Are you in need of a temporary extension for your insurance coverage? Whether you're navigating a transitional period or simply want peace of mind for a little longer, understanding the options available to you can make all the difference. This article will guide you through the steps to request a temporary insurance extension, ensuring you know exactly what to include in your letter. So, grab a cup of coffee and read on to discover how to protect yourself during this crucial time!

Policyholder Information

A temporary insurance extension may be necessary for policyholders undergoing significant life changes. Policyholders (individuals or businesses with insurance contracts) often seek these extensions during events like relocation, vehicle upgrades, or temporary travel. Specific policy details, such as policy number (a unique identifier assigned to each insurance contract) and coverage type (like auto, home, or health), must be included. The extension's duration (typically ranging from 30 to 90 days) should be specified to ensure clarity. Contact information (such as phone numbers or email addresses) enables direct communication for any follow-up queries related to the policy adjustments.

Policy Details

Temporary insurance extensions often require specific policy details to ensure coverage continuity. For instance, an automobile insurance policy (such as one from State Farm) may include a policy number (e.g., 123456789), effective dates (e.g., January 1, 2023, to December 31, 2023), and coverage types (e.g., liability, collision, comprehensive) that must be clearly outlined. Additionally, the insured party's name (e.g., John Smith) and the vehicle identification number (VIN) of the insured car (e.g., 1HGCM82633A123456) should be included. The temporary extension duration may range from 30 to 90 days, and requests often indicate specific reasons, such as pending vehicle inspection or financial negotiations. Keywords like "premium adjustment" and "endorsement" may also be relevant to ensure clarity in terms of any modifications.

Extension Request Reason

Temporary insurance extensions often arise from unforeseen circumstances such as natural disasters, job relocations, or significant life changes. For instance, individuals relocating to hurricane-prone areas like Florida may require extended coverage during storm season to safeguard personal property and assets. Furthermore, professionals awaiting contract finalizations in sectors such as construction or technology might need additional insurance to cover potential liabilities until projects commence. Such extensions ensure continuous protection under specific policies, often requiring documentation to justify the need for an extension and cover any associated risks.

Extension Duration

Temporary insurance extensions provide crucial support during unforeseen events. This extension typically spans 30 to 90 days, contingent upon the insurance provider's policies. Situations like natural disasters, medical emergencies, or property transactions often necessitate this duration. For instance, if a homeowner in Florida faces hurricane threats, a temporary extension ensures coverage until a comprehensive policy review occurs. Key factors influence the extension duration, including the nature of claims, existing policy terms, and the insurer's assessment. Policyholders should remain proactive in communicating with their providers to secure necessary coverage and avoid gaps in protection.

Contact Information

Temporary insurance extensions can provide crucial coverage during specific circumstances. An individual may seek a temporary extension to maintain protection against unforeseen events such as accidents or natural disasters. Typically, insurers issue these extensions for periods ranging from one month to twelve months, depending on the policy and the reason for the extension. It is essential to communicate updated contact information, including full names, addresses, and phone numbers, to ensure that the insurance provider can reach the policyholder promptly. This proactive approach helps avoid potential lapses in coverage, which can lead to financial exposure during critical situations. Proper documentation reflecting the temporary extension should also be clearly understood by both parties to prevent future disputes.

