Hey there! If you've recently experienced storm damage and are feeling a bit overwhelmed by the insurance process, you're not alone. Navigating the complexities of filing a claim can be daunting, but understanding your rights and responsibilities is key to getting the compensation you deserve. Stick around as we break down essential tips and strategies to help you tackle your insurance claim smoothly!

Policyholder Information

Storm damage can significantly impact residential properties, particularly in vulnerable areas like Florida and Texas. Heavy rains, hurricane winds, and flooding can damage roofs, windows, and siding, leading to costly repairs. Policyholders should review their home insurance policy, specifically sections covering natural disasters or severe weather events. Documentation of damage through photographs and detailed descriptions is crucial for effective claims processing. It is advisable to contact your insurance provider, such as State Farm or Allstate, immediately after the event to initiate the claims process and receive guidance on necessary steps. Local regulations may also require specific procedures for inspection and repair, emphasizing the importance of timely action.

Description of Storm Damage

Severe weather events such as hurricanes, thunderstorms, and blizzards can lead to extensive storm damage, affecting residential areas across regions like Florida and New York. Roofs may sustain significant damage from heavy winds exceeding 100 miles per hour, resulting in loose shingles or complete roof failures. Flooding from excessive rainfall can lead to water intrusion in basements, causing mold growth and compromising structural integrity. Additionally, fallen trees and debris can damage exterior walls, windows, and power lines, disrupting utilities for days or weeks. The aftermath often necessitates immediate repairs to prevent further deterioration, emphasizing the importance of timely insurance claims to cover repair costs.

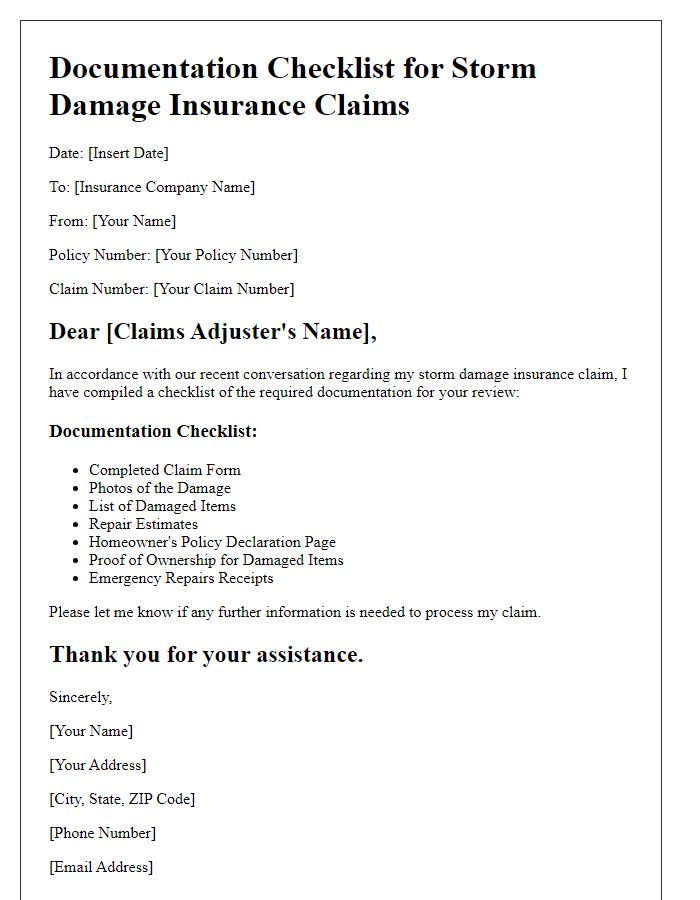

Required Documentation

Storm damage insurance claims require specific documentation to facilitate processing and approval. Photographic evidence of damage, showing affected areas and items within residential buildings, is crucial for assessment. Detailed damage descriptions, including the type of storm (e.g., hurricane, tornado) and date of occurrence (e.g., September 12, 2023), assist adjusters in understanding the severity of the incident. Repair estimates from licensed contractors provide insight into potential restoration costs. Personal identification, such as driver's licenses or homeowner's insurance policies, establishes ownership and policy details. Additionally, any previous claims related to storm damage from the past five years must be disclosed to ensure transparency during the claims process. Comprehensive documentation expedites resolution, allowing for faster recovery from the effects of severe weather events.

