Are you looking to make the most of your investment returns? A Dividend Reinvestment Plan (DRIP) could be the perfect solution for you, allowing your dividends to automatically buy more shares instead of just sitting in cash. This strategy not only maximizes your potential for compound growth but also simplifies your investment process. If you'd like to explore how a DRIP can work for you, keep reading to find out more!

Personal Information Details

The Dividend Reinvestment Plan (DRIP) enables shareholders to automatically reinvest their dividends into additional shares of the issuing company, enhancing portfolio growth over time. Participants, such as individual investors or institutional shareholders, can provide personal details including their full name, residential address, Social Security Number (SSN), and account information, which may include a brokerage account number or a unique identify identifier for accurate processing. By opting into the DRIP, investors often benefit from dollar-cost averaging, avoiding commission fees, and compounding returns, making it a strategic choice for long-term wealth accumulation.

Account and Shareholder ID

Dividend reinvestment plans (DRIPs) allow shareholders to automatically reinvest cash dividends into additional shares of a company. Shareholder ID represents the unique identification assigned to each investor in the company's registry. Account number indicates the specific investment account linked to the shareholder's profile. Accurate identification through these numbers streamlines the management of reinvestments and ensures precise tracking of shares owned. DRIPs typically offer advantages such as reduced transaction fees and the potential for compounding growth over time, appealing to long-term investors looking to maximize their investment potential efficiently.

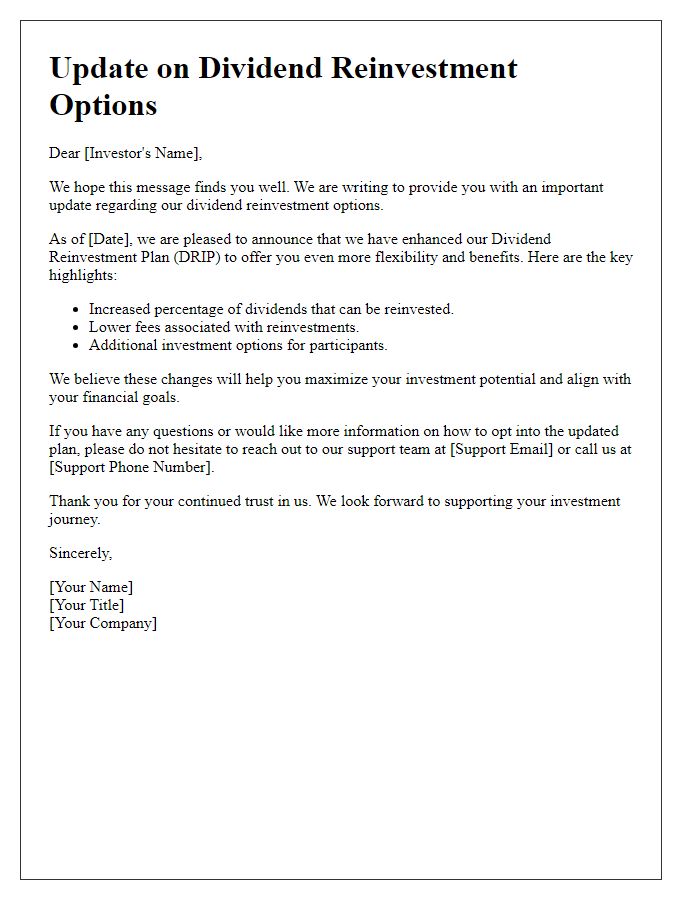

Reinvestment Plan Options

The dividend reinvestment plan provides shareholders an opportunity to reinvest dividends directly into additional shares of the company's stock, typically at a reduced cost and without brokerage fees. Participants in this plan can benefit from compound growth as dividends accumulate and purchase additional shares over time, enhancing investment value. For instance, many companies facilitate this by offering shares at a discount of 5% to 10% compared to the market price. The plan often allows for automatic reinvestment of dividends quarterly, making it a convenient option for investors aiming for long-term growth. Additionally, some plans offer flexibility by permitting shareholders to make optional cash purchases of shares, further increasing their investment in the company without the need for traditional brokerage services.

