Are you unsure about what to include in a letter confirming your hospitalization coverage? Writing this type of letter doesn't have to be complicated! By clearly outlining your insurance details and the specifics of your hospitalization, you can ensure a smooth communication process with your provider. Stay tuned as we explore helpful tips and a sample letter that will guide you through every step of the way.

Patient Information

Hospitalization coverage confirmation requires precise details for verification. Patient Information includes full name (John Doe), date of birth (February 15, 1985), social security number (123-45-6789), and insurance policy number (POL12345678). Contact information encompasses primary phone number (555-123-4567) and email address (john.doe@example.com). Address details consist of residential address (123 Maple Street, Springfield, IL, 62701). Medical necessity requires documentation, including diagnosis (diabetes type 2), prescribed treatment plan, and attending physician's name (Dr. Alice Smith, MD). Insurance provider name (HealthFirst Insurance Company) along with customer service number (800-555-0199) aids in direct communication for confirmation. Submission date must be noted for tracking purposes.

Hospital and Treatment Details

Hospitalization coverage confirmation is crucial for ensuring that medical expenses are adequately covered during a patient's stay in healthcare facilities. Hospitals (like the Cedars-Sinai Medical Center in Los Angeles, renowned for its advanced medical treatment) typically require confirmation of insurance coverage and pre-authorization for specific procedures. Treatment details may include information about the diagnosis (for instance, a surgical procedure for appendicitis), length of stay (often ranging from one to three days), estimated costs linked to room and board (averaging $2,000 to $4,000 per day), and necessary follow-up care. Additionally, the patient's insurance plan, such as Blue Cross Blue Shield, might stipulate co-pays, deductibles, and out-of-pocket maximums that could affect the overall cost. Therefore, obtaining accurate information about coverage is essential to minimize unexpected financial burdens during recovery.

Coverage and Policy Information

Hospitalization coverage confirmation requires specific details regarding the insurance policy. Policyholders must provide the policy number, typically a series of alphanumeric characters issued by the insurance provider, to identify the coverage plan. Coverage amounts, stated in currency (e.g., USD, EUR), outline the limits set by the insurance company for hospital services, including room and board, surgical procedures, and diagnostic tests. Pre-authorization requirements may exist, necessitating approval prior to scheduled admissions for certain treatments or procedures. Furthermore, understanding the network hospitals, often listed on the insurer's website, is essential, as care received outside of the network may result in reduced coverage or higher out-of-pocket expenses. Premium payments and co-payment amounts should also be clearly documented to ensure compliance with policy terms.

Authorization and Approval Codes

Hospitalization coverage confirmation is crucial for ensuring that medical expenses are managed effectively. Insurance companies typically provide authorization and approval codes necessary for inpatient treatment. These codes, consisting of alphanumeric characters, authenticate the patient's eligibility and streamline the billing process. For instance, a typical authorization code may reflect a specific treatment date range, such as January 15 to January 22, 2023, covering various medical services received at hospitals like Mount Sinai or Johns Hopkins. Obtaining these codes from insurers (like Blue Cross or Aetna) can aid healthcare providers in verifying coverage, avoiding payment delays, or denials related to hospitalization procedures such as surgeries, diagnostic tests, and rehabilitation services.

Contact Information and Next Steps

Hospitalization coverage confirmation provides crucial information regarding medical insurance policies and patient care procedures. Health insurance providers, such as Blue Cross Blue Shield or Aetna, often require detailed patient documents, including policy numbers and identification cards, to expedite the coverage process during emergencies. Patients are advised to communicate with hospital billing departments, ensuring they understand out-of-pocket expenses associated with treatment. It is important to check the pre-authorization requirements for specific procedures, as failure to obtain necessary approvals can lead to increased financial responsibility. Additionally, understanding the network of participating facilities enhances the coverage benefits, ensuring optimal cost-saving measures are taken during hospital stays.

