Are you tired of navigating the complexities of bulk payment processing? Managing numerous transactions can often feel overwhelming, but with the right approach, it can become a seamless task. Our comprehensive guide breaks down the essential steps and provides you with a practical letter template to streamline your payment management process. So, let's dive in and simplify your bulk payment challengesâread on to discover more!

Payment Process Workflow

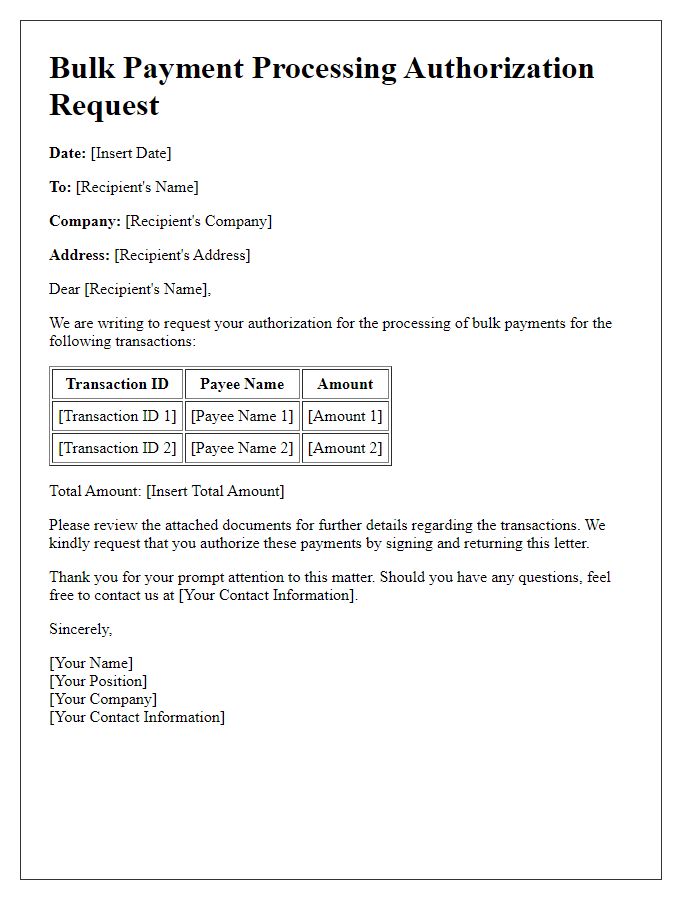

Efficient bulk payment processing is critical for businesses managing large transactions, especially in sectors like e-commerce and manufacturing. The workflow encompasses several key stages, starting with data collection from invoices (usually in Excel or CSV format) that must be error-free to ensure smooth processing. Following this, data validation checks against payment terms are performed, such as confirming due dates and amounts, typically involving sums exceeding hundreds of thousands of dollars. Next, payment authorizations require multiple approvals to mitigate fraud risks, with thresholds set at precise limits (e.g., $10,000 per transaction). The actual payment disbursement occurs through secure payment gateways, such as ACH (Automated Clearing House) or credit wire transfers, where electronic logs are maintained for audit purposes. Lastly, reconciliation processes involve matching payments with corresponding invoices, ensuring accurate financial reporting, and maintaining vendor relationships, often looking at historical payment cycles spanning quarterly or annually for performance analysis.

