Have you ever found yourself in a frustrating situation where your premium refund request was denied? It can be incredibly disheartening, especially when you feel you've met all the necessary criteria. In this article, we'll explore the common reasons why refund requests get denied and how you can navigate the appeal process effectively. Join me as we uncover strategies and tips that could help your caseâread on to discover more!

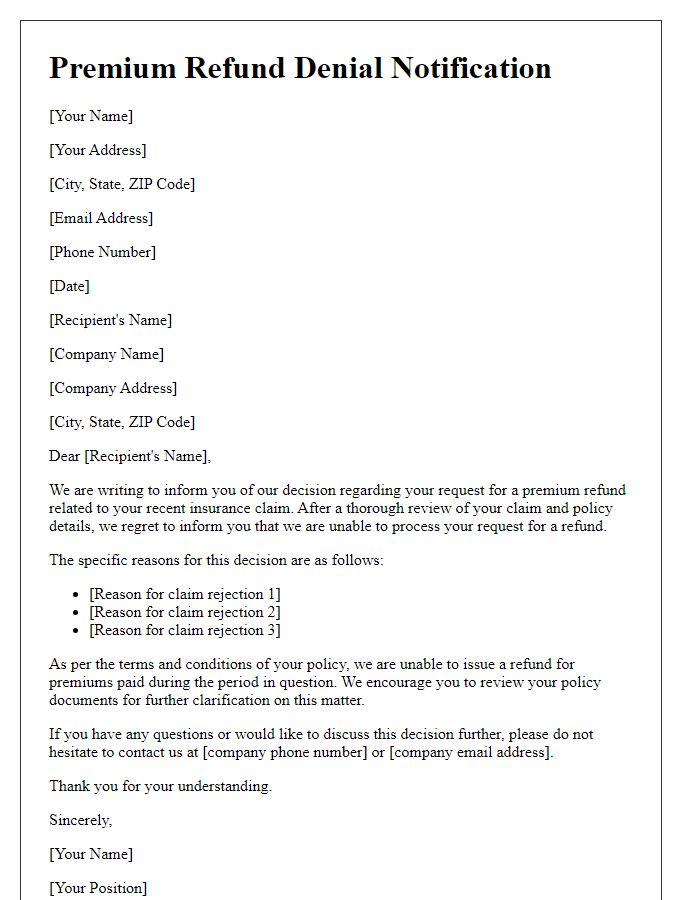

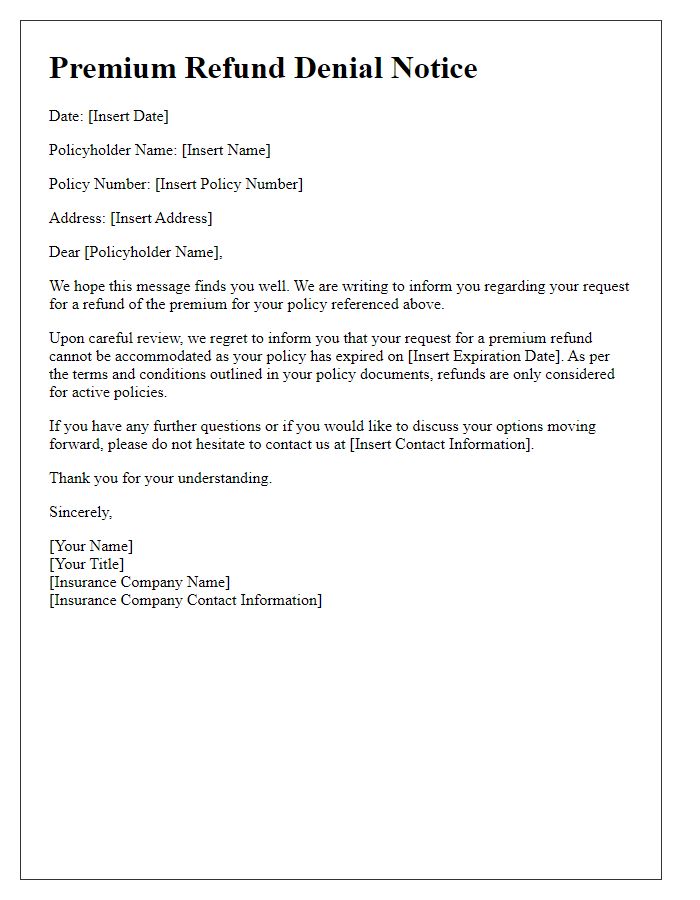

Clear Subject Line

A premium refund denial notice typically includes concise details regarding the refund request, including the policy number, the reason for denial, and any relevant dates. Clear communication is essential, often stating the specifics of the policy criteria that led to the denial. Customer service contact details are usually provided to assist the recipient with further inquiries. Keeping the tone professional and informative helps maintain customer relations, even in denial notices.

Polite Opening Statement

A premium refund denial can be a disappointing experience, impacting customers' satisfaction and trust in a service. Clear communication regarding the reasons behind the denial is crucial. For instance, if a customer policy from a major insurance company like Allstate was not maintained as per the agreed terms, this could lead to a denial of the premium refund. In this scenario, insistent policies like coverage lapsed could play a significant role. It's essential to address customers politely in this correspondence, maintaining empathy while conveying the company's stance on the matter. Clarity and understanding in the articulation can help mitigate any negative sentiments from the customer's perspective.