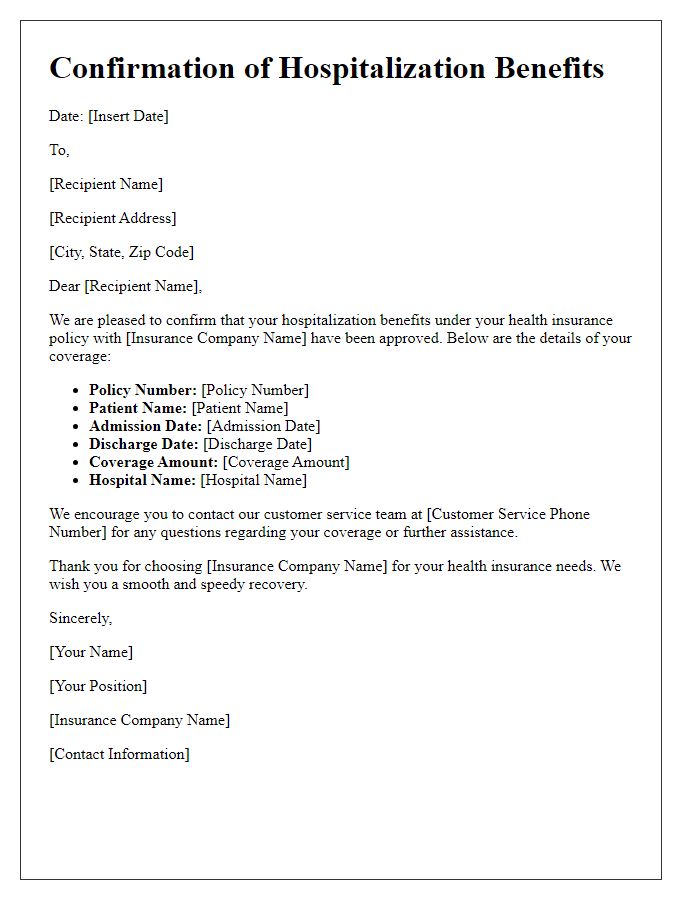

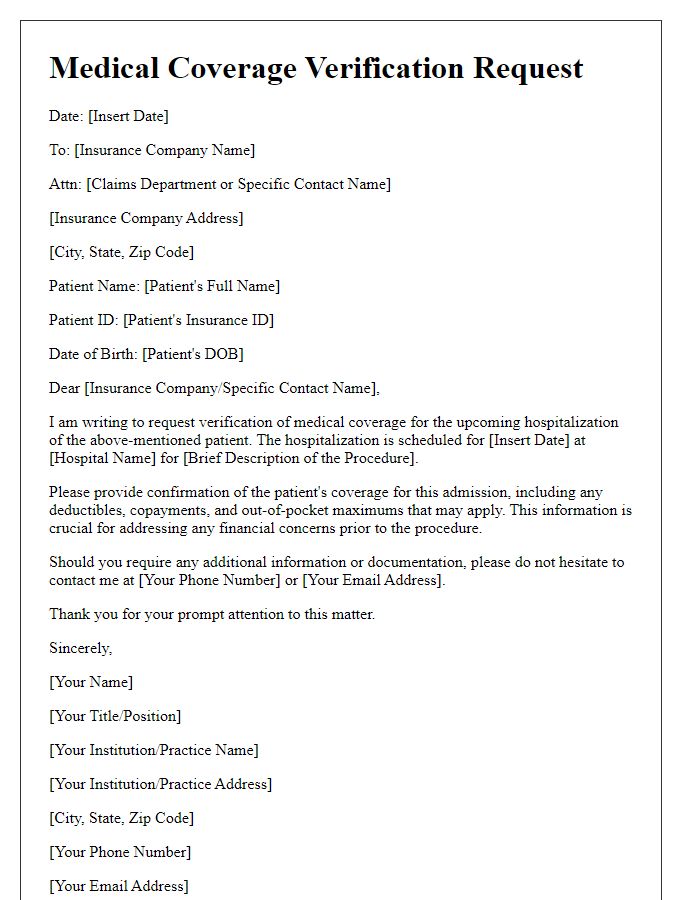

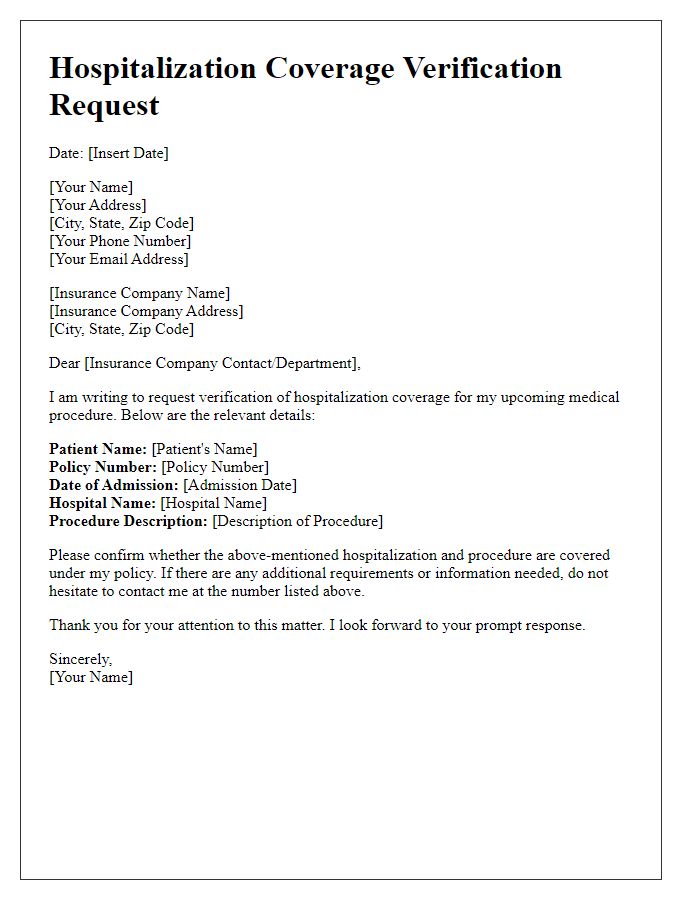

