Are you tired of missing payment deadlines or dealing with late fees? Setting up a recurring payment system can simplify your finances and give you peace of mind. With just a few simple steps, you can ensure that your bills are paid on time, every time, without the hassle of manual transactions. Curious about how to get started? Read on to discover our easy guide to setting up recurring payments!

Clear subject line.

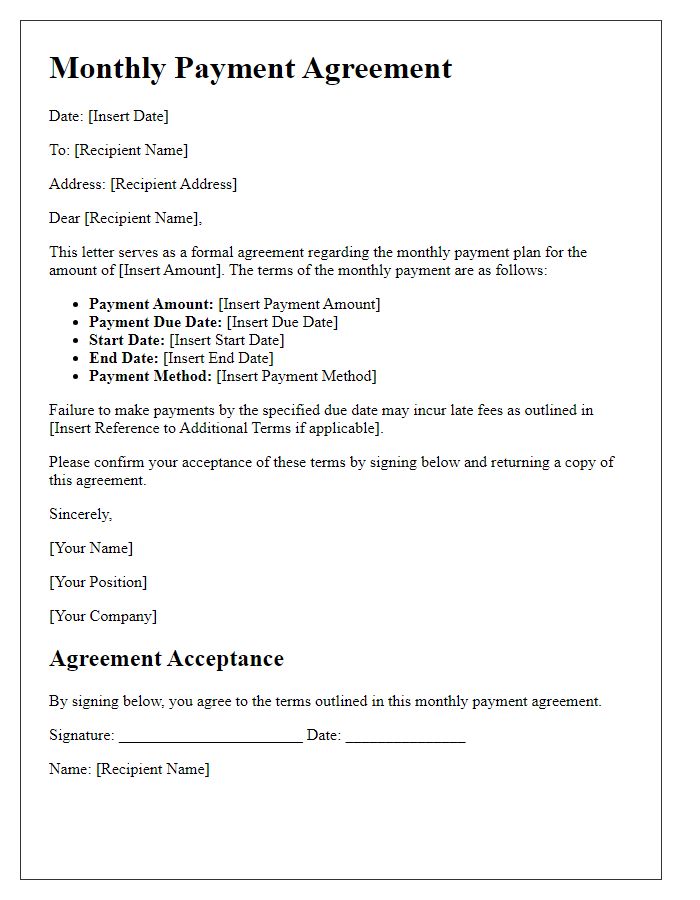

Recurring payment setups facilitate convenient and automated financial transactions, improving cash flow management for both businesses and customers. Typical setups include monthly, quarterly, or annual payments, tailored to services like subscriptions, memberships, or utility bills. Clear communication of payment dates, amounts, and frequency enhances understanding and reduces disputes. Utilization of secure payment platforms, such as PayPal or Stripe, ensures transactional safety while offering options for credit card or direct debit payments. Including detailed terms regarding cancellations, refund policies, and contact information for support fosters transparency and trust. Additionally, compliance with regulations, such as the Payment Services Directive (PSD2) in the European Union, is essential for legal integrity in processing repeating payments.

