Hey there! We understand that keeping track of your investments can sometimes feel overwhelming, but that's why we're here to simplify things for you. In this monthly investment summary, we'll break down your portfolio's performance, highlight key trends, and provide insights that can help guide your future decisions. Interested in diving deeper into the details? Let's explore this month's updates together!

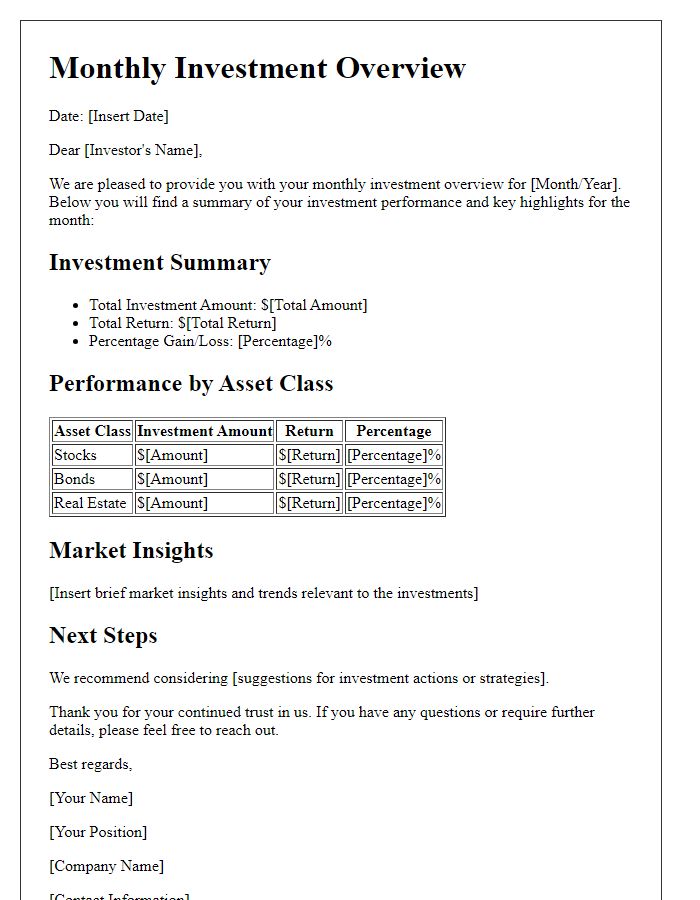

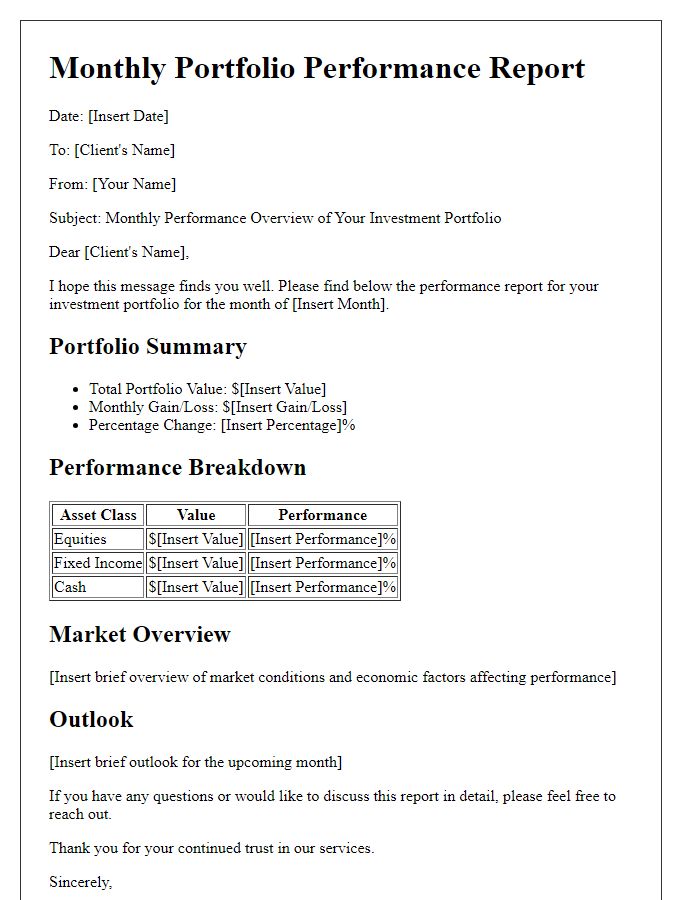

Portfolio Performance Overview

Monthly investment summaries provide insights into portfolio performance, detailing key factors influencing returns. The stock market, particularly indices like the S&P 500, typically fluctuates based on economic indicators like GDP growth or employment rates. Mutual funds, which pool money from multiple investors, may show varying performance depending on the sectors involved, such as technology or healthcare. Interest rates set by the Federal Reserve can also impact bond markets, affecting fixed-income investments. Return on investment (ROI) benchmarks, often expressed as percentages, help assess overall performance. Currency exchange rates