Hey there! Are you struggling with gaps in your payment reconciliation process? Closing these gaps can seem daunting, but with the right approach and tools, it becomes manageable. In this article, we'll explore effective strategies to streamline your payment reconciliation, ensuring your financial records align seamlessly. Ready to uncover some valuable tips? Let's dive in!

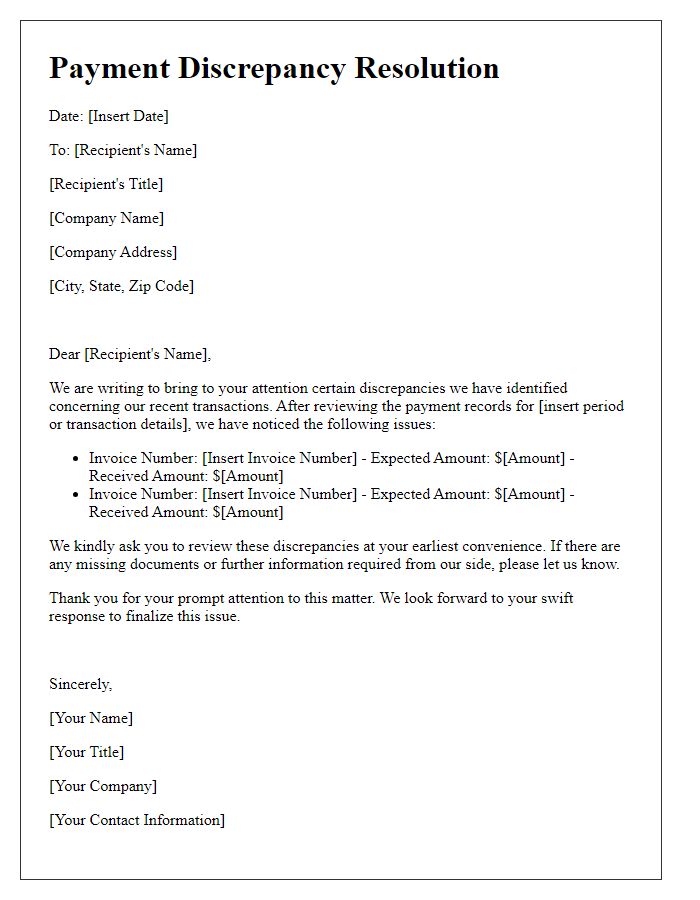

Concise explanation of discrepancies

During the quarterly financial audit of Q3 2023, a significant discrepancy, valued at $12,000, emerged between recorded payments and bank statements for the New York branch's operational expenses. This gap, primarily attributed to late invoices from vendors, resulted in underreported accounts payable. Further analysis revealed that transactions from early September were not entered in the accounting system, causing an inaccurate depiction of the cash flow. Additionally, duplicate entries were identified for three major client payments, totaling $7,500, further complicating reconciliation efforts. Promptly addressing these discrepancies is critical to restoring accurate financial records and maintaining fiscal transparency.

Detailed account summary

Payment reconciliation gaps can occur in financial statements, impacting accounts payable and receivable. A detailed account summary is essential for identifying discrepancies between expected payments and actual transactions recorded. This summary should include invoice amounts, payment dates, and vendor information for clarity. Each transaction needs to be categorized by status, such as pending, completed, or disputed, regardless of the payment method used, whether credit card, wire transfer, or check. Identifying specific transactions with differences can lead to uncovering issues like misapplied payments, duplicate entries, or missing invoices. Utilizing accounting software can facilitate tracking these variations, aiding in swift resolution and enhancing overall financial accuracy. Regular reconciliations, ideally monthly or quarterly, are crucial for maintaining up-to-date records and ensuring that all accounts reflect the correct financial standing.

