Are you feeling overwhelmed by premium arrears on your policy? You're not alone; many policyholders face this challenge at some point. Understanding your options and the potential consequences of unpaid premiums is crucial for maintaining your coverage and peace of mind. Keep reading to discover practical tips and guidance on navigating this situation effectively!

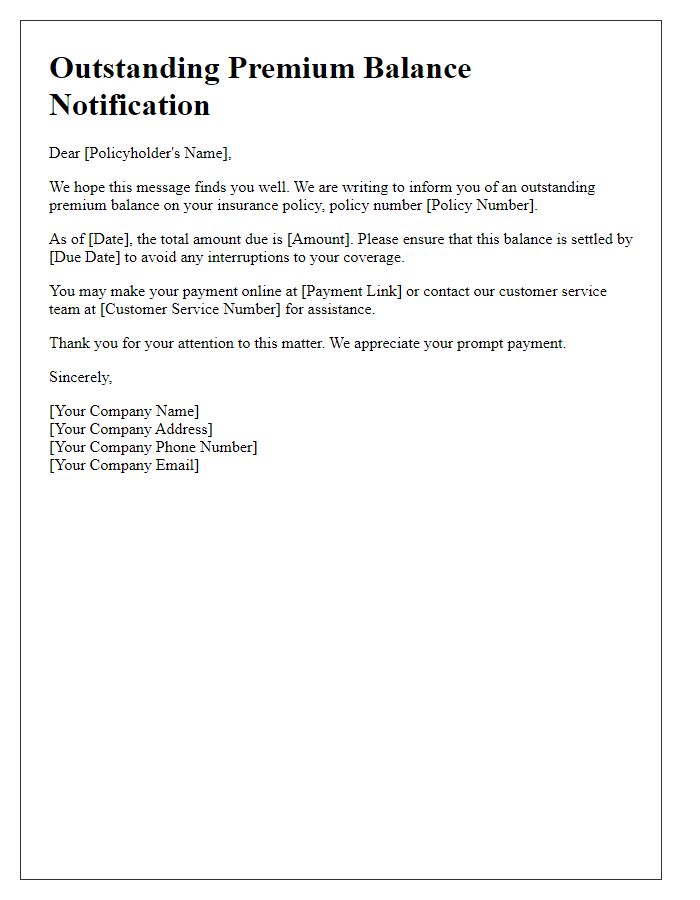

Policy Details

Premium arrears can lead to policy lapses in insurance contracts, highlighting the importance of timely payments. Policyholders with defaulting premiums may face service interruptions. Maintaining a comprehensive awareness of policy details, including the policy number, coverage start date, and premium payment schedules, significantly aids in avoiding potential lapses. Failure to address arrears can result in reduced benefits and claims processing complications. It's crucial for policyholders to review their financial obligations regularly, ensuring compliance with the terms stipulated in the insurance agreement. Communication with insurance representatives can clarify payment options and reinstatement procedures.

