Have you ever found yourself in a bit of a panic when your insurance coverage lapses? It can be a surprisingly common experience, but understanding the ins and outs of what happens next can ease your mind. In this article, we'll explore what a coverage lapse notification looks like and what steps you should take to ensure you're protected. So, grab a cup of coffee and join us as we delve into this essential topic!

Policyholder Information

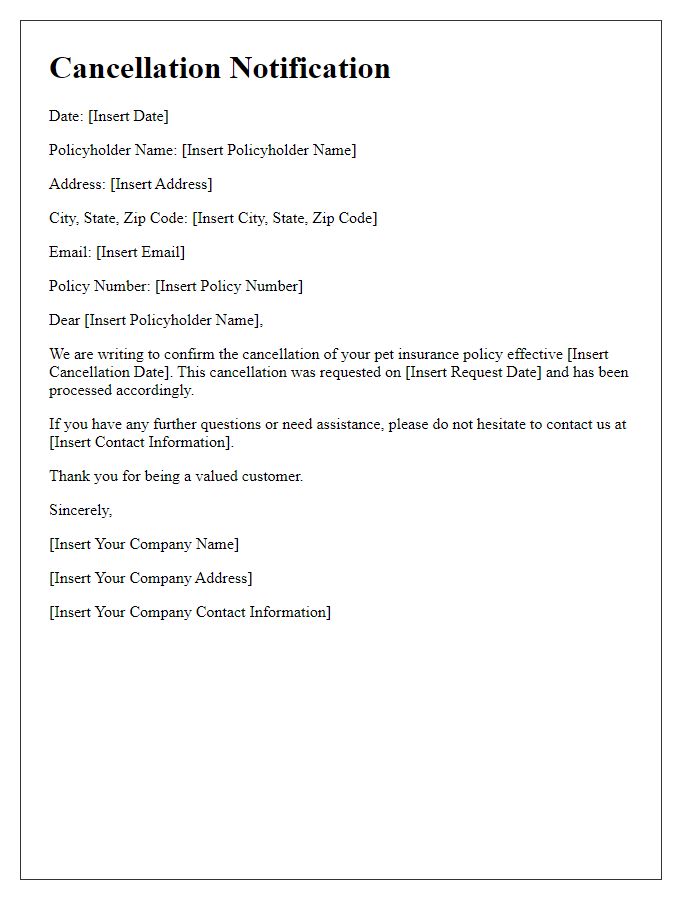

Insurance policies require diligent attention to avoid gaps in coverage. For instance, when a policyholder, residing in California, fails to pay the premium (which may be due monthly on the 15th), the policy may lapse, leaving them exposed to potential risks like accidents or property damage. This notification process typically involves informing the policyholder through a formal letter, emphasizing the importance of timely payments. Insurance companies, such as Allstate or State Farm, often provide a 30-day grace period before coverage terminates. It is crucial for policyholders to verify their payment history, including any missed payments, to prevent financial loss and ensure continued protection against unforeseen events.

