Are you considering diving into the world of special purpose vehicle (SPV) investments? These unique financial structures offer a plethora of opportunities for both seasoned investors and newcomers alike. With their ability to isolate financial risk and streamline funding processes, SPVs have become a popular choice for various investment strategies. Curious to learn how you can leverage SPVs in your investment portfolio? Let's explore this intriguing subject further!

Letterhead and contact information

Special purpose vehicles (SPVs) serve as important financial structures in investment strategies, often utilized for isolating financial risk. These entities, commonly set up by corporations like investment funds and real estate developers, allow for development or joint ventures in diverse sectors such as renewable energy or real estate. By focusing on specific projects, SPVs can attract investors by providing a clear framework for asset management and risk mitigation. Locations like New York City and London frequently host SPVs targeting high-value assets, capitalizing on local tax benefits and investor incentives. Understanding regulations, such as the Investment Company Act or Foreign Investment in Real Property Tax Act (FIRPTA), is critical for compliance. Investors often seek out SPVs for transparency concerning cash flows and investment returns, fostering a controlled environment for project execution.

Purpose and objective of the SPV

A Special Purpose Vehicle (SPV) serves as a distinct legal entity created primarily for the purpose of isolating financial risk and facilitating specific investment objectives. The objective of the SPV often includes the acquisition of particular assets, for example, real estate properties in strategic locations such as downtown financial districts or emerging markets with growth potential. SPVs can also be utilized for project financing, enabling investors to pool resources for large infrastructure developments or renewable energy projects, like solar farms. Additionally, the SPV structure enhances transparency and assessable risk management, providing investors with detailed financial reporting and accountability measures, ensuring that invested capital is utilized for designated purposes while minimizing exposure to liabilities associated with the parent company or individual investors.

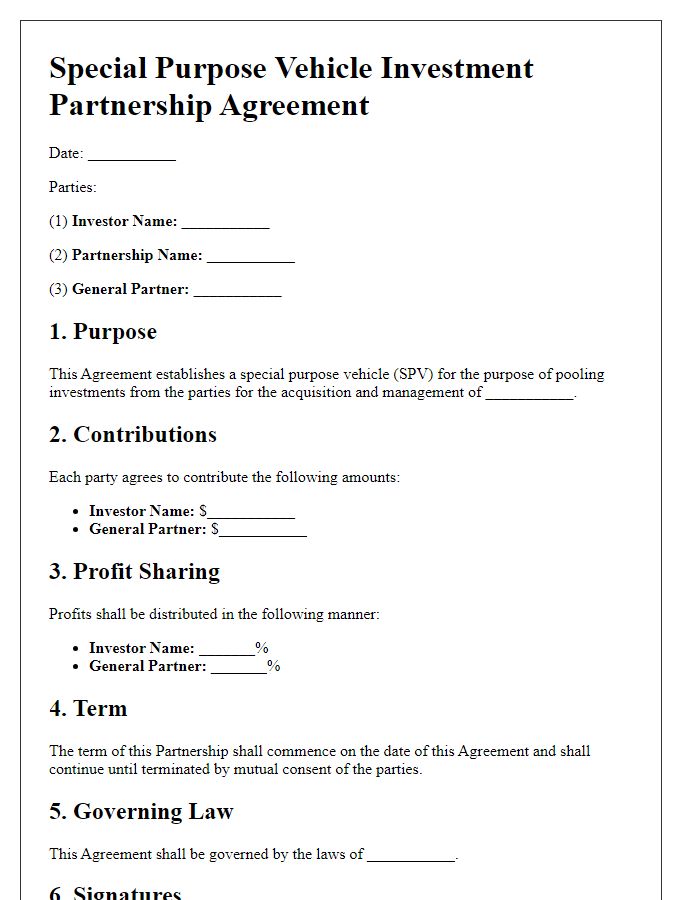

Details of investment agreement

Special purpose vehicles (SPVs) are often created for specific investment opportunities, allowing investors to limit liability and streamline management. The investment agreement outlines critical details such as the ownership structure, defined in percentages reflecting stakes among participants, including general partners and limited partners. Investment amount usually specified, ensuring clarity on financial commitments from each party, often numbering in the millions for real estate ventures or technology startups. Duration of the investment, often spanning five to ten years, defines the timeline for returns. Profit-sharing terms highlight distribution ratios after expenses, potentially influenced by performance benchmarks. Governance structure provides authority breakdown for decision-making processes, including voting rights, typically requiring a simple majority for routine decisions and a supermajority for significant changes. Exit strategy details outline mechanisms for investors to sell their interests or liquidate assets, ensuring planned return on investment upon sale, often linked to market valuations or pre-set financial goals. Confidentiality clauses protect sensitive information related to the investment while compliance with applicable securities regulations ensures legal adherence throughout the investment lifecycle.