Letter Template For Temporary Insurance Extension Samples

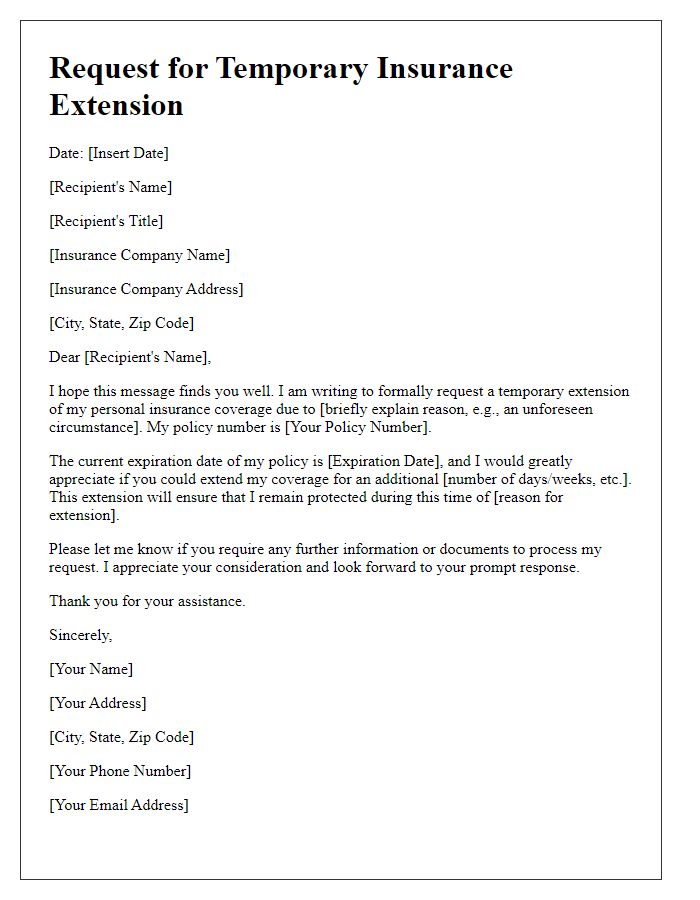

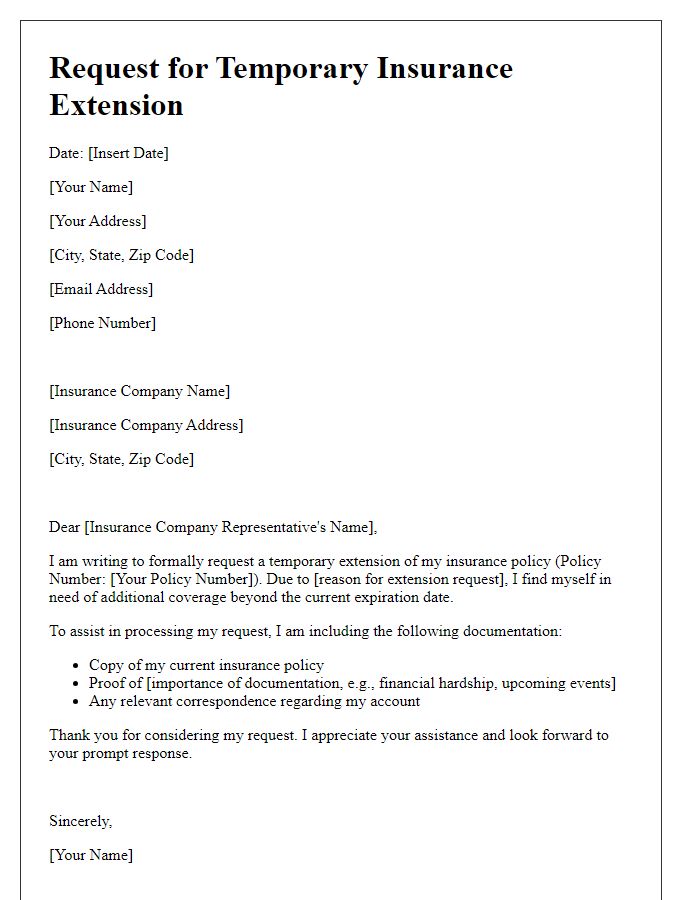