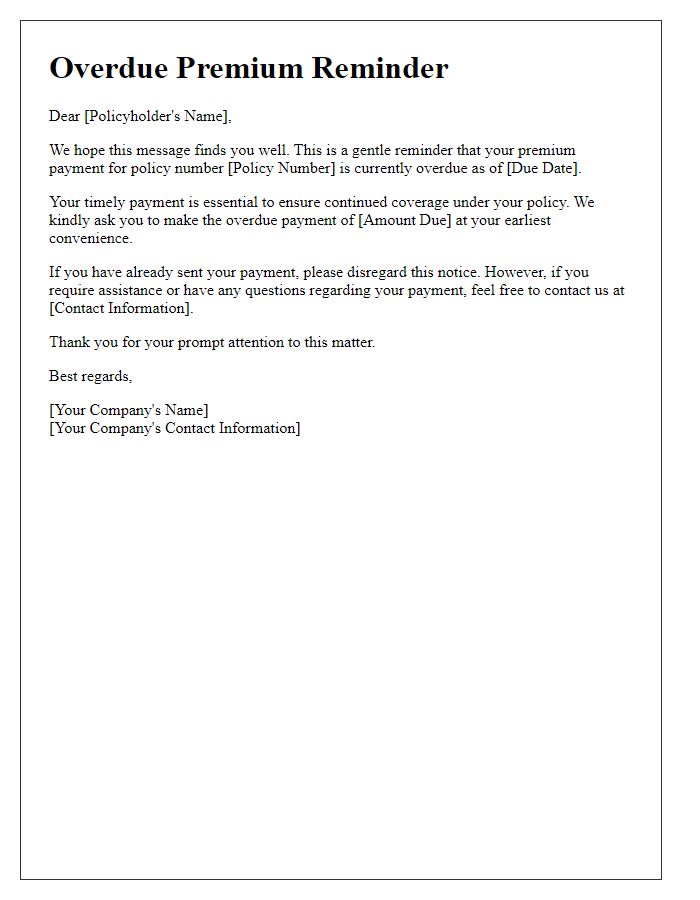

Due Date and Amount

Premium arrears can create significant issues for policyholders, impacting coverage continuity and financial obligations. A policyholder should be aware that the due date for premium payment is often specified in the policy document, typically falling on a monthly, quarterly, or annual schedule. For instance, if the premium amount is $500 due on January 1, 2024, failure to pay by this date may result in a grace period of typically 30 days before any lapse in coverage occurs. Late fees may also be incurred, affecting the total outstanding amount. Maintaining timely payments ensures that the insured remains protected under the terms of their policy and avoids potential penalties associated with premium delinquency.

Consequences of Non-Payment

Policyholders facing premium arrears may experience significant ramifications, including policy cancellation and loss of coverage. Insurance policies, such as life insurance or health insurance, typically require timely payments to maintain active status. In many cases, a grace period of 30 days is provided, allowing policyholders to make overdue payments without immediate penalties. However, if payments remain unpaid beyond this period, insurers may initiate formal cancellation procedures, potentially affecting claims processing. Additionally, policyholders may face increased premiums upon reapplication due to raised risk profiles. Insurers often communicate these consequences through official notices, requiring policyholders to take immediate action to avoid disruption of their insurance services.

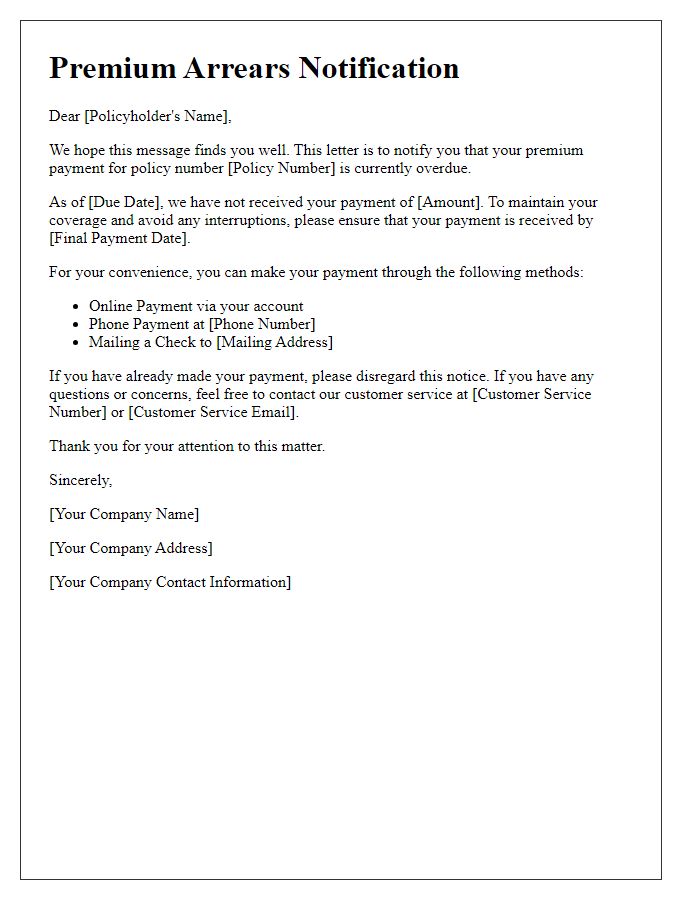

Payment Instructions

Policyholders with premium arrears often face challenges in maintaining their insurance coverage. Specific payment instructions are crucial for these individuals to restore their policy status. First, policyholders must verify the outstanding amount due, which may vary based on the duration of the arrears. Next, they should select a preferred payment method, such as online bank transfer, credit card payment, or check submission. For online transactions, a secure payment portal is typically provided, requiring input of the policy number and personal identification information to ensure accuracy. If opting for check payments, timely mailing to the specified address--often designated by the insurance company (such as the corporate headquarters in Des Moines, Iowa)--is essential to avoid further penalties. Deadlines for payment submission should be strictly followed, as most insurance firms impose a grace period ranging from 10 to 30 days before considering the policy lapsed. In addition, contacting customer service for clarification on any discrepancies or to set up a payment plan can be beneficial for those in financial difficulty.

Contact Information

Policyholders facing premium arrears may receive notifications from insurance companies regarding outstanding payments. These notifications typically include vital information such as policy number, premium amount due, and payment deadline. Clear contact information is essential for policyholders to address their concerns or inquiries about the arrears. It generally consists of the insurance company's customer service phone number, email address, and website URL for online inquiries. Additionally, reminders may highlight the implications of non-payment, such as potential policy lapses or coverage interruptions. These communications serve to ensure policyholders understand their financial obligations and maintain their insurance coverage without disruption.

Comments