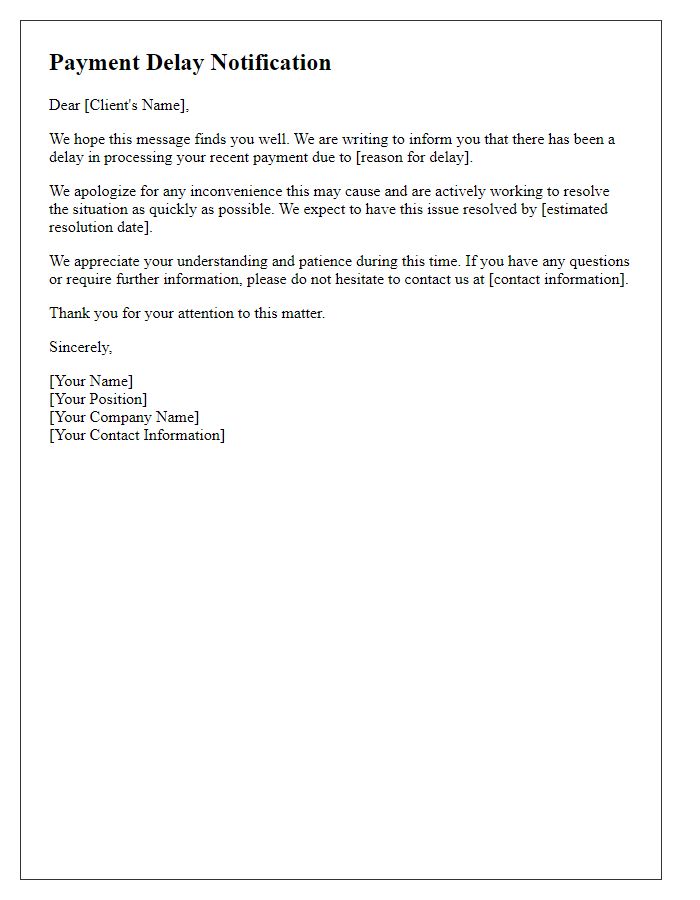

Have you ever found yourself in a situation where you need to notify someone about a payment delay? It can be a bit tricky to strike the right balance between professionalism and empathy, especially if you're concerned about how the news will be received. In this article, we'll explore the best practices for crafting a clear and respectful letter, ensuring your message is communicated effectively. So, if you're ready to learn how to navigate this delicate conversation, keep reading!