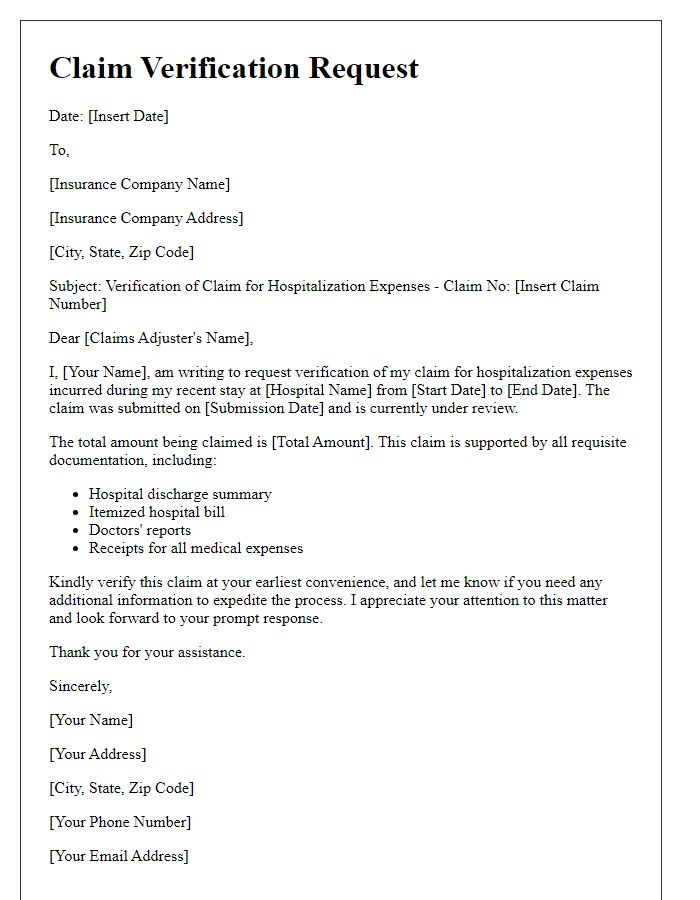

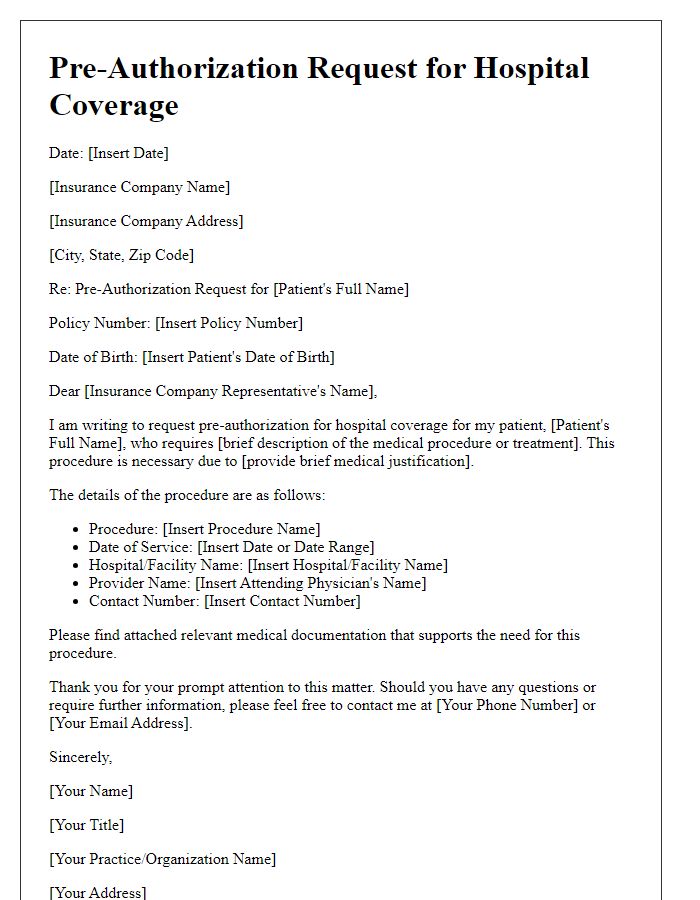

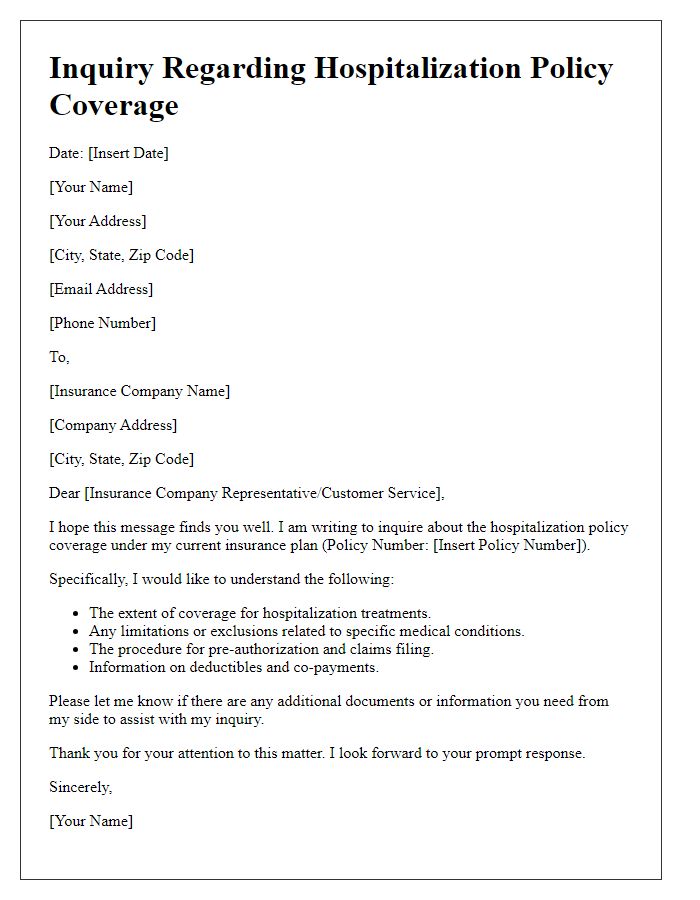

