If you're diving into the world of equity investment agreements, crafting the perfect letter can set the tone for a successful partnership. Whether you're an investor looking to fund a promising venture or a startup seeking essential capital, a well-structured letter outlines the key terms and expectations for all parties involved. It's not just about numbers; it's about building trust and clarity right from the start. Ready to explore how to create an effective equity investment agreement letter? Keep reading!

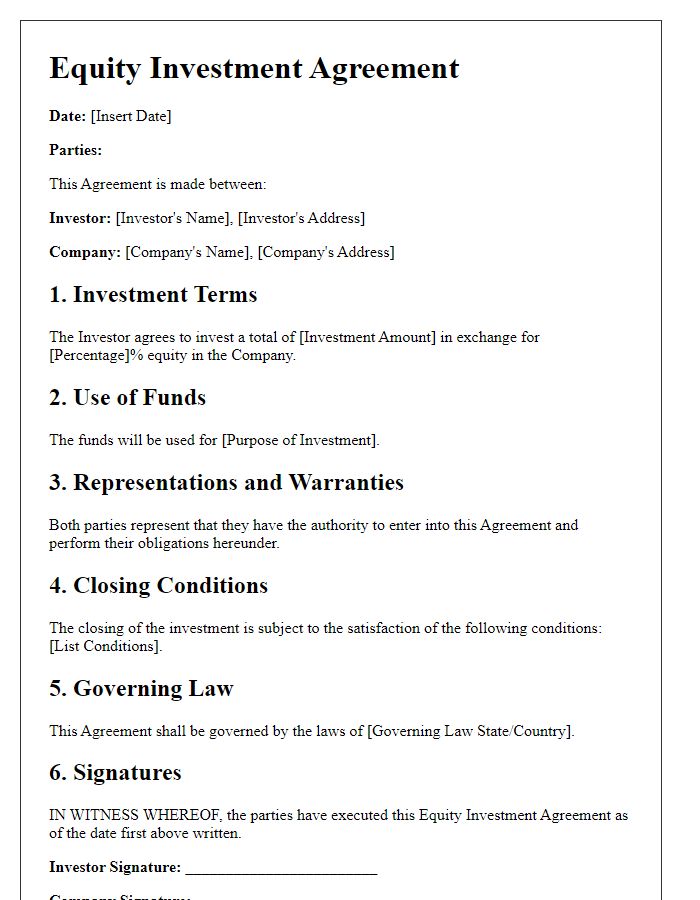

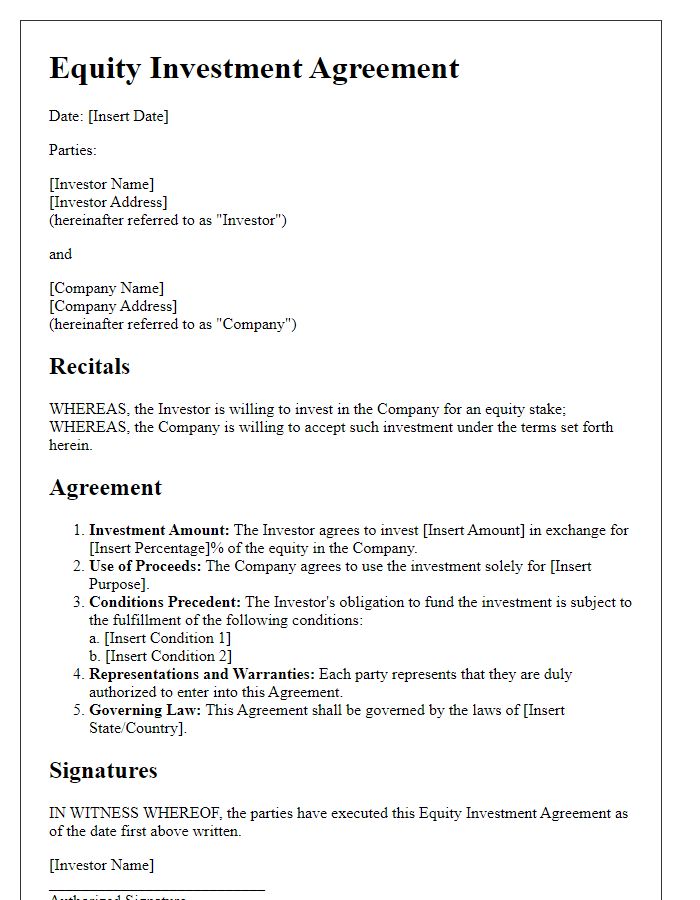

Parties Identification

An equity investment agreement typically begins with the identification of the parties involved. This section outlines the legal names of the entities participating in the agreement, including investors and the company receiving investment. For example, "Investor: ABC Capital Partners, a limited liability company organized under the laws of Delaware, with a registered office located at 123 Investment Lane, Wilmington, DE, 19801. Company: XYZ Innovations Inc., a corporation incorporated under the laws of California, with its