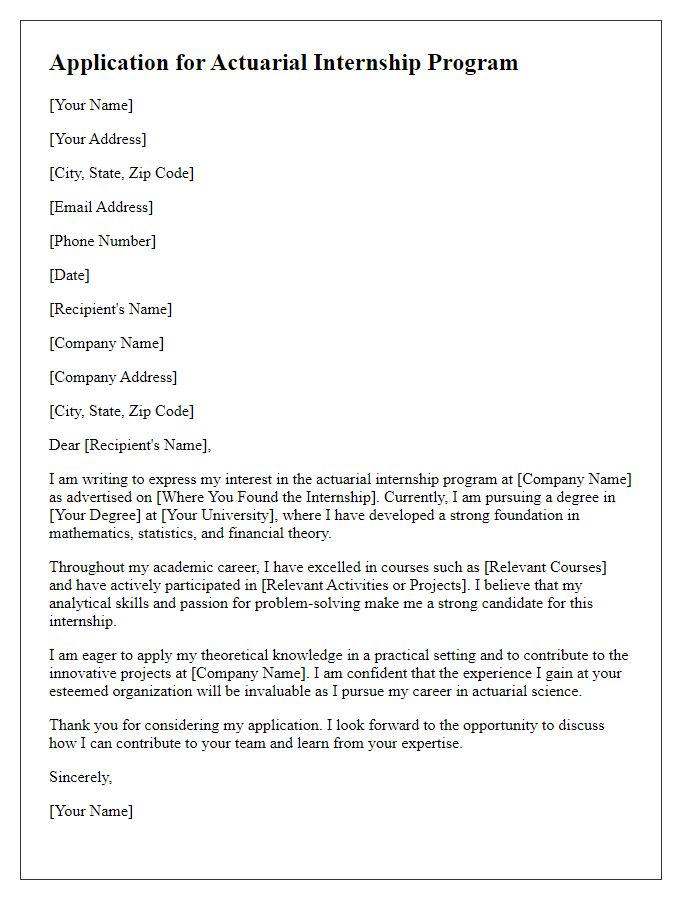

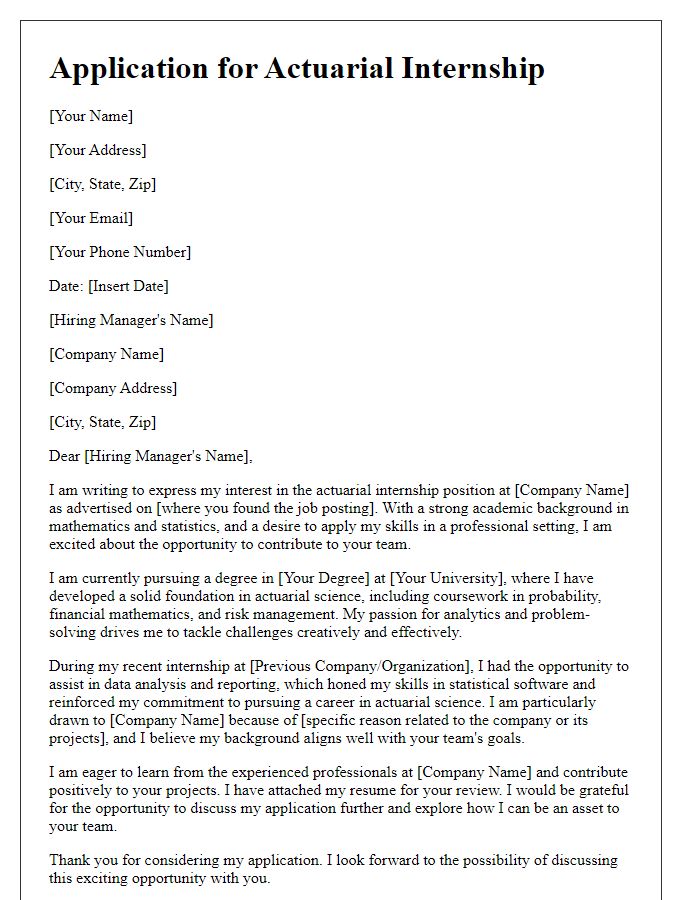

Are you gearing up to apply for that coveted actuarial internship? Crafting the perfect letter can set you apart from the competition and showcase your skills and passion for the field. In this article, we'll share tips and a template that will make your application stand out to potential employers. Ready to elevate your internship application? Let's dive in!

