Are you feeling a bit overwhelmed by your outstanding balance? It's completely normal to have questions about your finances, and understanding your statement can help you regain control. In this article, we'll break down the key elements of an outstanding balance summary, making it easier for you to navigate your financial picture. So, stick around to discover how to efficiently manage your account and take informed steps forward!

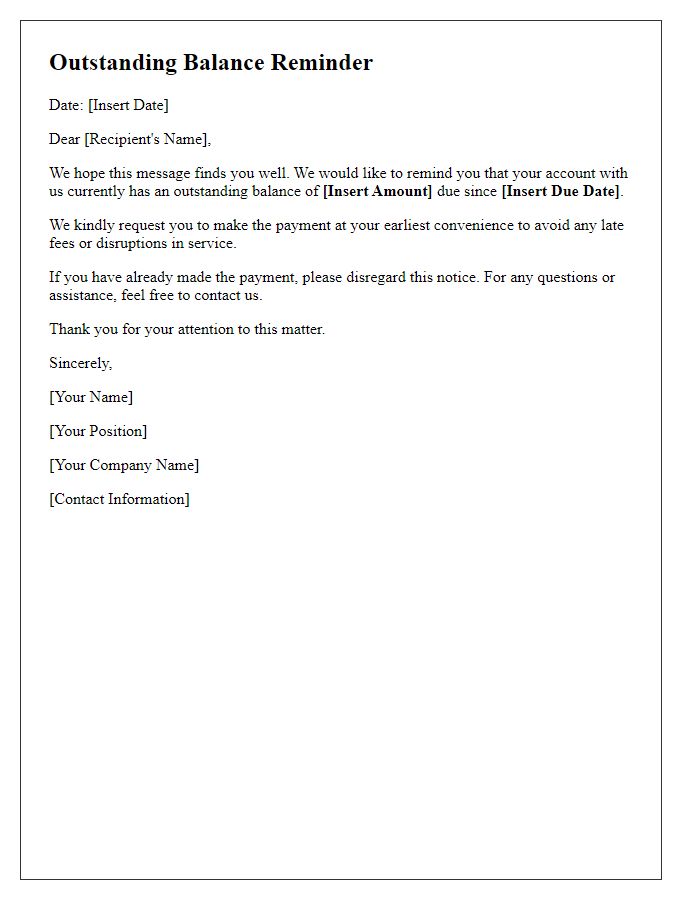

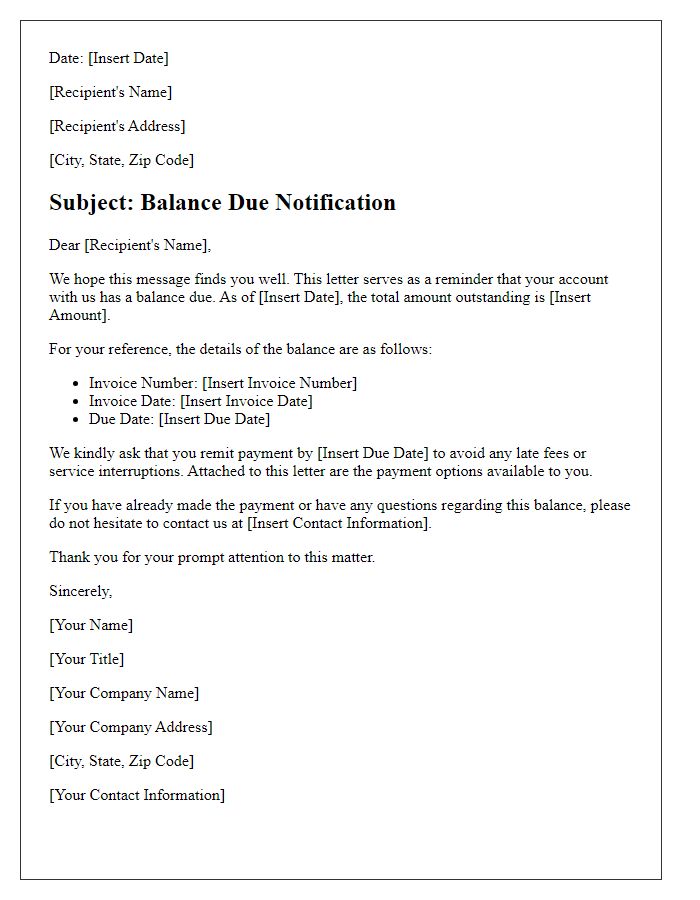

Clear subject line

Outstanding balance summaries highlight the financial obligations of individuals or businesses. An outstanding balance is defined as the amount still owed on a financial account. Customers may receive these summaries from various entities such as banks, credit card companies, or service providers. Summaries typically include key details such as the total outstanding amount, payment due date, and any applicable late fees. For example, a credit card balance of $1,500 might accrue an interest rate of 15% annually if not paid by the due date. Timely payments can improve credit scores (a numerical rating of creditworthiness), while missed payments can lead to additional charges and a negative impact on financial health. Regular monitoring of these summaries is crucial for effective financial management and avoiding complications.

