Hey there! We all know that keeping track of invoices can sometimes feel like a juggling act, especially when details matter the most. That's why it's essential to cross-check every aspect to ensure accuracy and avoid any hiccups down the line. If you're looking for a straightforward template to help you streamline this process, you're in the right place. Read on to discover a useful letter template that makes cross-checking a breeze!

Invoice Number and Date

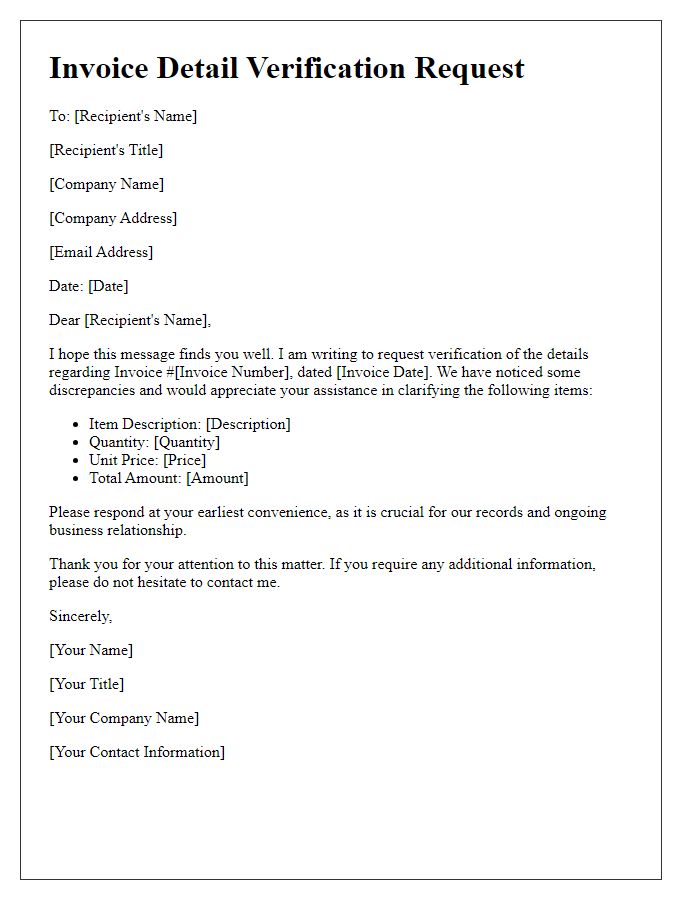

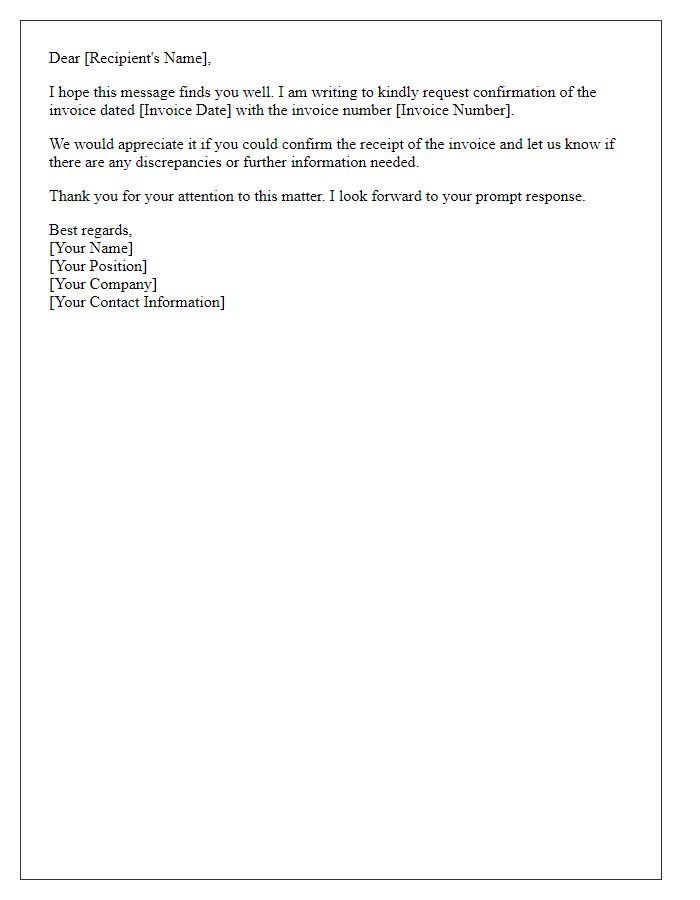

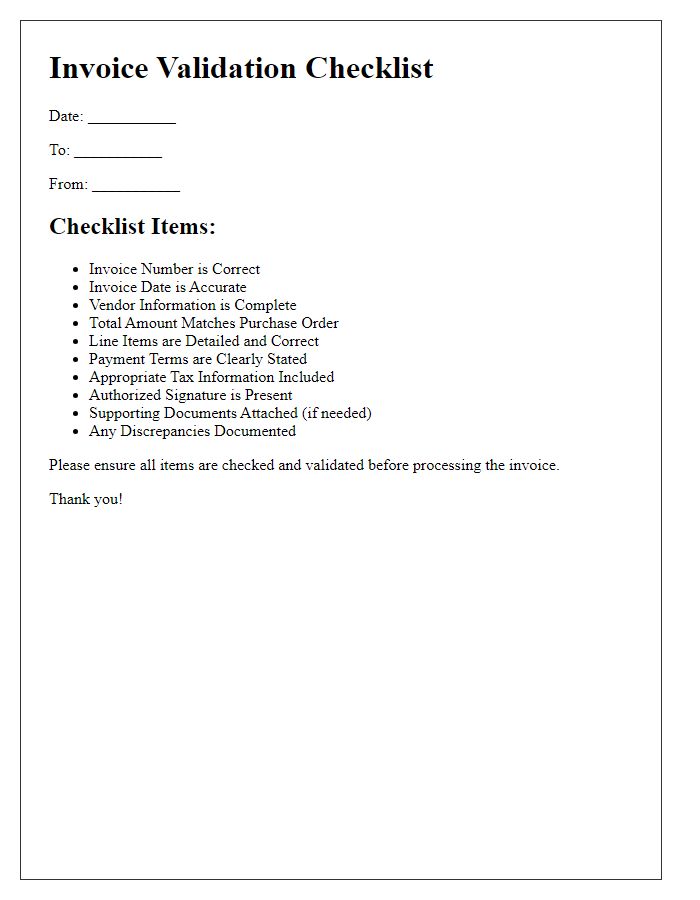

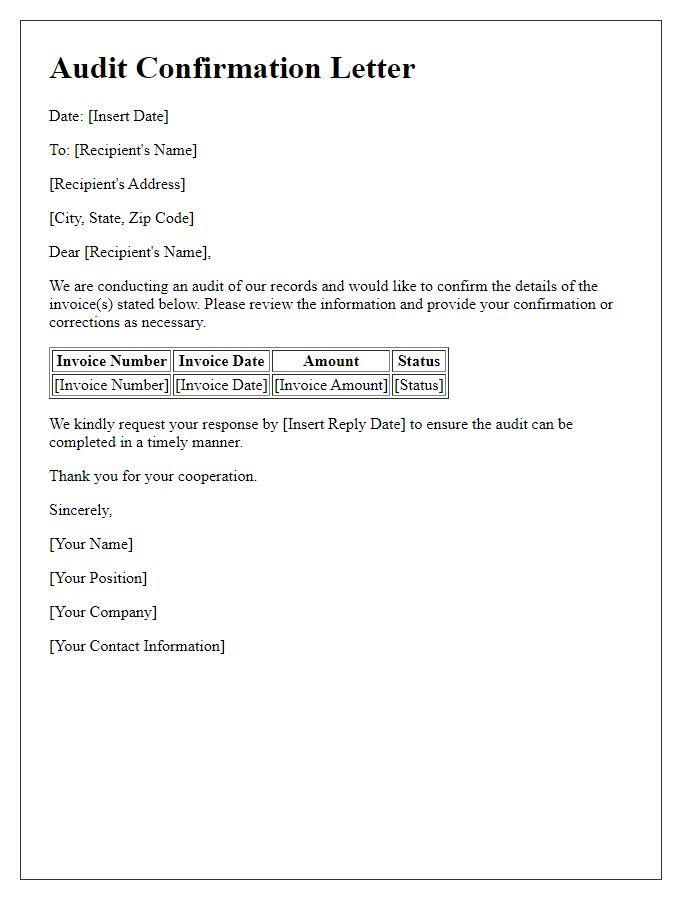

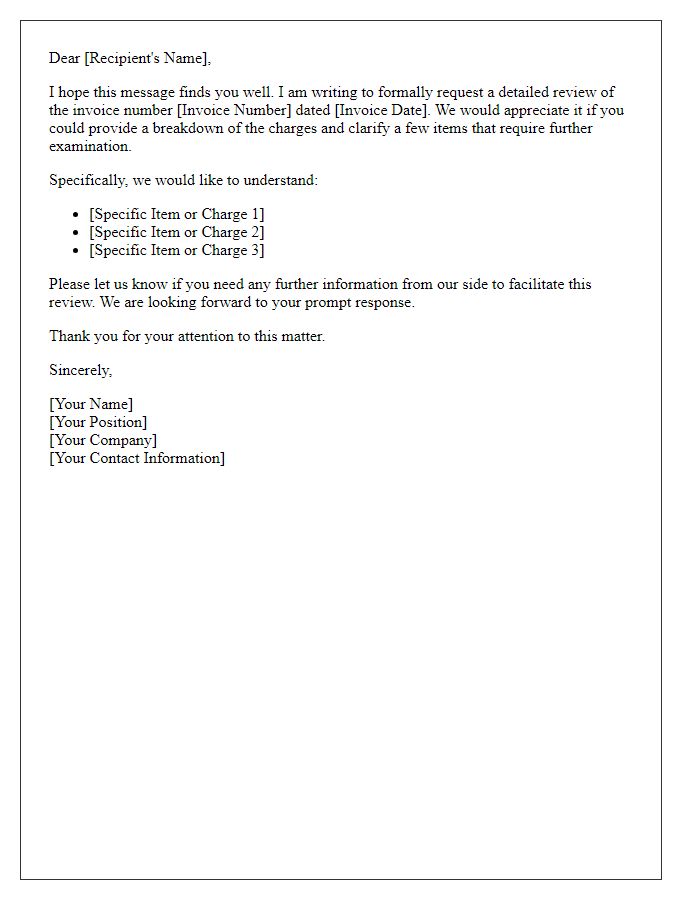