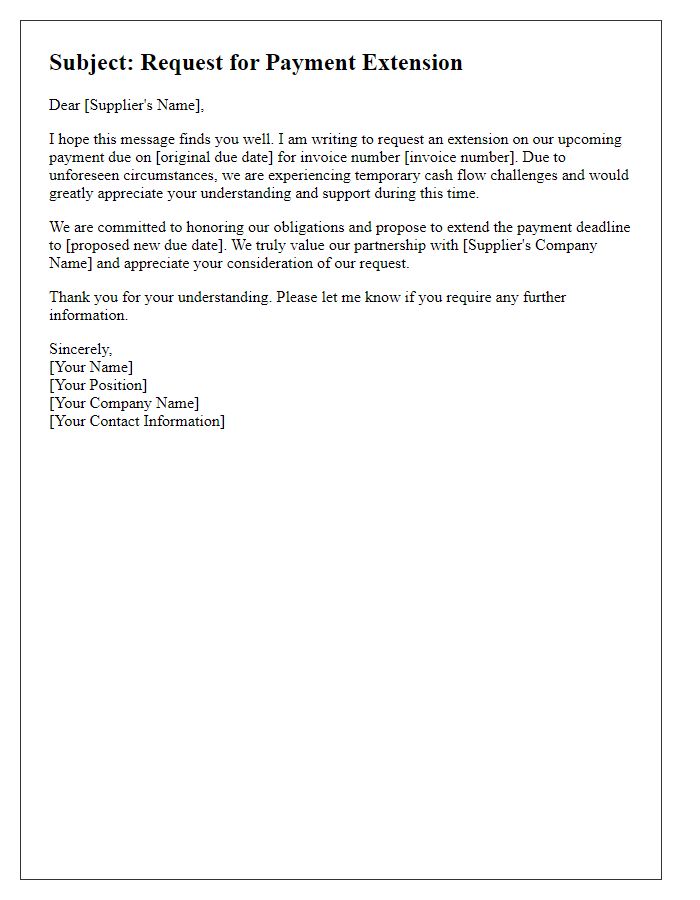

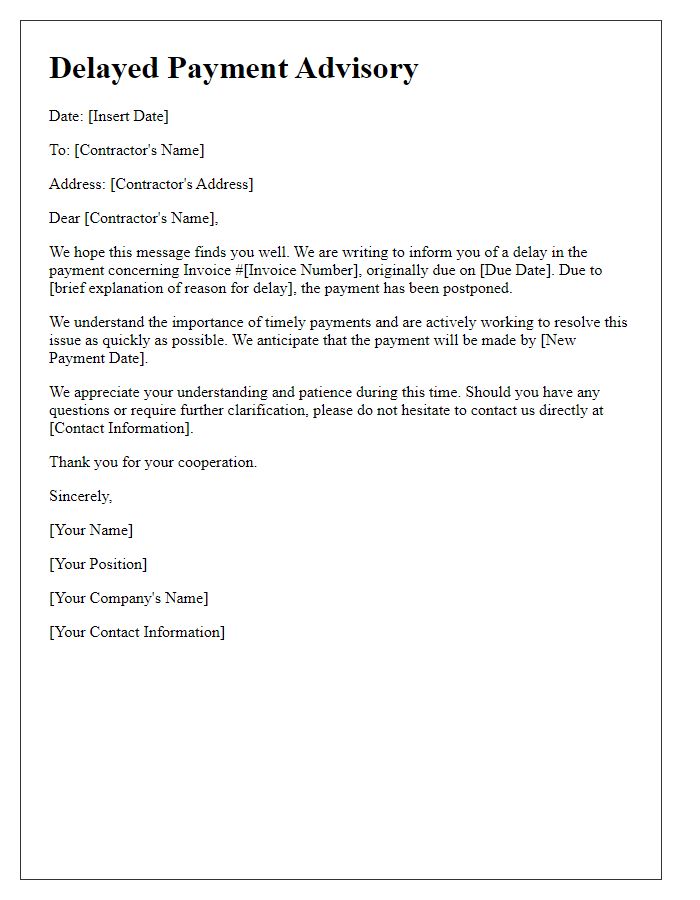

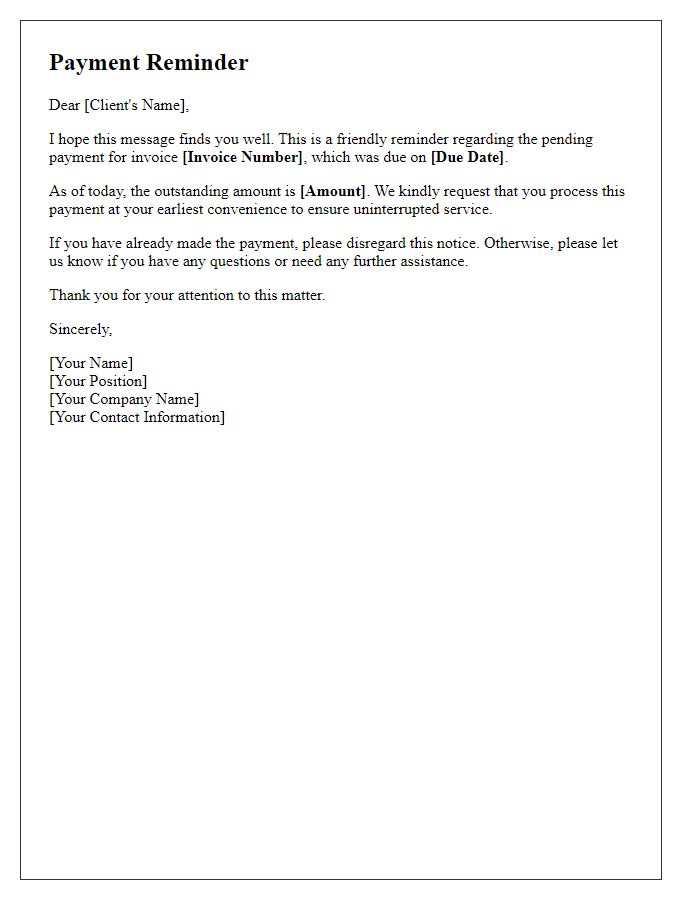

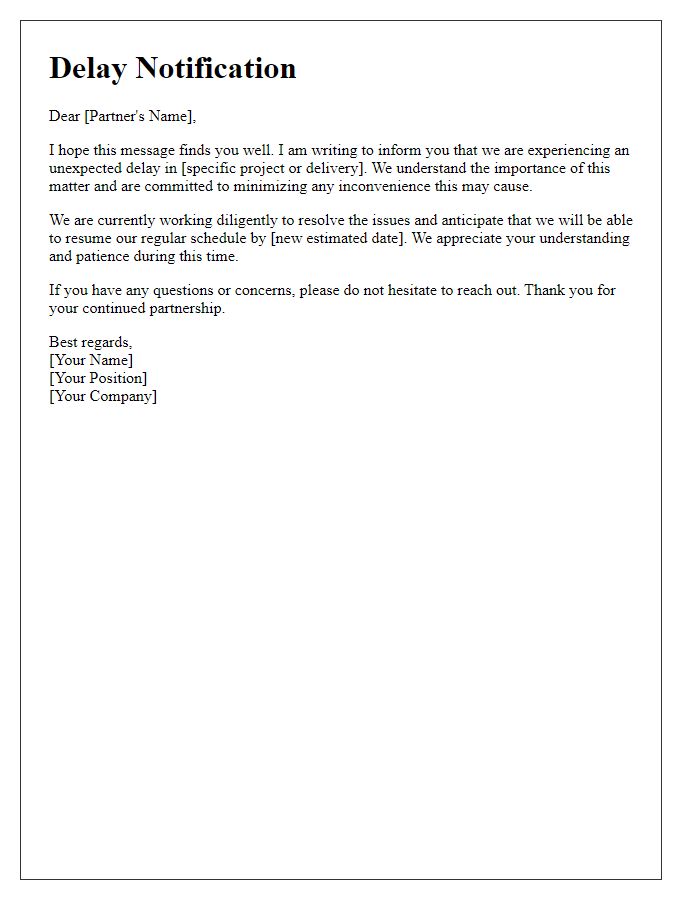

Polite and professional tone.

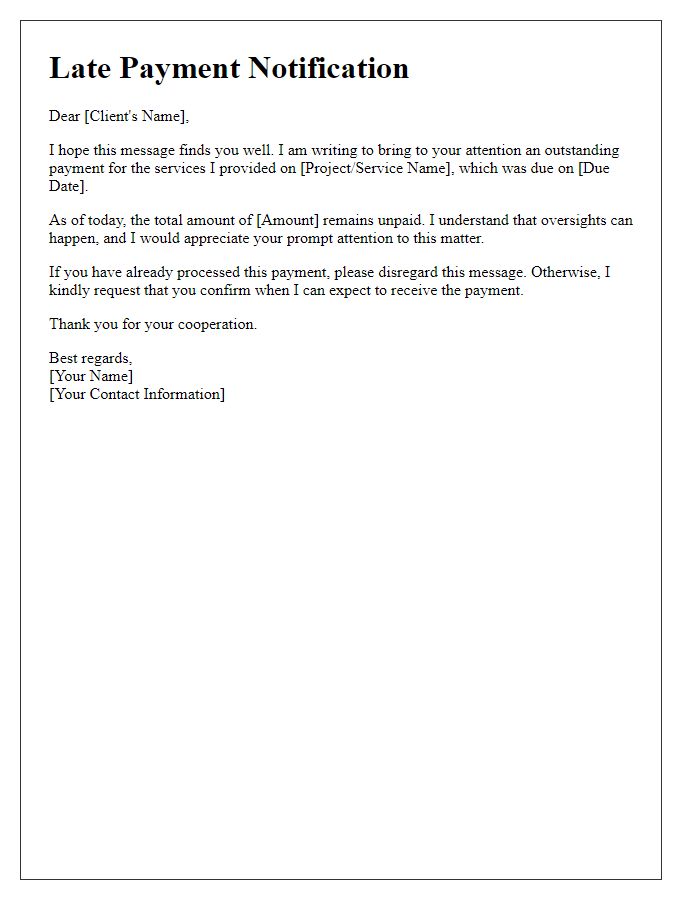

Delayed payments can disrupt cash flow for businesses, particularly small enterprises. Invoices typically due within 30 days can lead to financial strain when payments exceed this timeframe, potentially impacting ongoing operations such as inventory replenishment or employee salaries. Notification of payment delays should clearly state the original due date, specify the new expected payment date, and emphasize the importance of timely transactions for maintaining professional relationships. Maintaining professionalism during these communications is crucial to uphold trust, ensuring both parties remain committed to resolving any issues swiftly.

