Are you curious about how to effectively declare your insurance bonuses? Writing a clear and concise letter for this purpose can make all the difference in ensuring that you receive the benefits you're entitled to. In this article, we will guide you through a straightforward template that outlines all the necessary details while maintaining a friendly tone. So, grab a cup of coffee and let's dive in to help you make your declaration easier!

Personal Information Verification

Personal information verification for insurance bonus declaration is critical for assessing eligibility for financial rewards linked to policy performance. Accurate data such as policyholder name, identification number, and contact information must be cross-checked against official records for authenticity. Verification ensures compliance with regulations set forth by governing bodies like the Insurance Regulatory and Development Authority (IRDA) in India. Dates related to policy inception and premium payment history are also essential for determining bonus amounts, typically calculated on an annual basis, often resulting in winners receiving bonuses ranging from 5% to 15% of their accumulated premiums. Documentation required might include policy documents and proof of identity to confirm the legitimacy of claims and maintain the integrity of the insurance process.

Policy Details Confirmation

The insurance bonus declaration process involves the confirmation of policy details, crucial for the accurate assessment of entitlements. Each insurance policy, such as life, health, or auto insurance, typically includes a unique identification number for tracking. Insurers regularly evaluate policies based on various factors, including premium payments (with percentages determining bonus eligibility) and claim history (high claim frequency can negatively affect bonuses). The effective date of the policy plays a significant role, as bonuses are often calculated based on policy duration. Insurers may offer different types of bonuses, like loyalty rewards (recognizing long-term commitment) or performance-based bonuses (reflecting low risk). This systematic confirmation ensures that policyholders receive their entitled benefits while maintaining the integrity of the insurance process.

Bonus Calculation Method

In an insurance bonus declaration, the bonus calculation method is crucial for understanding how bonuses are determined for policyholders. Many insurance companies, like Prudential and AIG, employ a formula based on various factors, including premium contributions, policy duration, and the financial performance of the insurer. Typically, bonuses are expressed as a percentage of the policy's sum assured, and they may fluctuate annually depending on the company's profitability, investment returns, and claims experience. For instance, a policy lasting ten years could yield bonuses ranging from 3% to 5% of the annual premium, contingent on the insurer's overall financial health. It's important for policyholders to review their annual statements, which detail the declared bonuses alongside the company's performance metrics, reinforcing transparency and trust within the insurance sector.

Payment Schedule and Options

The payment schedule for insurance bonuses, specifically for life insurance policies or health insurance products, typically outlines the timeframe for receiving bonus payments, which may occur annually or semi-annually. Insurers such as Prudential or AIG may offer multiple options for receiving bonuses, including direct bank transfers, premium reductions, or contributions to policy investments. An important factor to consider is the bonus declaration date, usually set at the end of each financial year, which allows policyholders to determine the accrued bonus amount based on the insurer's performance. Additionally, various regulatory guidelines govern these declarations, ensuring transparency and fairness in the distribution of bonuses to policyholders.

Contact Information for Queries

For inquiries regarding the insurance bonus declaration process, please reach out to our dedicated customer service team at the toll-free number 1-800-555-0199, available Monday through Friday from 9:00 AM to 5:00 PM (EST) excluding public holidays. Alternatively, you can email us at support@insurancecompany.com for assistance anytime. Our physical headquarters are located at 123 Insurance Way, New York, NY 10001. We encourage you to reference your policy number in all communications, ensuring a swift and efficient response to your queries.

