Are you feeling a bit overwhelmed by the intricacies of insurance endorsement updates? You're not alone; many people find the process complicated and confusing. But don't fret! In this article, we'll break down everything you need to know about updating your insurance endorsements and simplify the steps you should take. So, keep reading to discover essential tips that will make your endorsement updates a breeze!

Policyholder information

Updating an insurance endorsement requires precise details. Policyholder information includes the full name of the insured (e.g., John Smith), policy number (e.g., 123456789), and contact details (e.g., 555-1234 or johnsmith@email.com). Address information is crucial for coverage accuracy, often including street name, city, state, and ZIP code (e.g., 456 Elm Street, Springfield, IL 62704). Coverage type and details, like home insurance or auto insurance, must be specified, along with any amendments to coverage limits or additional insured parties. Timestamp of the endorsement update, often significant either by date or effective date range, is vital for record accuracy and to avoid disputes in claims processing. Each element, when presented clearly, ensures smooth communication between the policyholder and insurance provider.

Policy details and endorsement specifics

An insurance endorsement update involves changes to an existing policy, such as property, auto, or health insurance. Policy details, including the policy number (typically a unique identifier like 123-456-789), the insured's name, and the effective date of the original policy are crucial. Specific endorsements may include alterations to coverage limits (increased values like $500,000 for home insurance), the addition of new risks covered (for instance, flood damage), or changes in deductibles (e.g., increasing from $1,000 to $2,500). Understanding how these specific changes affect premiums or terms of service is essential for maintaining optimal coverage and ensuring compliance with state regulations.

Effective date of changes

An insurance endorsement update marks a significant alteration in coverage terms, impacting policies like homeowners, auto, or health insurance. This document outlines effective changes to ensure coverage aligns with client needs. Clear specification of the effective date, typically identified as the day adjustments take place, is crucial for policyholders. Detailed endorsements may include modifications in coverage limits, premium adjustments, or additional covered events. Clients and insurers must maintain thorough records to prevent disputes related to claims and coverage misunderstandings. Timely updates safeguard policyholders and reflect altering circumstances in their insurance needs.

Confirmation of premium adjustments

Insurance endorsement updates often include confirmation of premium adjustments following a policy review or modification. Insurers, such as State Farm or Allstate, may increase or decrease premium amounts based on factors like claims history, changes in coverage, or risk assessments. Effective dates for these adjustments typically range from 30 to 60 days after notice, allowing policyholders time to review. Communication methods may include email or postal mail, ensuring that clients are informed promptly about changes affecting financial obligations. Updated policy documents often accompany confirmation, providing detailed breakdowns of new rates and coverage impacts.

Contact information for further inquiries

For insurance policy endorsement updates, effective communication is crucial. Clear contact information provides policyholders with accessible support channels. Utilizing phone numbers, email addresses, and dedicated customer service lines can streamline the inquiry process. For instance, a contact number such as (+1) 800-555-0199 ensures immediate assistance during business hours (typically 9 AM to 5 PM local time). An email address like support@insurancecompany.com allows for detailed queries requiring documentation. Additionally, providing links to online chat services or customer resource centers enhances user experience and promotes efficient resolution of endorsement-related questions.

