When it comes to insurance, understanding the reasons behind a policy underwriting rejection can feel daunting. Many individuals find themselves confused and uncertain after receiving the news, often questioning what went wrong in the application process. The good news is that having clarity about these rejections can empower you to take the right steps moving forward. So, if you're ready to dive deeper and uncover the key factors that influence underwriting decisions, keep reading!

Clear reason for rejection

Insurance policy underwriting rejections can stem from various factors, including insufficient information, high-risk profiles, or discrepancies in the application. A high-risk profile, such as a history of chronic illnesses like diabetes affecting health insurance applications, often leads to a denial. In cases of life insurance, lifestyle choices such as smoking or high-risk occupations like construction work can raise red flags. Additionally, incomplete or inaccurate information related to personal details or past claims can result in a rejection. Each rejection typically comes with a specific explanation pertaining to the identified risks or missing information, aiding applicants in understanding the underwriting decision.

Personalized salutation

Policy underwriting rejection occurs when an insurer determines an applicant's risk profile as unacceptable based on specific criteria in the insurance industry. Factors include medical history, lifestyle choices, and financial stability. Insurers, such as AIG or State Farm, use advanced algorithms and actuarial data to assess risk levels. Common rejection reasons may involve significant pre-existing health conditions like diabetes or hypertension that increase potential claims. The outcome can lead to heightened premiums or alternative policy offers tailored to mitigate insurer risk exposure. Rejected applicants often seek clarification on decision criteria, exploring options for appeal or reconsideration.

Positive tone and empathy

Crafting an effective response to policy underwriting rejection involves conveying empathy while maintaining a positive tone. A well-structured approach acknowledges the applicant's efforts, explains the reasoning behind the decision, and encourages future interactions or applications. For instance, a letter might begin with appreciation for the applicant's interest in securing a policy with the company. It is crucial to highlight that thorough evaluations are essential in underwriting to ensure the best fit for customers and the policy's guidelines. Specific reasons for the rejection, perhaps related to risk assessment or eligibility criteria, should be explained clearly yet sensitively to avoid discouraging the applicant. A positive outlook encourages prospective clients to seek further clarification or explore other options the company may offer. Ending the letter with an invitation to reach out for assistance or to discuss alternative solutions reinforces a supportive atmosphere, showing that the company values the applicant and their relationship with them. Overall, the letter should leave the recipient feeling understood, respected, and encouraged to pursue other opportunities, whether with the same company or elsewhere. This approach maintains the company's professional image while fostering goodwill.

Contact information for inquiries

Inquiries regarding policy underwriting rejections can be directed to the underwriting department of the insurance company, typically available at their corporate headquarters' address. Customer service representatives are often reachable via phone at a specific number, such as 1-800-555-0199, or through email at inquiries@insurancecompany.com. Each policyholder is encouraged to have their policy number on hand for reference during discussions. Furthermore, some companies may offer a dedicated FAQ section on their website, addressing common reasons for rejection. It's advisable to note business hours, usually Monday through Friday from 9 AM to 5 PM, for optimal assistance.

Policy review options or future application suggestions

Policy underwriting rejection can result from various factors including applicant risk profiles, financial stability, or missing documentation. Applicants may explore options such as requesting a reconsideration of the decision, addressing any identified deficiencies in their application, or providing additional supporting documents to strengthen their case. Future applications can benefit from enhanced preparedness, including thorough review of individual risk factors and consultation with insurance agents for tailored advice. Pursuing alternative coverage options from different insurers may also lead to successful underwriting in subsequent attempts.