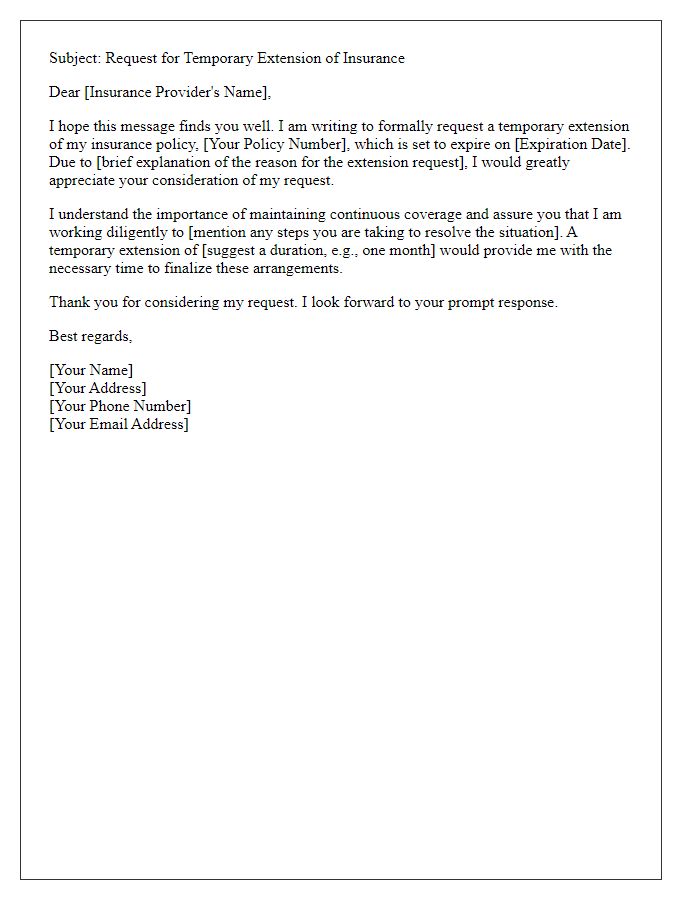

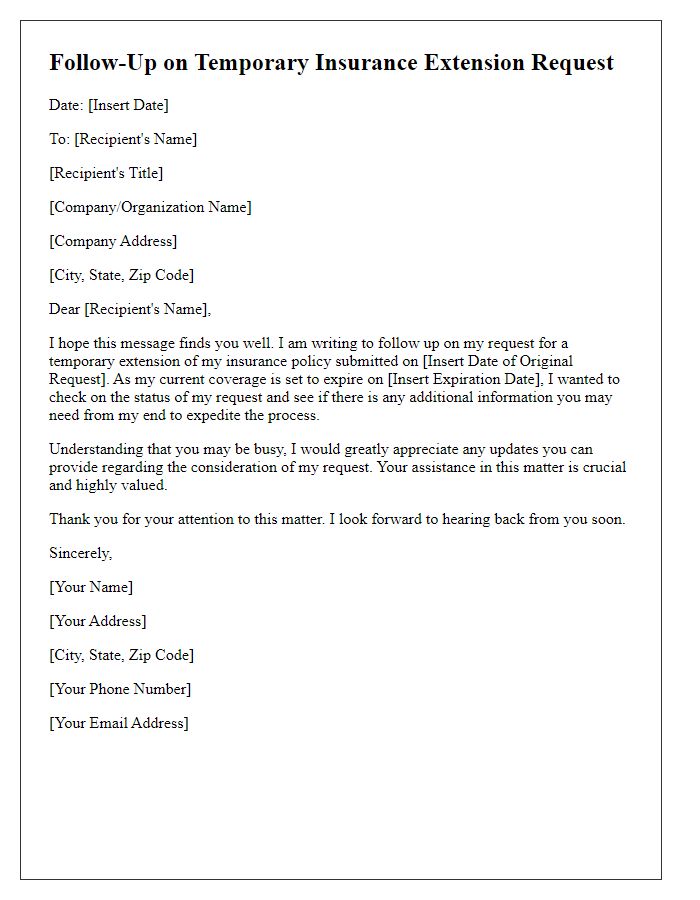

Letter template of request for temporary insurance extension for personal coverage