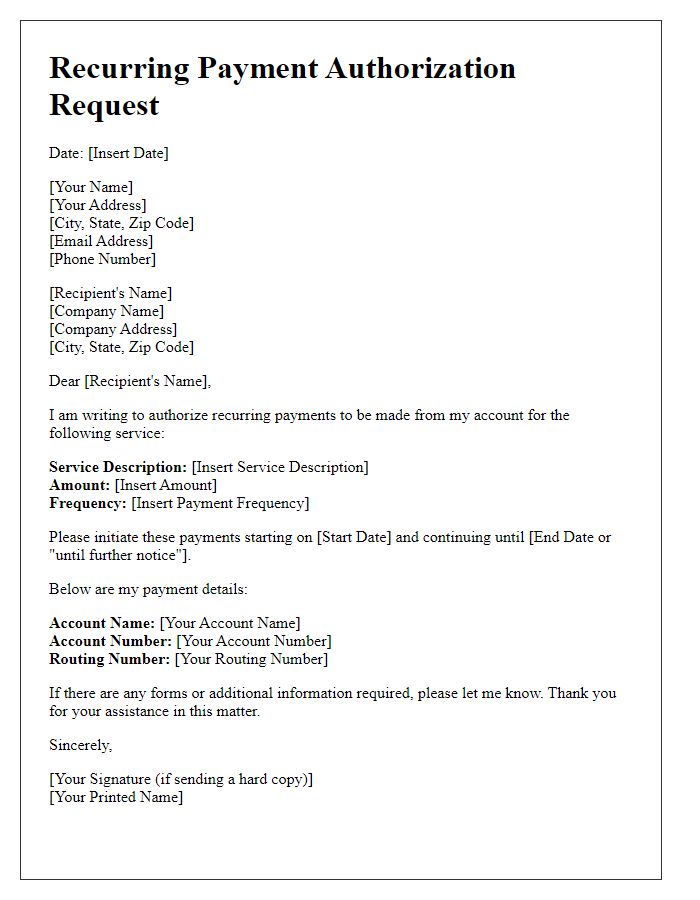

Recipient's contact information.

Recipient's contact information includes essential details necessary for establishing clear communication regarding the recurring payment setup. This may consist of the recipient's full name, which identifies the individual or organization; the physical address, which facilitates any required postal correspondence; the email address, vital for electronic communication and confirmation of transactions; and the telephone number, enabling direct contact for any queries or clarifications. Including this information ensures all parties are informed and can efficiently manage any issues that may arise during the payment process.

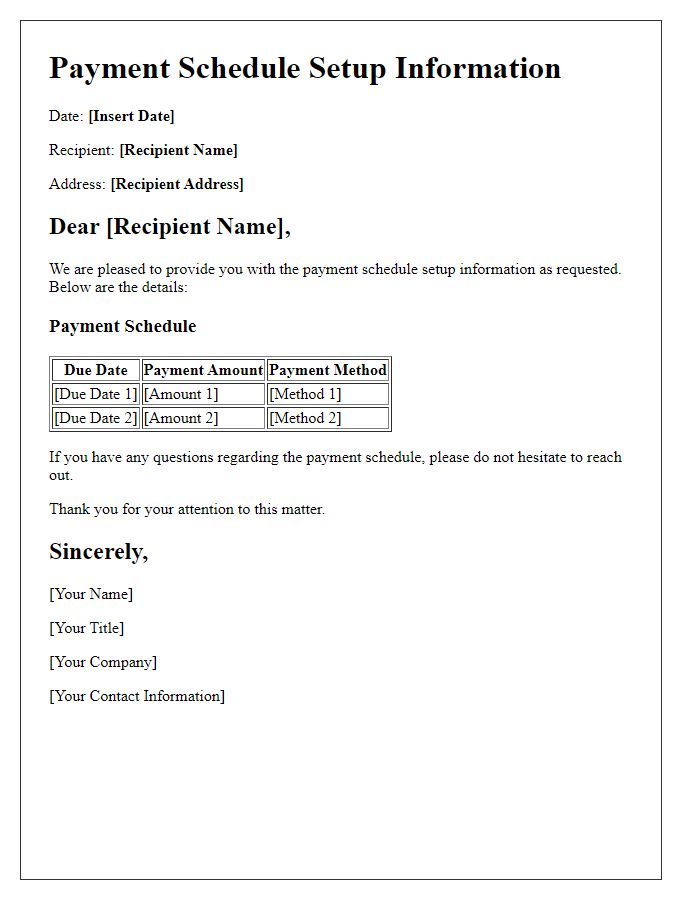

Payment details and schedule.