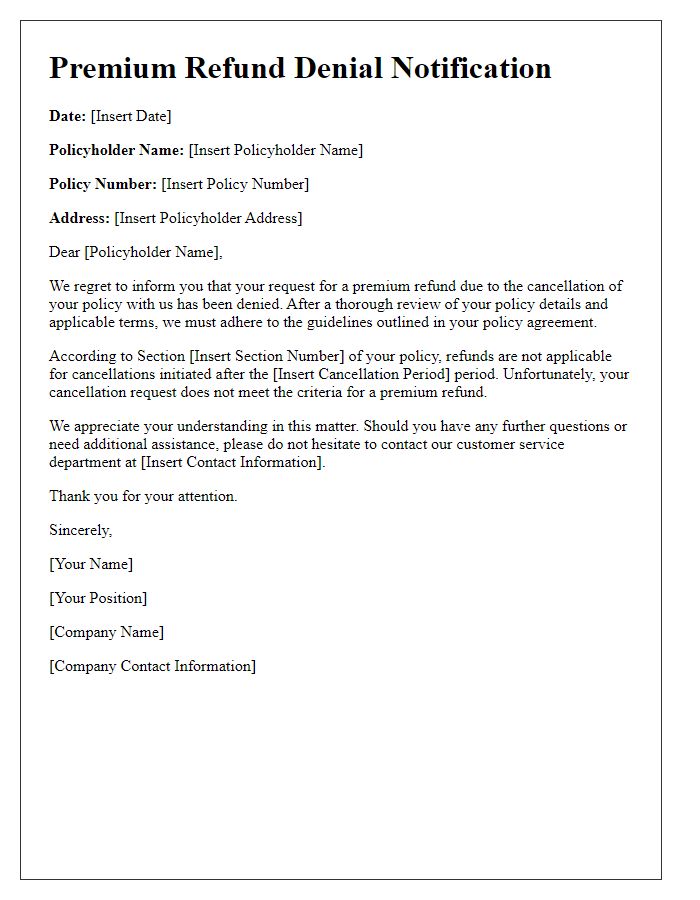

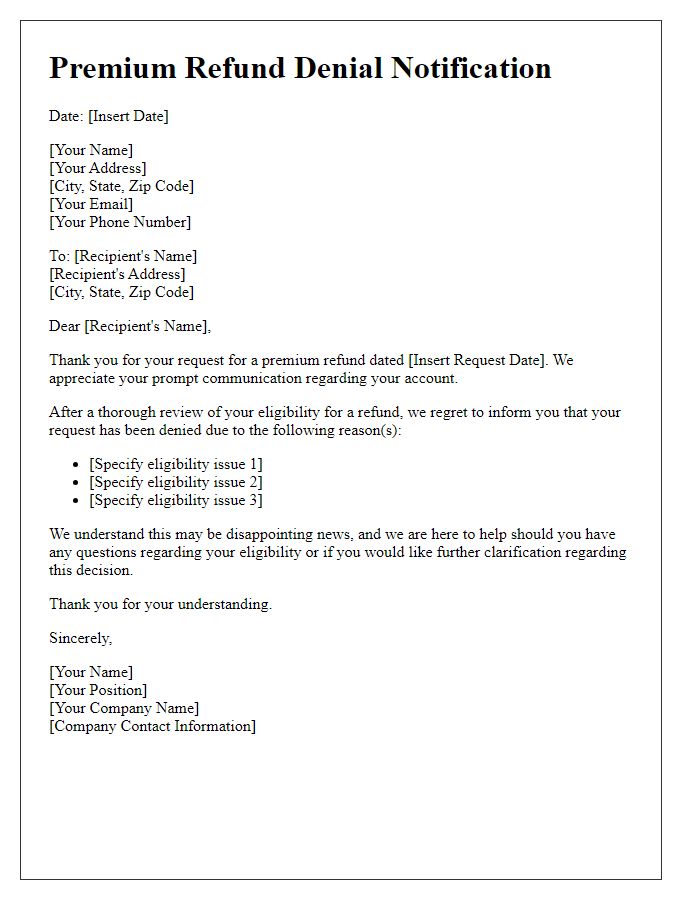

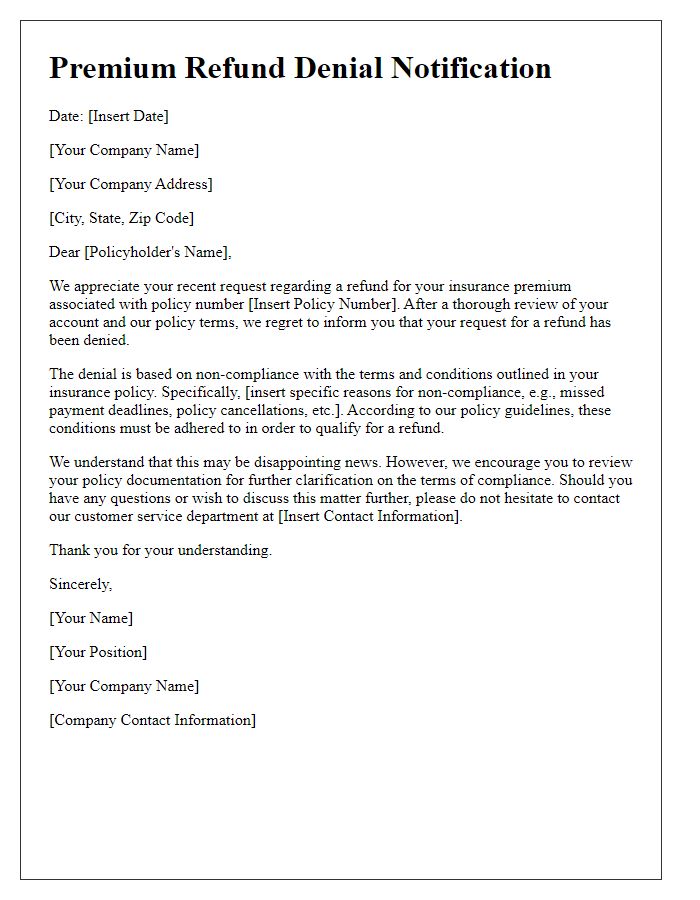

Explanation of Denial Reason

Premium refund requests may be denied due to various reasons including policy terms, claim filing period, or policyholder status. For example, if the refund request is made after the stipulated window (often 30 days after policy cancellation), eligibility for the refund lapses. Additionally, some policies may state that refunds are not available if claims have been filed (such as for vehicle damage or health-related issues) during the coverage period. Another reason for denial could relate to the type of policy itself, such as non-refundable premiums within certain insurance types (like guaranteed issue life insurance) where all premiums may be forfeited if the policy is canceled early. Understanding specific policy language is crucial in determining the validity of a refund request.