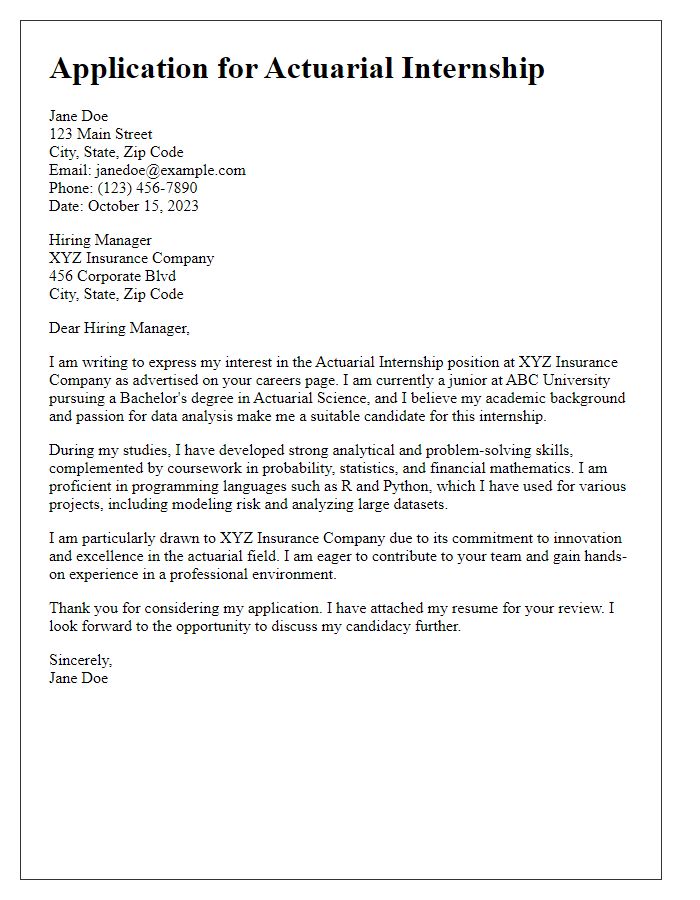

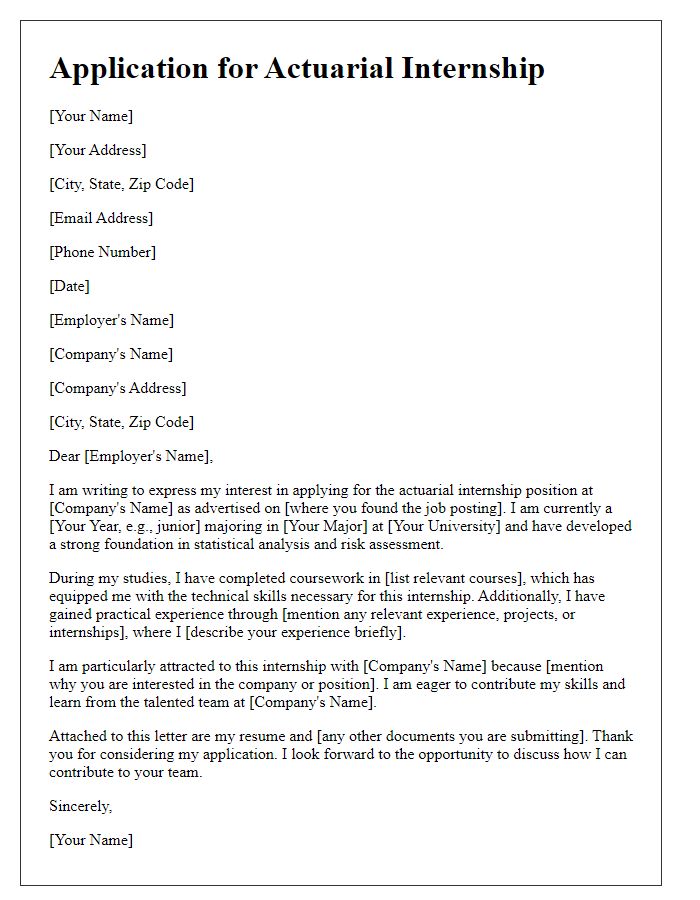

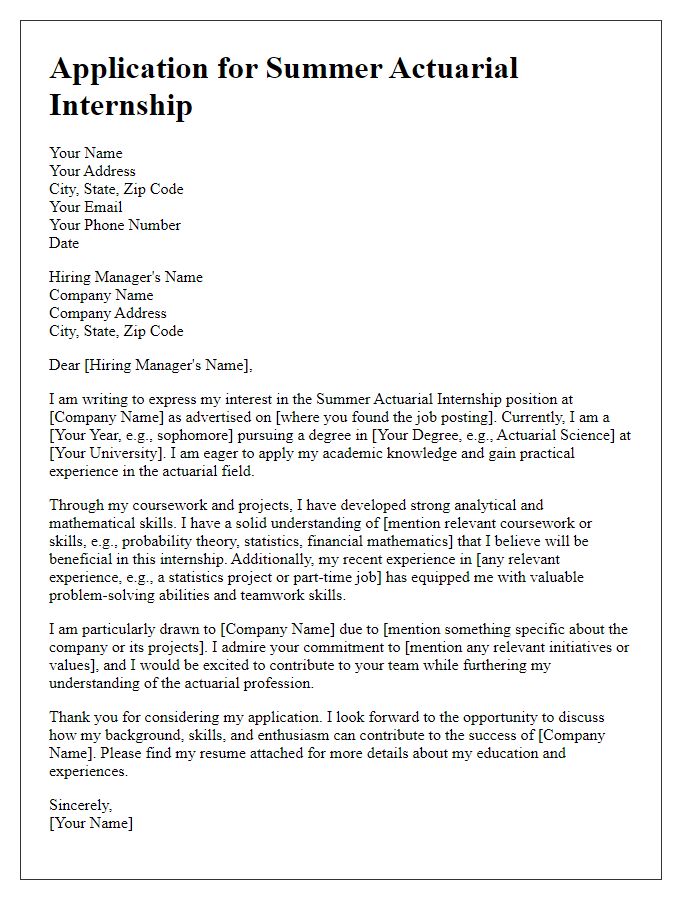

Personal and Professional Background

Aspiring actuaries often showcase their personal and professional backgrounds through relevant experiences and education. A solid foundation in mathematics, statistics, and business principles is essential for actuarial internships. Many candidates participate in academic clubs and industry-related organizations, such as the Society of Actuaries, to network and gain insights. Internships usually require proficiency in software tools like Excel and programming languages such as R or Python, which enhance analytical capabilities. Relevant coursework often includes probability theory, financial mathematics, and risk management, all crucial for making informed decisions in insurance or finance sectors. Additionally, demonstrating effective communication skills and teamwork through project collaborations can greatly enhance a candidate's profile for an internship in the competitive field of actuarial science.

Relevant Skills and Experiences

Aspiring actuaries possess a strong foundation in mathematics, statistics, and analytical skills, essential for roles in risk assessment and financial forecasting. Proficiency in software like R and Python, commonly utilized for data analysis, enhances one's ability to manipulate large datasets effectively. Internship candidates often showcase experiences gained through academic projects or prior internships, providing practical exposure in areas such as loss modeling or insurance policy analysis. Participation in actuarial clubs or competitions, like the Society of Actuaries challenges, demonstrates commitment to professional development and networking. Ultimately, successful candidates present a robust understanding of actuarial principles, complemented by real-world applications and collaborative teamwork in analytical tasks.

Motivation for Applying

