Are you tired of juggling multiple payment channels and looking for a seamless solution? Consolidating your payment systems can streamline your finances, reduce confusion, and save you valuable time. Imagine managing all your transactions from one easy-to-use platform, simplifying not just your accounting but also enhancing your customer experience. Dive into our article to explore the benefits and steps for consolidating your payment channels!

Clear communication of objectives and benefits.

Consolidating payment channels enhances operational efficiency for businesses. Streamlining processes results in reduced transaction costs, typically between 1-3% of total sales, which increases profit margins. Implementing a unified payment system simplifies customer experiences, reducing cart abandonment rates that average around 70% in e-commerce. Businesses with consolidated channels often report improved cash flow management, with payment settlements processed within 1-3 business days, ensuring quicker access to funds. Enhanced data analytics capabilities arise from a single platform, allowing for better insights into customer purchasing behaviors. Additionally, improved security measures, such as PCI compliance, safeguard sensitive financial information, building customer trust and loyalty.

Detailed timeline and implementation process.

Consolidating payment channels involves a structured timeline and implementation process to ensure smooth integration across platforms. Initial planning and assessment phase should occur in Q1 of 2024, focusing on identifying current payment methods such as credit cards, e-wallets, and bank transfers. By the end of Q1, the team should finalize the selection of a unified payment gateway like Stripe or PayPal. In Q2, development and testing should begin, including integration with existing systems, followed by user acceptance testing (UAT) scheduled for mid-Q2 to address any issues. Training sessions for staff on using the new system are crucial and should occur in late Q2. Launching the consolidated payment solution is targeted for July 2024, allowing for a complete transition and monitoring of performance metrics, ensuring a seamless customer experience by end of Q3. Post-launch analysis will be vital for continuous improvement and addressing any emerging challenges.

Explicit instructions and contact information for support.

Consolidating payment channels streamlines financial transactions for businesses, enhancing efficiency in revenue collection. Organizations often utilize integrated platforms such as PayPal, Stripe, and Square, which facilitate multiple payment methods like credit cards, digital wallets, and bank transfers. Clear instructions for consolidating these channels typically involve updating the payment gateway settings within the company's e-commerce platform or accounting software. Additionally, businesses should include explicit contact information for technical support, ensuring swift resolution of any issues. A dedicated support team, reachable via email or phone during business hours, can guide organizations throughout the consolidation process, minimizing disruptions and optimizing cash flow management.

Assurance of secure transaction handling.

Secure transaction handling enhances consumer confidence in online payment platforms, such as PayPal and Stripe, often used in e-commerce environments. These payment channels implement advanced encryption measures (like AES-256) to protect sensitive information, reducing the risk of data breaches. Compliance with regulations like PCI DSS (Payment Card Industry Data Security Standard) ensures that processing payment data adheres to strict security protocols, safeguarding both merchants and customers. Regular audits and monitoring practices contribute to identifying vulnerabilities, reinforcing the integrity of transactions. Additionally, multi-factor authentication (MFA) adds an extra layer of protection, making unauthorized access significantly more difficult.

Terms and conditions of new payment channels.

Consolidating payment channels enhances the efficiency of financial transactions for businesses. The introduction of streamlined payment solutions, such as digital wallets (e.g., PayPal, Venmo), blockchain cryptocurrency systems (e.g., Bitcoin, Ethereum), and traditional bank transfers, revolutionizes how consumers interact with their monetary assets. Key terms and conditions for these new payment channels typically include transaction fees (ranging from 1.5% to 3.5%), security measures (such as encryption and fraud protection), settlement times (which may vary from instant to three business days), and customer support availability (often 24/7). Furthermore, compliance with regulations such as the Payment Card Industry Data Security Standard (PCI DSS) ensures safe handling of cardholder data. By integrating these payment methods, businesses can cater to diverse customer preferences while reducing transaction friction.

Letter Template For Consolidating Payment Channels. Samples

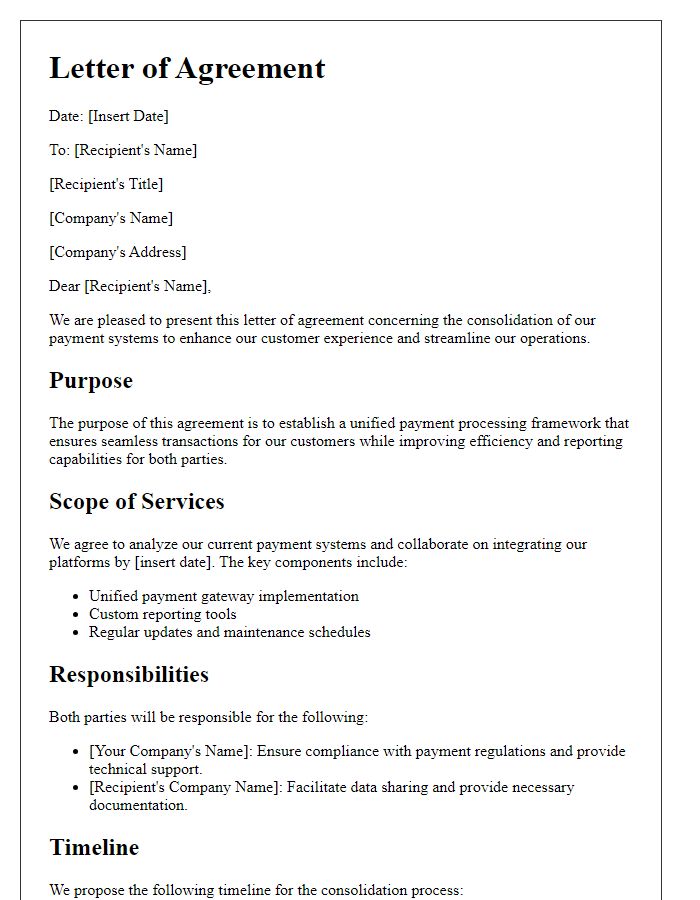

Letter template of request for consolidating payment channels for efficiency.

Letter template of notification regarding the consolidation of payment methods.

Letter template of proposal for merging payment channels to streamline transactions.

Letter template of update on the consolidation of payment processing systems.

Letter template of inquiry into improved payment channel consolidation options.

Letter template of confirmation for consolidating payment avenues for better tracking.

Letter template of recommendation for unified payment processing channels.

Letter template of explanation for consolidating payment platforms for security.

Letter template of implementation of streamlined payment channels for convenience.

Comments