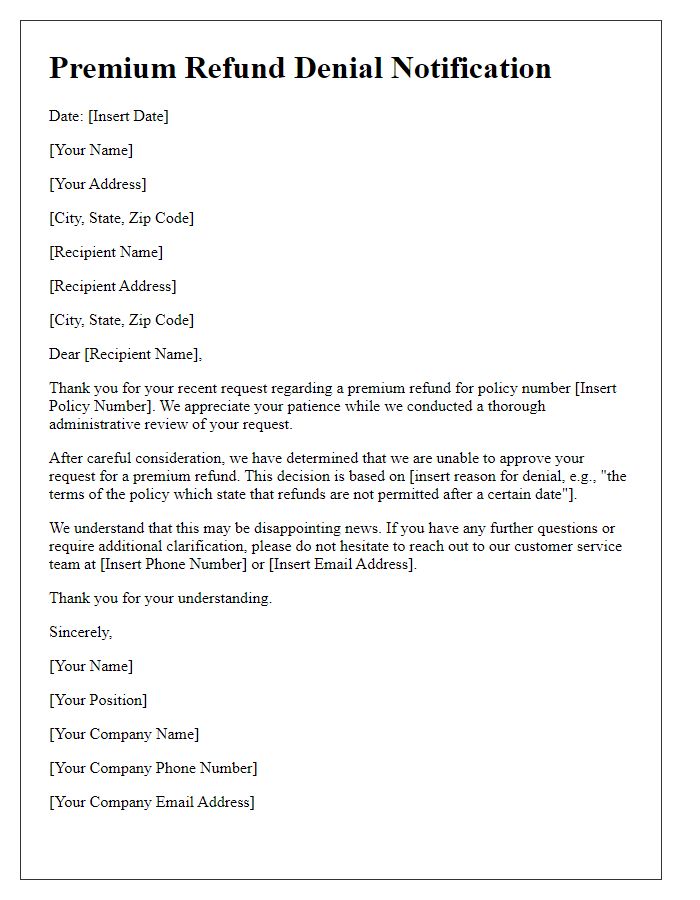

Reference to Policy Terms

Premium refunds are often denied based on specific policy terms and conditions outlined in insurance agreements. Policies contain clauses detailing the circumstances under which refunds may be permitted. For instance, many insurance providers stipulate that premiums are non-refundable after a grace period, which is typically 30 days from the policy's effective date. Some policies may also specify that refunds can only be granted if the policyholder has not made claims during the coverage period. Moreover, terms may vary significantly between different companies or types of insurance, such as health, auto, or life insurance, emphasizing the importance of thoroughly reviewing individual policy documents. Understanding these contractual obligations is crucial for policyholders seeking to navigate refund requests effectively.