may further influence portfolios with international assets, affecting growth in foreign markets. Understanding these elements aids investors in making informed decisions to optimize their investment strategies.

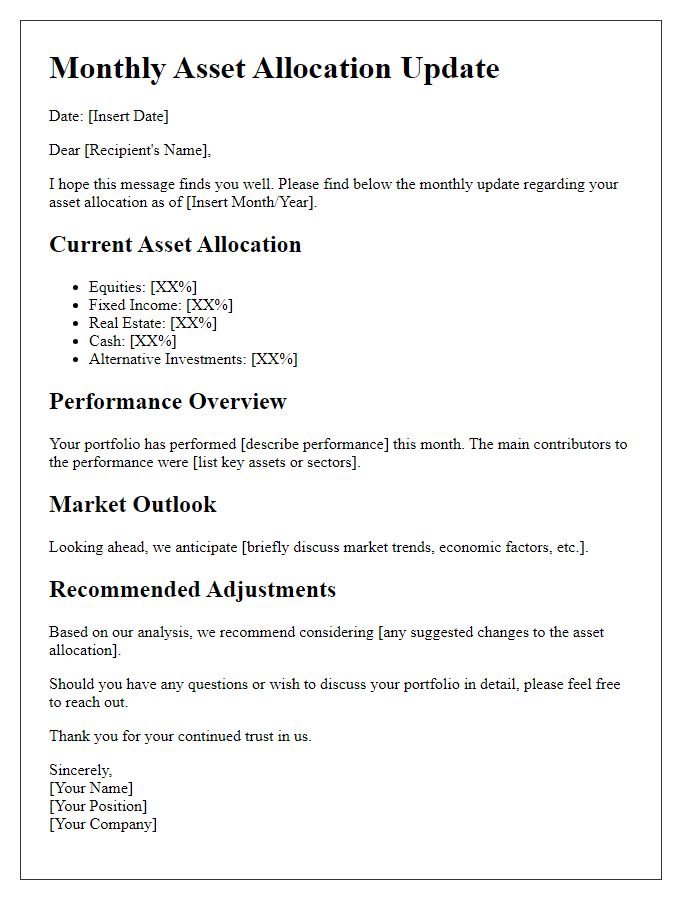

Asset Allocation Breakdown

In the financial realm, an asset allocation breakdown represents a strategic distribution of an investment portfolio's assets across various categories, such as stocks, bonds, and alternative investments. For instance, a typical balanced portfolio might allocate 60% to equities, comprising both domestic and international stocks, while dedicating 30% to fixed income securities, including government and corporate bonds, with the remaining 10% invested in alternative assets like real estate or commodities. This allocation aims to optimize returns while managing risk, tailored to an investor's specific goals and market conditions. In September 2023, for example, many investors sought to diversify amidst the volatility caused by geopolitical tensions and interest rate fluctuations, leading to noticeable adjustments in their asset allocations in response to changing economic indicators.

