation from involved parties to maintain integrity in financial reporting.

Deadline for response

An invoice audit trail request is essential for financial transparency, often required during audits to verify the accuracy of account transactions. A response to this request needs to be submitted by a specific deadline, often set at 14 days after the initial inquiry is received. This timeline is crucial, as it allows auditors to review documents related to transactions, such as invoices from various suppliers and payment receipts, ensuring compliance with financial regulations and standards. Delays in gathering this documentation can hinder the audit process, potentially leading to discrepancies in financial reporting or compliance issues with regulatory bodies like the Securities and Exchange Commission (SEC) or the Internal Revenue Service (IRS). Prompt responses facilitate a smoother audit experience and promote trust and accountability between stakeholders.

Contact information for follow-up or questions

The process for an invoice audit trail request typically requires detailed contact information to facilitate follow-ups or address any questions. Essential components include a primary contact name, for instance, John Smith, along with a direct phone number, such as (555) 123-4567, and a professional email address, for example, john.smith@company.com. Additionally, including the organization's name and address, like ABC Corporation, 123 Main Street, Suite 200, Springfield, IL 62701, enhances authenticity and ensures clarity in communication. Specifying business hours, for example, Monday to Friday, 9 AM to 5 PM CST, allows for timely interactions. Clear contact information fosters efficiency and accuracy during the audit trail inquiry, leading to expedited resolution of any issues.

Letter Template For Invoice Audit Trail Request Samples

Letter template of invoice audit trail request for financial documentation.

Letter template of invoice audit trail request for internal review process.

Letter template of invoice audit trail request for account reconciliation.

Letter template of invoice audit trail request for regulatory compliance.

Comments