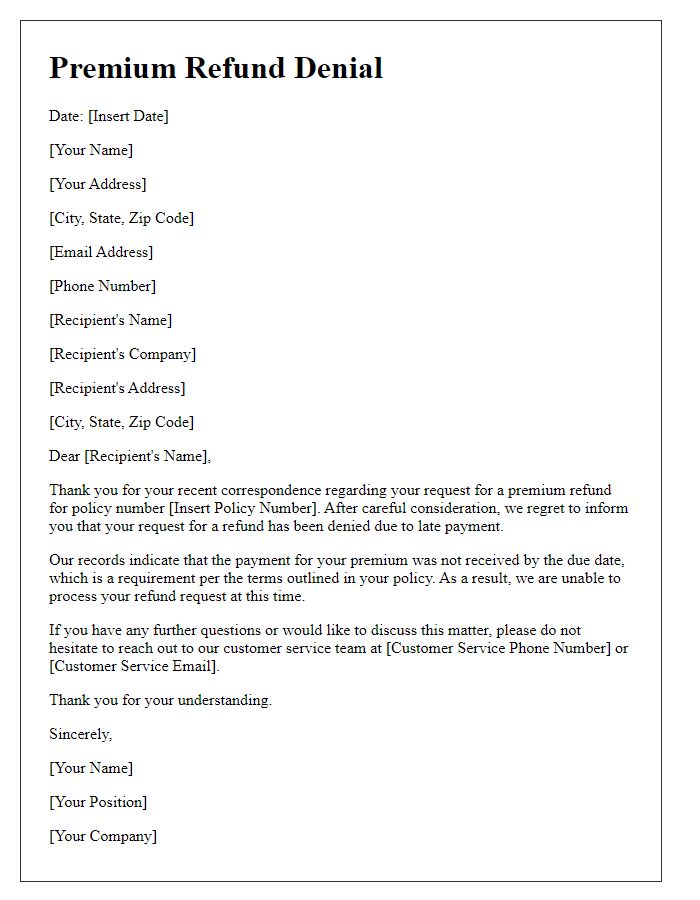

Closing Statement with Contact Information

Premium refund denial letters often conclude with a clear closing statement, reaffirming the decision while providing contact information for further inquiries. The closing statement should reiterate the basis for the denial, often citing policy terms or conditions that were not met. For instance, policy number 123456789 under XYZ Insurance Company specifies that refunds are only applicable under certain criteria, which in this case were not fulfilled. Contact information should include a phone number, email address, and mailing address to ensure accessibility for the recipient. For example, customer service can be reached at (123) 456-7890, available Monday through Friday from 9 AM to 5 PM, or via email at support@xyzinsurance.com. Physical correspondence can be directed to XYZ Insurance Company, 123 Main St, Anytown, USA, ZIP 12345.