Lapse Effective Date

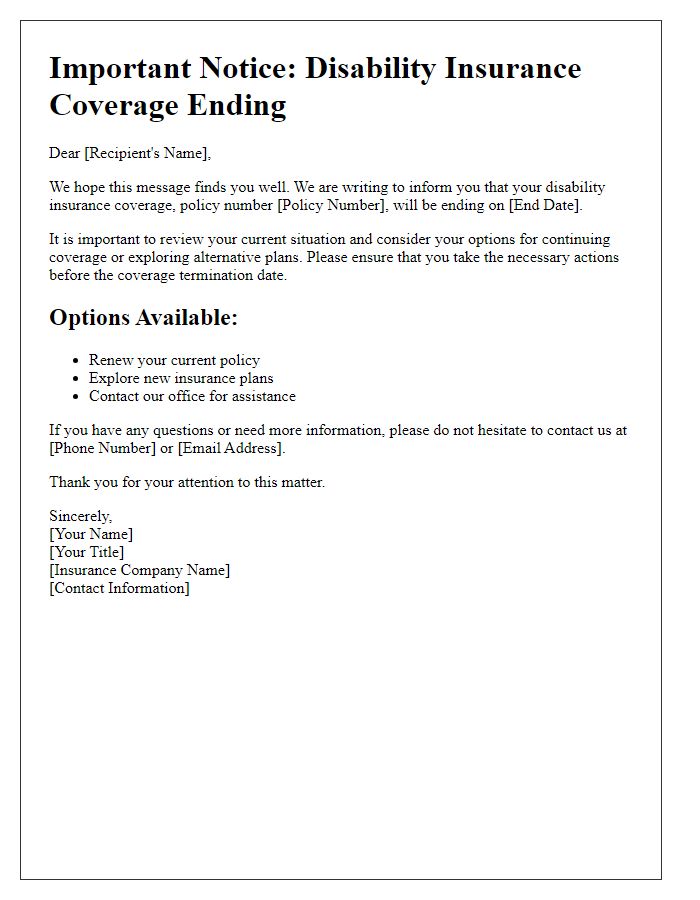

A coverage lapse notification is critical for informing policyholders about a lapse in their insurance coverage due to non-payment or other reasons. Policyholders must be made aware of the lapse effective date, which specifies the exact date when the coverage ceased to be valid. For instance, if a policyholder's payment was due on September 1, 2023, and they failed to make that payment, the lapse effective date would be September 1, 2023. The lapse can lead to being uninsured for specific events or accidents, severing claims processing. It's essential for policyholders to understand their options post-lapse, including reinstatement procedures or exploring new coverage options. Immediate action can prevent gaps in protection, ensuring continuity in coverage.

Explanation of Lapse

A lapse in insurance coverage can occur due to several reasons, such as non-payment of premiums, policy expiration without renewal, or failure to provide required documentation. For example, a missed payment by the due date can lead to cancellation of coverage, often resulting in a grace period of 30 days, during which the policyholder can rectify the situation. Additionally, if an individual does not submit necessary updates regarding their health status or changes in personal circumstances, the insurer may deem the policy void. Furthermore, certain insurance providers may impose stricter renewal requirements based on underwriting guidelines, impacting the continuation of coverage. It is essential to be aware of the specific terms and conditions outlined in the insurance policy to prevent unintentional lapses and ensure continued protection against unforeseen risks.

