Are you ready to dive into the world of venture capital and discover how to secure the funding your startup deserves? In this article, we'll explore essential tips for crafting an impactful introduction letter that captures the attention of potential investors. By understanding the key elements to include, you can create a compelling narrative that highlights your unique value proposition. So, let's get started and unlock the secrets to making a lasting impression on venture capitalists!

Clear and Concise Value Proposition

A clear and concise value proposition is essential for attracting venture capital investment in startup companies. Effective presentations should highlight unique offerings or innovative solutions to existing problems, particularly in sectors such as technology, healthcare, or renewable energy. Identifying target demographics, market size statistics (for example, a projected growth of 15% in the tech industry by 2025), and potential revenue models can enhance the pitch. Additionally, demonstrating a competitive advantage, such as proprietary technology or an experienced founding team with industry expertise, can significantly influence investment decisions. Showcasing successful pilot programs or user acquisition metrics adds credibility, further enticing potential investors.

Market Opportunity and Differentiation

Emerging technology firms have identified significant growth opportunities in the renewable energy sector, specifically solar power solutions. According to the International Energy Agency (IEA), global solar energy capacity reached 1,200 gigawatts in 2022, reflecting a year-on-year increase of over 25%. Companies like SunPower, based in California, differentiate themselves through innovative photovoltaic cell designs, enhancing energy efficiency by up to 22% compared to traditional models. Additionally, advancements in energy storage systems, such as Tesla's Powerwall, offer scalability options for residential and commercial applications, catering to the rising demand for sustainable energy sources. This sector not only addresses environmental concerns but also promises substantial economic returns as governments worldwide implement green energy initiatives, fostering a favorable investment landscape for venture capitalists.

Team Background and Expertise

Aspiring entrepreneurs often seek funding from venture capital firms to scale their innovative ideas into successful businesses. An effective introduction should highlight the team's unique qualifications, including educational backgrounds from prestigious institutions like Stanford University and Harvard Business School, along with relevant industry experience in tech startups and successful exits totaling over $50 million. Mentioning key team members, such as a former software engineer from Google and a marketing strategist with experience at Salesforce, provides credibility. Additionally, showcasing insights into previous successful projects, such as an app that garnered over 1 million downloads within six months, emphasizes the team's proven track record in execution and growth potential. This narrative sets the stage for a compelling venture capital pitch.

Financial Overview and Growth Projections

The financial overview of our startup, XYZ Innovations, illustrates a robust revenue model projected to generate $5 million in 2024, escalating to $15 million by 2026. Key revenue streams include both subscription-based services and one-time project fees within the technology consulting sector. Current cash flow from initial projects shows a 25% profit margin, driven by low operational costs and strategic partnerships with industry leaders in Silicon Valley. Our growth projections indicate a compound annual growth rate (CAGR) of 60% over the next three years, bolstered by anticipated client acquisitions and market expansion efforts in Europe. Investment in marketing and product development is expected to increase our client base by 150%, positioning us as a crucial player in the evolving tech landscape.

Ask and Next Steps

In the rapidly evolving landscape of technology startups, engaging with venture capital firms can be crucial for securing necessary funding. Venture capitalists, individuals or firms that manage pooled investments in high-growth potential startups, are often looking for innovative ideas that promise substantial returns. Articulating a clear ask involves outlining specific funding requirements, detailing the use of funds for product development, market expansion, or talent acquisition. Following the ask, clearly defined next steps, such as scheduling a follow-up meeting or providing additional materials like a business plan, can facilitate further discussions. Demonstrating traction through metrics like user acquisition rates or revenue growth can enhance the appeal of the proposal, making it more likely to pique the interest of investors.

