Are you gearing up for a post-investment review meeting and unsure where to start? Crafting an effective letter template can streamline the process and ensure that all critical points are covered. By clearly outlining the agenda and objectives, you can foster productive discussions and set the stage for future collaboration. Dive into our article to discover a structured template that will enhance your meeting outcomes!

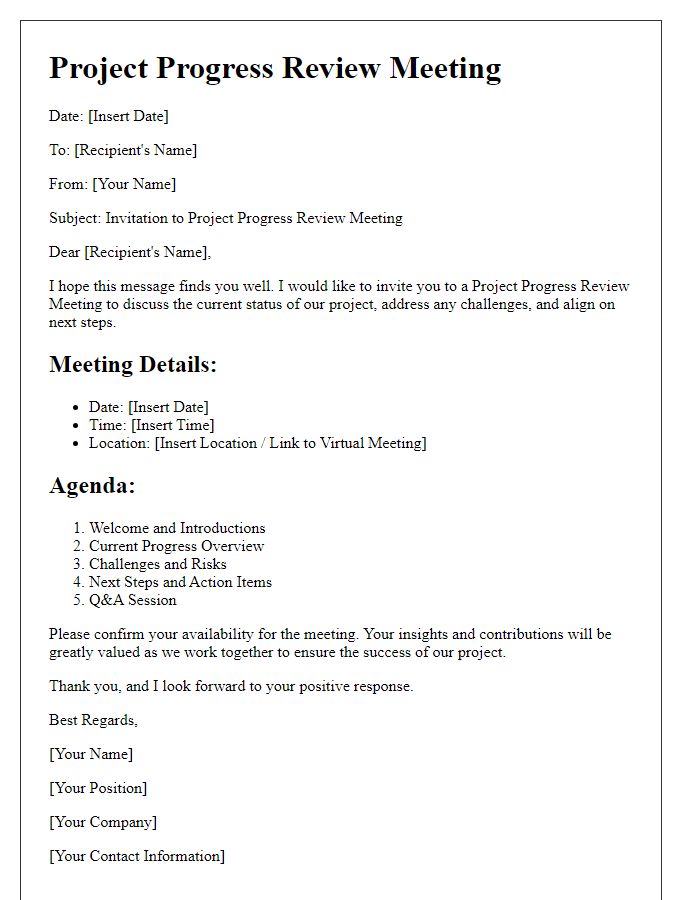

Clear Meeting Agenda

A clear meeting agenda for a post-investment review meeting outlines essential topics for discussion to evaluate the recent investment's performance and future prospects. Key areas of focus include investment rationale, expected outcomes, current performance metrics, and alignment with strategic goals. Participants should review data such as return on investment (ROI) percentages, market trends, and competitive positioning in the industry. Additional points should encompass resource allocation, risk assessment on potential challenges, and future action plans to enhance investment value. This structured approach fosters a comprehensive evaluation, ensuring all stakeholders engage in productive dialogue.

Key Performance Indicators (KPIs)

Key Performance Indicators (KPIs) are essential metrics used to evaluate the success of investments across various sectors. For instance, in the financial industry, return on investment (ROI) percentages that exceed 15% annually demonstrate effective utilization of capital. Customer satisfaction scores, often measured through surveys on a scale from 1 to 10, significantly impact repeat business, with a score of over 8 indicating strong customer loyalty. In the tech sector, user engagement metrics, such as daily active users (DAUs) surpassing 1 million, reflect robust product acceptance and market penetration. Additionally, market share growth, particularly increases of at least 5% in competitive segments, serves as a critical indicator of overall business health. These KPIs, combined with quarterly revenue growth rates, ideally above 10%, provide a comprehensive view of investment performance, guiding strategic decisions and future funding opportunities.