Reconciliation Strategy

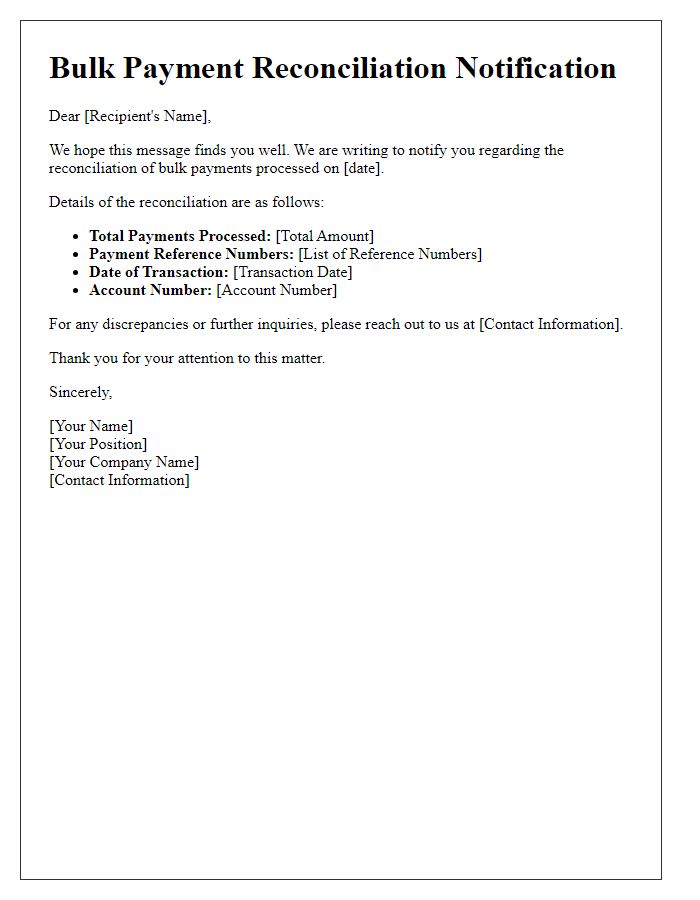

Effective bulk payment processing requires a structured reconciliation strategy to ensure accuracy and efficiency. Businesses often handle significant transaction volumes, so implementing an automated system can significantly reduce human error and save time. Reconciliation involves comparing recorded transactions within financial systems to actual bank statements or payment records. This process should be performed daily or weekly, depending on transaction frequency. Utilizing advanced software with reconciliation features can facilitate matching payments, allowing for quick identification of discrepancies arising from incorrect payment amounts, transaction failures, or duplicate entries. Establishing a dedicated team trained in financial analysis, accounting principles, and relevant software tools will enhance the monitoring process. Regular audits and real-time reporting can provide insights into cash flow management and financial health, leading to informed decision-making and improved operational efficiency. For optimal results, integrating Artificial Intelligence (AI) tools can predict and analyze transaction patterns, further refining the reconciliation process.

Security Compliance

Bulk payment processing security compliance involves strict adherence to financial regulations, safeguarding sensitive information. Payment Card Industry Data Security Standards (PCI DSS) require companies to maintain secure networks and protect cardholder data. Implementing encryption protocols, such as Advanced Encryption Standard (AES), ensures data security during transmission. Regular security audits and vulnerability assessments are necessary to identify and mitigate potential risks in systems handling transactions. Multi-factor authentication (MFA) provides an additional layer of security, preventing unauthorized access to sensitive financial records. Compliance with the General Data Protection Regulation (GDPR) emphasizes the importance of data privacy and accountability in processing bulk payments across European markets. Organizations must train staff on security best practices and incident response to effectively manage any breaches in compliance.