The actuarial internship at [Company Name], renowned for its innovative risk management strategies, presents a unique opportunity to apply academic knowledge in real-world scenarios. My strong foundation in probability and statistics, developed through coursework at [University Name], aligns perfectly with the analytical demands of the actuarial field. Participation in [specific event, such as a case competition or seminar], where I collaborated with peers to analyze complex data sets, ignited my passion for leveraging quantitative analysis to inform financial decisions. This experience highlighted the importance of precision and detail in the actuarial profession, motivating my aspiration to learn from industry leaders at [Company Name]. The prospect of contributing to projects involving [specific projects or tools related to the industry, like predictive modeling or financial forecasting] excites me, as I aim to enhance my practical skills while providing meaningful insights to the team.

Alignment with Company Values and Goals

An actuarial internship at Pacific Life insurance company can provide valuable experience in analyzing risk and financial data. The company emphasizes integrity, innovation, and customer focus as core values. Interns engage in projects involving statistical modeling, data analysis, and forecasting for insurance products. The Pacific Life team aims to support personal and business financial security while maintaining a commitment to community service. Collaborating with experienced actuaries provides insights into ethical decision-making and strategic planning in a competitive market. Aligning with these values, interns contribute to the mission of delivering reliable financial solutions.

Availability and Contact Information

Availability for the actuarial internship typically aligns with the academic calendar, often spanning 10 to 12 weeks during the summer months (May to August). Interns are generally expected to commit 40 hours per week, allowing for full immersion in projects and mentorship opportunities. Contact information should include a professional email address, often formatted with the applicant's name, ensuring easy communication. Additionally, a mobile phone number may be provided for timely updates or interview scheduling. It is also beneficial to include a LinkedIn profile link, showcasing relevant skills and experiences for actuarial roles.

Comments