Are you feeling the financial pinch while managing your business expenses? Extended payment terms can be a game changer, offering you the flexibility to better manage cash flow and intensify your growth potential. In this article, we'll explore how negotiating these terms with suppliers can lead to greater financial stability and increased opportunities. So, let's dive in and see how you can leverage this strategy to elevate your business!

Understanding of Client's Financial Situation

Understanding a client's financial situation entails an in-depth evaluation of their unique fiscal landscape, characterized by variables such as cash flow, outstanding invoices, operational expenses, and revenue streams. Assessing aspects like payment cycles (typically 30 to 90 days for many industries) reveals how quickly the client can mobilize funds to settle debts. Factors like seasonal fluctuations in income and unexpected financial hardships, such as economic downturns or supply chain disruptions, can further complicate their ability to adhere to standard payment schedules. Additionally, understanding the client's credit history and current outstanding obligations (potentially reaching into the thousands or millions) provides valuable insight into their overall financial health and capability to meet financial commitments.

Articulation of Mutual Benefits

Extended payment terms can provide strategic advantages for businesses, easing cash flow management and enhancing financial flexibility. For companies aiming to invest in growth initiatives, such as expanding product lines or increasing inventory levels, longer payment periods can free up critical operating capital. Networking with suppliers for this arrangement can strengthen partnerships, allowing businesses to negotiate terms that foster mutual profitability. In regions with fluctuating economic conditions, companies can better navigate unforeseen expenses while maintaining relationships with stakeholders. Furthermore, extended payment terms can improve supplier loyalty, as consistent order volumes assure revenue stability. This collaboration ultimately creates a win-win scenario, where suppliers benefit from ongoing business and companies support their financial sustainability during growth phases.

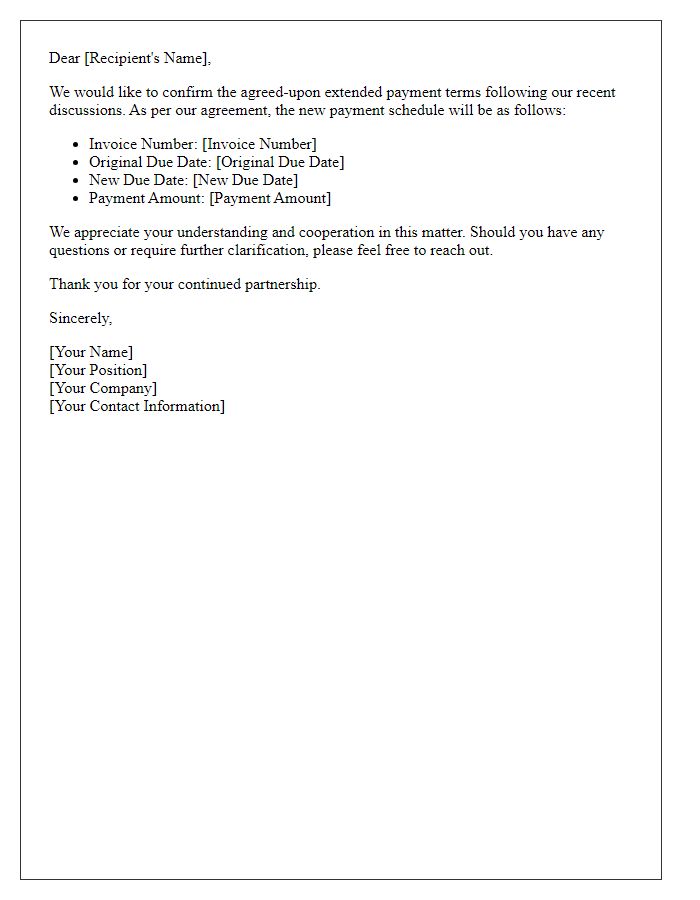

Clear Proposal for Extended Terms

Extended payment terms, often sought by businesses during financial negotiations, provide flexibility in managing cash flow and optimizing working capital. Companies may propose a 60 to 90-day payment period instead of the traditional 30 days, allowing them to allocate resources effectively. This adjustment can significantly impact supplier relationships, especially for high-volume transactions exceeding $100,000 monthly. Industries such as manufacturing and retail frequently utilize extended terms to enhance inventory turnover, mitigate cash strain during peak seasons, or align with larger contracts. Properly negotiated terms can result in increased order volumes, improved supplier partnerships, and a more resilient business model in fluctuating economic climates.

Justification for Request

Businesses often seek extended payment terms to improve cash flow management and facilitate growth opportunities. Extended payment terms, such as net 60 or net 90 days, can alleviate pressure on working capital, allowing organizations to allocate resources to operational needs, such as inventory acquisition or workforce expansion. For instance, a small manufacturing company might benefit significantly from longer payment durations, enabling them to fulfill production orders without immediate financial strain. Furthermore, strategic suppliers might offer discounts or incentives to strengthen business relationships when longer terms are negotiated, enhancing the overall supply chain efficiency. In times of economic uncertainty, such as during a market downturn or supply chain disruptions, extended payment terms become crucial for maintaining stability and ensuring business continuity.