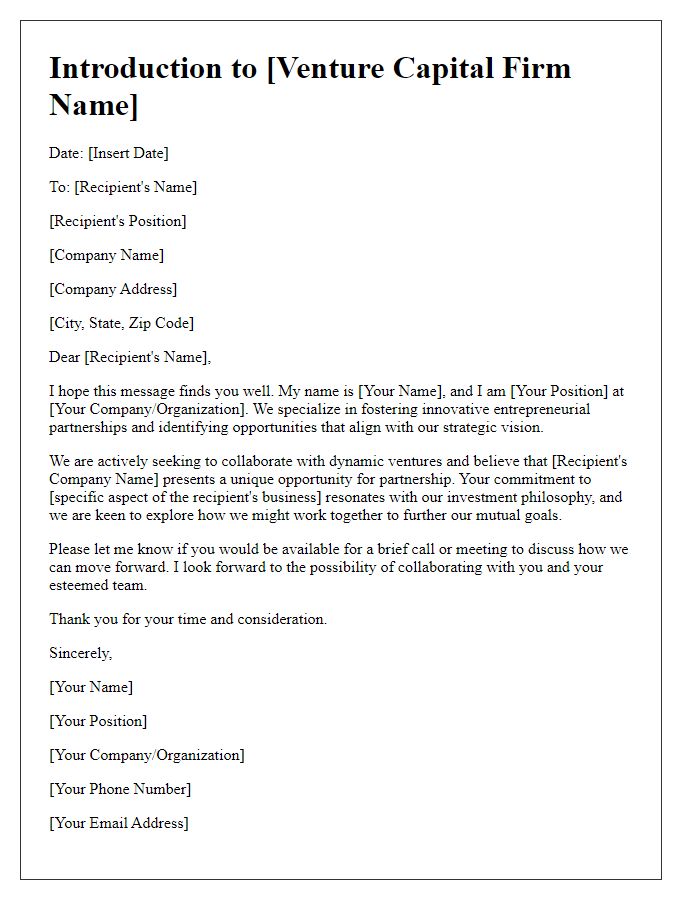

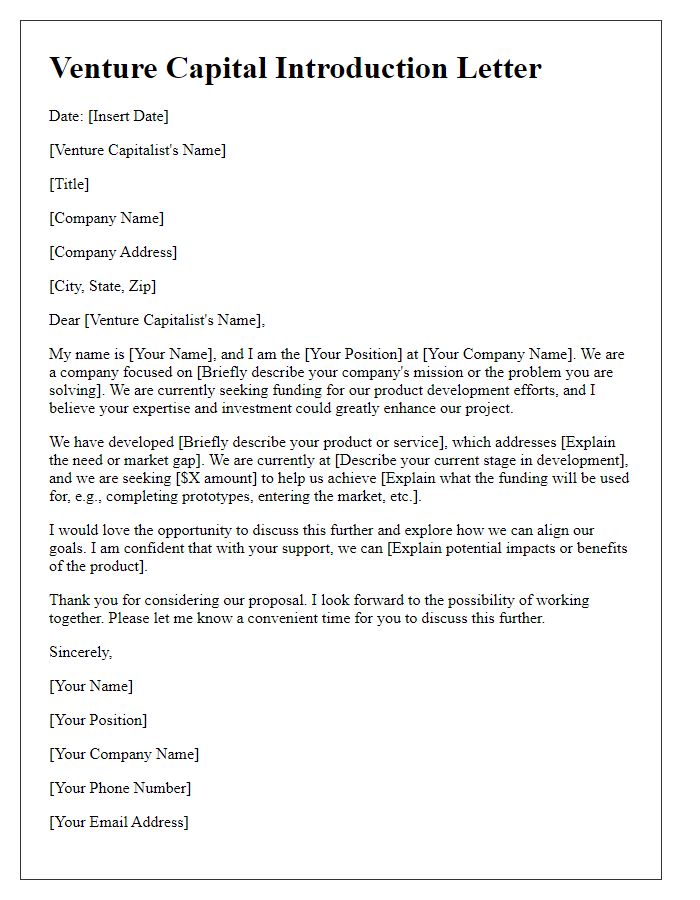

Letter Template For Venture Capital Introduction Samples

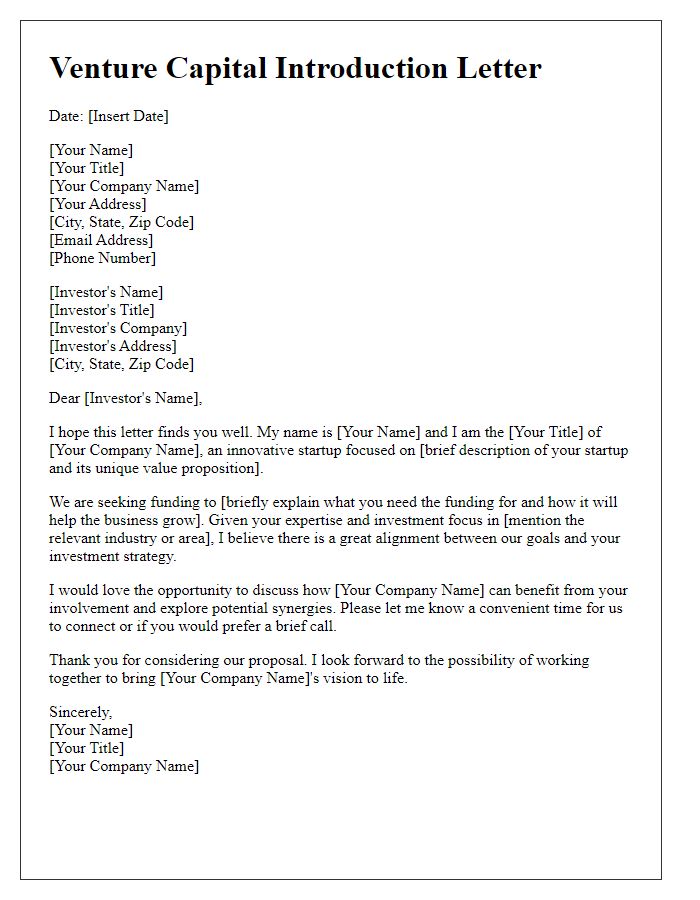