principal place of business at 456 Tech Avenue, San Francisco, CA, 94105." Such clear identification ensures that all parties are accurately recognized legally, minimizes potential disputes regarding responsibilities, and defines the contractual relationship between them.

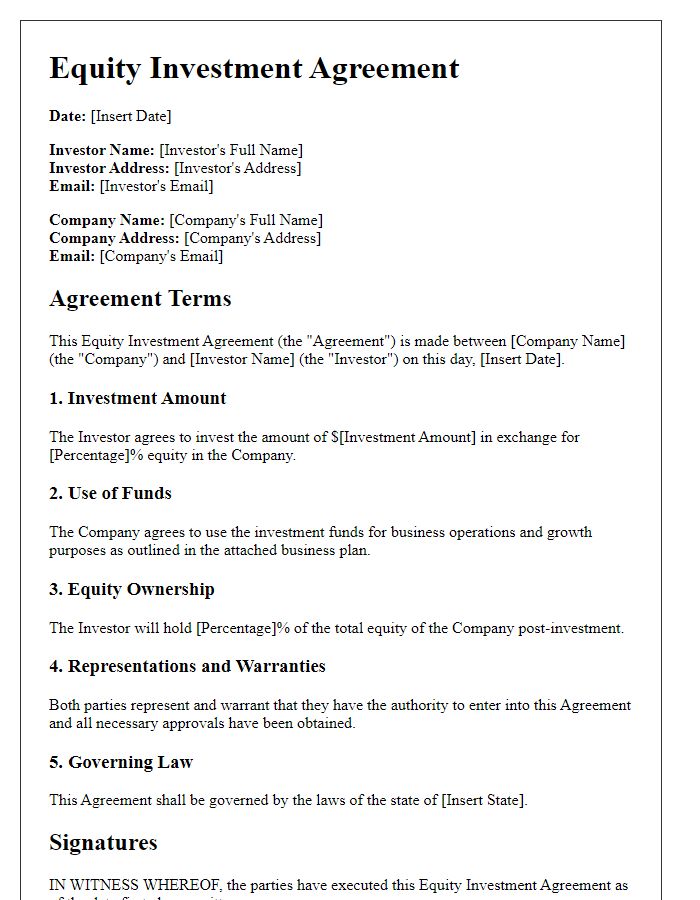

Investment Amount and Valuation

Investment amount details can outline the specific monetary contribution made by an investor to a startup or growing company, often indicated in U.S. Dollars or Euro, depending on the agreement's financial context. Valuation, which refers to the estimated worth of the company prior to investment, typically includes pre-money valuation (value before the new capital injection) and post-money valuation (value after the investment is added). These valuations provide a basis for determining the percentage of equity shares allocated to the investor, which can significantly impact ownership percentages in future financial rounds and the overall capital structure of the company. Accurate calculations are crucial for ensuring fair negotiations, especially as companies grow and attract additional funding.