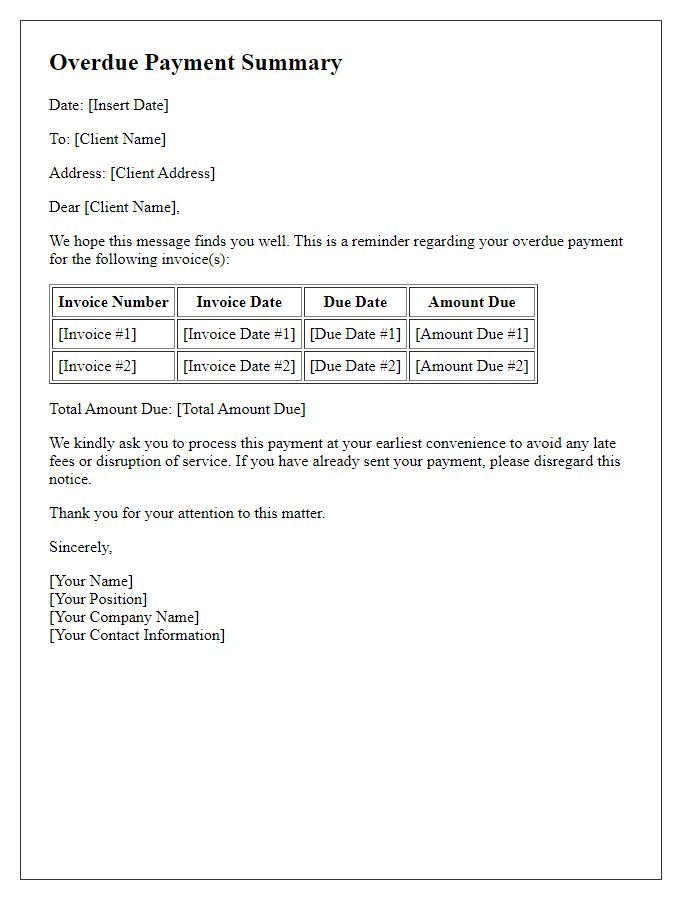

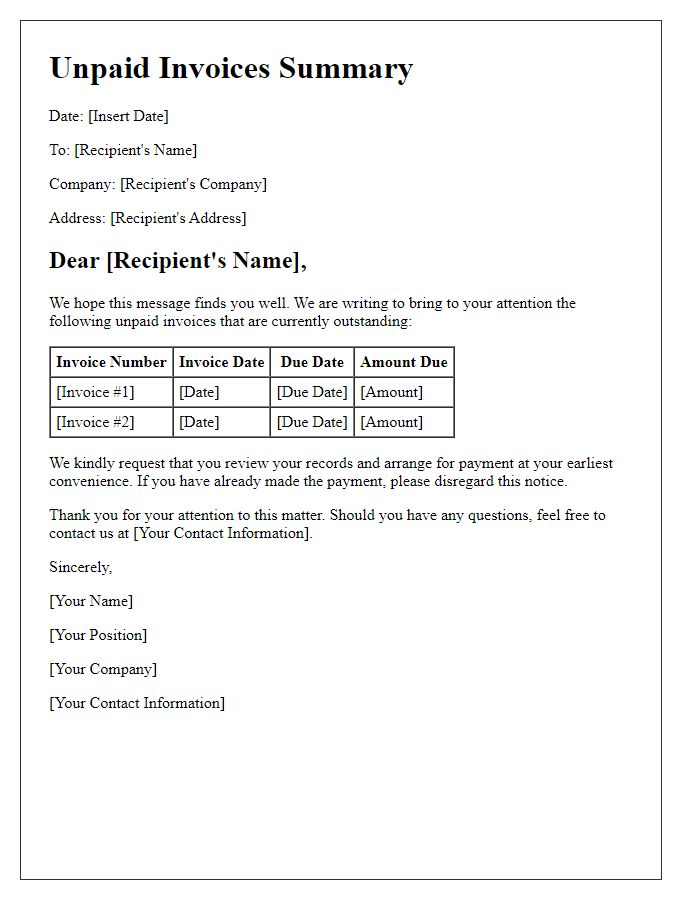

Recipient's details

A detailed outstanding balance summary provides essential information for account management. The summary typically includes the account holder's name, the total amount owed, the due date for payment, and a breakdown of individual charges such as late fees or service costs. Alongside this, it may offer insights into past payment history, including dates of previous transactions that have contributed to the current balance. This overview is crucial for maintaining clear communication between creditors and debtors, ensuring all parties are aware of the expectations and obligations. Accurate recipient details, including contact information, are vital for an effective correspondence process.