Letter template of venture capital introduction for startups seeking funding.

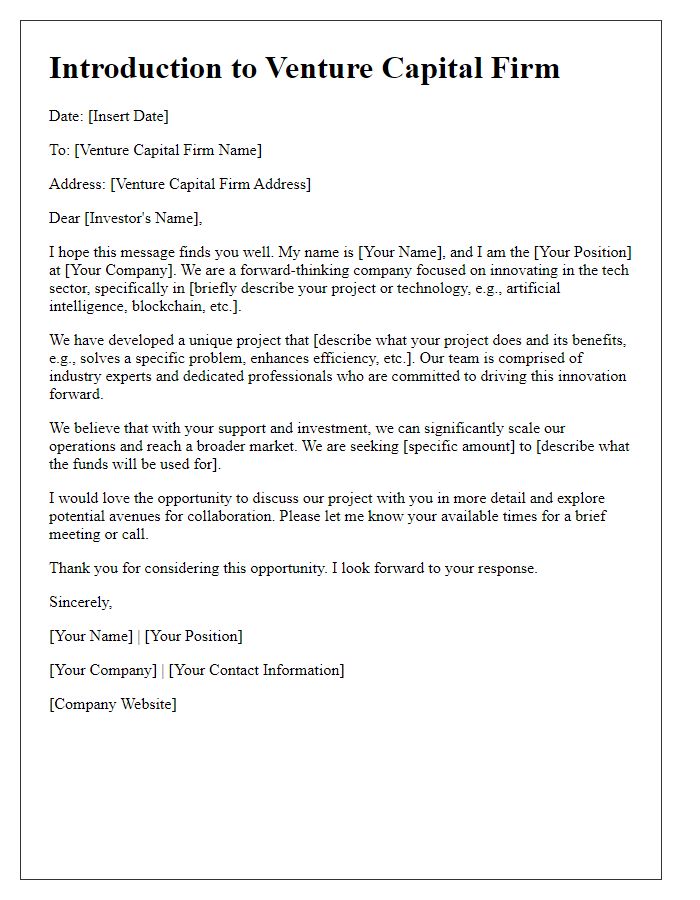

Letter template of venture capital introduction for tech innovation projects.