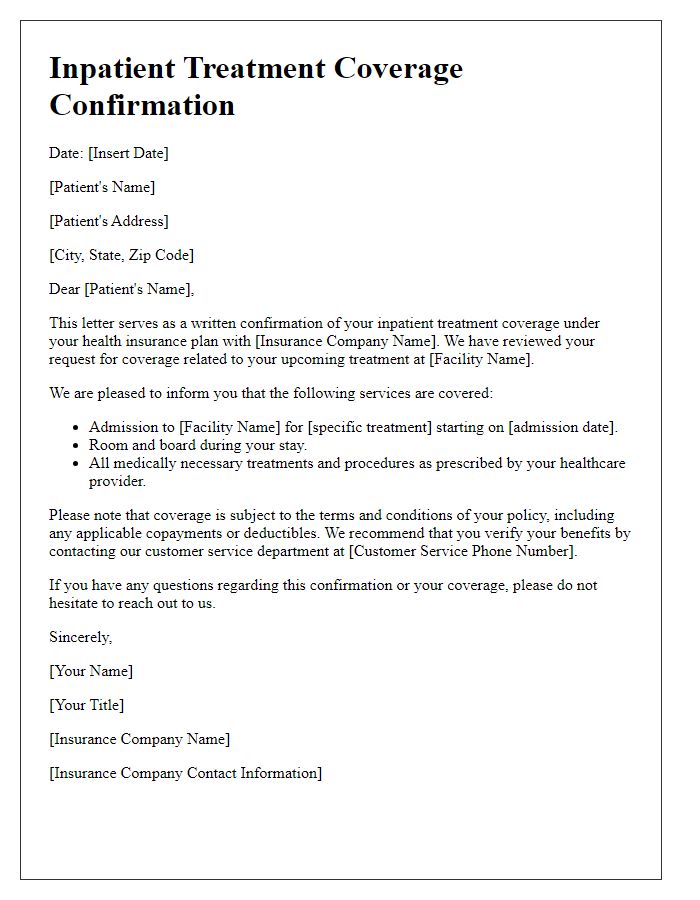

Letter Template For Hospitalization Coverage Confirmation Samples

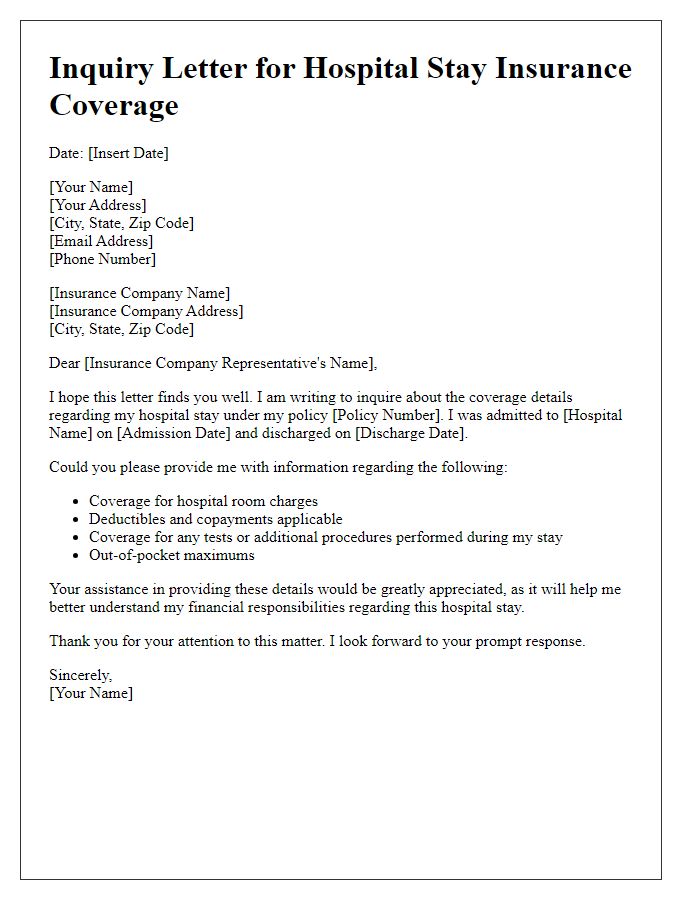