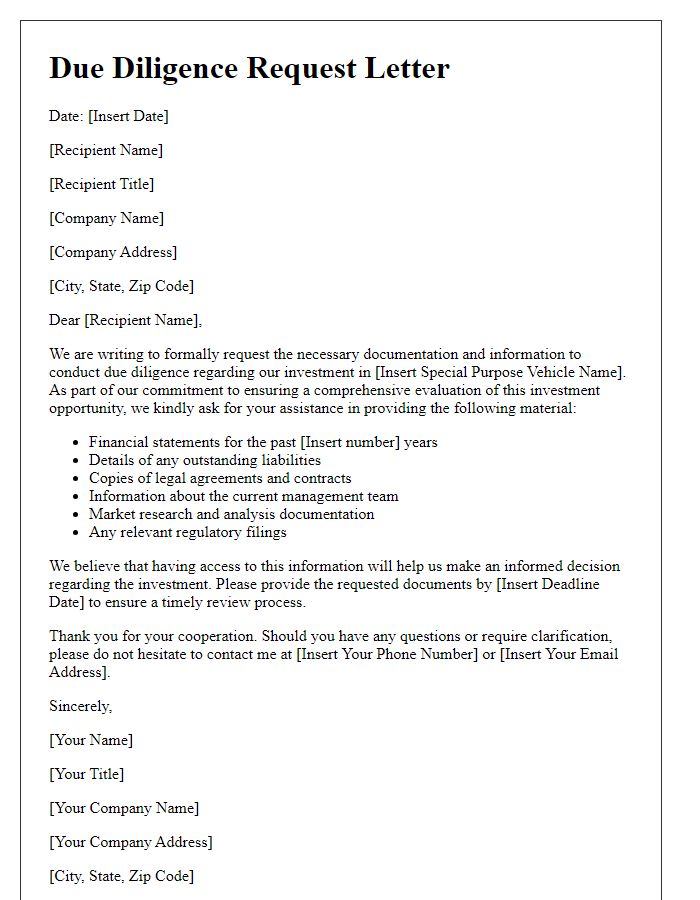

Risk disclosure and mitigation strategies

Risk disclosure is essential when investing in Special Purpose Vehicles (SPVs), which are created for specific financial objectives, typically involving high-value projects. Key risks include market volatility, potential financial losses, and illiquidity. Market assessments indicate that fluctuations in economic conditions can impact project success, particularly in sectors like renewable energy or real estate. Investors should be aware of the legal structure of the SPV, including regulatory requirements and tax implications, particularly involving jurisdictions such as the Cayman Islands or Delaware. Mitigation strategies may involve diversification across multiple SPVs to spread risk, implementing strong due diligence practices to evaluate management teams, and maintaining clear communication regarding investment performance. Enhanced reporting frameworks can also provide transparency, enabling investors to assess risk exposure continuously.

Signature and authorization section

In special purpose vehicle (SPV) investment agreements, a signature and authorization section is crucial for validating commitments. This section typically includes designated spaces for the authorized representatives' signatures, clearly labeling the entities involved, such as the SPV name (e.g., Green Energy Innovations SPV) and the investment partner (e.g., Global Venture Capital LLC). The section may also specify the capacity of each signatory, such as titles (e.g., Managing Director, Chief Financial Officer) to confirm their authority to bind the respective organizations. Additionally, the date of signing is important to establish timelines, alongside witness signatures if required for added legal formality. Compliance with jurisdictional requirements, such as notary acknowledgments, may also be included to enhance enforceability.

Letter Template For Special Purpose Vehicle Investment Samples

Letter template of special purpose vehicle investment partnership agreement

Letter template of special purpose vehicle investment due diligence request

Comments