Are you tired of dealing with confusing billing cycles that make it hard to keep track of your expenses? We understand how frustrating it can be to manage your finances when billing dates are inconsistent or misaligned with your pay schedule. That's why we're excited to share tips on how to effectively revise your billing cycle arrangements for a smoother and more manageable experience. Join us as we dive deeper into this topic and discover ways to simplify your billing process!

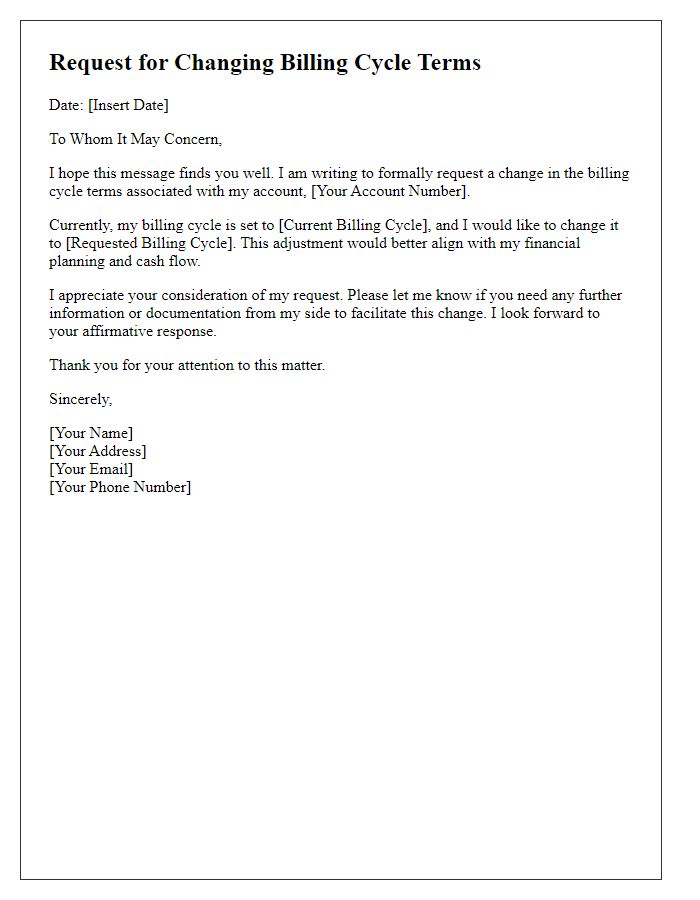

Salutation and Recipient's Name

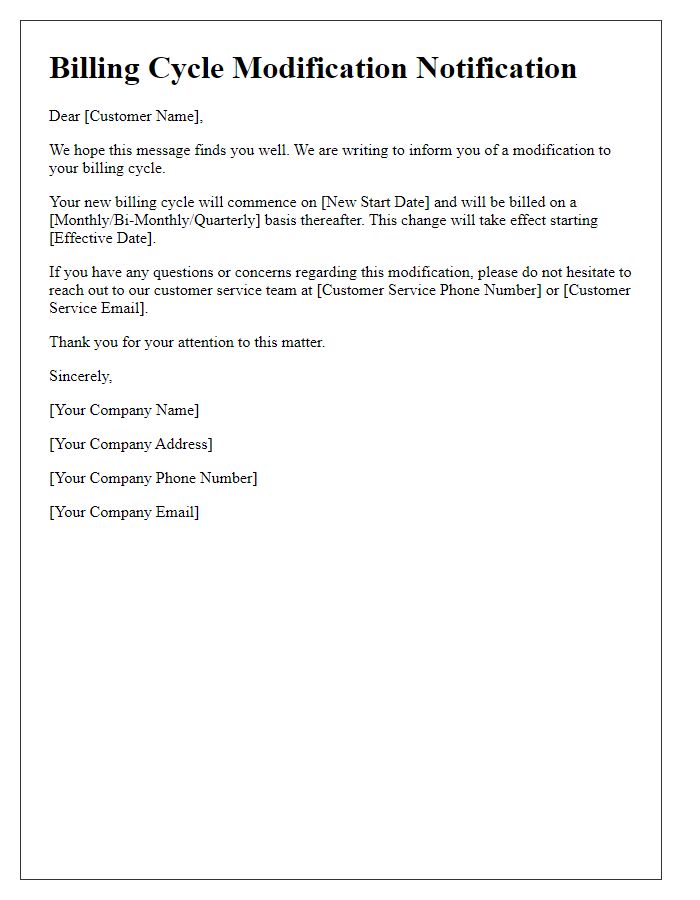

Revised billing cycle arrangements may influence financial management for businesses. Adjustments could optimize cash flow, ensuring timely payments to suppliers and service providers. A consistent billing cycle, such as monthly or quarterly, may aid in budgeting, reducing administrative efforts associated with invoicing. Notable entities involved in this process include the finance department within an organization and vendors receiving payments. Additionally, legal considerations may arise regarding payment terms outlined in contracts. Evaluating the effectiveness of billing cycles periodically can enhance overall operational efficiency, impacting profitability positively.