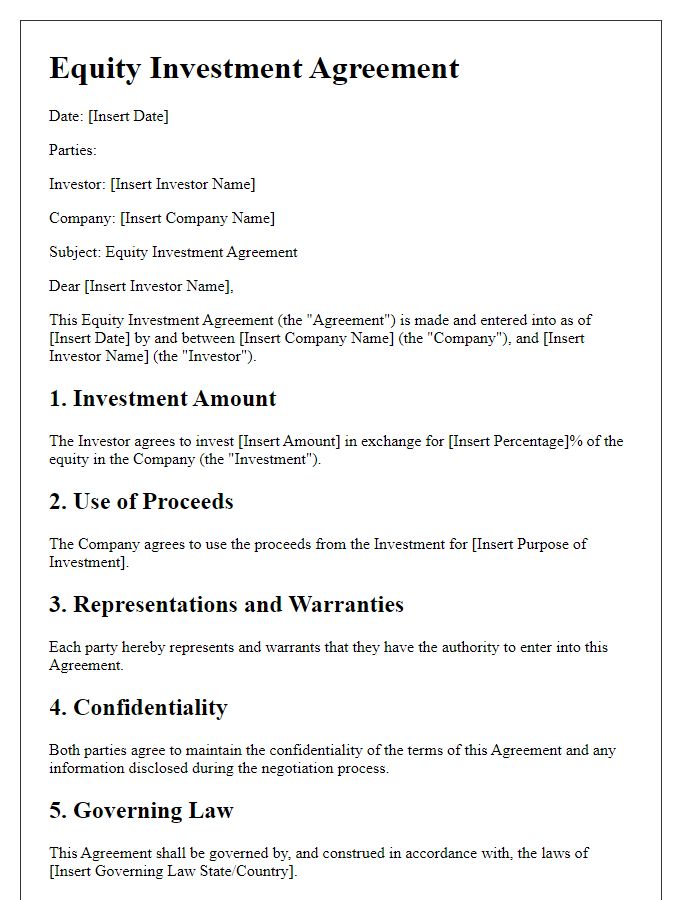

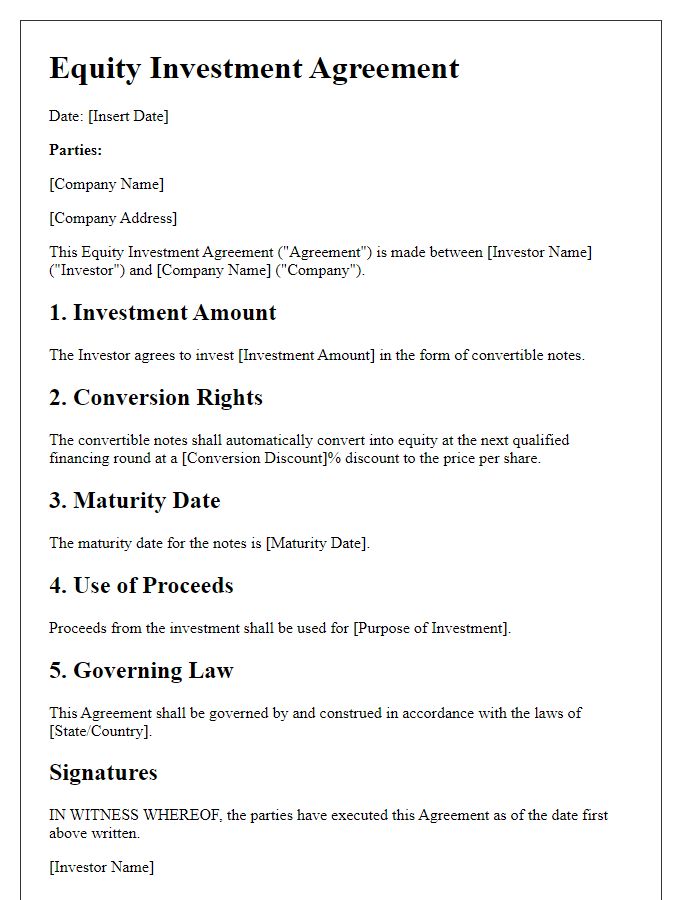

Equity Terms and Conditions

The equity investment agreement outlines the specific terms and conditions governing the investment made by an investor into a company, typically a startup or a private company. The investment amount, often ranging from thousands to millions of dollars, specifies the percentage of equity ownership granted in return. Key terms include valuation cap, which sets a maximum company valuation for equity conversion; liquidation preference, detailing the order in which investors are paid during company liquidation events; and vesting schedule, outlining the timeframe for equity distribution for key personnel. Rights associated with equity ownership might encompass voting rights, board representation, and access to financial statements. Additionally, exit strategies such as initial public offerings (IPOs) or acquisitions play a vital role in determining potential returns on investment. These terms are crucial for aligning the interests of both investors and founders in ensuring the business's growth and profitability.