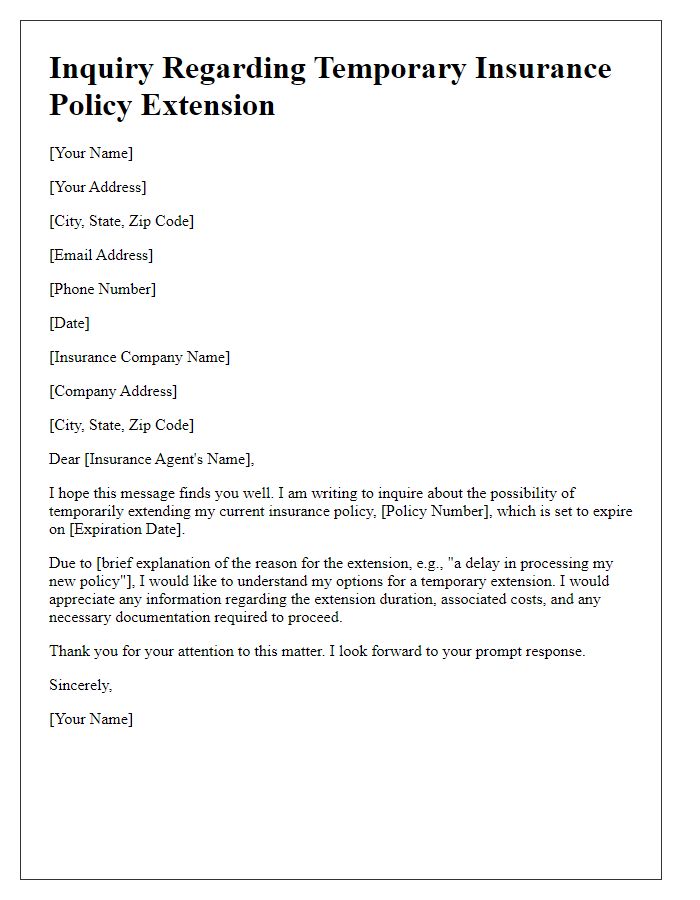

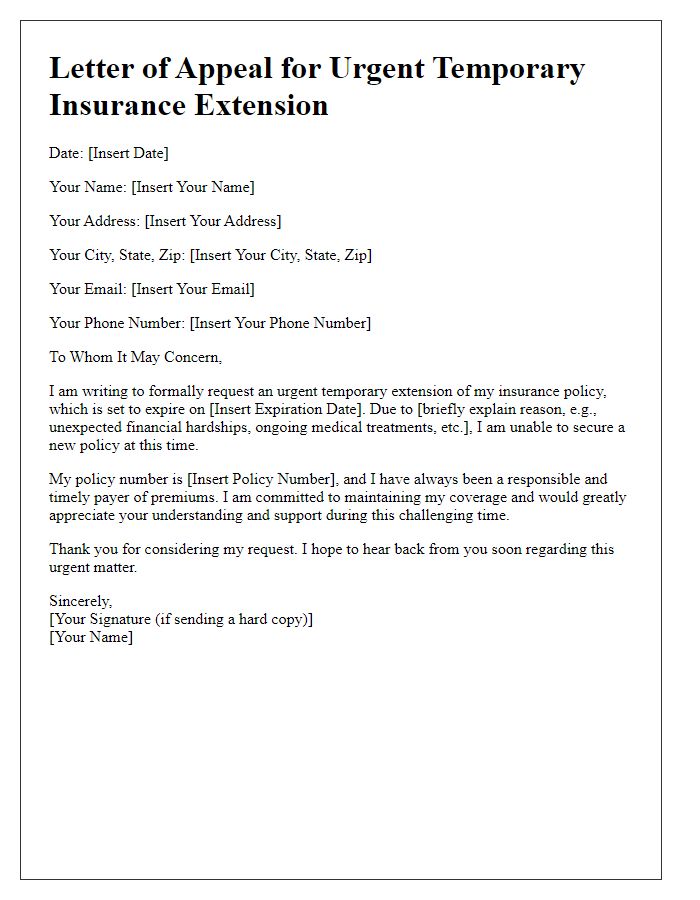

Letter template of inquiry regarding temporary insurance policy extension

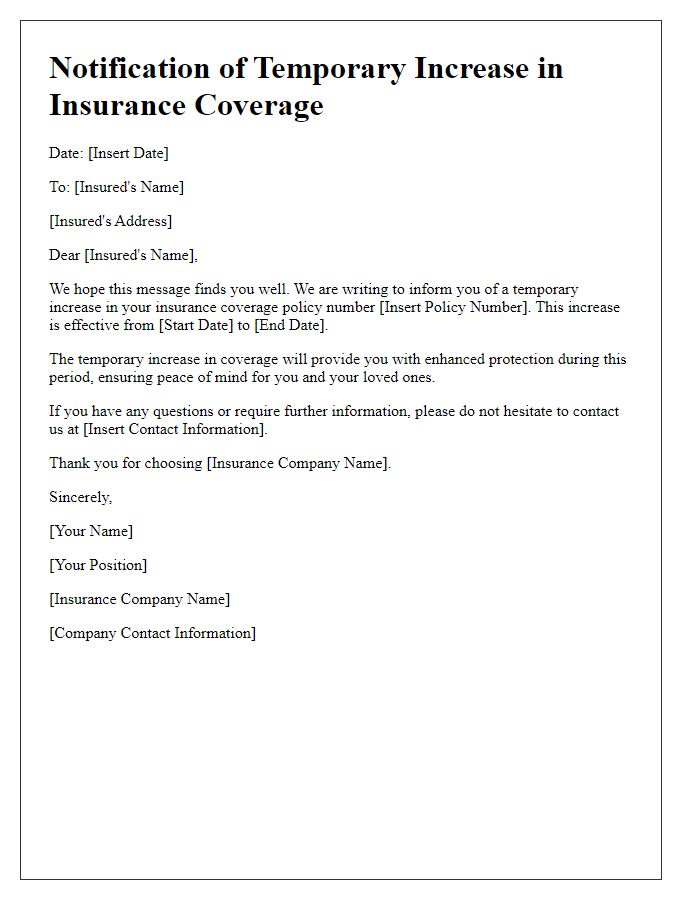

Letter template of notification for temporary increase in insurance coverage

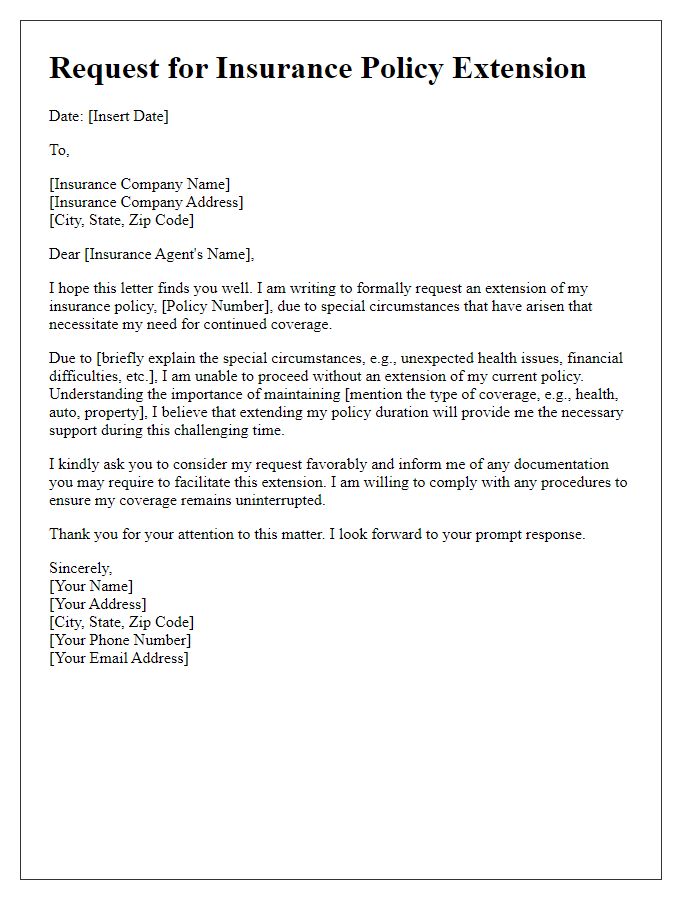