Market Trends and Analysis

The monthly investment summary provides insights into market trends and analysis, focusing on significant fluctuations in equity indices, such as the S&P 500, which rose by 5% over the past month, influenced by strong technology sector performance. The bond market, particularly U.S. Treasury yields, reached 3.25%, reflecting tightening monetary policy by the Federal Reserve, with interest rate hikes anticipated in upcoming meetings. Global events, including geopolitical tensions in Eastern Europe and trade negotiations in Asia, continue to impact investor sentiment, leading to increased volatility in commodity prices like oil and gold. Additionally, sectors such as renewable energy are gaining traction, driven by a push for sustainability amid climate change concerns, highlighting potential investment opportunities for forward-thinking portfolios.

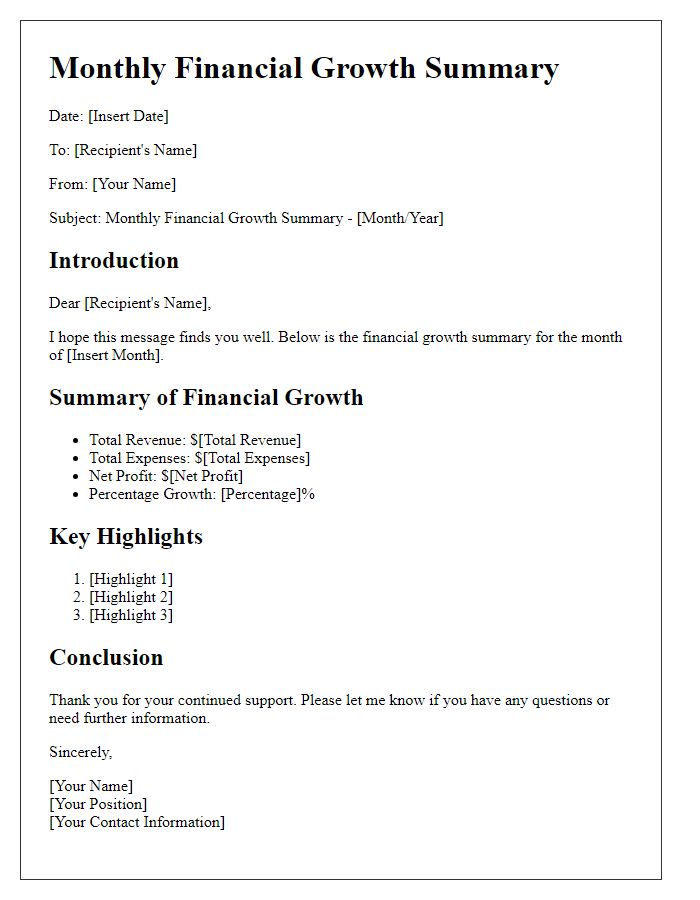

Key Investment Highlights

Key investment highlights for November 2023 showcase notable market trends and portfolio performance. The technology sector, exemplified by companies like Apple and Microsoft, saw a 15% increase due to strong quarterly earnings reports and growing demand for cloud services. Real estate investments, particularly in urban areas like New York and San Francisco, showed resilience, with a 5% appreciation in property values attributed to low interest rates and ongoing urban development projects. Additionally, sustainable energy stocks surged, driven by a 20% rise in demand for renewable energy sources and government incentives aimed at reducing carbon emissions. Overall, diversification across these sectors resulted in an average portfolio growth of 10% this month, outperforming the benchmark S&P 500 index by 3%.

Recommendations and Future Outlook

The monthly investment summary provides insights into portfolio performance across various asset classes such as equities, bonds, and real estate investments. Key observations from the market include a 5% increase in the S&P 500 index during September 2023, driven by robust earnings reports from technology giants like Apple and Microsoft. Investments in renewable energy sectors, particularly solar energy companies, showcased a 10% growth this month, highlighting the ongoing shift towards sustainable energy solutions amidst rising demand. Future outlook emphasizes diversification strategies, particularly in emerging markets and cybersecurity stocks, which are projected to benefit from increased global digitalization trends. Recommendations for the coming month include reallocating a portion of funds towards undervalued sectors, such as healthcare, which remains resilient despite economic fluctuations. Monitoring global economic indicators and interest rate changes from the Federal Reserve will remain crucial for informed decision-making.

Comments