Clear explanation for the delay.

Payment delays can arise from various factors, such as banking processing times or unexpected administrative issues. For instance, electronic funds transfers may take 3 to 5 business days to clear, depending on financial institutions involved. Documentation errors can also cause processing holdups, requiring additional verification steps. In some cases, high transaction volumes during peak periods lead to longer delays, as seen during major shopping events like Black Friday. Clear communication of these issues is essential to maintain trust in business relationships and ensure prompt resolution.

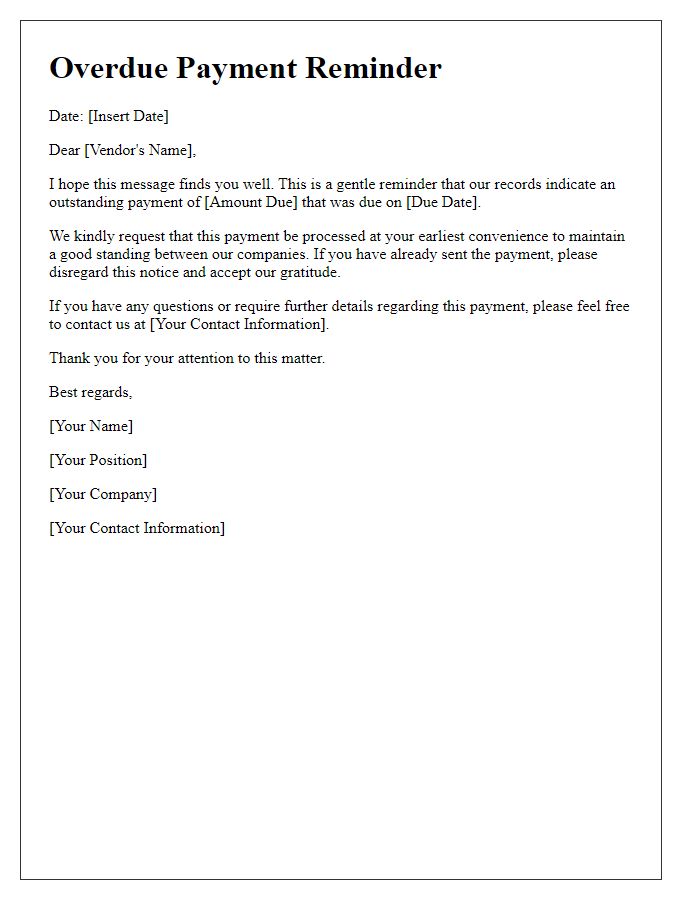

New payment timeline.

Payment delays can significantly impact business operations, particularly in industries reliant on timely transactions. For example, a small business may experience cash flow issues when awaiting payments from clients. A delay extended by more than 30 days can necessitate adjustments in budgeting plans and operational strategies, especially for companies in the technology sector, reliant on cash for ongoing projects. Establishing a new payment timeline is critical, as it sets clear expectations for both parties involved. Transparent communication regarding revised dates ensures trust and maintains healthy business relationships. Emphasizing the importance of timely payments can help prevent future delays in business dealings.

Contact information for inquiries.

Payment delays can lead to potential disruptions in financial operations for both businesses and individuals. Outstanding invoices typically refer to payments that have not been settled as per the agreed timelines, often causing cash flow challenges. The payment deadline, often established in contractual agreements or invoices, should ideally fall within 30 days from the date of the invoice. In situations involving missed deadlines, it's essential to communicate with the concerned parties, providing them with necessary contact information for inquiries, such as a dedicated email address or a direct phone number, to streamline the resolution process. Keeping records of previous communications regarding billing and payment schedules can also be beneficial in discussions about delays, ensuring clarity and accountability.

Apology and appreciation for understanding.

Due to unforeseen circumstances, there has been a delay in the payment scheduled for October 15, 2023. The delay stems from issues related to the financial processing system, affecting transactions at our accounting department. This situation has prompted us to seek a resolution to ensure all payments are processed correctly and promptly. We appreciate your understanding and patience during this time, recognizing the impact delays may have on your operations. Please rest assured that we are working diligently to expedite the payment process and fulfill our commitment to you. Thank you for your continued support and partnership.

Comments