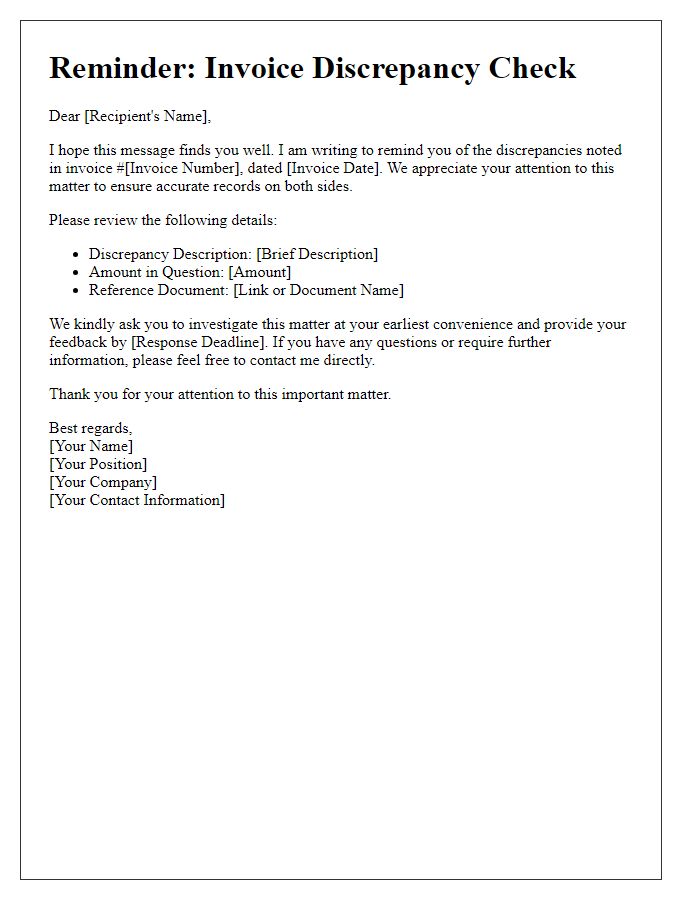

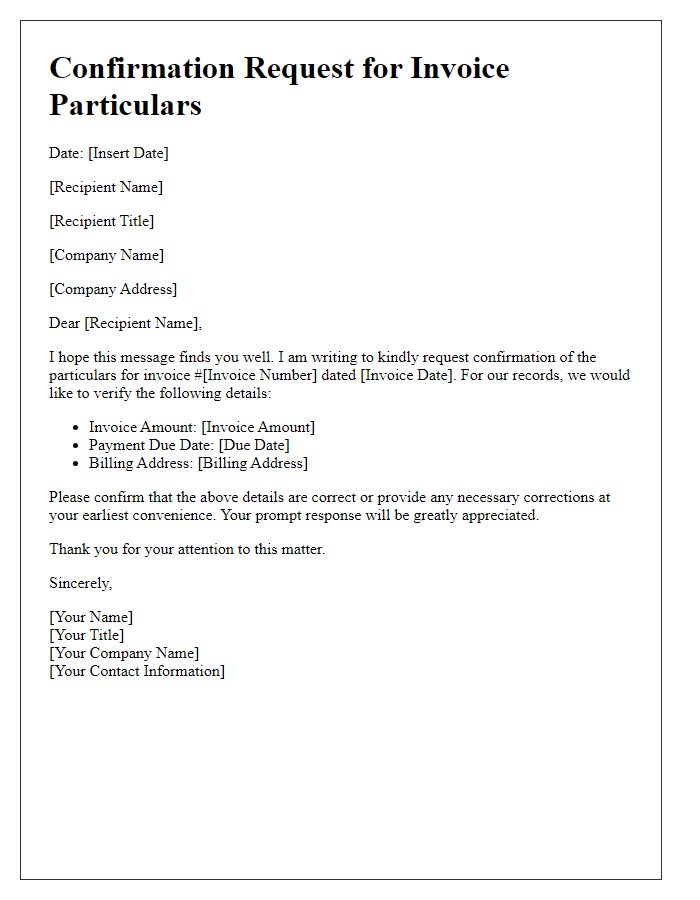

Invoice verification is crucial in financial transactions within businesses. The invoice number serves as a unique identifier, often formatted as a string of alphanumeric characters, which facilitates tracking and reconciliation in accounting systems. The date of the invoice indicates when the service or product was rendered, providing necessary context for payment timelines. Ensuring that invoice details align with purchase orders and services delivered avoids discrepancies that may lead to disputes. Accurate documentation not only upholds financial integrity but also streamlines audits and financial assessments.