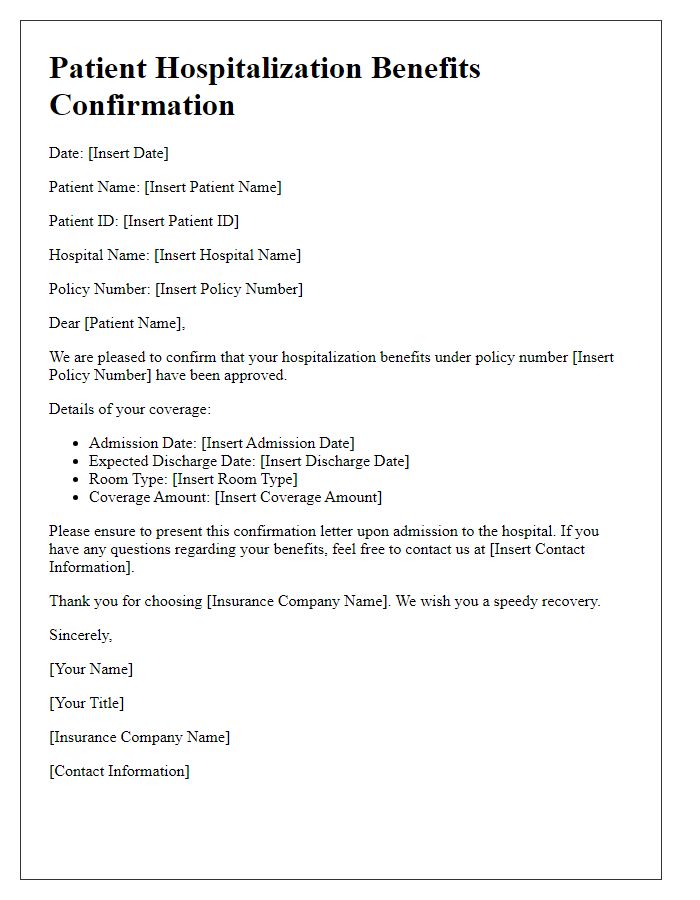

Letter template of confirmation for health insurance hospitalization benefits.