Assurance of Continued Partnership

Amid economic fluctuations, extending payment terms can strengthen partnerships, preserving mutual interests. Companies across various industries, such as manufacturing and retail, often face cash flow challenges; implementing flexible payment options, like 30, 60, or 90-day terms, can enhance liquidity. In 2023, financial analysts report that businesses adopting elongated payment schedules witnessed a 15% increase in client retention rates. Establishing clear communication with partners regarding this adjustment fosters trust and collaboration, ensuring that both parties can navigate uncertain market conditions effectively. Continued partnership assurance during these transitions reinforces commitment and promotes long-term relationships, crucial for thriving in the competitive landscape.

Letter Template For Leveraging Extended Payment Terms. Samples

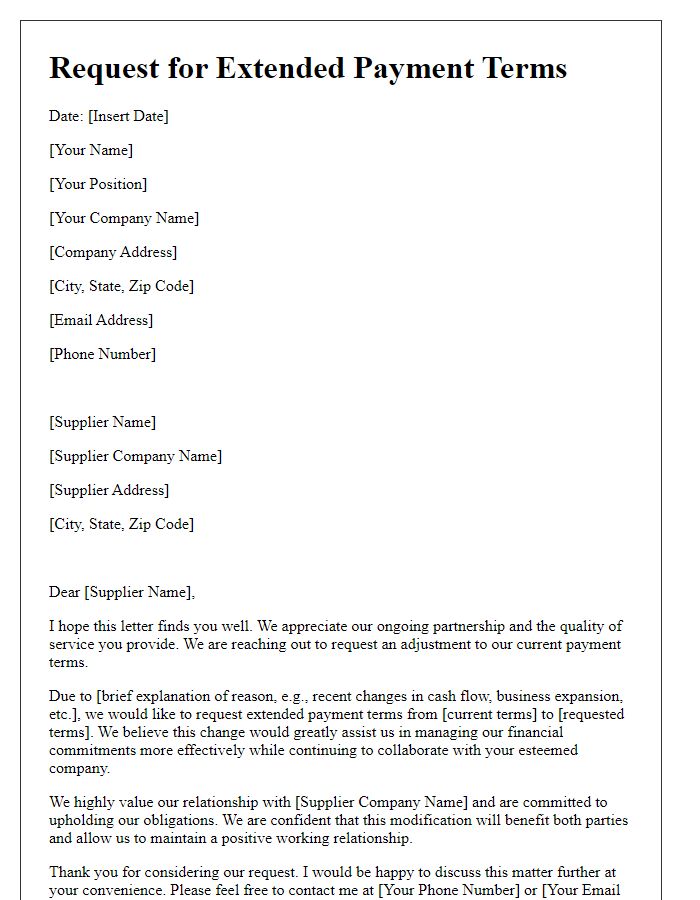

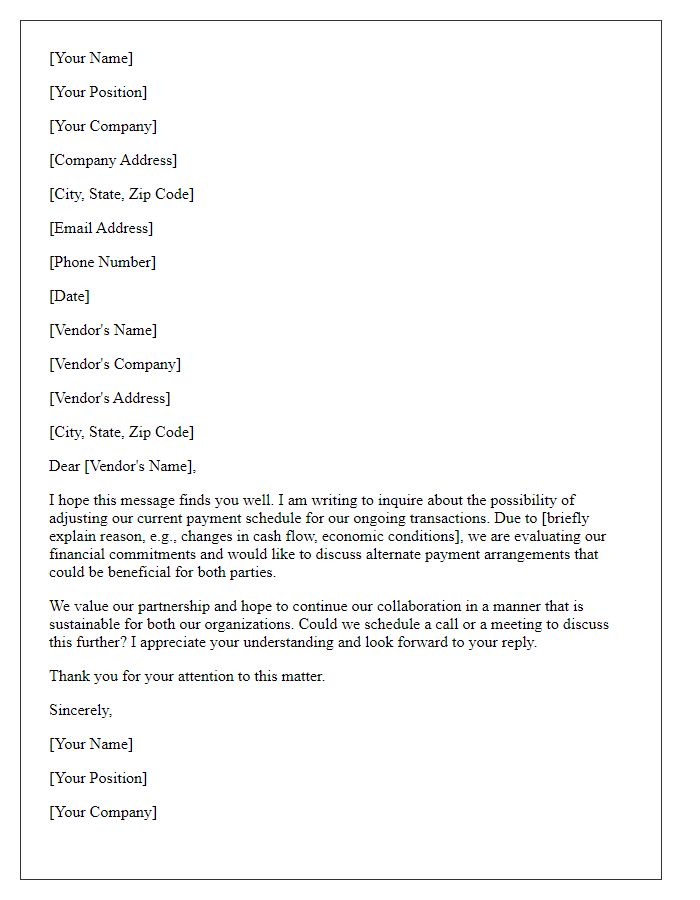

Letter template of request for extended payment terms for supplier agreements.