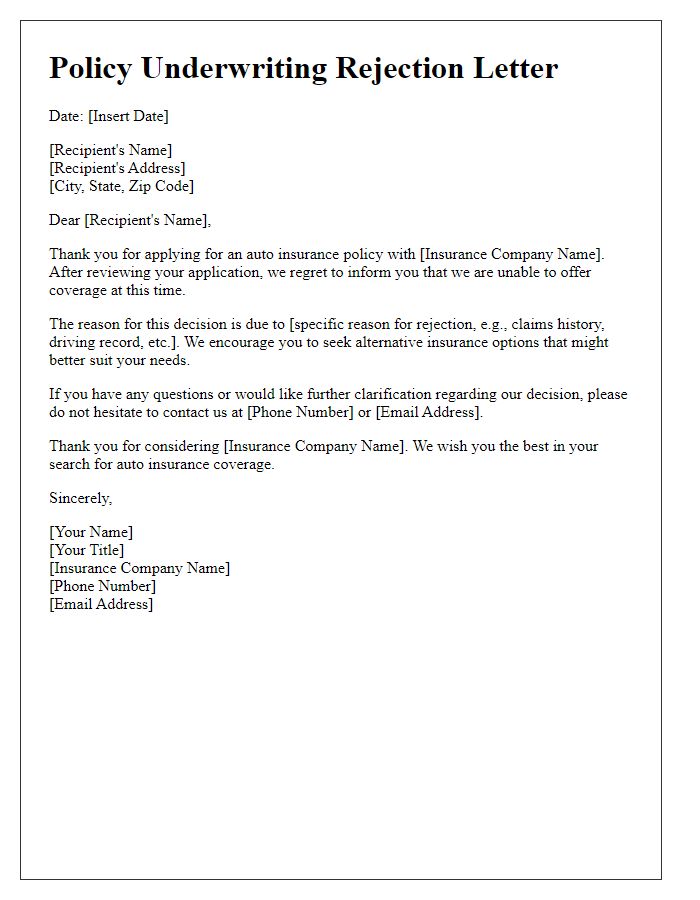

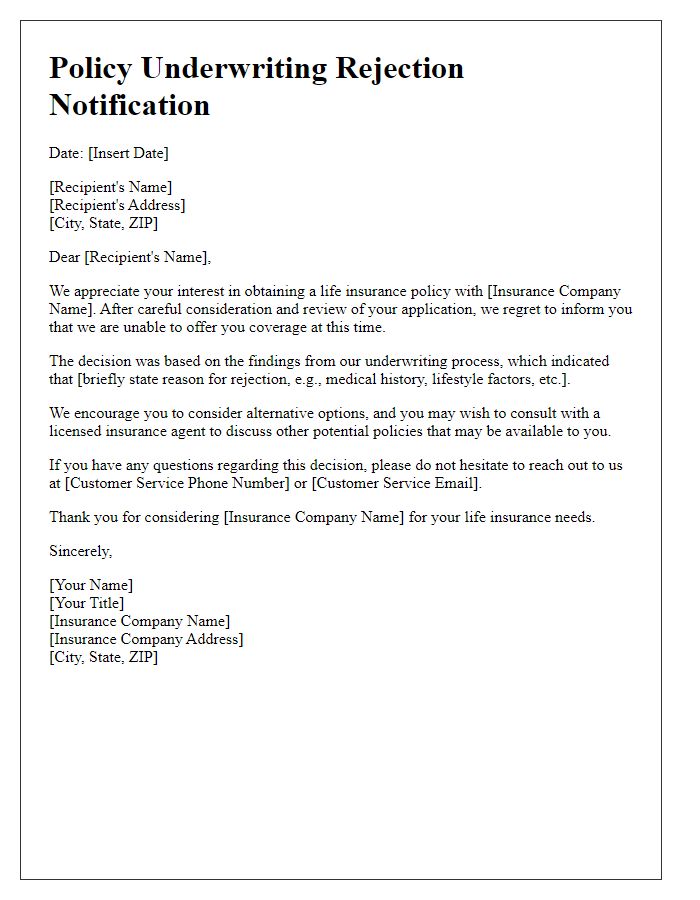

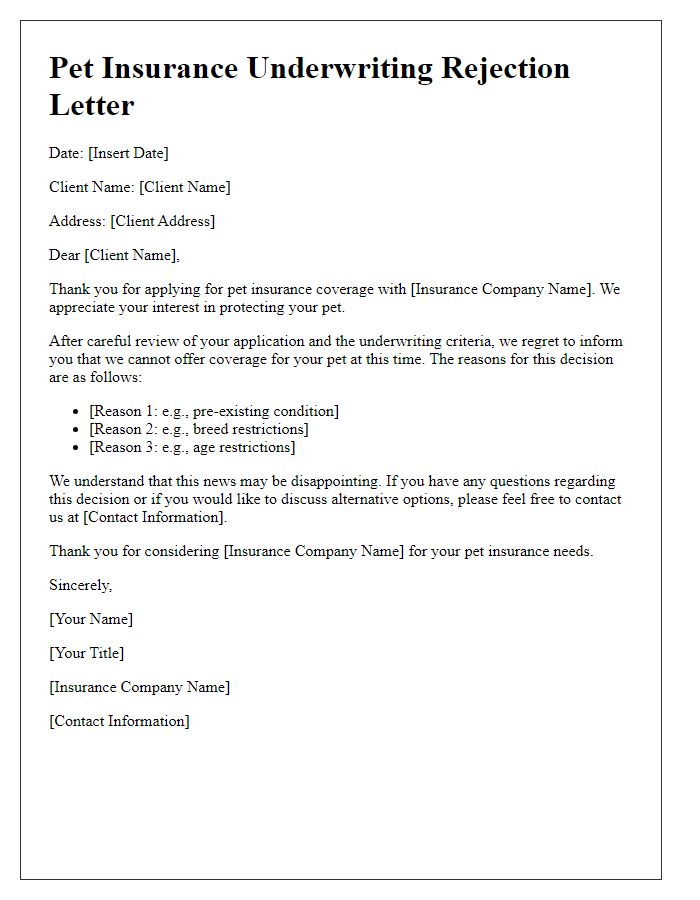

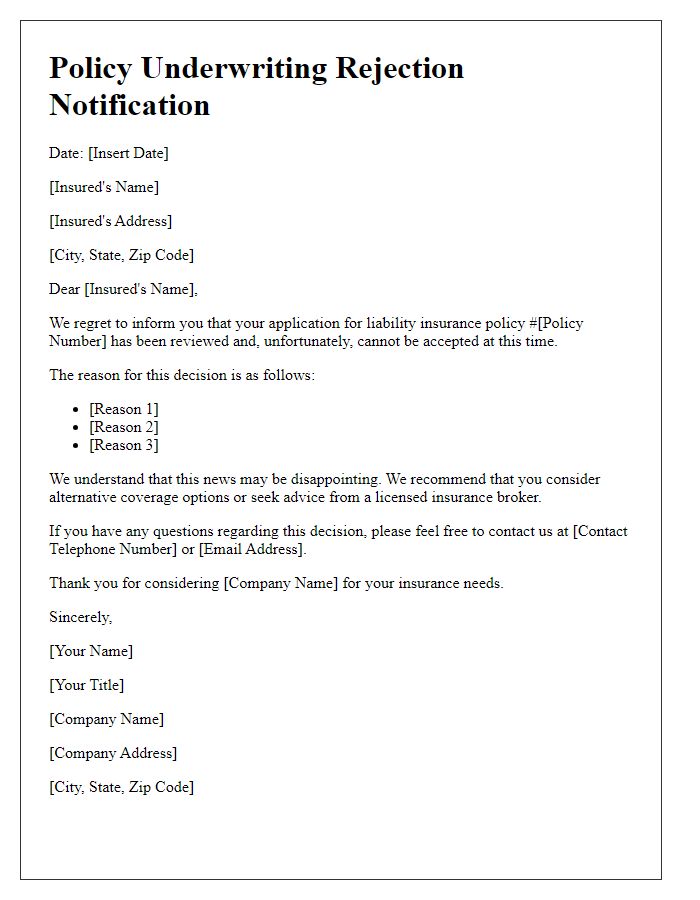