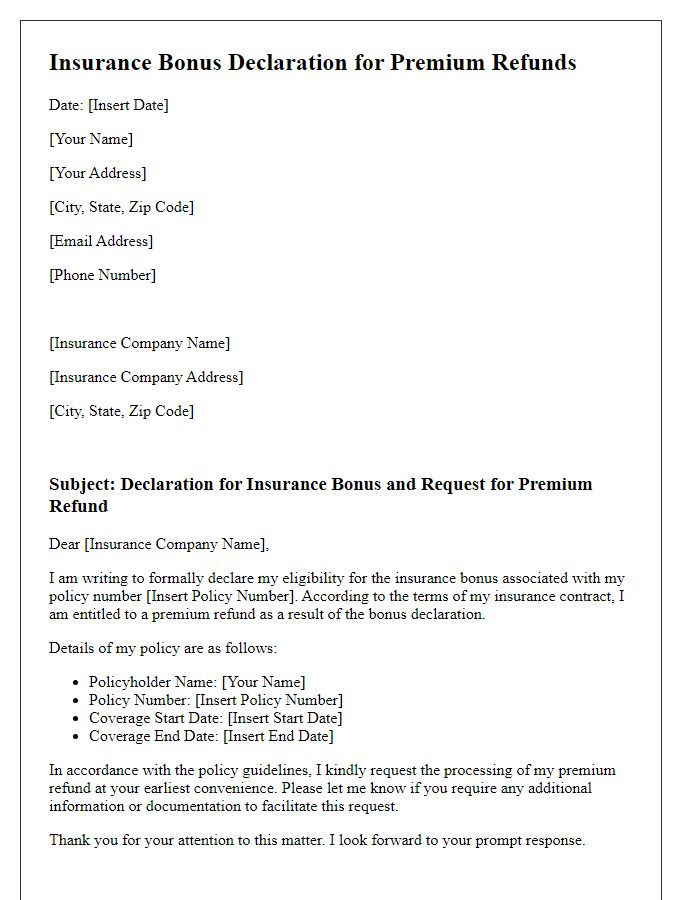

Letter Template For Insurance Bonus Declaration Samples

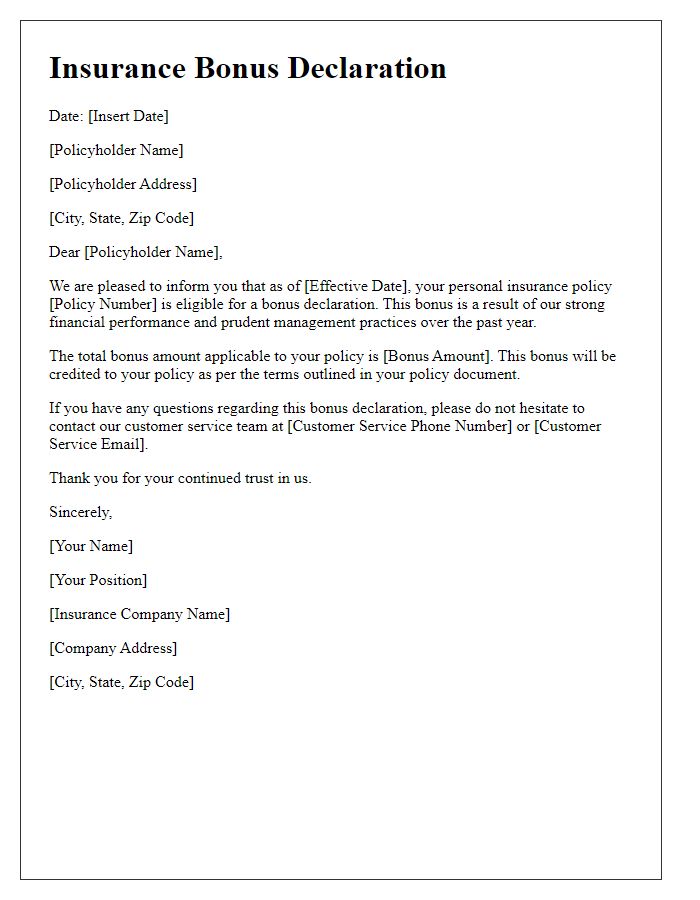

Letter template of insurance bonus declaration for personal policyholders.