Investment Progress Review

The post-investment review meeting serves to evaluate the performance and progress of investment initiatives, particularly in the context of venture capital startups based in Silicon Valley. Key metrics such as revenue growth, user acquisition rates, and operational efficiency are analyzed to assess alignment with projected milestones outlined in the investment thesis. Participants, including investment analysts and founders, concentrate on financial statements from Q3 2023, market conditions influenced by recent economic shifts, and pivot strategies emerging from customer feedback. The outcome determines necessary adjustments in future funding rounds or operational guidance while fostering transparent communication between stakeholders.

Stakeholder Feedback

Stakeholder feedback plays a crucial role in evaluating the outcomes of a recent investment, such as a $2 million capital infusion into a tech startup specializing in artificial intelligence. Gathering input from key stakeholders, including venture capital partners, product development teams, and customer representatives, is essential for assessing the effectiveness of the investment strategy and alignment with market trends. For instance, the feedback could focus on product quality enhancements, customer satisfaction metrics indicating increased engagement, or shifts in sales figures. These insights not only help in identifying strengths such as successful product launches or innovative features adopted, but also highlight areas for improvement, including potential risks associated with market competition or operational inefficiencies. Engaging stakeholders in this review ensures comprehensive analysis and informed decisions for future investment initiatives.

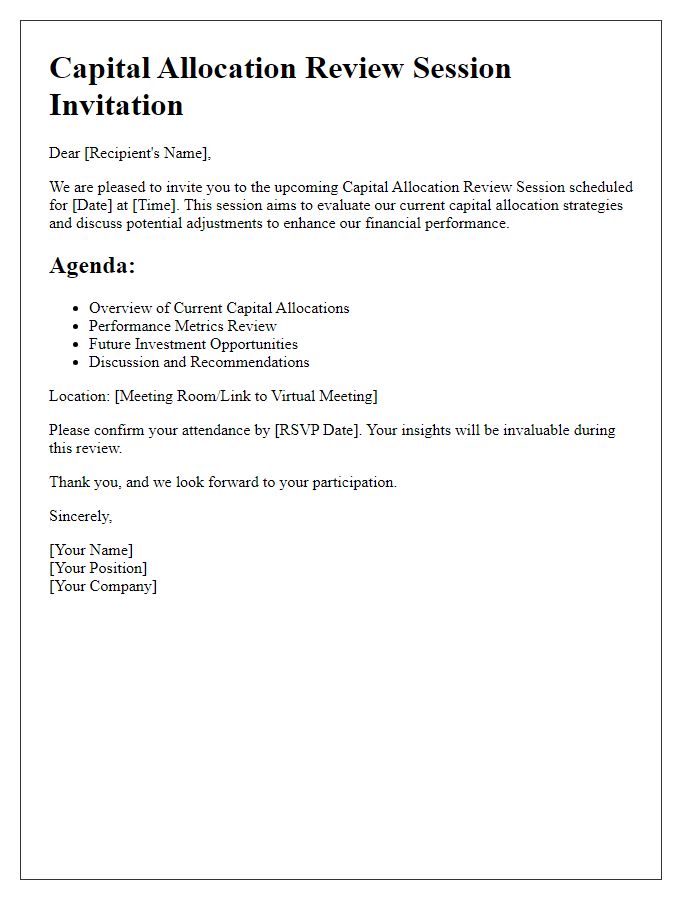

Action Items and Future Strategies

During the post-investment review meeting, stakeholders will discuss critical action items pertaining to project evaluation and future strategies aimed at enhancing business performance. Key metrics, such as return on investment (ROI) percentages from Q1 to Q3 2023, will be analyzed to assess profitability and growth potential. Evaluation of the strategies implemented during the initial investment phase will consider competition within specific markets, notably technology hubs like Silicon Valley and emerging hotspots in Southeast Asia. Discussions will guide strategic priorities, including potential partnerships, market expansion plans, and product innovation initiatives, ensuring alignment with overarching company goals. Additionally, participants will address resource allocation efficiency to optimize operational workflows, ensuring sustainability in growth while decreasing overhead costs.

Comments