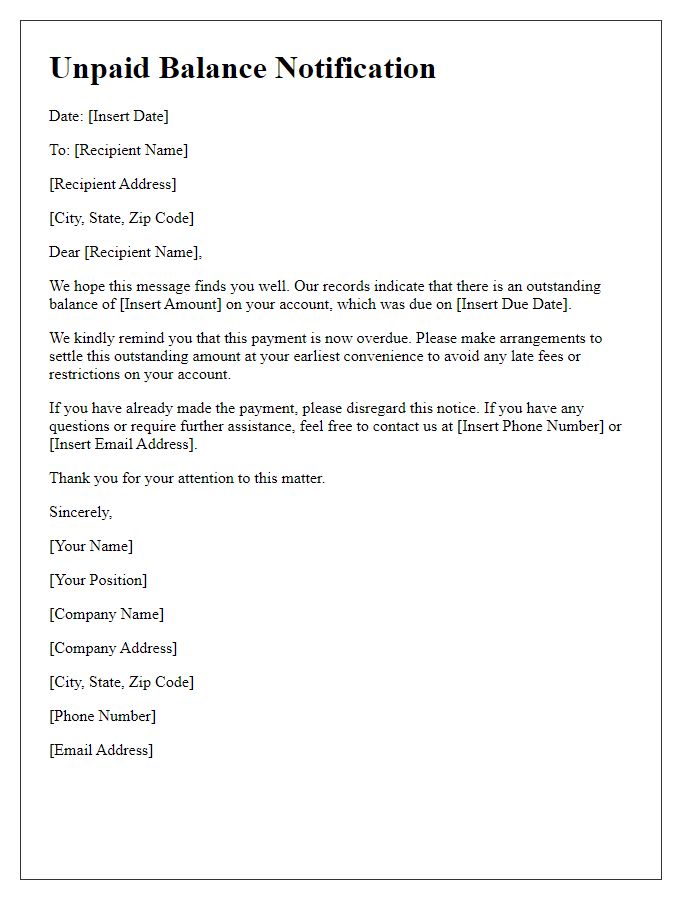

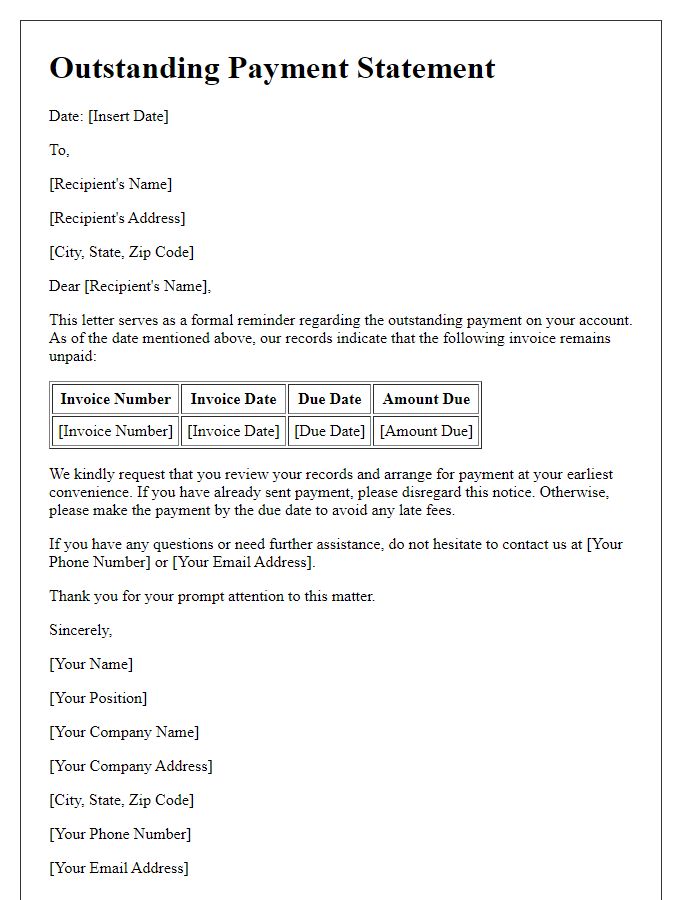

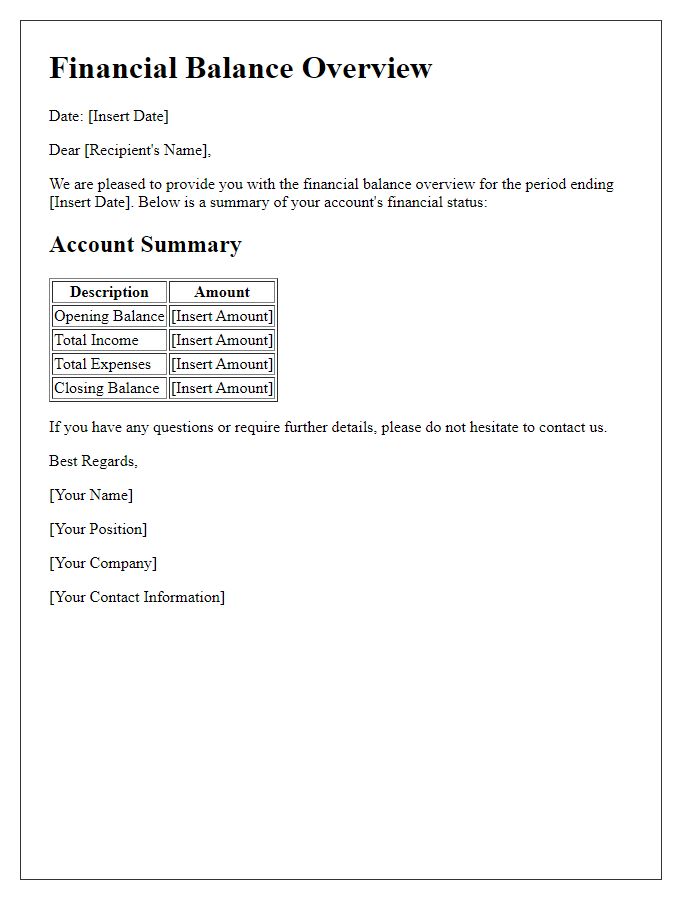

Statement of account

Outstanding balances can significantly impact financial health for both individuals and businesses. A statement of account typically outlines transaction details, including outstanding amounts, payment due dates, and interest rates. For example, a credit card statement may indicate a balance of $1,200, with a minimum payment due of $50 by the 15th of the month, along with an annual percentage rate (APR) of 18%. Understanding these details is crucial for managing debts effectively. Moreover, businesses may issue balance summaries to clients, detailing invoices that remain unpaid or overdue, helping maintain transparent communication and fostering timely payments.