Letter Template For Premium Refund Denial Samples

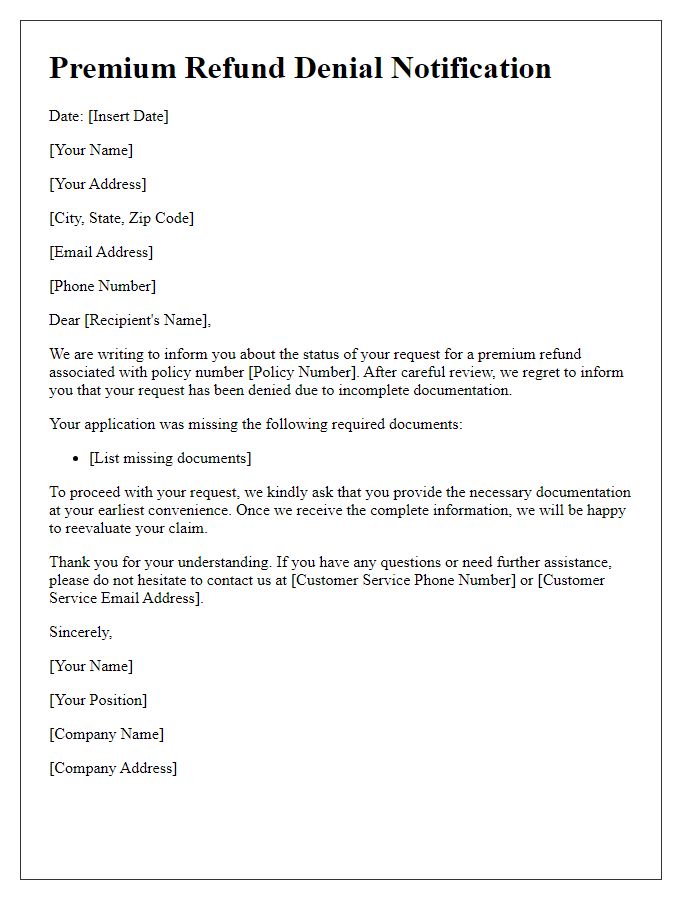

Letter template of premium refund denial due to incomplete documentation

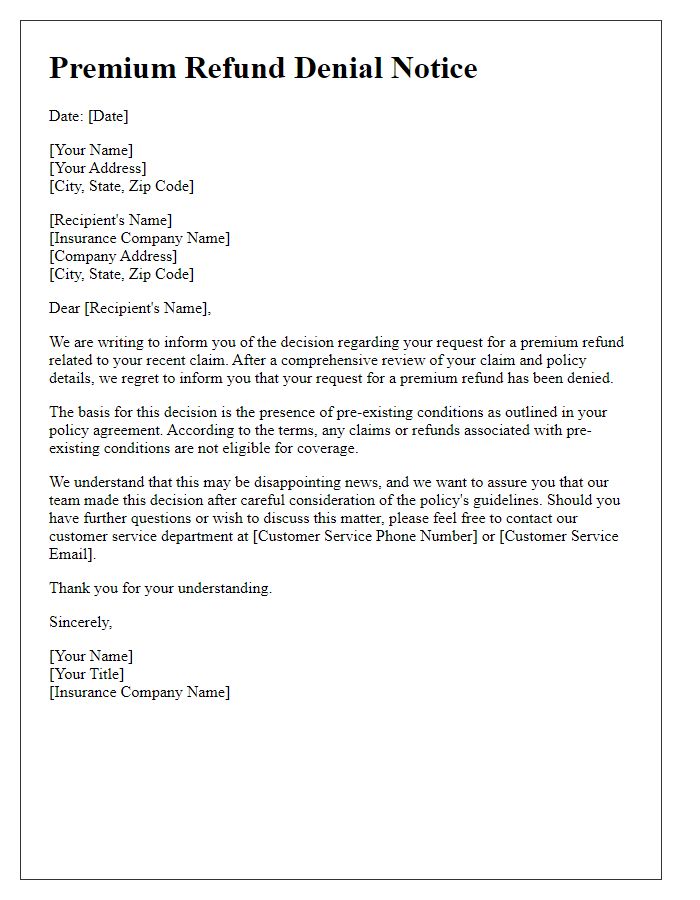

Letter template of premium refund denial related to pre-existing conditions

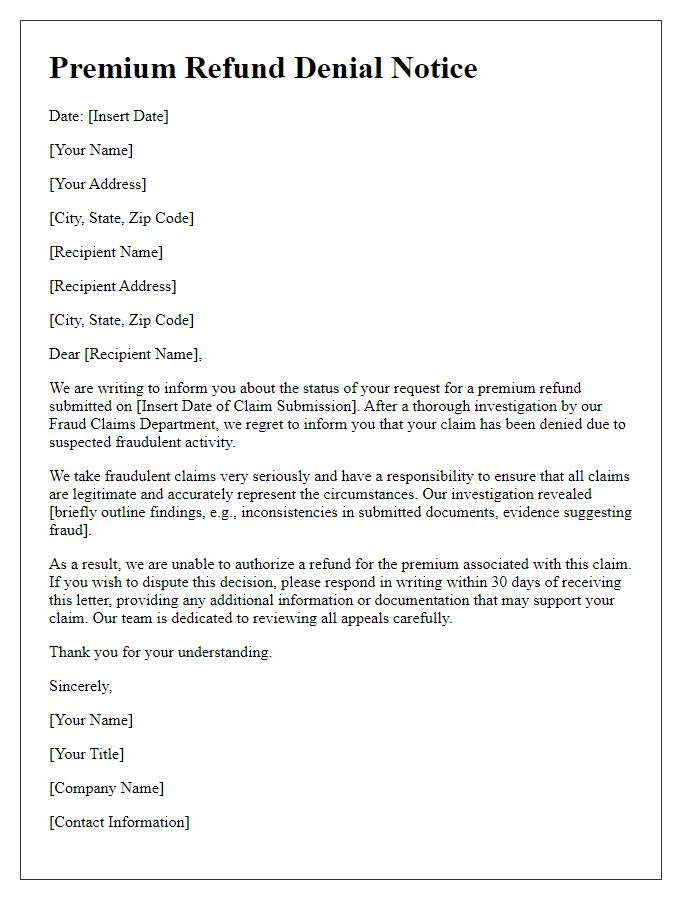

Letter template of premium refund denial for fraudulent claims investigation

Comments