Letter Template For Policy Underwriting Rejection Samples

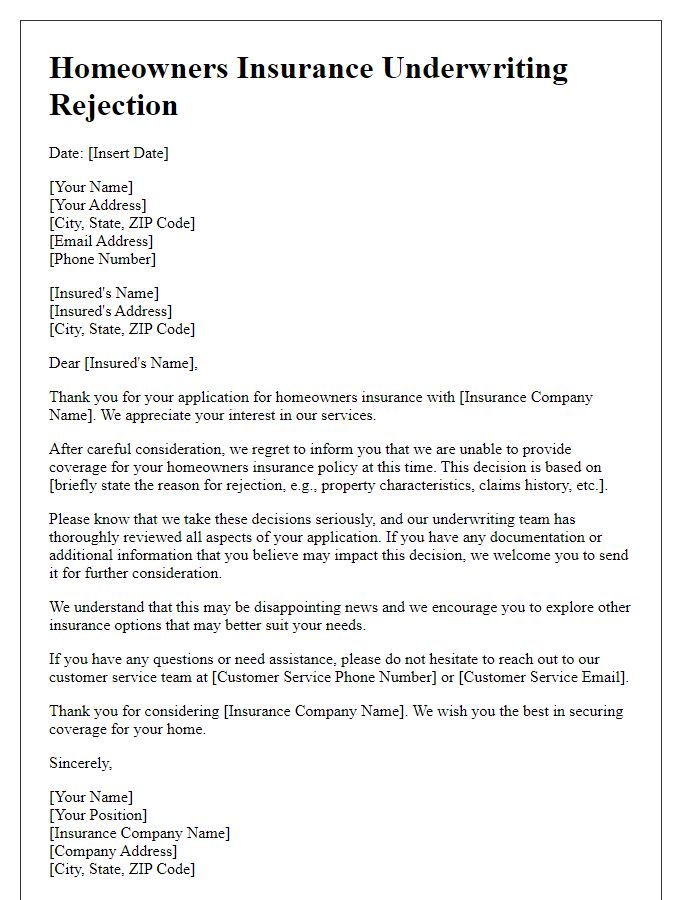

Letter template of policy underwriting