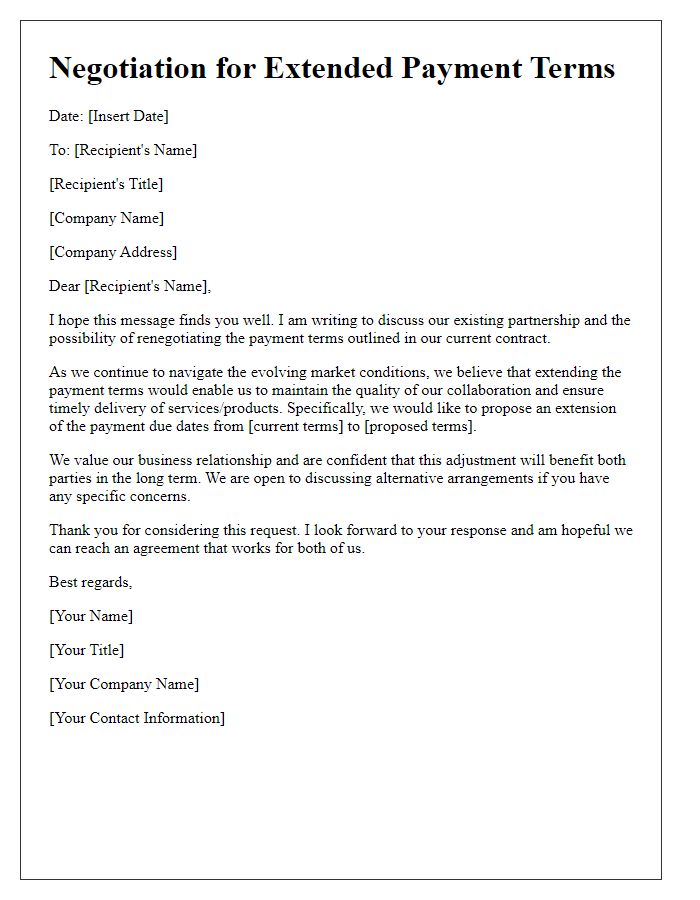

Letter template of negotiation for extended payment terms in partnership contracts.

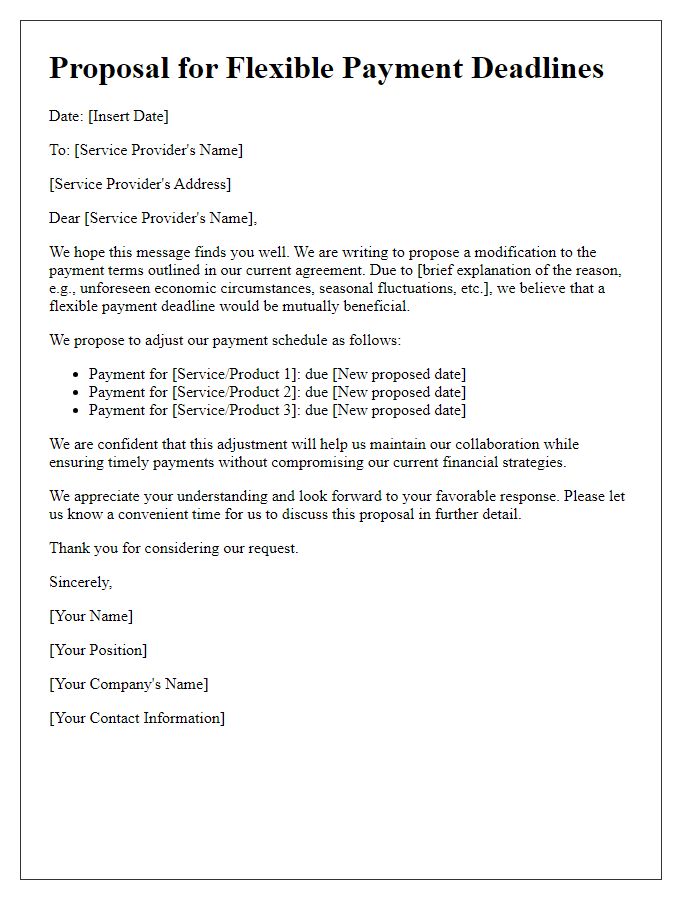

Letter template of proposal for flexible payment deadlines with service providers.

Letter template of application for longer payment terms in project financing.

Letter template of appeal for extended payment options due to cash flow issues.

Letter template of discussion for tailored payment conditions with manufacturers.

Letter template of communication for seeking deferred payment arrangements.

Comments