Are you considering expanding your investment horizons through a limited partnership? This innovative structure can offer unique financial advantages and collaborative opportunities, paving the way for mutual success in various industries. By pooling resources and expertise with like-minded partners, you'll be able to navigate the complexities of investment with greater ease and confidence. Curious to learn more about how a limited partnership can benefit you? Keep reading!

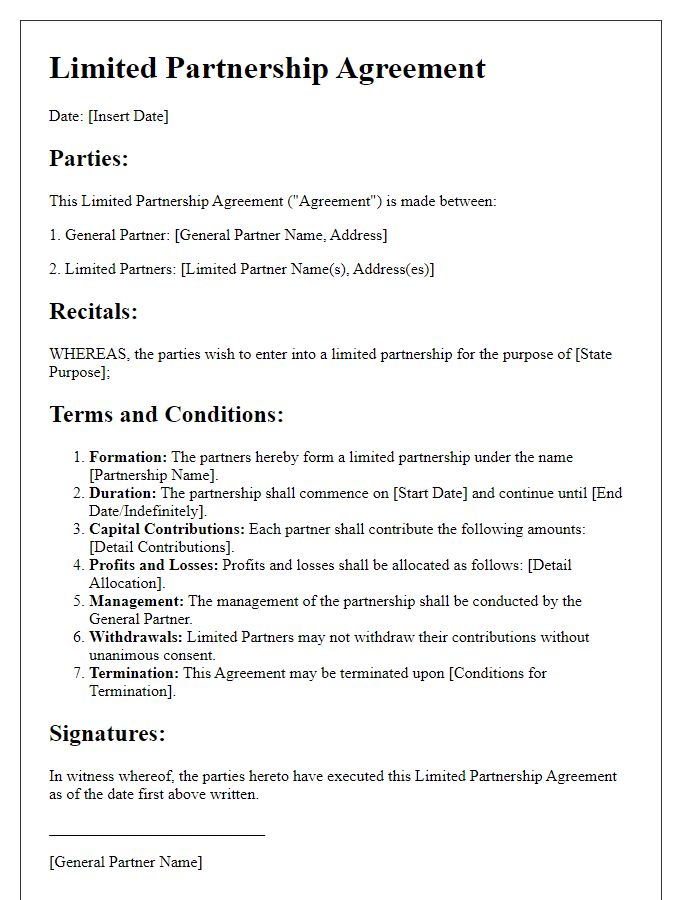

Partnership Structure and Overview

In a limited partnership structure, two distinct classes of partners exist: general partners and limited partners. General partners, often involved in day-to-day operations, possess unlimited liability for the debts and obligations of the partnership, while limited partners contribute capital and have liability limited to their investment amount, typically a fixed dollar amount or percentage of the total capitalization. The partnership operates under a formal agreement that specifies the roles, responsibilities, and distribution of profits, including specify a percentage often outlined (commonly 70%-30% split) between the two classes based on investment contribution or operational involvement. Generally, limited partnerships are advantageous for investors seeking reduced liability and passive income opportunities, especially in sectors such as real estate investment, private equity, and venture capital, where capital outlay can be substantial, attracting high-net-worth individuals. This structure also allows for efficient management and operational flexibility while adhering to state regulations as outlined in partnership laws ranging from the Revised Uniform Limited Partnership Act (RULPA) to specific state statutes.

