Hey there! We know that keeping you informed is vital, so we wanted to take a moment to let you know about some recent changes to our policy terms. These updates are designed to enhance your experience and ensure that you are always covered in the best possible way. We'd love for you to dive deeper into the specifics and understand how these changes may affect you. So, keep reading to learn more about what's new!

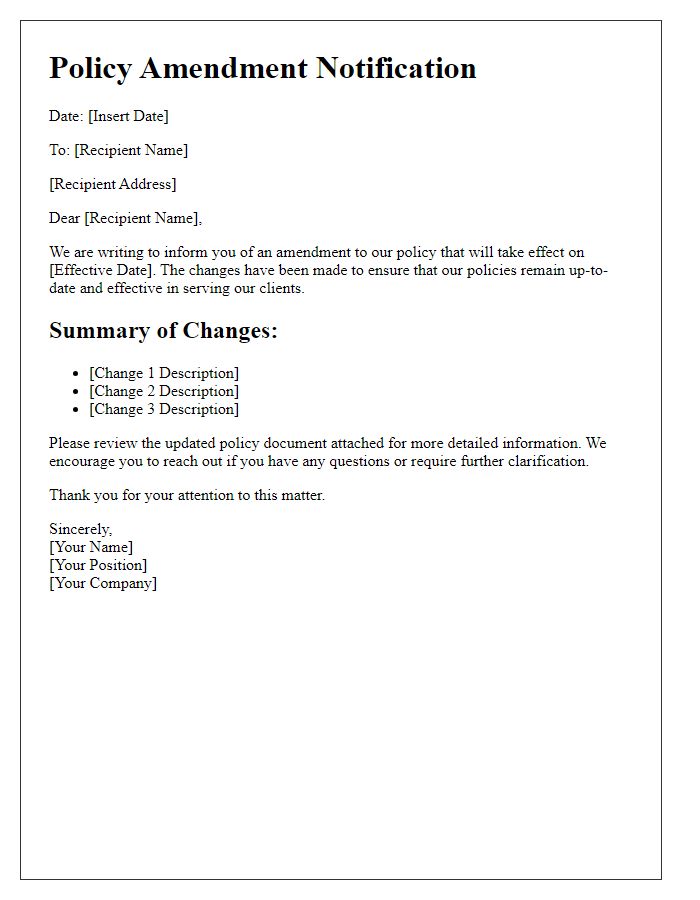

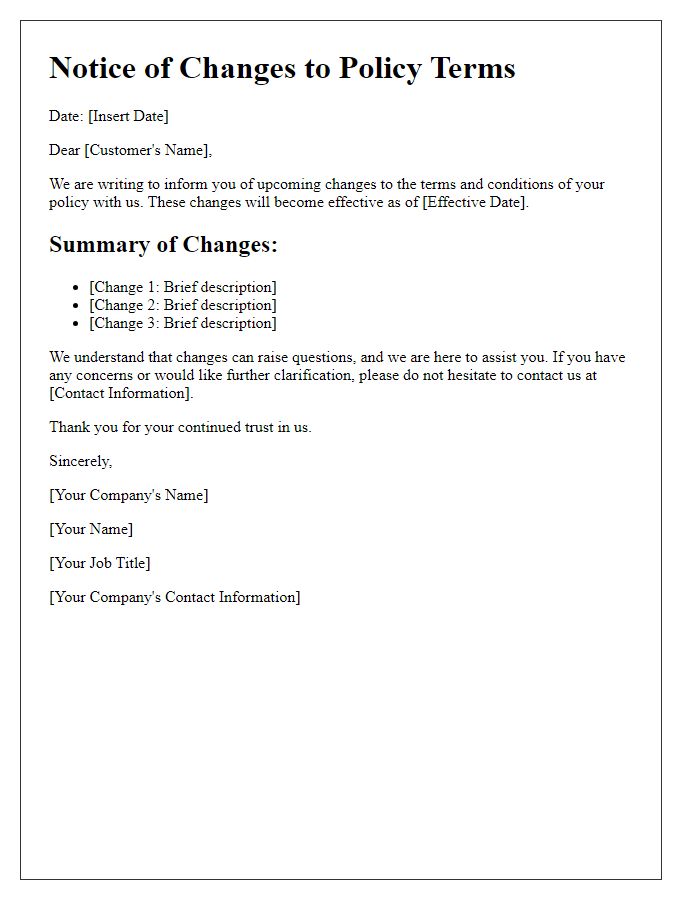

Clarity and concise language

Recent changes in policy terms can significantly influence customer understanding and compliance. Clear communication is essential to ensure that clients, such as policyholders of insurance companies, grasp updates without confusion. Terminology should be simple, avoiding legal jargon, while key changes, such as premium adjustments, coverage limits, or exclusions, must be prominently emphasized. Notifications can be distributed via multiple channels, including email and direct mail, enabling clients to access information easily. Additionally, providing a FAQ section can address common inquiries, ensuring that policyholders feel informed and supported during the transition.