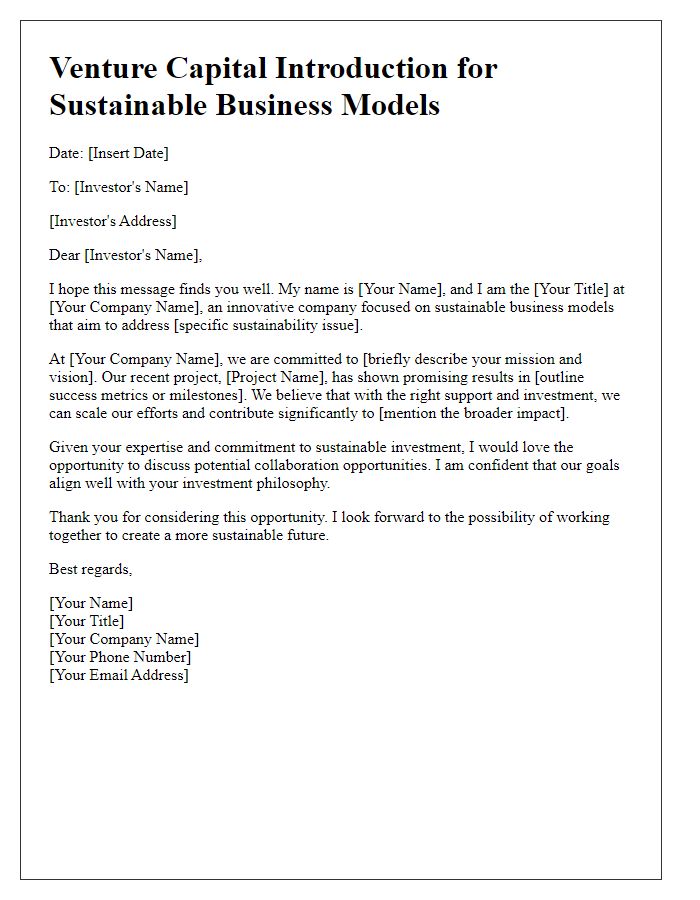

Letter template of venture capital introduction for sustainable business models.

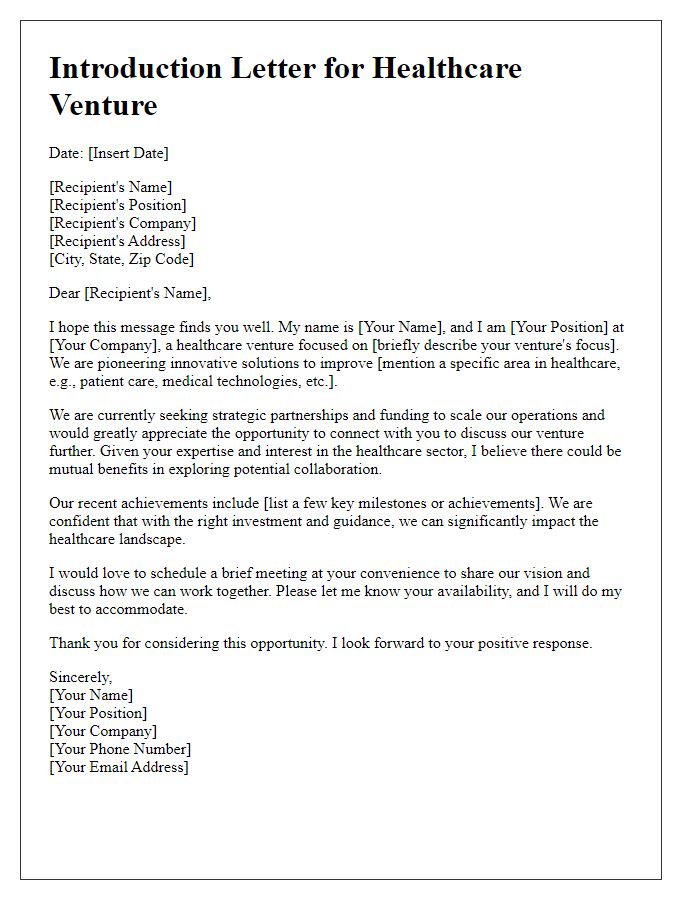

Letter template of venture capital introduction for healthcare ventures.

Letter template of venture capital introduction for social impact initiatives.

Letter template of venture capital introduction for early-stage companies.

Letter template of venture capital introduction for crowdfunding campaigns.

Letter template of venture capital introduction for expanding market opportunities.

Letter template of venture capital introduction for entrepreneurial partnerships.

Comments