Recurring payment setups enable automated transactions for services or subscriptions. Users typically need to provide their payment details, including credit card numbers, account types, and expiration dates. The schedule often includes payment frequency options, such as monthly or quarterly intervals, with specific start dates (e.g., 1st of the month) to ensure timely processing. Payment processors, such as PayPal or Stripe, securely manage these transactions to prevent unauthorized access. Confirmation emails or receipts, sent after each transaction, help track payments easily. Users should regularly review their financial statements to verify transaction accuracy.

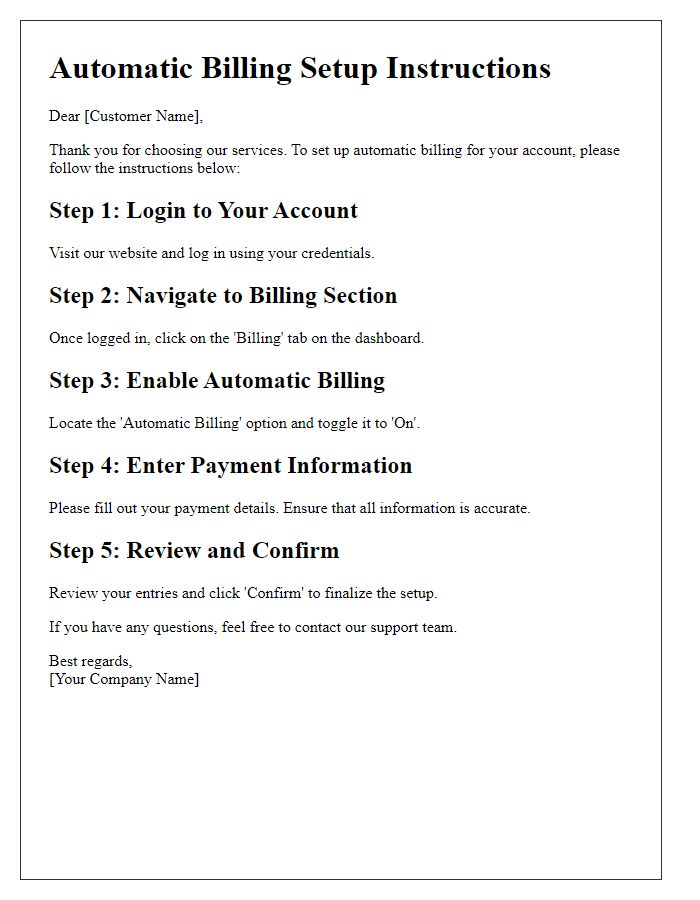

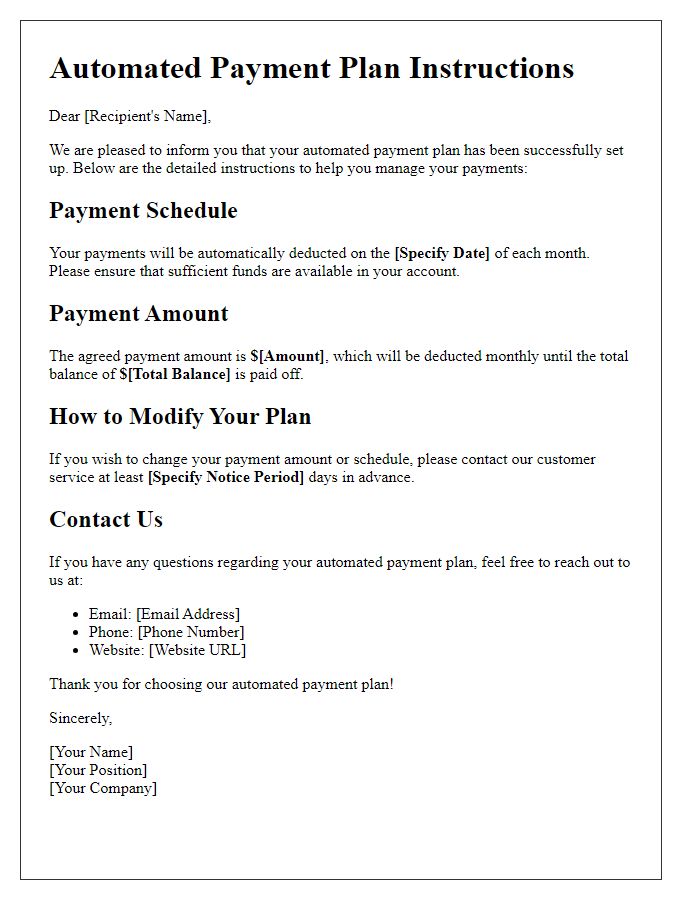

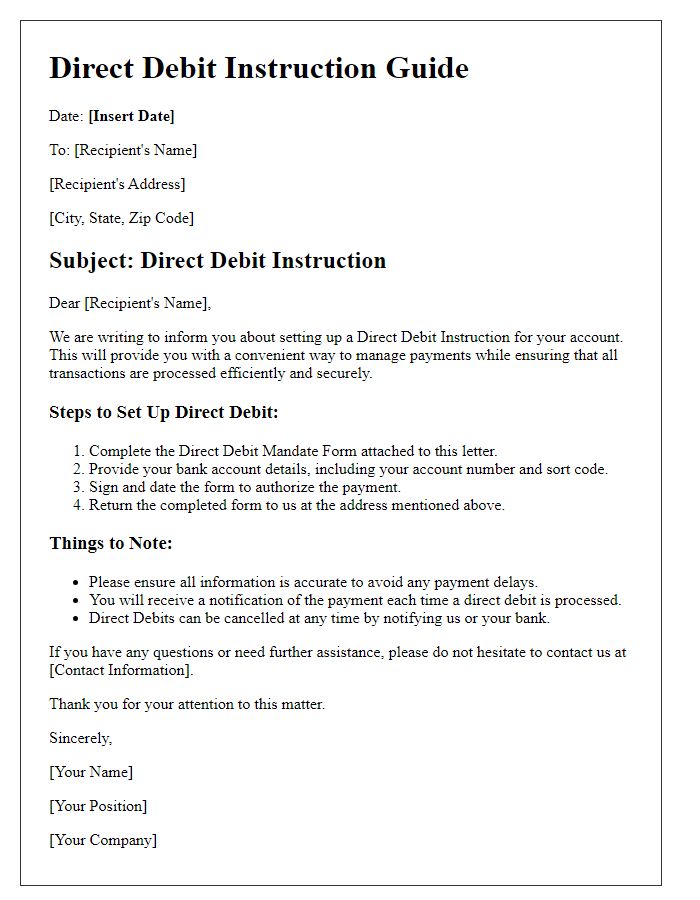

Instructions for setup.

Recurring payment setups streamline financial transactions, such as monthly subscriptions or automated bill payments, making them convenient for users. Clear instructions are vital for ensuring successful setup. Users should access their online banking portal or payment service provider, like PayPal or Stripe, and navigate to the payments section. After selecting recurring payments, users input relevant details, including the amount ($50 monthly for a gym membership, for example), payment method (credit card or bank account), and start date (the first of the month). Users should also review terms and conditions, including cancellation policies and transaction fees, which average 2-3% of each payment. After confirming the setup, an email receipt should be generated for record-keeping.

Contact information for support.

Recurring payment setup, crucial for automated billing, requires precise instructions to ensure seamless transactions. Typically, payment platforms such as PayPal or Stripe offer detailed guides to assist users in configuring monthly payments efficiently. Users must verify account details including bank account number or card information to prevent interruptions. For assistance, support teams are usually reachable via dedicated contact channels such as a 24/7 hotline or online chat, offering help for common issues like payment failures or subscription updates. Contact information often includes an email address for inquiries, ensuring prompt resolution.

Comments