Are you feeling a bit overwhelmed by your current insurance rates? You're not alone! Many policyholders are discovering that their premiums are rising and are wondering if there's a way to ease the financial burden. In this article, we'll explore how to effectively request a review of your insurance rates and ensure you're getting the coverage you deserveâread on to find out more!

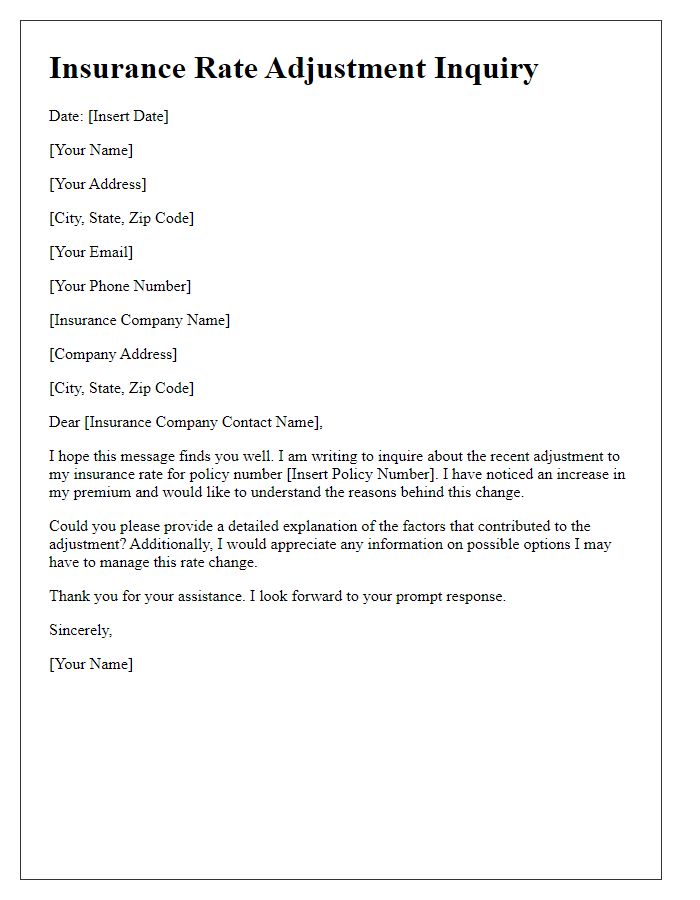

Applicant Information Section

When submitting an insurance rate review request, it is crucial to accurately provide applicant information, including full name, contact details, policy number, and date of birth. The applicant's full name must be clearly stated, such as "John Doe", along with a valid phone number formatted in the standard North American style (e.g., (555) 123-4567) and an email address for electronic correspondence. The policy number serves as a unique identifier for the insurance account, allowing for streamlined processing. Additionally, the date of birth of the applicant is necessary, reflecting the birth month, day, and year to verify age-related premiums. This information ensures that the request is properly associated with the appropriate insurance account.