Reinstatement Options

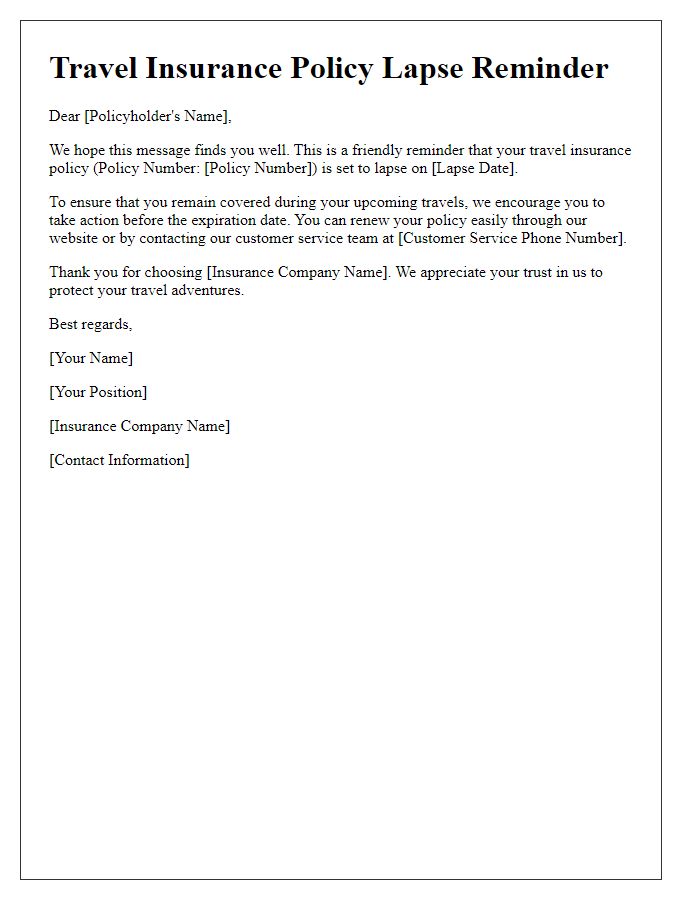

In the realm of insurance, policyholders may encounter coverage lapses, often due to non-payment or failure to renew before the expiration date. When this occurs, the insurer typically sends a lapse notification, informing the policyholder about the lost coverage. Many insurers provide reinstatement options, allowing the insured, under conditions such as completing a reinstatement application and paying any outstanding premiums, to regain their coverage. Timeframes for reinstatement may vary, often set at 30 to 60 days after lapse, based on the insurer's guidelines. Additionally, the reinstatement process may involve a review of health status or driving records, ensuring that the insured remains eligible for coverage. Awareness of premium payment deadlines and maintaining open communication with the insurance provider can help mitigate the risks associated with coverage lapses.

Contact Information for Assistance

Coverage lapse notifications inform policyholders about their insurance coverage status and potential gaps. These notifications typically include contact information for assistance, ensuring that individuals can promptly address their concerns. Insurance companies often provide multiple contact methods, such as a dedicated customer service phone number (usually available Monday to Friday, 8 AM to 8 PM), email support specific to coverage inquiries, and an online chat option through the company's website. Additionally, some providers include the name and direct extension of a representative for personalized support, allowing for a quicker resolution to any issues related to coverage gaps.

Letter Template For Coverage Lapse Notification Samples

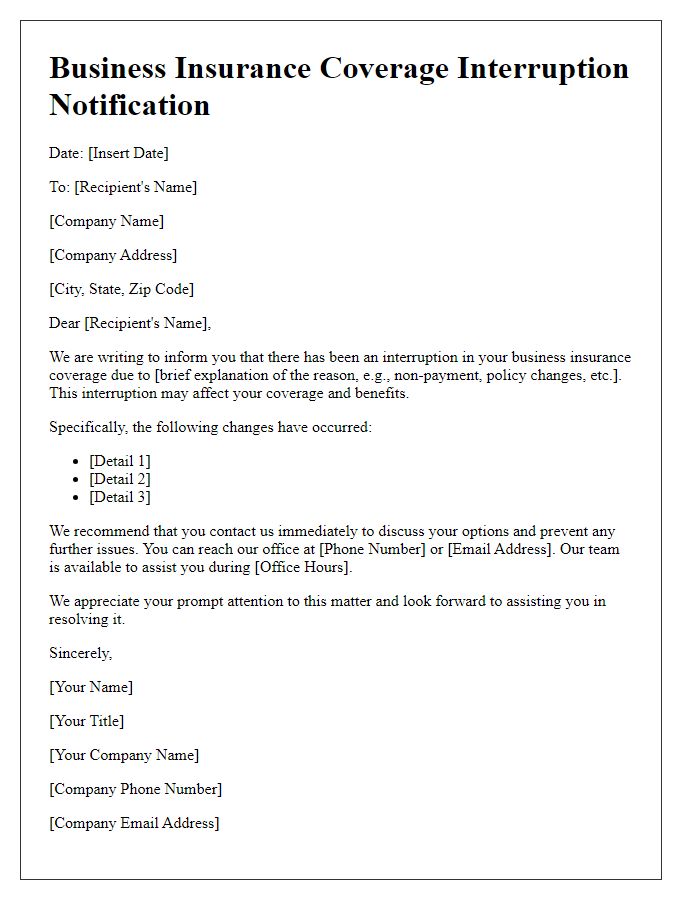

Letter template of business insurance coverage interruption notification

Comments