rejection for homeowners insurance

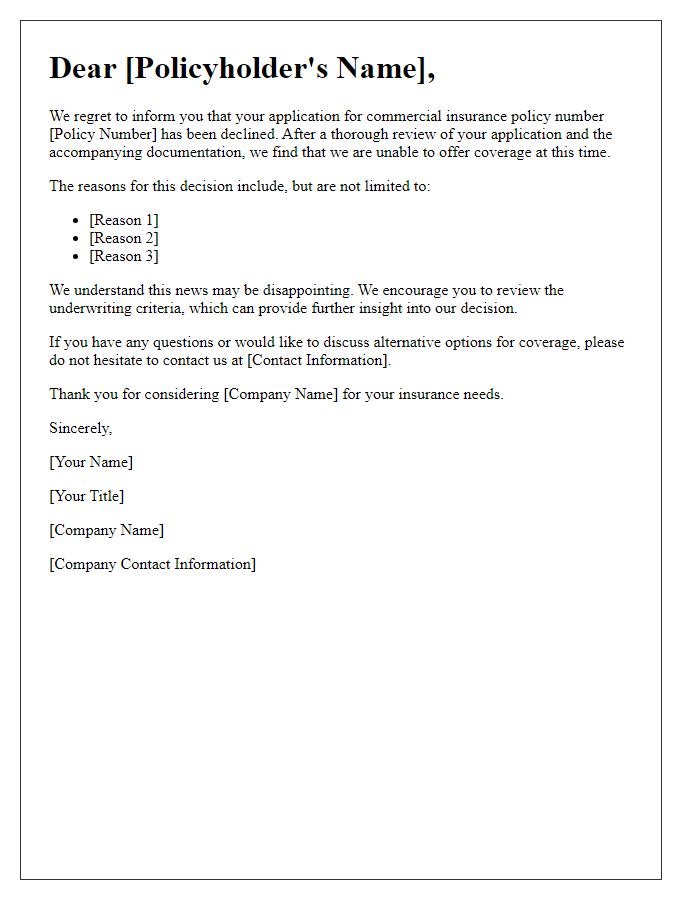

Letter template of policy underwriting rejection for commercial insurance

Comments