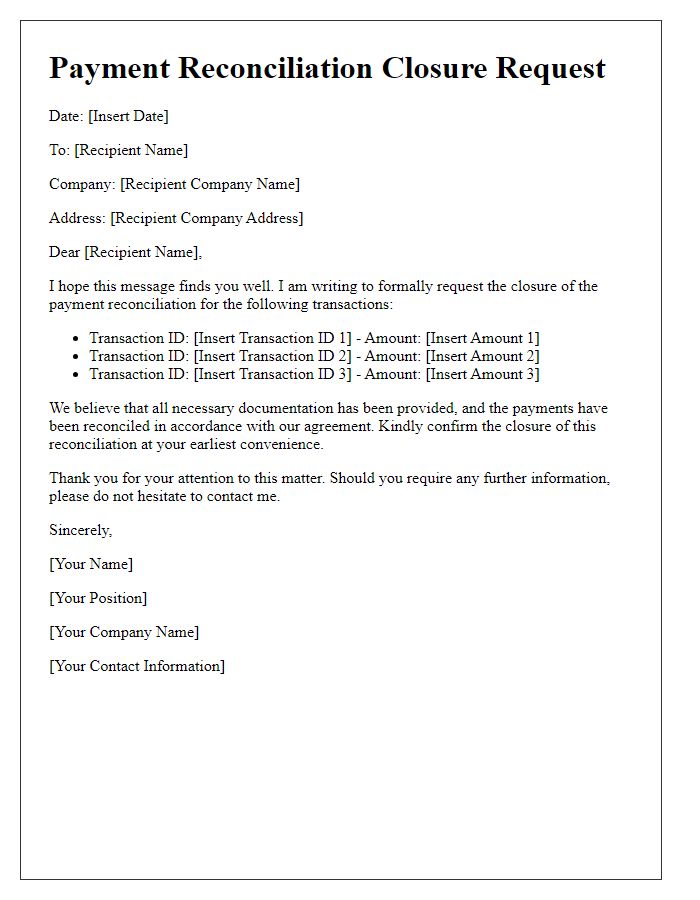

Proposed reconciliation process

The proposed reconciliation process aims to systematically address and rectify payment discrepancies between accounts, ensuring accuracy in financial reporting. This procedure involves a detailed review of transaction records, including invoices, receipts, and payment confirmations, typically spanning a three-month period for thorough analysis. Each account will be cross-verified against the financial statements generated from accounting software, such as QuickBooks or SAP, to identify any mismatched entries. Communication with department heads, including finance and procurement, will occur to clarify and resolve discrepancies. Additionally, a weekly follow-up meeting will take place to monitor progress and ensure all issues are addressed promptly. Final reconciliation reports will be compiled and submitted to the accounting committee for approval by the end of the reconciliation period.

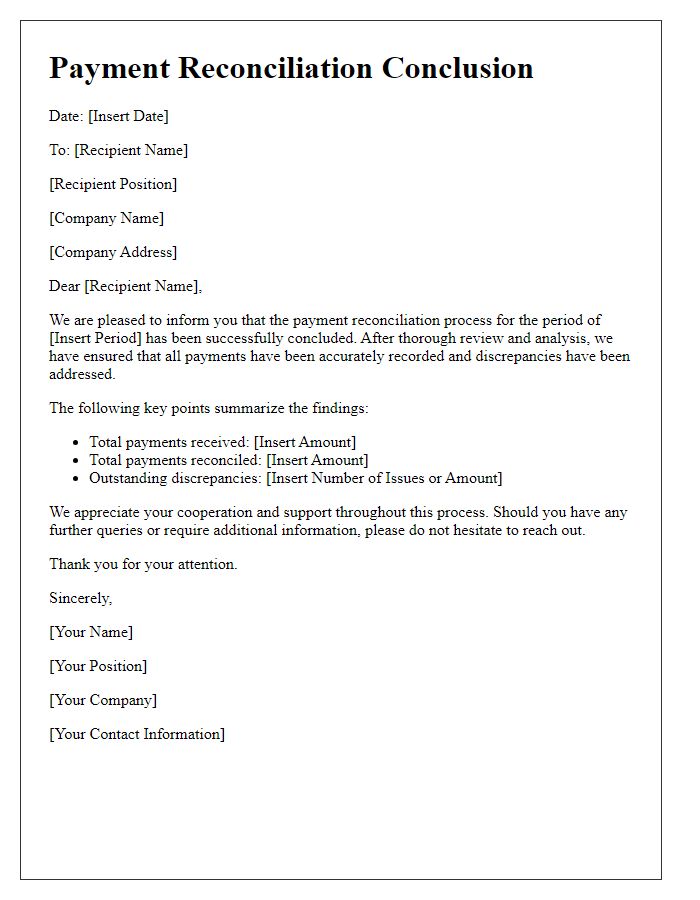

Acknowledgement of responsibility and measures

Closing a payment reconciliation gap requires a thorough understanding of financial accountability and proactive measures. This involves identifying discrepancies between recorded transactions and bank statements, ensuring that all invoices, such as those from vendors like ABC Supplies or service providers like XYZ Consulting, are accurately processed. Acknowledgment of responsibility includes recognizing any oversight or error by your organization, which may have resulted in missed payments or unrecorded transactions. Implementing measures, such as regular audits and establishing clear protocols for payment processing, can enhance financial accuracy. Additionally, training staff on best practices for reconciliation can further minimize future gaps. Documentation of these processes is essential, ensuring transparency and accountability in financial management.

Contact information for further discussion

Payment reconciliation gaps often arise during financial processes, especially in large organizations managing numerous transactions. These discrepancies can occur in accounting software systems like QuickBooks, especially when dealing with multiple accounts or currencies. A common issue is mismatches in transaction records, which can lead to financial inaccuracies and budgeting errors. To address these gaps, it's crucial to establish a clear communication channel between departments, such as finance and procurement, ensuring all relevant personnel are informed. Furthermore, utilizing reconciliation tools, such as automated matching algorithms, can streamline the identification of errors. Parties involved should maintain up-to-date contact information for further discussions, ensuring swift resolution of any outstanding discrepancies.

Comments