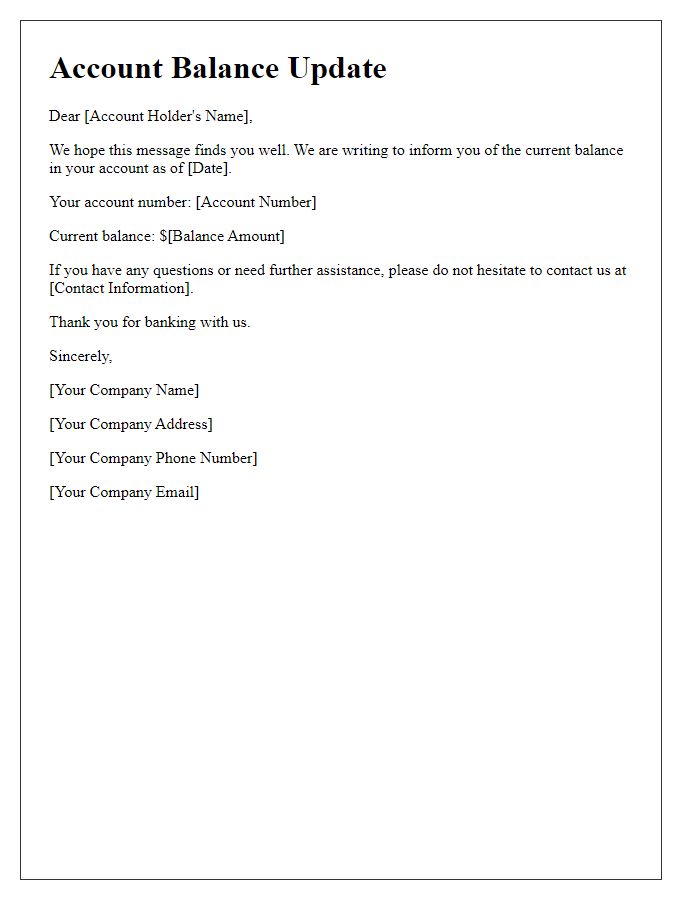

Payment options and instructions

Outstanding balances can create financial stress for individuals and organizations. Payment options available may include one-time payments, installment plans, or online payment gateways. Detailed instructions to complete each payment method ensure clarity. For instance, when using credit cards, providing the card number, expiration date, and CVV (Card Verification Value) is essential. In some cases, bank transfers may require specific account details, including routing numbers and account numbers, especially for ACH transfers in the United States. Clear deadlines for payment, such as within 30 days, can prevent additional fees and interest from accumulating, as well as detrimental impacts on credit scores.

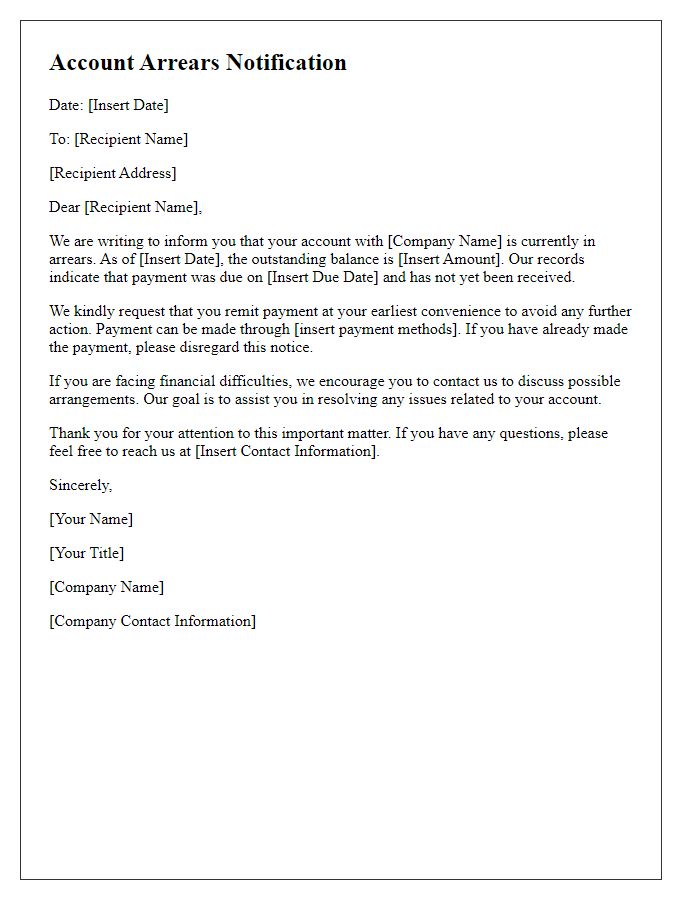

Consequences of non-payment

Outstanding balances can lead to significant financial consequences. For individuals, non-payment of credit accounts can result in damage to credit scores, often dropping by 100 points or more within a few months. This deterioration impacts future borrowing options, potentially increasing interest rates on loans or mortgages. In some cases, account delinquencies may escalate to collections, involving third-party agencies chasing debts that can exceed several hundred dollars. For businesses, unpaid invoices can disrupt cash flow, jeopardizing operations or causing layoffs. Legal actions may ensue, with costs accumulating quickly due to attorney fees and court expenses. In severe cases, there is a risk of asset seizure or bankruptcy filings. Addressing outstanding balances promptly is crucial to mitigate these adverse effects.

Comments