Are you looking to enhance your financial operations? Introducing new payment terms can streamline processes and improve cash flow for your business. In this article, we'll guide you through the essentials of crafting an effective letter to communicate these changes with clarity and professionalism. Ready to dive in and ensure a smooth transition for all parties involved?

Clear and concise communication.

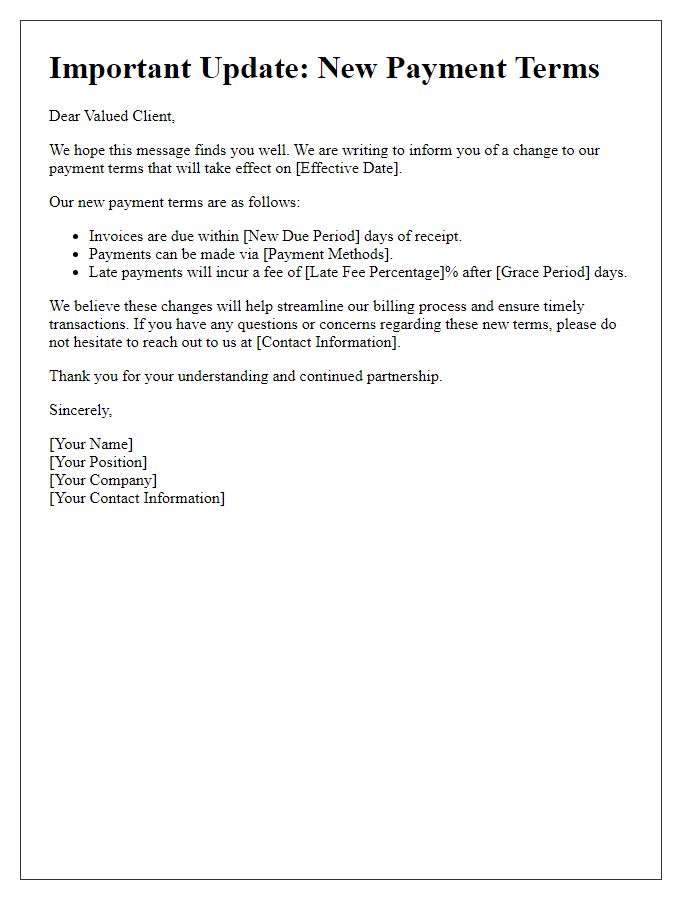

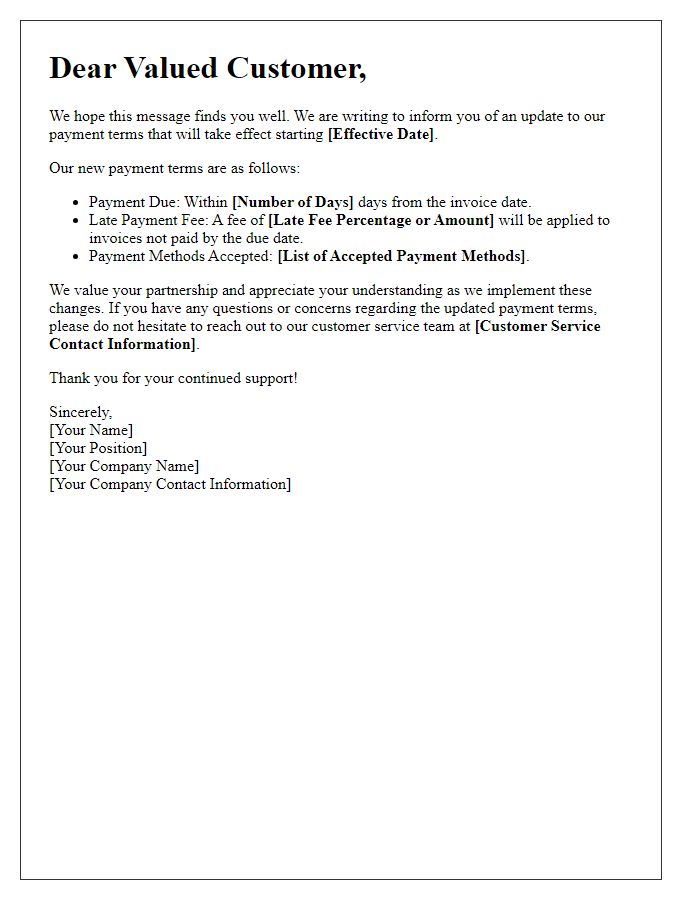

Introducing new payment terms can streamline financial processes in businesses and enhance cash flow management. Effective communication regarding changes, such as a shift from Net 30 to Net 45 payment terms, can minimize confusion. Establishing clarity about these terms ensures all stakeholders, including clients and suppliers, understand their payment obligations. The new payment timeline may improve budgeting efforts and predictability for cash flow management. Providing written documentation in an email or formal letter format, specifying effective date and reasons for the changes, reinforces transparency and fosters strong business relationships. A clear call to action encouraging questions or concerns helps maintain open channels of communication.