Letter template of formal request for insurance policy extension due to special circumstances

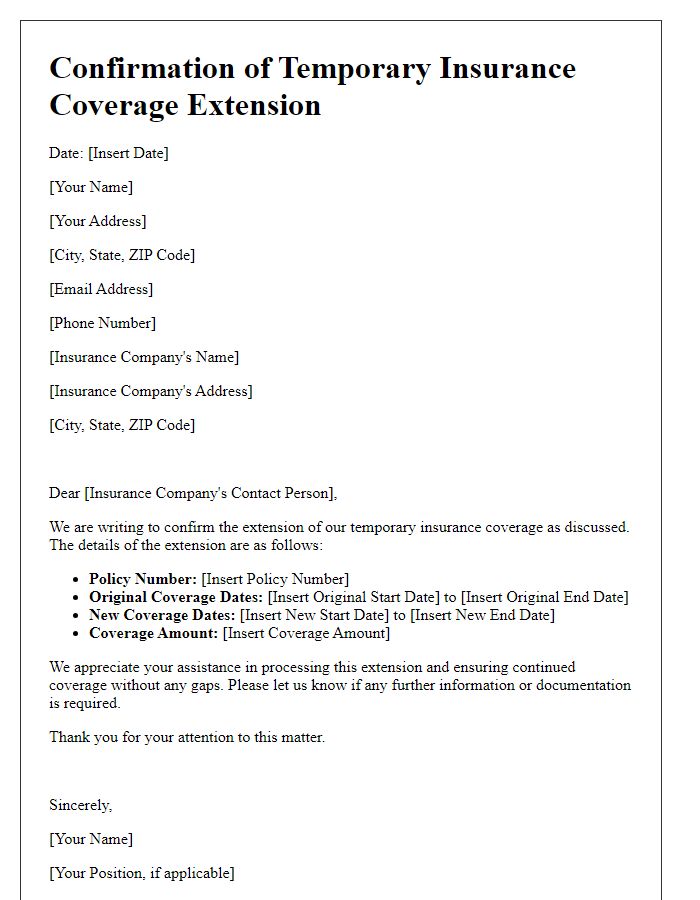

Letter template of confirmation of temporary insurance coverage extension

Letter template of documentation needed for temporary insurance extension

Comments