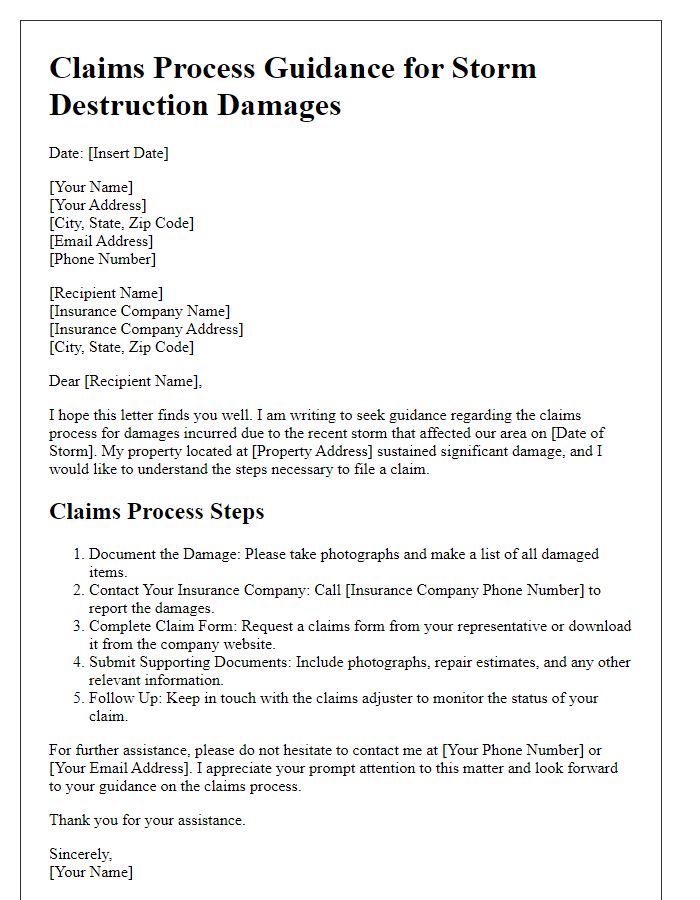

Claim Submission Process

Storm damage insurance claims require a meticulous approach to ensure proper reimbursement. Begin by documenting the damage thoroughly; take high-resolution photographs and videos of all affected areas, including roofs, windows, and interiors, to support your claim. Review your policy details, specifically looking for coverage limits and exclusions related to storm events. Prepare a detailed list of damaged items, noting their original value, purchase dates, and replacement costs. The National Flood Insurance Program (NFIP) states that claims should be submitted within 60 days of the event. Contact your insurance company directly, using the claims hotline listed on their website, to initiate the process. Ensure you have your policy number on hand for efficient service. After submission, maintain organized records of all correspondence, including emails and notes from phone conversations, which may be crucial in case of disputes.

Contact Information for Assistance

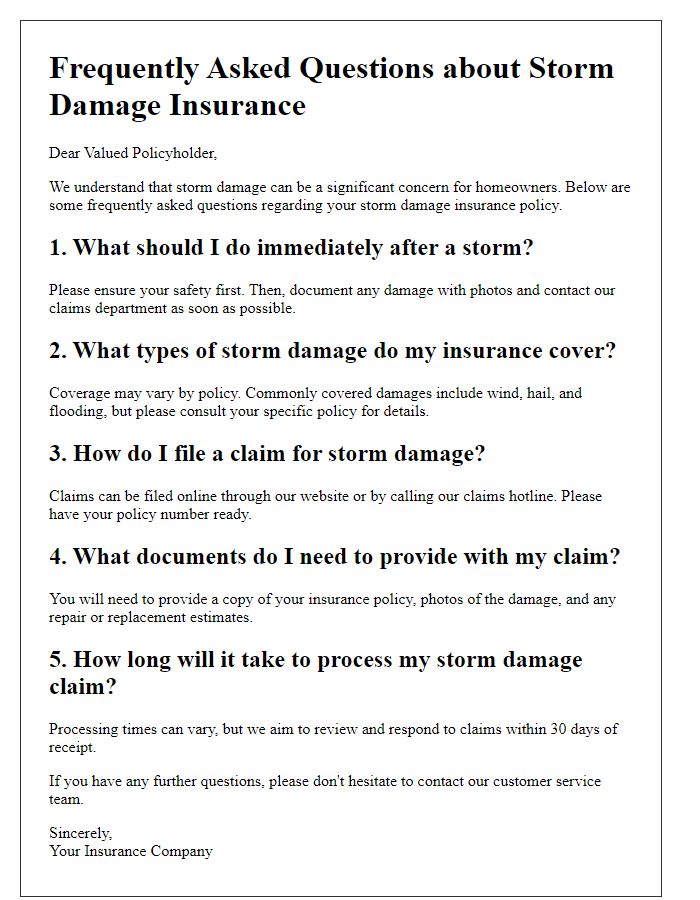

Storm damage insurance claims require prompt attention to facilitate quick recovery. Policyholders should gather all relevant documentation, including pictures of the damage, estimates for repairs, and any previous correspondence with insurance agents. Contact the insurance company's claims department, which typically operates during business hours (8 AM - 5 PM, Monday through Friday). Utilize the customer service hotline or the claim submission portal, both of which should be listed on the company's website. Importance lies in noting claim deadlines, as some insurers require reports filed within a specific timeframe following storm events. Keeping organized records of all communications can significantly streamline the claims process.

Letter Template For Storm Damage Insurance Guidance Samples

Letter template of claims process guidance for storm destruction damages

Letter template of documentation checklist for storm damage insurance claims

Letter template of frequently asked questions about storm damage insurance

Comments