Are you curious about the best timing for ex-dividend investments? Understanding the nuances of ex-dividend dates can be the key to maximizing your portfolio's returns. In this guide, we'll break down what ex-dividend means and how you can strategically plan your investments around these dates. So, grab a cup of coffee and let's dive deeper into how to make the most of your investment strategy!

Company name and stock symbol

Investing in stocks, such as Apple Inc. (AAPL), requires an understanding of ex-dividend dates, critical for maximizing dividend income. Ex-dividend is a key date, typically set one business day before the dividend record date, when shareholders must own the stock to qualify for the upcoming dividend payout. For example, if Apple announces a dividend on March 1 with an ex-dividend date of March 15, investors must purchase shares before the 15th to be eligible for the dividend. Monitoring these dates is essential for strategic investment timing and ensuring receipt of dividends, which can significantly enhance overall investment returns.

Ex-dividend date

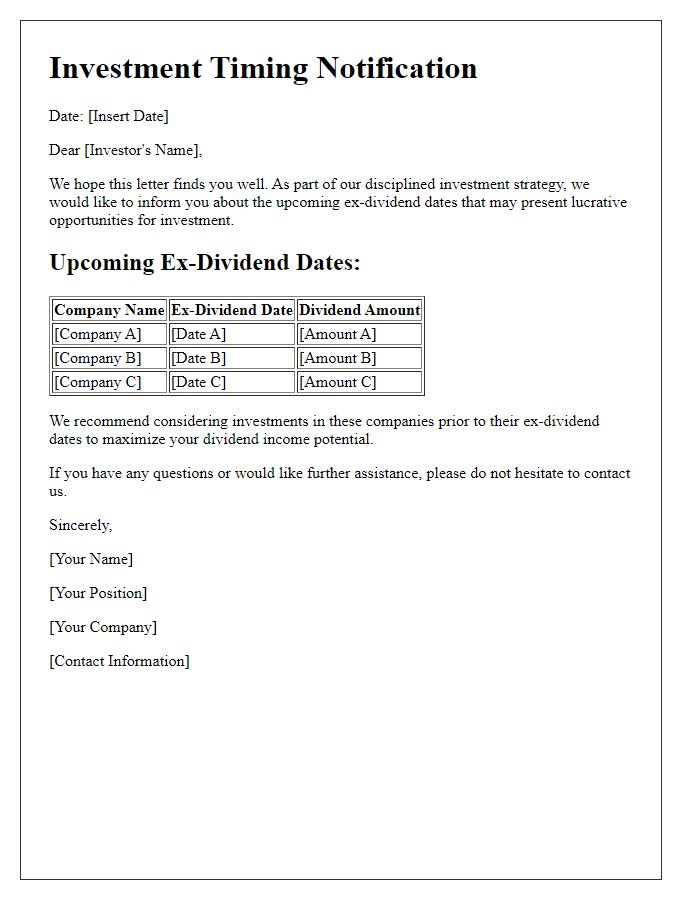

Investors keen on capitalizing on dividend-paying stocks must pay attention to the ex-dividend date, which signifies the cutoff point for receiving the next dividend payment. For instance, let's consider a prominent company like Apple Inc. (AAPL), where the ex-dividend date falls on January 7, 2024. Shareholders who purchase shares on or after this date will not receive the upcoming dividend, scheduled for distribution on February 15, 2024. To secure dividends, investors typically aim to purchase the stock before the ex-dividend date. Timing the market around these critical dates is essential for optimizing returns in a dividend-centric investment strategy. Understanding these dates allows shareholders to make informed decisions, maximizing their income from dividends while navigating the stock market effectively.

Record date

Investors seeking to capitalize on ex-dividend investment strategies must pay close attention to key dates such as the record date, which is the date set by a company to determine its shareholders eligible to receive the upcoming dividend payment. This date is crucial for maintaining ownership in dividend-yielding stocks, and investors must purchase shares before the ex-dividend date, typically one business day prior to the record date, to qualify. Companies like Coca-Cola, known for regular dividend payouts, often announce their ex-dividend dates along with their quarterly earnings reports. Understanding the timeline surrounding these events is essential; for instance, if the record date is set for December 10th, investors should ensure they buy their shares before December 9th, thus securing their entitlement to the dividend. Failing to do so means missing out on potential income from dividends, impacting overall investment strategy.

Dividend payment date

Ex-dividend investment timing plays a crucial role for investors seeking to capitalize on dividends. The ex-dividend date, typically set one business day before the record date, signifies the deadline to purchase shares in order to receive the upcoming dividend payment. For instance, if a company announces a dividend payment date of March 15 and a record date of March 10, the ex-dividend date would be March 9. Shares purchased on or after this date do not qualify for the declared dividend, prioritizing investors who hold shares before the cut-off. This critical timeframe allows investors to optimize their investment strategy, ensuring eligibility for dividend disbursements while maintaining overall portfolio performance.

Dividend per share amount

Ex-dividend investment timing involves strategic decisions around dividend distribution dates. Companies announce a specific Dividend Per Share (DPS) amount, which indicates the cash payout to shareholders on a per share basis. This financial event, typically announced in quarterly earnings reports, necessitates investors to determine the ex-dividend date--often set one business day before the record date. For example, if a company declares a DPS of $0.50 and the ex-dividend date falls on July 15, investors must purchase shares by July 14 to qualify for the dividend. Missing this deadline results in forfeiting the payout, making the timing of investments crucial for dividend-seeking portfolios. Understanding the financial implications surrounding Announcements, Ex-Dividend, and Payment dates shapes an investor's approach to building income-generating assets.

Comments