Effective subject line

Notification of Changes to Policy Terms and Conditions Effective Immediately

Impact summary on the recipient

Notification of policy terms changes can significantly affect recipients' coverage and financial responsibilities. For example, adjustments to premium rates may result in increased monthly costs for policyholders, potentially impacting budgeting plans. Changes in coverage limits for specific events, such as natural disasters, can leave individuals underinsured in vulnerable situations like hurricanes or floods, particularly in high-risk areas like Florida or Texas. Additionally, alterations to deductibles could mean higher out-of-pocket expenses when filing claims, which might discourage policyholders from seeking assistance during significant incidents like car accidents. Recipients need to carefully review updated terms to understand how these changes could affect their personal obligations and overall financial security.

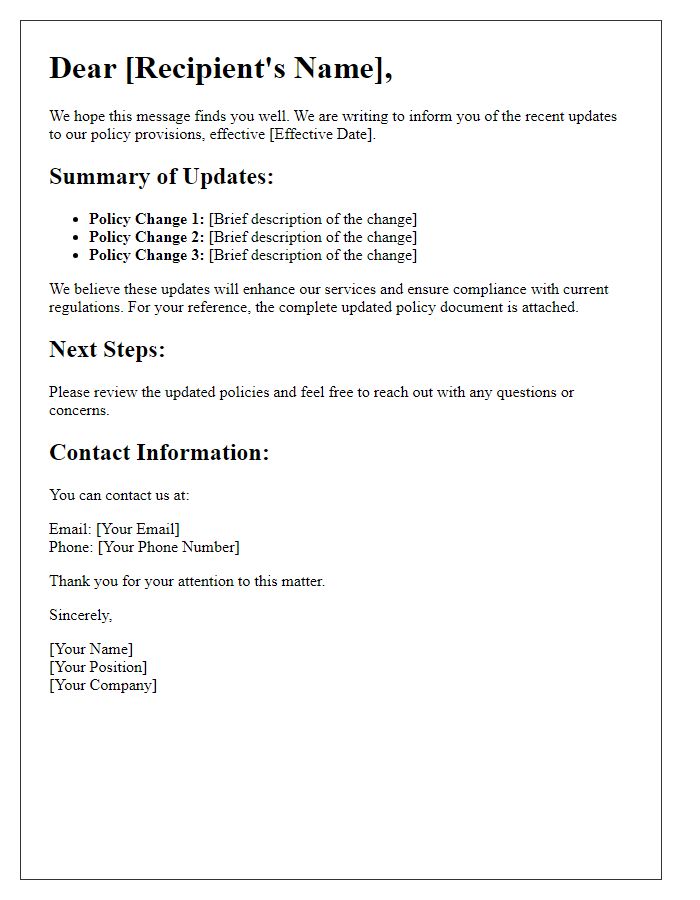

Key changes highlighted

Key changes in policy terms notification highlight significant adjustments in insurance coverage details. Updated clauses include enhanced coverage limits for property damage, now set at $500,000, effective January 1, 2024. Exclusions related to natural disasters, specifically floods and earthquakes, have been clarified to specify conditions under which claims may be denied. The premium rates have also been modified, reflecting an overall increase of 15% in monthly payments. Additionally, the claims processing timeline has been streamlined, with a commitment to a maximum of 30 days for decision-making. Finally, customer service contact hours have extended to 8 AM to 8 PM on weekdays, ensuring improved accessibility for policyholders.

Contact information for inquiries

Policyholders may refer to Company XYZ's official website for comprehensive policy documentation updates, accessible on the Customer Portal. For specific inquiries regarding changes in policy terms, customers can reach the dedicated Customer Service Team at (123) 456-7890 between 8 AM and 6 PM EST, Monday to Friday. Additionally, an email can be sent to support@companyxyz.com for assistance. Physical correspondence can be addressed to Company XYZ, 1234 Insurance Drive, Suite 100, New York, NY 10001.

Comments