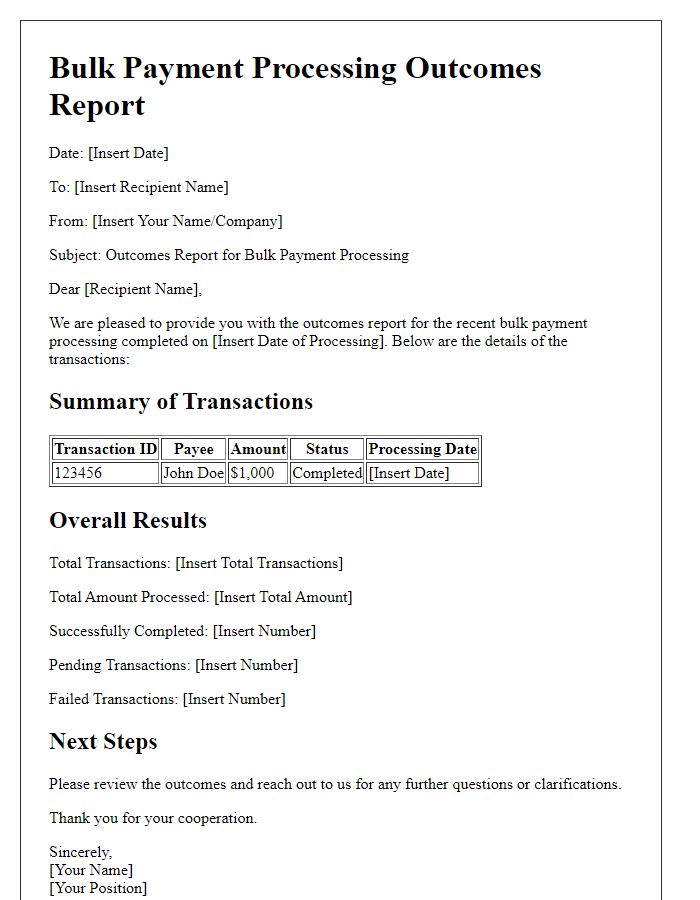

Automated Reporting Tools

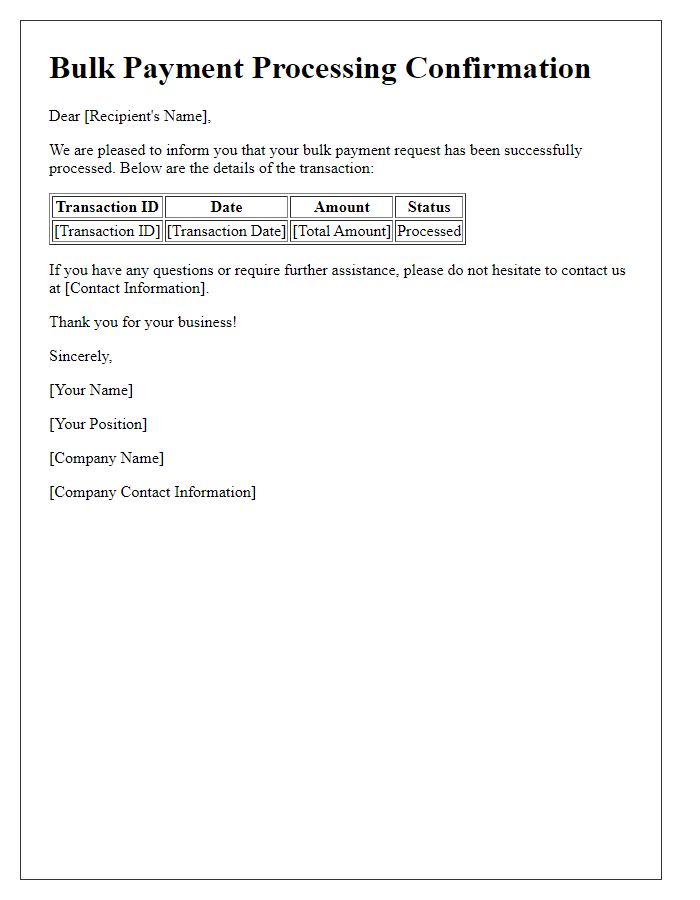

Automated reporting tools streamline the bulk payment processing workflow, enhancing efficiency and accuracy. These software solutions, such as SAP Concur or PayPal Mass Payments, can generate comprehensive reports on payment statuses, transaction dates, and recipient details. Users can configure these tools to deliver real-time analytics, enabling finance teams to monitor cash flow effectively. Moreover, they support compliance with regulatory requirements, ensuring that large-scale transactions adhere to financial standards. Integration capabilities with platforms like QuickBooks or Xero enhance the overall management experience by allowing seamless data transfer and reconciliation. By employing automated reporting tools, businesses can reduce manual errors, expedite processing times, and improve overall operational transparency.

Client Communication Plan

Efficient management of bulk payment processing is crucial for businesses handling numerous transactions weekly or monthly. Streamlined procedures and robust software solutions (like ERP systems) can significantly reduce processing times and errors. Ensuring data accuracy, especially account numbers and payment amounts, is paramount to maintain financial integrity. Regular reconciliation with banking institutions (e.g., monthly audits) minimizes discrepancies. Communication protocols with clients, including confirmation emails and notifications for completed transactions, enhance transparency and trust. Additionally, setting clear timelines for processing (e.g., 3 business days for ACH transfers) can improve customer satisfaction and manage expectations effectively.

Comments