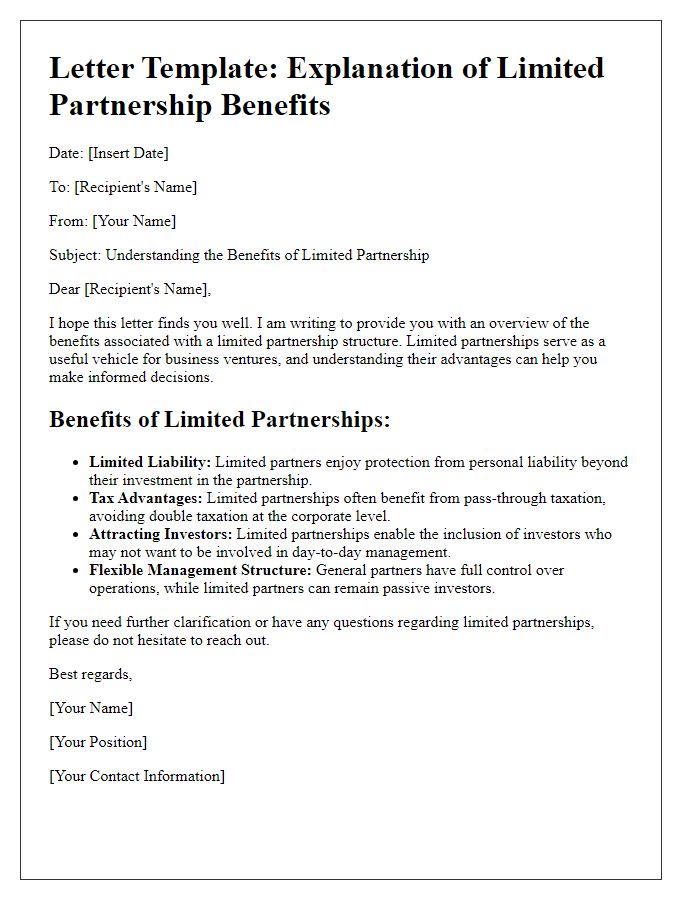

Investment Opportunity and Benefits

Limited partnerships present a unique investment opportunity for individuals seeking to engage in business ventures with a blend of limited liability and pass-through taxation. Investors can benefit from contributing capital to a diverse range of sectors, such as real estate, startups, or renewable energy projects, often outlined in partnership agreements. Each partner's liability is restricted to their investment amount, minimizing personal financial risk. Potential returns on investment, often projected at impressive rates, can stem from profit-sharing arrangements and appreciation in asset value. Additionally, limited partners may enjoy the advantage of passive income without involvement in day-to-day operations, making this structure appealing for both novice and seasoned investors. Effective management by general partners typically enhances the potential for growth and sustainability in the targeted industries.

Risk Factors and Disclosures

Limited partnerships present unique investment opportunities but come with specific risk factors that potential investors must consider. Market volatility can impact investment returns, particularly in sectors such as real estate, venture capital, or energy markets, where fluctuations can exceed 20% within a year. Regulatory changes across jurisdictions, like tax reforms or compliance mandates, pose additional risks, affecting operational costs and profitability. Liquidity risk remains significant, as limited partners may face challenges in selling their interests due to a lack of market demand, particularly in private placements. Furthermore, management decisions led by general partners can significantly influence performance, placing limited partners at risk if management lacks experience or fails to execute strategy effectively. Understanding these factors is crucial for informed decision-making in partnership investments.