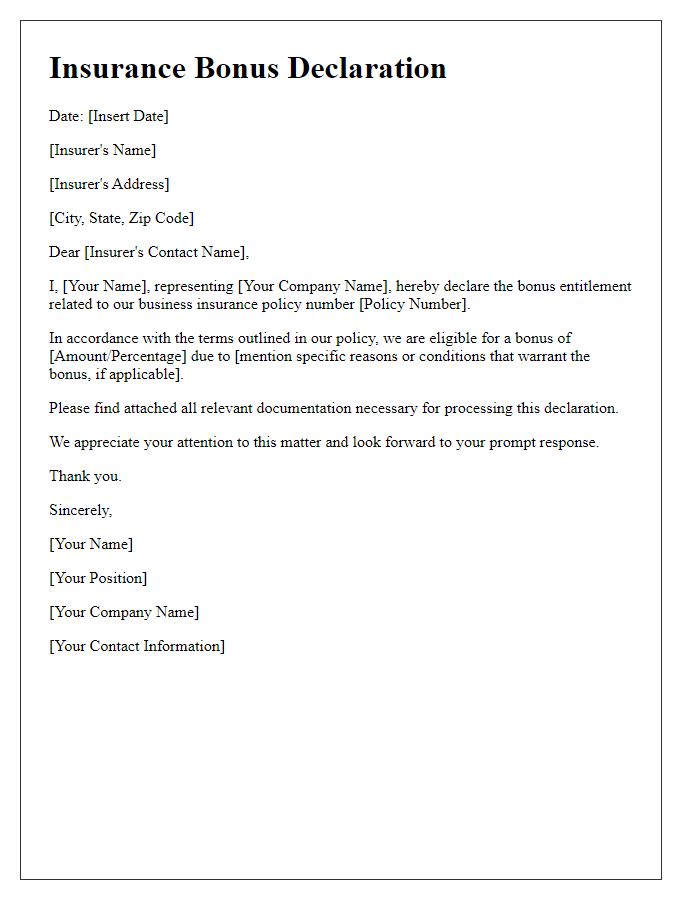

Letter template of insurance bonus declaration for business policyholders.