Letter Template For Insurance Endorsement Update Samples

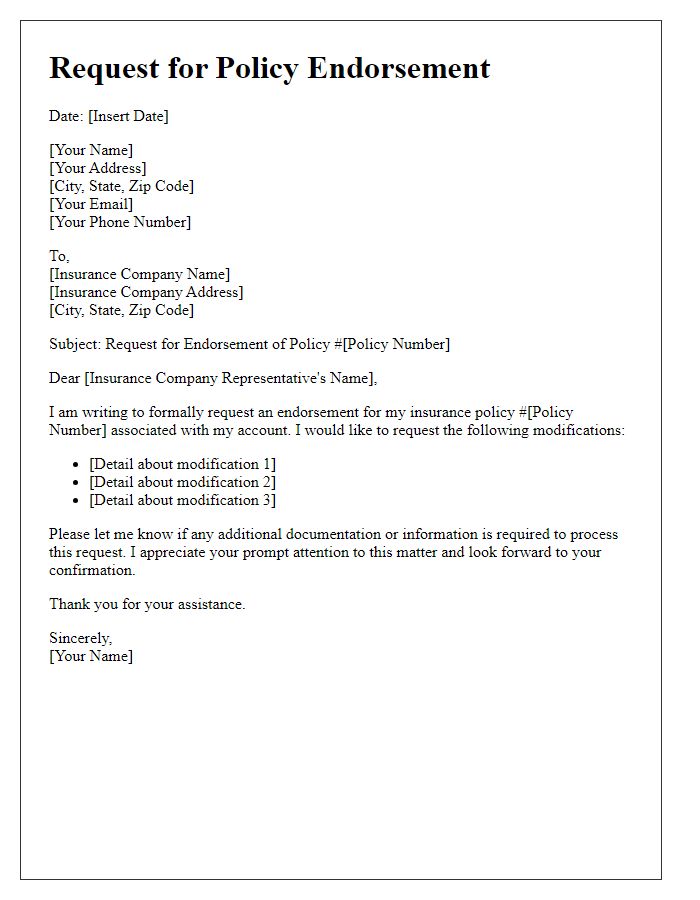

Letter template of insurance endorsement request for policy modification

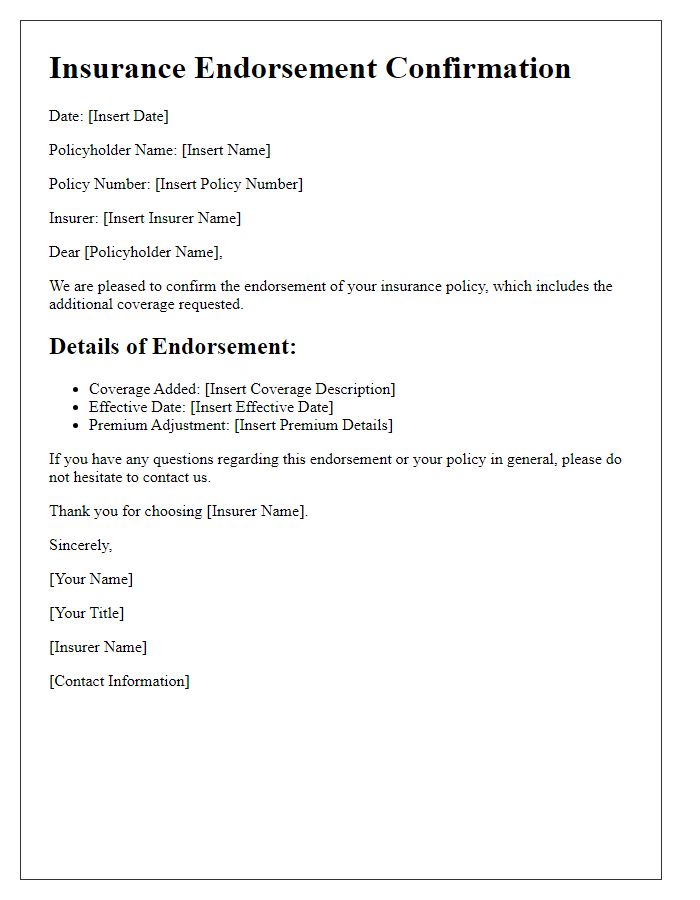

Letter template of insurance endorsement confirmation for added coverage