Dividend Allocation Preferences

In a Dividend Reinvestment Plan (DRIP), shareholders can choose to reinvest their dividends instead of receiving cash payouts. This decision can significantly enhance long-term investment growth by purchasing additional shares automatically, often without brokerage fees. Shareholders may allocate preferences for how dividends are distributed among various investment options, such as purchasing shares in the parent company or funding specific projects. This systematic approach (often executed quarterly) allows for compounded growth, especially in companies with robust dividend policies and a history of increasing payouts, such as Fortune 500 firms. By selecting reinvestment, investors align their preferences with a strategic growth plan, potentially benefiting from favorable tax treatments on long-term capital gains.

Contact and Customer Support Information

For inquiries regarding the Dividend Reinvestment Plan (DRIP), contact our dedicated Customer Support team, available Monday to Friday from 8 AM to 6 PM Eastern Time. Reach our customer service hotline at (800) 555-0199 for immediate assistance or email support at support@companyname.com for less urgent matters, ensuring a response within 24 hours. Access our online help center at www.companyname.com/support for comprehensive resources, frequently asked questions, and detailed guides on managing your account. Follow us on social media platforms like Twitter and Facebook for the latest updates and announcements related to the DRIP and other investment opportunities.

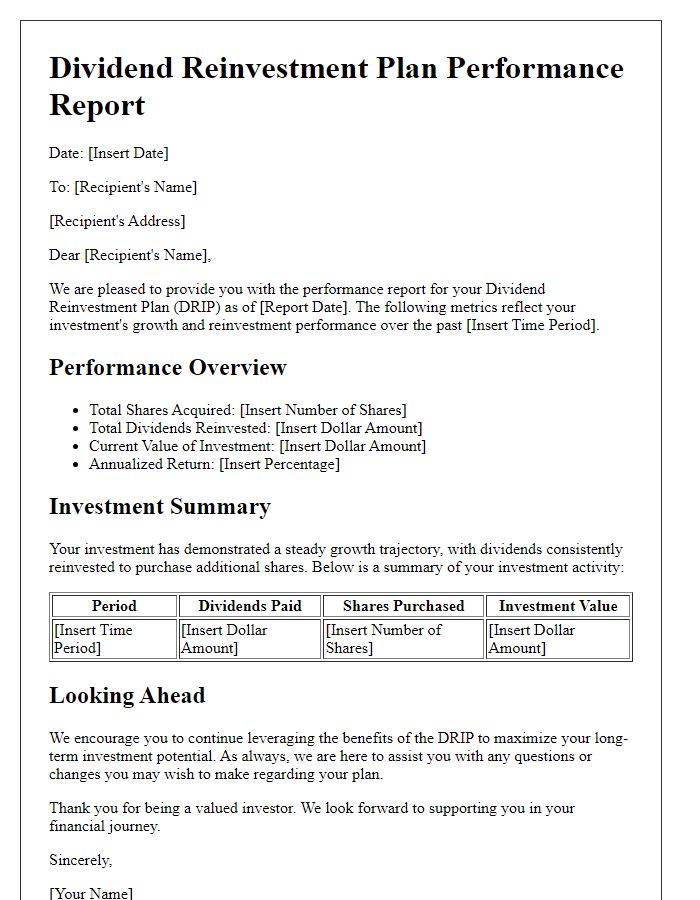

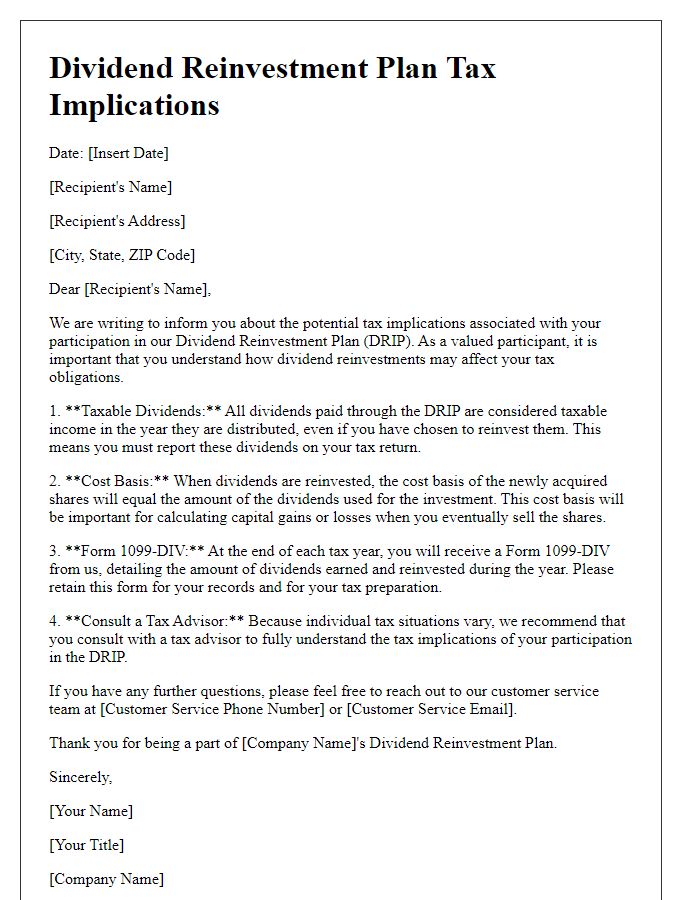

Letter Template For Dividend Reinvestment Plan Samples

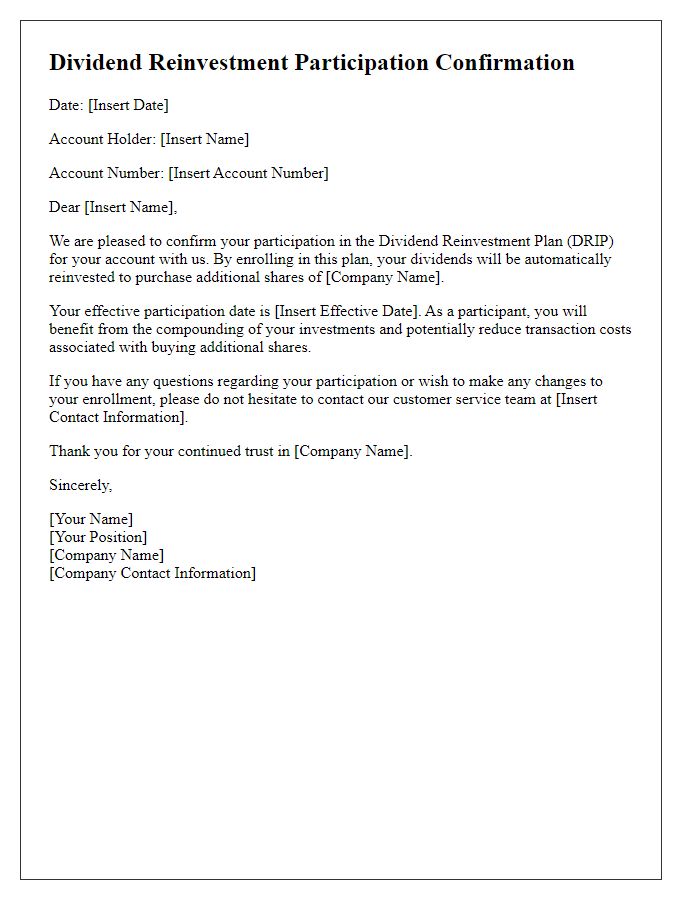

Letter template of confirmation for dividend reinvestment participation.

Comments