Introduction and Purpose Statement

A revised billing cycle arrangement can lead to improved cash flow management for businesses and enhanced payment scheduling for customers. This adjustment aims to align payment due dates with revenue generation cycles, ensuring timely payments and reducing administrative burdens. Transitioning to a more efficient billing cycle supports financial planning, fosters better customer relationships, and minimizes late fees related to payment delays. Evaluation of this new billing structure can be facilitated through customer feedback and data analysis, ultimately contributing to a streamlined financial process.

Current Billing Cycle Description

The current billing cycle is established as a 30-day period that begins on the first day of each month and ends on the last day. Billing occurs on the last day of each cycle, with invoices issued for services rendered during that period. For example, the billing statement for January will be generated on January 31, outlining usage and charges from January 1 to January 30. Payment is typically due within 15 days of receipt of the invoice, promoting timely processing. This cycle affects all accounts, including residential and commercial, influencing cash flow and service continuity. Adjustments to this cycle can impact billing consistency and customer satisfaction if not communicated effectively.

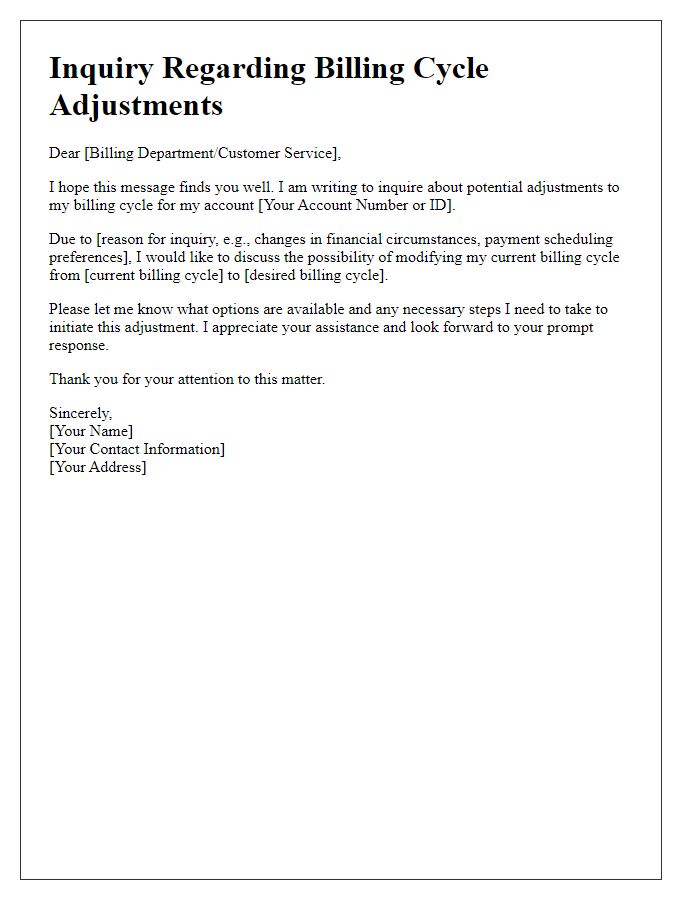

Proposed Billing Cycle Changes

Proposed billing cycle changes can significantly impact cash flow management for businesses. For instance, transitioning from a monthly billing cycle to a bi-weekly schedule may improve financial liquidity by receiving payments more frequently, such as every two weeks instead of once a month. This adjustment can align better with expenses that occur on a bi-weekly basis, providing a more consistent cash inflow. It's essential to evaluate the effects of proposed changes on both operational efficiency and customer satisfaction, considering how frequent billing might influence payment behavior. Furthermore, ensuring clear communication regarding any changes to the billing cycle is crucial to maintain transparent relationships with clients.

Contact Information for Further Queries

Contact information for further queries regarding billing cycle arrangements is essential for ensuring clear communication. Typically, customers should reach out to the billing department (at a specific phone number, e.g., +1-800-123-4567) or email address (e.g., billing@company.com) for assistance. Additionally, the customer service hours, often Monday to Friday from 9 AM to 5 PM (local time), provide a timeframe for when support is available. Including a physical mailing address (like 123 Business St, Suite 101, City, State, Zip Code) may also be beneficial for formal correspondence. Prompt response times and dedicated support teams enhance customer satisfaction and facilitate smooth billing cycle management.

Comments