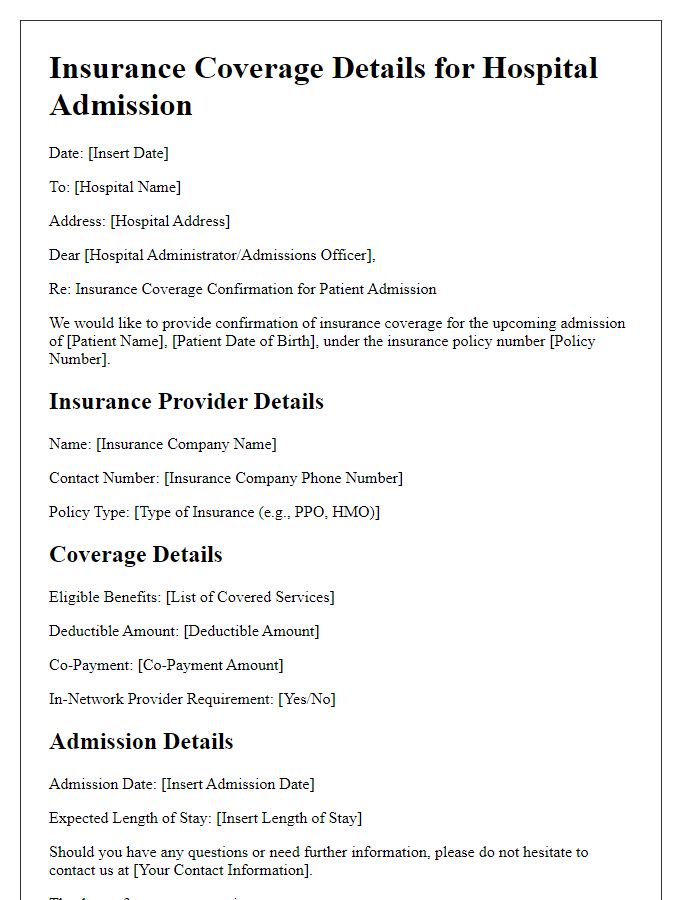

Letter template of medical coverage verification for upcoming hospitalization.

Comments