Itemized List of Goods/Services

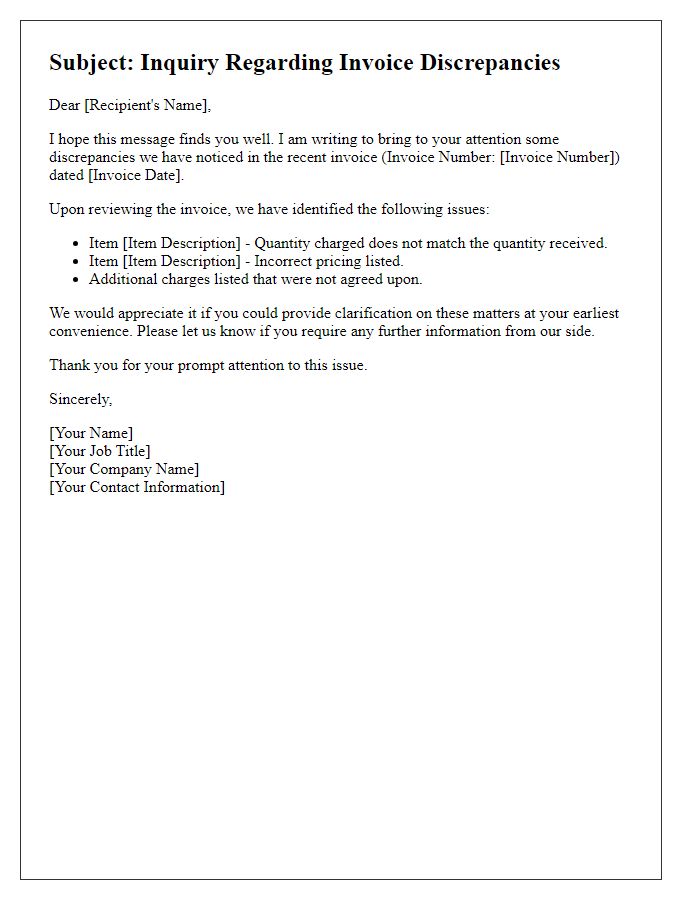

Cross-checking invoice details involves verifying the accuracy of the itemized list of goods and services presented. Each entry must include specific details such as product name, SKU (Stock Keeping Unit), quantity ordered, unit price, and total price for clarity. For instance, an electronic device such as a smartphone may have specifications detailing its model number (e.g., Galaxy S21) along with its corresponding quantity (e.g., 5 units) and unit price ($799). Services rendered, like graphic design, should list the project name, hours worked (e.g., 20 hours), and hourly rates ($50/hour). Inaccuracies in these details could lead to disputes and require immediate attention to ensure the integrity of the financial transaction.