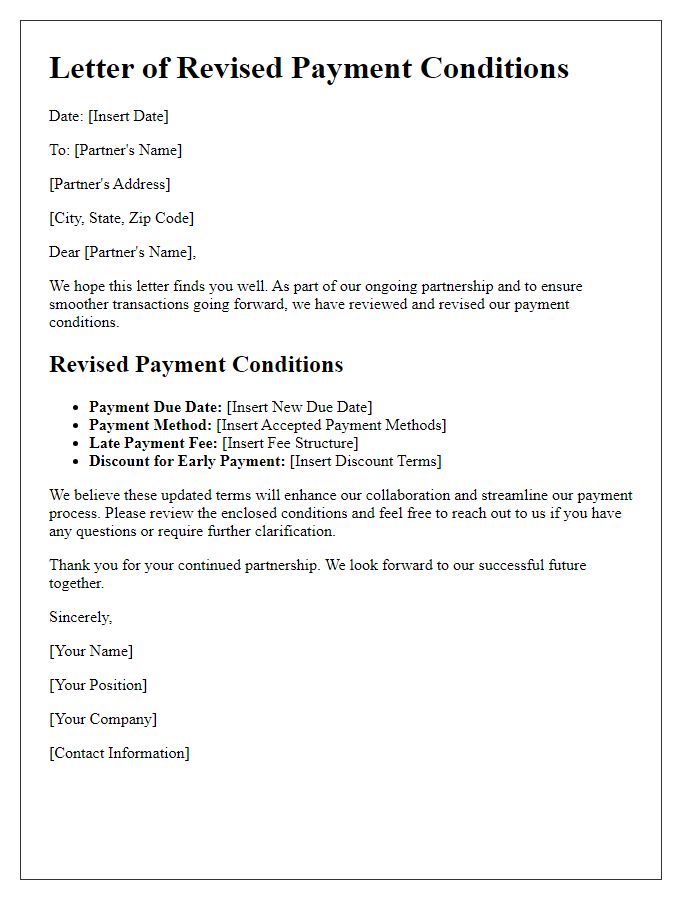

Explanation of new terms and conditions.

The introduction of new payment terms transforms financial interactions between businesses, enhancing clarity and efficiency. These updated terms specify payment deadlines, emphasizing net 30 days from the invoice date, which aligns with industry standards. Businesses are encouraged to utilize electronic payment systems, such as ACH transfers, to streamline transactions. Late fees, calculated at 1.5% per month, will apply to overdue invoices, ensuring timely payments. Furthermore, discounts of 2% will be offered for early payments made within 10 days, incentivizing prompt settlement. These changes aim to improve cash flow management, strengthen supplier relationships, and foster a more predictable financial environment.

Benefits for the recipient.

Introducing new payment terms can enhance financial flexibility for clients, particularly in sectors such as retail or services. Extended payment periods allow businesses to manage cash flow more effectively, improving liquidity management in various industries. Discounts for early payments incentivize prompt transactions, leading to enhanced customer relationships and increased repeat business. This change can also reduce late payment risks, ensuring smoother operations for both parties. Clear communication regarding these new terms, including specific dates and percentages, is crucial for seamless implementation and building trust with clients. Positive adjustments can lead to higher customer satisfaction rates and retention, benefiting overall business performance.

Transition timeline and implementation date.

The introduction of new payment terms, specifically concerning the implementation date of January 1, 2024, signifies a strategic shift for financial operations. Key stakeholders, including vendors and clients, will receive comprehensive guidelines and support during the transition timeline, which spans from December 1 to December 31, 2023. Training sessions and informational resources regarding these terms will be available to ensure clarity and effective adoption. Additionally, the anticipated adjustments may influence cash flow management and accounting practices, necessitating meticulous planning and collaboration among all affected parties to ensure seamless integration into existing workflows.

Contact information for questions or support.

Introducing revised payment terms can greatly impact financial practices within organizations. Updated practices, effective from January 1, 2024, will include net 30 payment terms for all invoices exceeding $500. Previously, the terms varied, often creating confusion and delays in cash flow. For any inquiries or support concerning these new conditions, individuals can contact the finance department via email at finance@company.com or by phone at (555) 123-4567. Emphasizing clarity, this initiative aims to enhance operational efficiency and improve working relationships with partners and vendors alike.

Comments