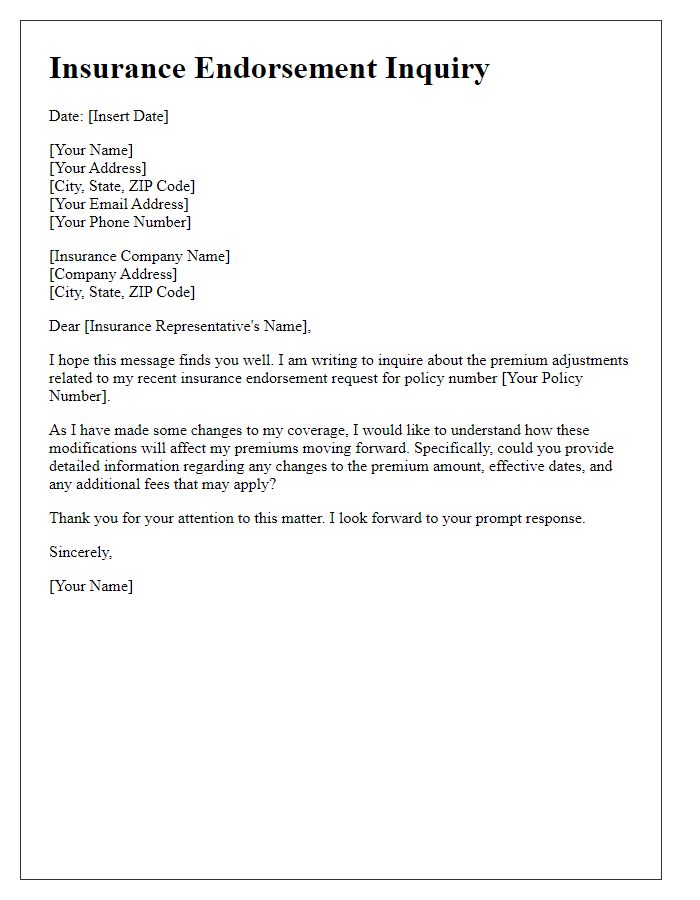

Letter template of insurance endorsement inquiry about premium adjustments

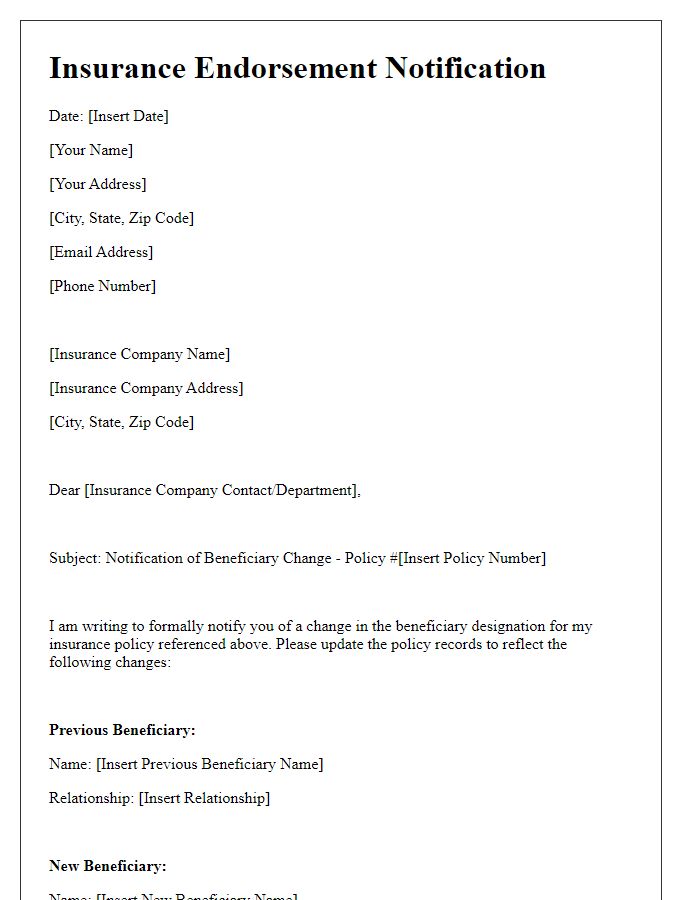

Letter template of insurance endorsement notification for beneficiary change