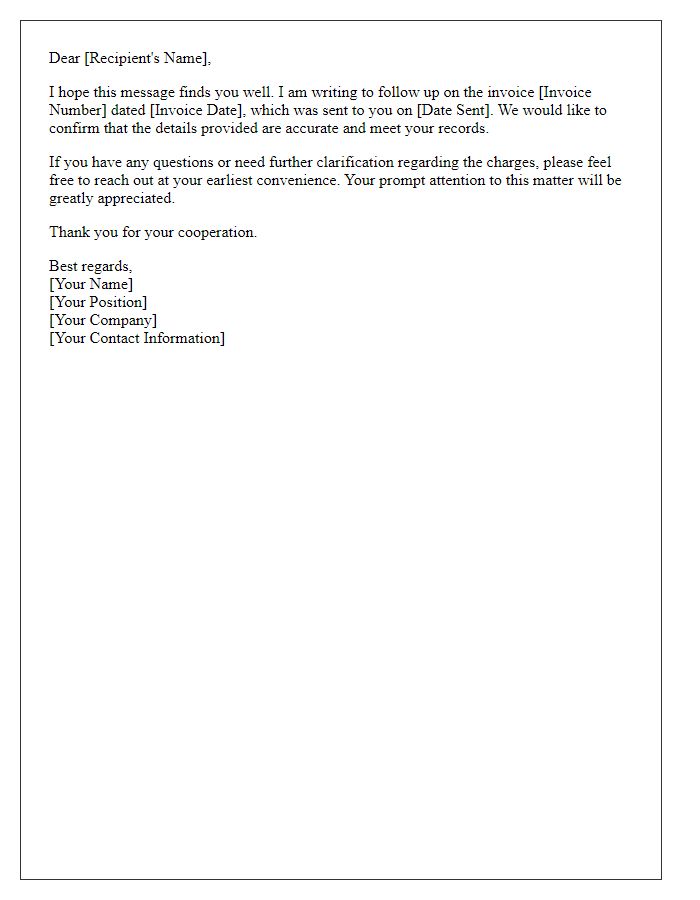

Payment Terms and Due Date

When reviewing invoice details, the importance of clear payment terms and due dates cannot be overstated. Accurate payment terms outline specific conditions for payment, such as net 30 or net 60, indicating that the total invoice amount should be paid within that timeframe from the invoice issuance date. Due dates represent the exact day by which payment must be received, often specified in accordance with the agreed-upon terms. Failure to adhere to these terms can result in late fees or penalties. Therefore, both parties involved in the transaction--usually a service provider and a corporate client--should double-check every detail to ensure alignment and avoid potential disputes related to payment discrepancies.

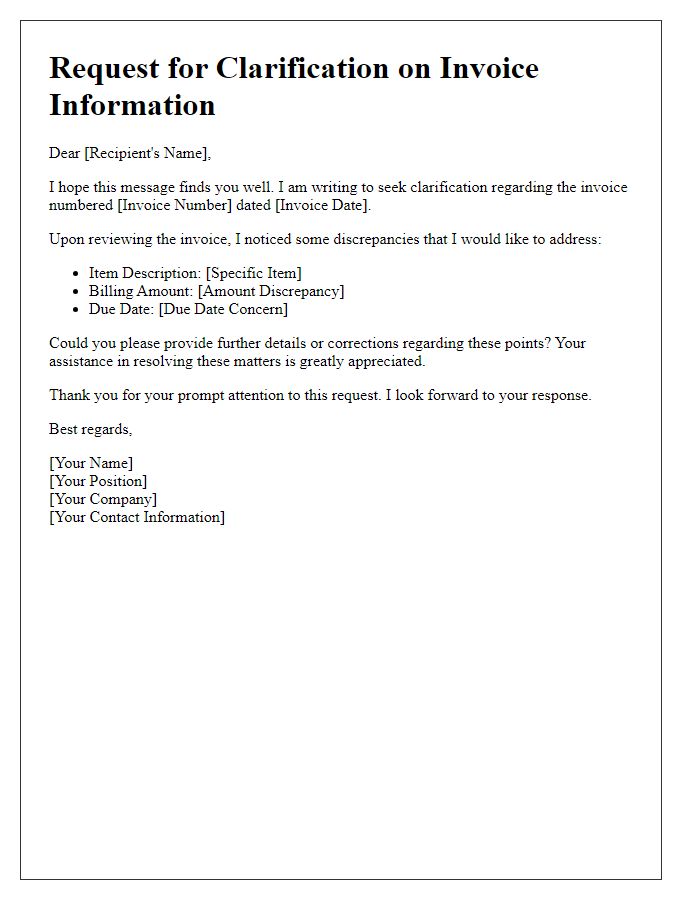

Contact Information for Discrepancies

Invoices often contain critical details that require careful verification to ensure accurate financial transactions. Key components include invoice numbers, dates of issue, and payment terms, which should align with contractual agreements. If discrepancies arise, contacting the accounts payable department is essential, typically reaching out via email or phone. Ensure that the point of contact has access to supporting documentation like purchase orders or previous correspondence. Double-checking amounts due, tax calculations, and line item descriptions can prevent payment delays and promote smoother business operations. Ensuring clear communication can foster better relationships and trust between vendors and clients.

Detailed Payment Instructions

Invoice verification is crucial in maintaining accuracy within financial transactions. Essential details include invoice number (unique identifier), vendor name (company or individual), date issued (when the invoice was generated), due date (when payment is required), and payment amount (total owed). Payment methods such as bank transfer (often includes account details), credit card (transaction fees may apply), or check (requires mailing address) should be specified. Attachments may include the original invoice (for reference) and any relevant contracts (binding agreements). Cross-checking these elements ensures agreement between services rendered and expected compensation, preventing miscommunication or disputes.

Comments