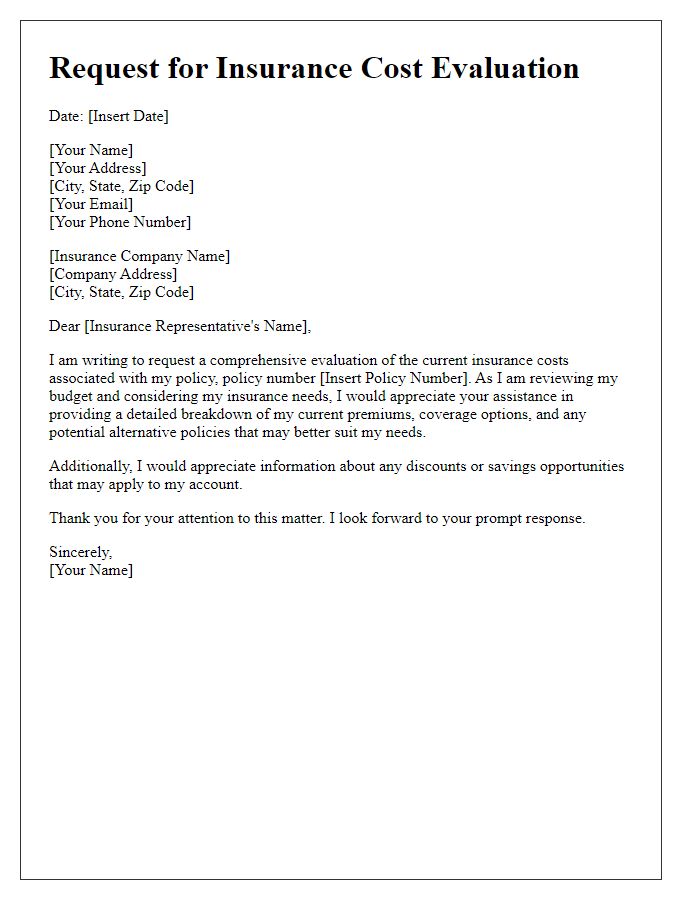

Policy Details and Coverage Information

To ensure an accurate assessment, provide comprehensive policy details including the policy number (e.g., 123456789), effective coverage dates (such as January 1, 2020, to December 31, 2023), and the type of insurance coverage (e.g., homeowner's insurance, auto insurance). Additionally, include information about coverage limits (e.g., dwelling coverage of $250,000), deductibles (like a $1,000 deductible for claims), and any endorsements or riders (such as flood coverage). Highlight any recent changes in circumstances, such as property renovations or a new vehicle purchase, that may impact the premium assessment. Request a review of the current premium rate in relation to the provided information, emphasizing the importance of fair and accurate pricing based on current market trends and policyholder loyalty.

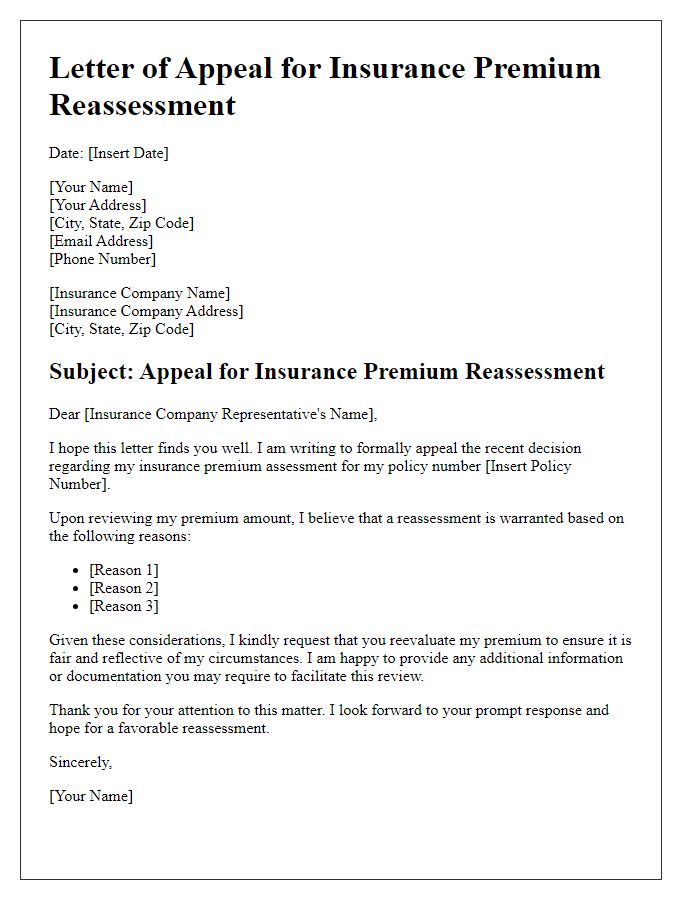

Reasons and Justifications for Rate Review

Insurance rate review is often prompted by various factors that warrant a reassessment of premiums charged to policyholders. Significant changes in personal circumstances, such as recent home renovations increasing property value, can lead to higher coverage needs. Additionally, local market conditions, such as changes in crime rates or natural disaster risk assessments in areas like California or Florida, may influence the overall risk profile and thus justify a rate review. Moreover, improvements in safety features, including the installation of security systems or updated wiring, can reduce the risk of claims and should be considered for potential premium adjustments. Lastly, maintaining a clean claims history over a period of time can serve as a strong argument for reduced rates, reflecting responsible ownership and risk management.

Supporting Documentation and Evidence

An insurance rate review request requires comprehensive supporting documentation to justify the need for a reassessment of premium costs. Essential documents include recent policy statements from highly-regarded insurance providers such as State Farm, Allstate, or Geico, which showcase competitive rate offerings. Detailed evidence may comprise current market analysis reports, demographic trends affecting risk profiles, and claims history that reflects low incident rates over the past three years. Additionally, include expert assessments highlighting any changes in property value, such as recent home appraisals or renovations that enhance safety features like updated electrical systems or new roofing materials, which could demonstrate lowered risk to insurers. Presenting this data effectively can strengthen the case for a favorable rate adjustment.

Contact Information and Preferred Follow-Up Method

An insurance rate review request requires clear communication of personal details and preferences for follow-up. Include full name, policy number, and contact phone number for accurate identification. Utilize email or phone call as preferred contact methods, ensuring accessibility. Specify optimal times for follow-up responses to streamline communication. Providing a concise summary of the reasons for the rate review, such as increased premiums or changes in coverage needs, can further assist the insurance representative in addressing concerns efficiently.

Comments