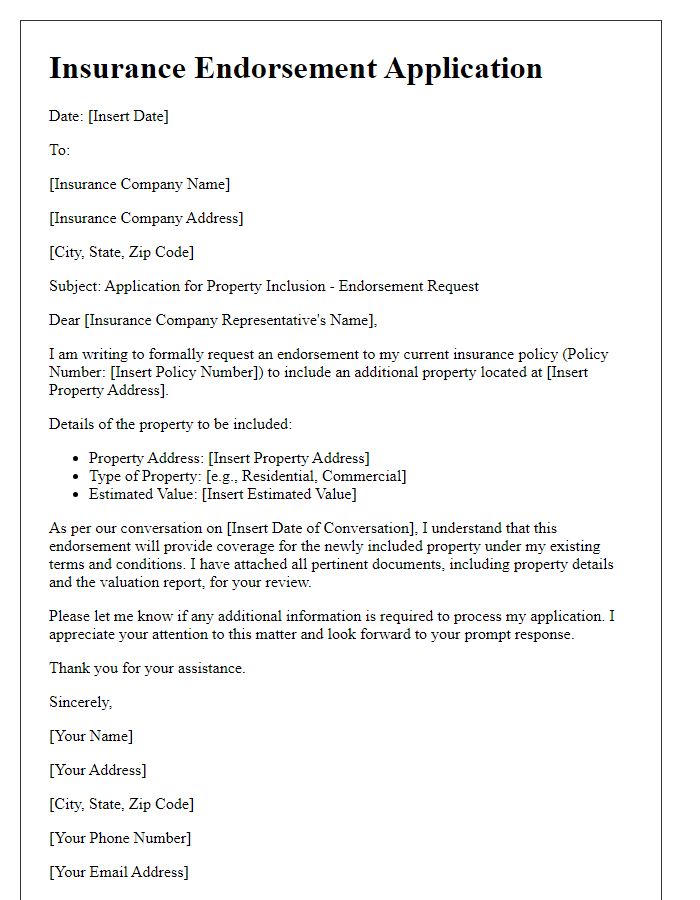

Letter template of insurance endorsement application for property inclusion

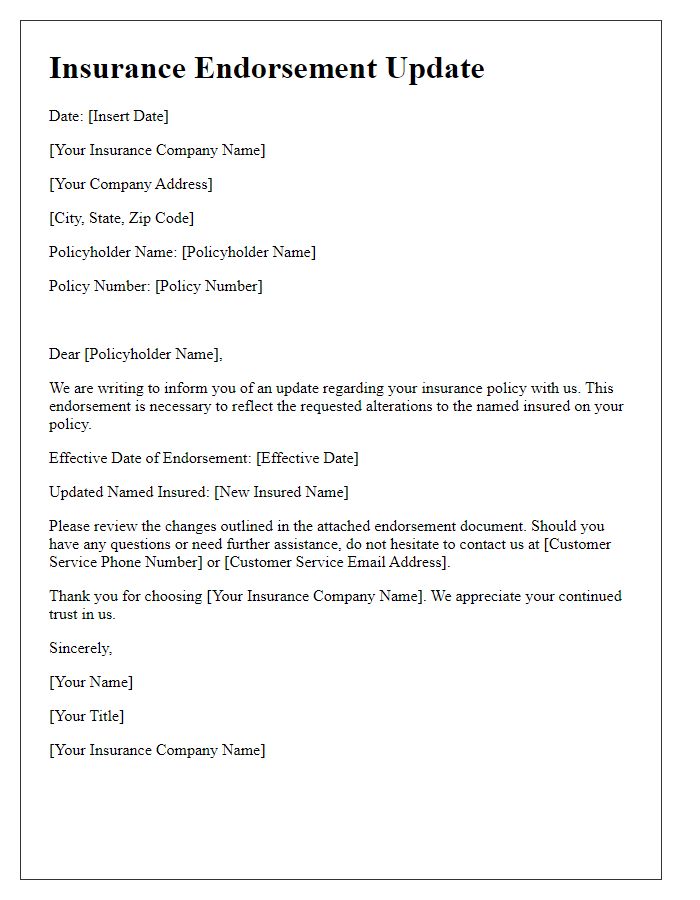

Letter template of insurance endorsement update for named insured alterations