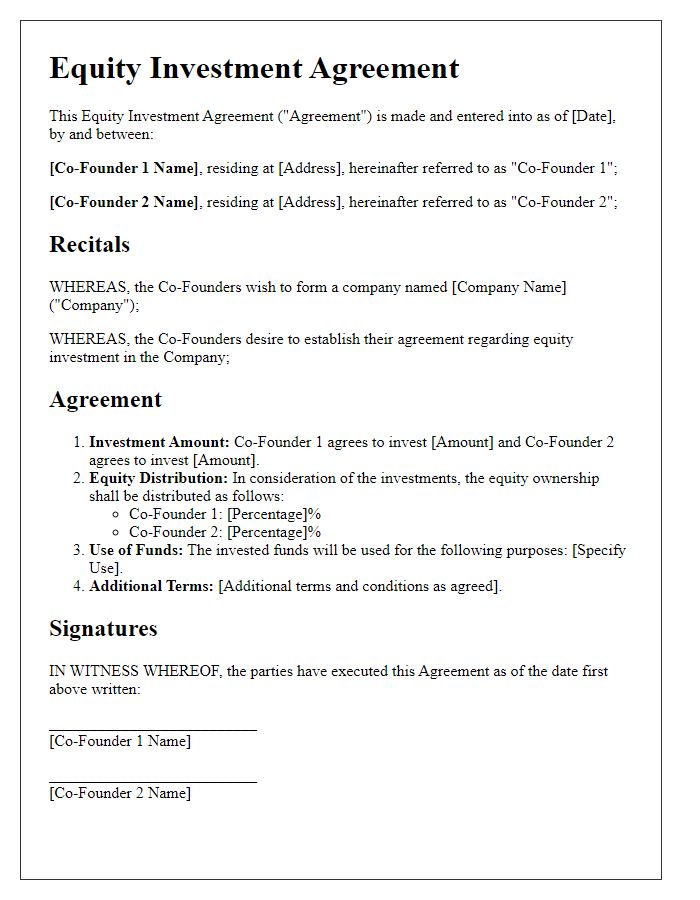

Rights and Obligations

In an equity investment agreement, the rights and obligations delineate the responsibilities of both the investors and the issuing company. Key terms include equity stake, which refers to the percentage of ownership in the company, typically defined in shares. Investors often gain preferred rights, such as priority in dividend distribution, which can be distributed quarterly or annually based on company profitability. Voting rights empower investors to participate in significant company decisions, such as mergers or acquisitions. Additionally, obligations may include financial reporting requirements, where the company must provide accredited investors with annual financial statements audited by a certified public accountant. Exit rights outline the conditions under which investors can sell their equity stake, including drag-along rights that facilitate sales if a majority opts for a sale. These provisions ensure alignment of interest between shareholders and management, promoting transparency and accountability throughout the investment duration.

Dispute Resolution and Governing Law

Dispute resolution mechanisms are crucial in equity investment agreements to address potential conflicts between parties. Standard clauses often require mediation as the first step, followed by arbitration, specifically under institutions such as the American Arbitration Association (AAA) or the International Chamber of Commerce (ICC). The governing law, typically specified within the agreement, determines the legal framework applicable to the contract, often favoring jurisdictions known for their business-friendly laws, such as Delaware in the United States. This ensures clarity in legal proceedings and enhances the enforceability of the agreement. Specific timelines for dispute resolution processes, consequences for non-compliance, and the appointment of arbitrators should also be clearly outlined to avoid ambiguity.

Letter Template For Equity Investment Agreement Samples

Letter template of equity investment agreement for crowdfunding campaigns

Letter template of equity investment agreement for family and friends investments

Letter template of equity investment agreement for international investors

Comments