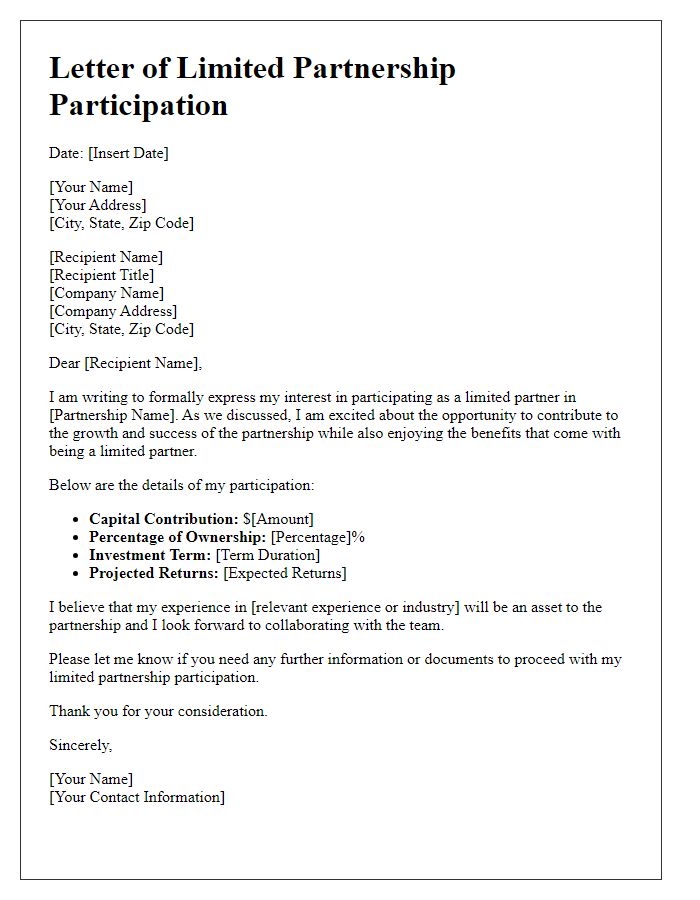

Terms and Conditions of the Offering

The limited partnership offering outlines specific terms and conditions crucial for potential investors. The initial capital contribution required is $50,000, providing access to exclusive investment opportunities in emerging markets, specifically renewable energy sectors. The partnership duration is set at 5 years, with an annual return rate projected at 8% based on historical performance metrics. Investors must comply with accredited investor standards, as defined by the Securities and Exchange Commission (SEC). Distribution of profits will be conducted quarterly, commencing three months post-formation. Additionally, the partnership may impose management fees up to 2% annually, to cover operational costs. Requested commitments must be finalized by December 15, 2023, to ensure inclusion in this investment cycle.

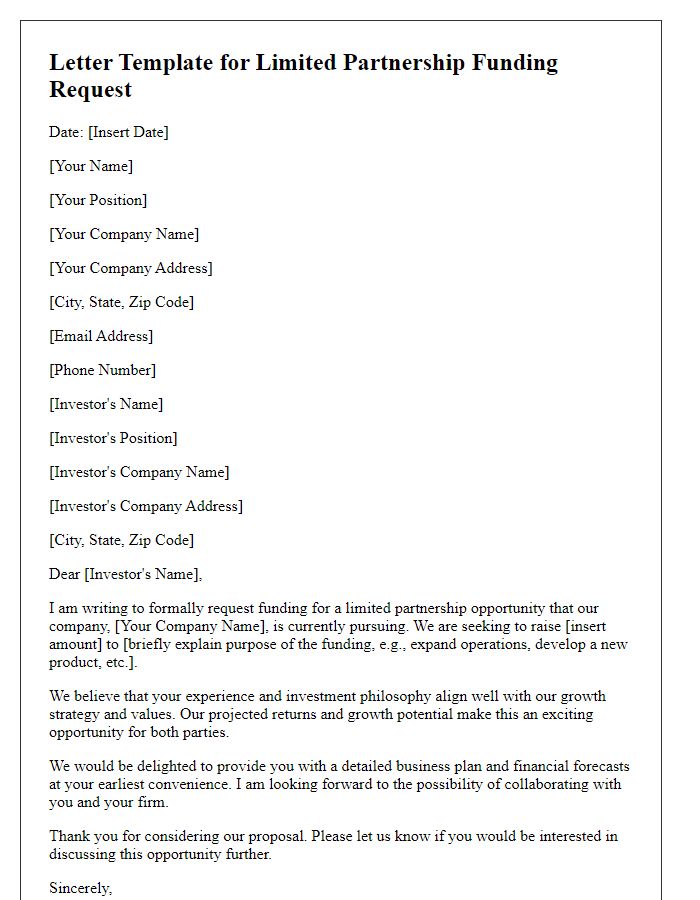

Contact Information for Inquiries and Further Details

Limited partnership offerings often require clear and accessible contact information for potential investors seeking inquiries and further details about the investment opportunity. This contact information should ideally include the name of the partnership entity, a dedicated email address (such as info@partnershipname.com), a direct phone number including area code (like (123) 456-7890), and physical office location (for example, 123 Investment St, Suite 100, New York, NY 10001). Ensuring that the designated contact person is knowledgeable about the partnership, such as a fund manager or investment advisor, can facilitate a smoother inquiry process while also establishing credibility with interested parties in the investment landscape.

Comments