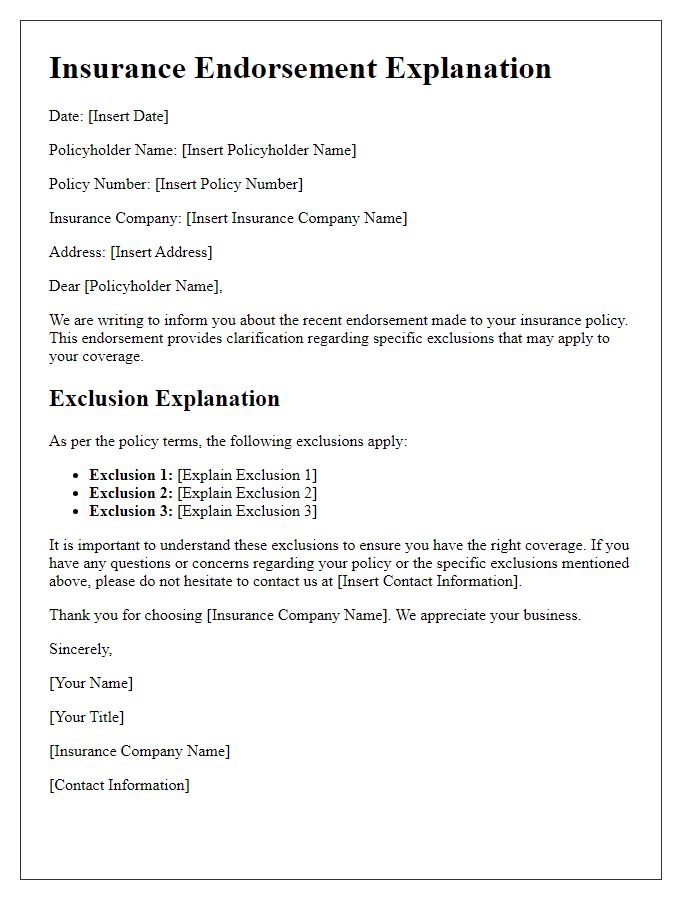

Letter template of insurance endorsement explanation for policy exclusions

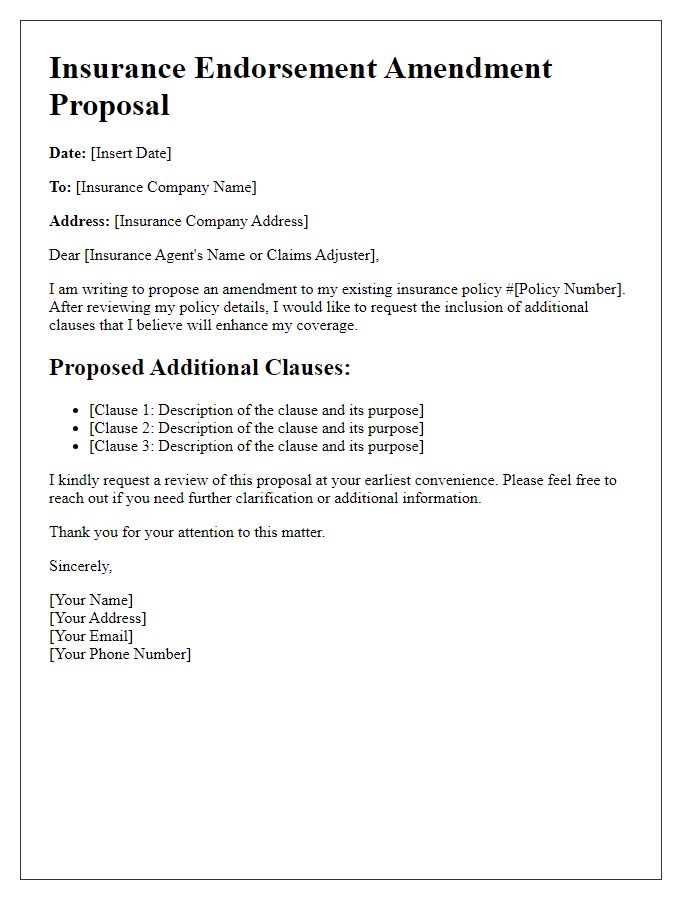

Letter template of insurance endorsement amendment proposal for additional clauses

Comments