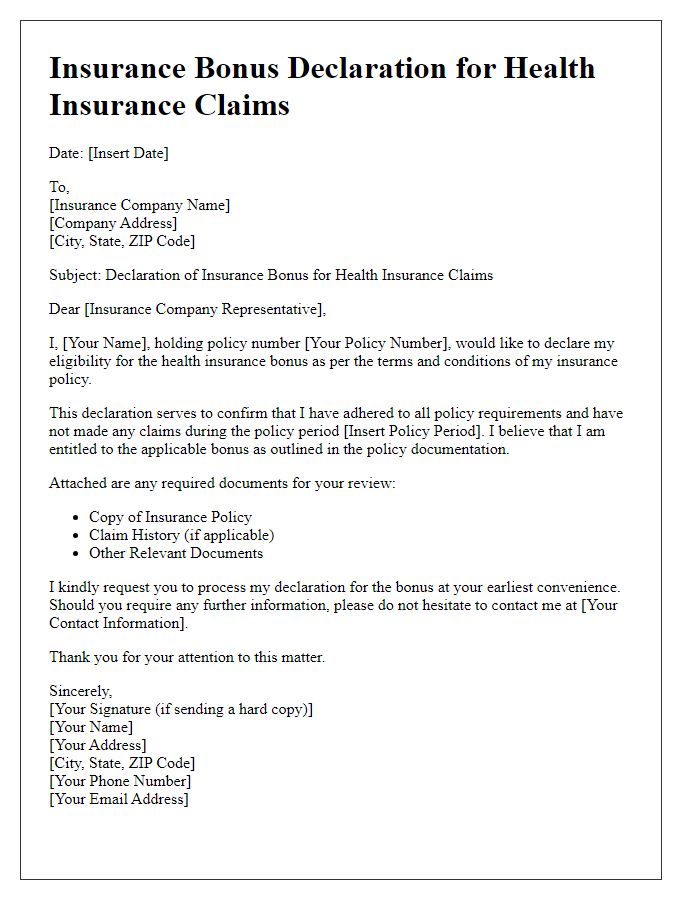

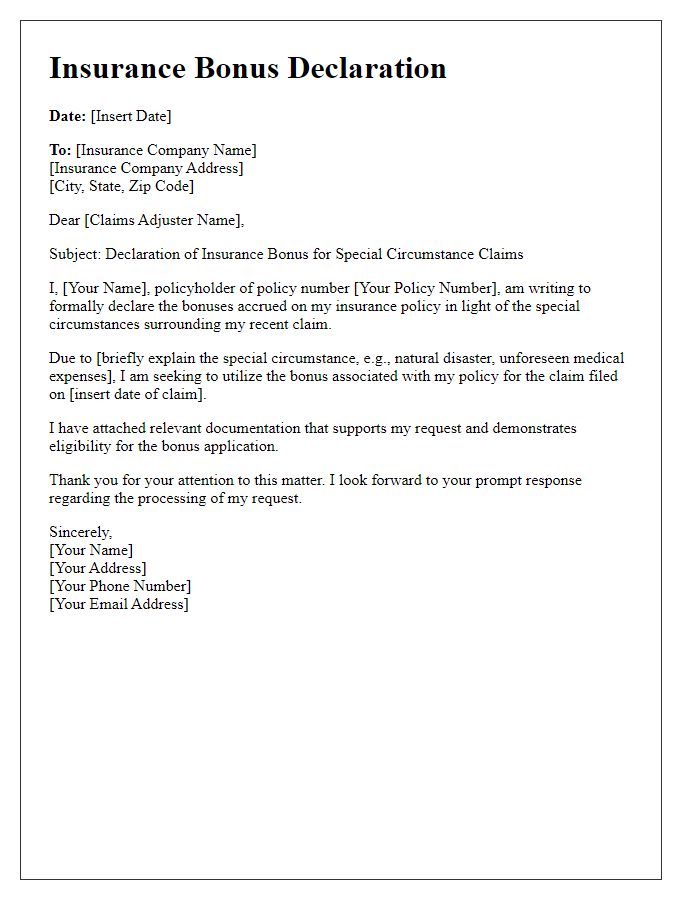

Letter template of insurance bonus declaration for health insurance claims.

Letter template of insurance bonus declaration for life insurance policies.

Letter template of insurance bonus declaration for motor insurance rewards.

Letter template of insurance bonus declaration for property insurance benefits.

Letter template of insurance bonus declaration for group insurance participants.

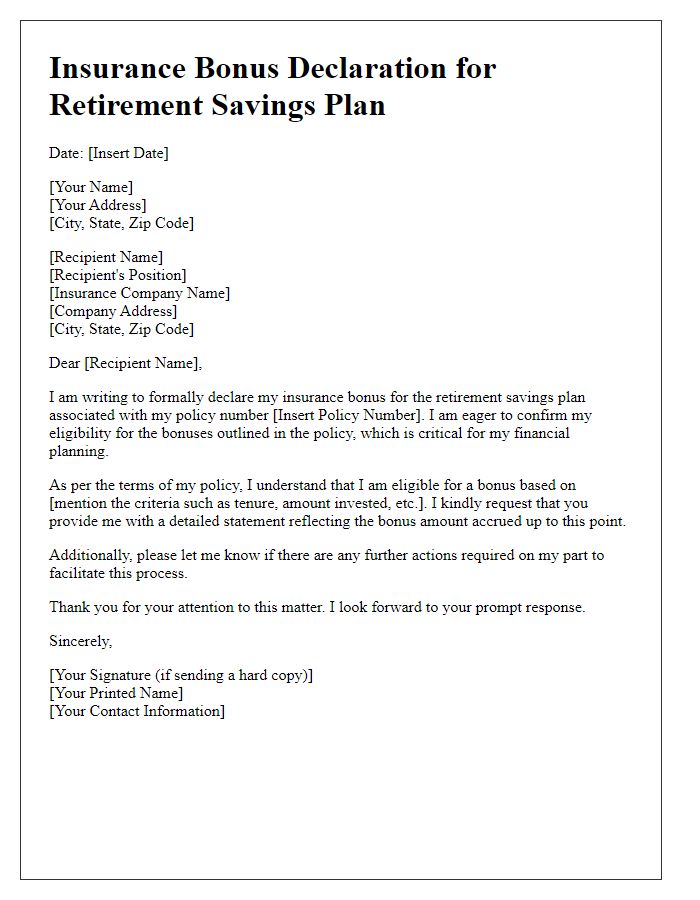

Letter template of insurance bonus declaration for retirement savings plans.

Comments