Are you looking to make changes to your insurance coverage but unsure where to start? Crafting a coverage modification request letter can seem daunting, but it doesn't have to be! In this article, we'll break down the essential components that make your request clear, concise, and effective. Let's dive into the details so you can confidently communicate your needs and ensure you're protected as you desire!

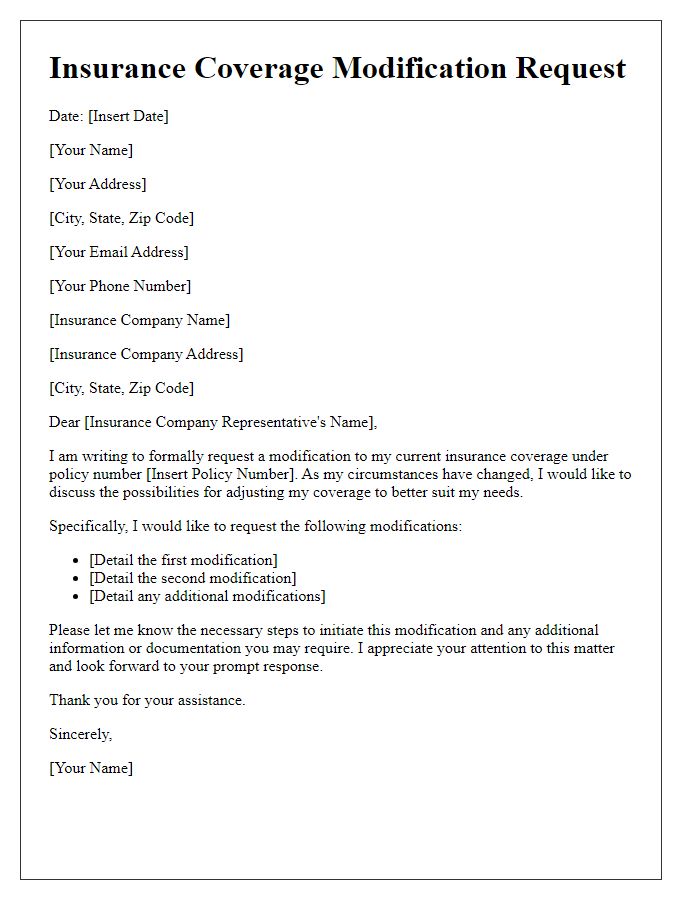

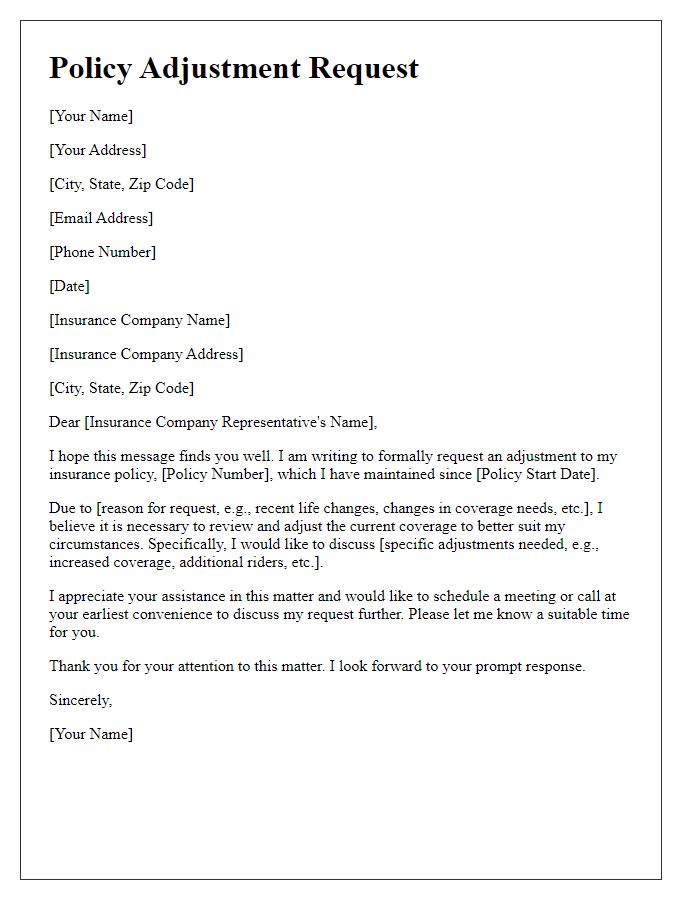

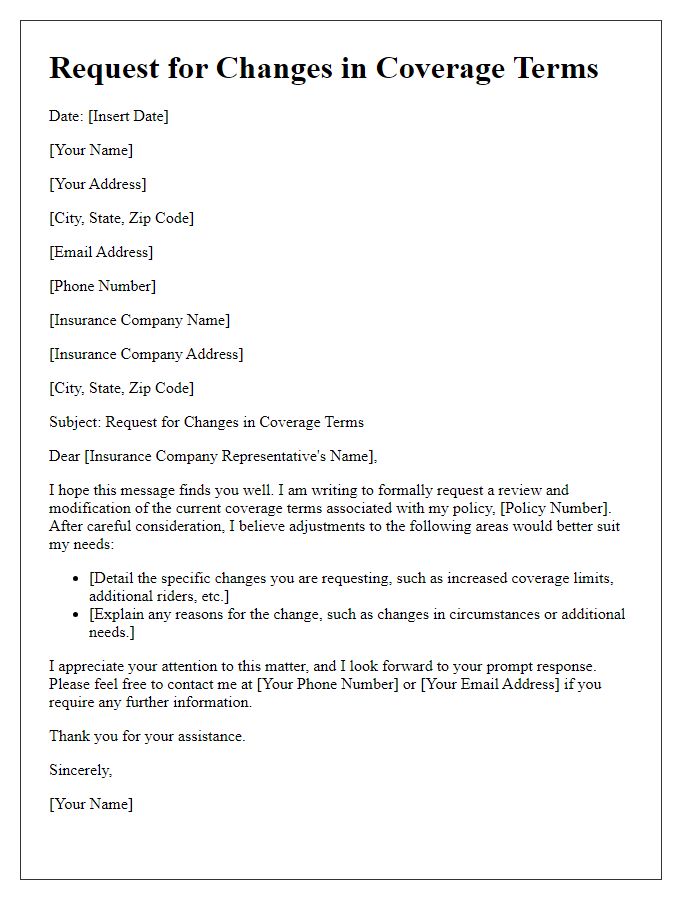

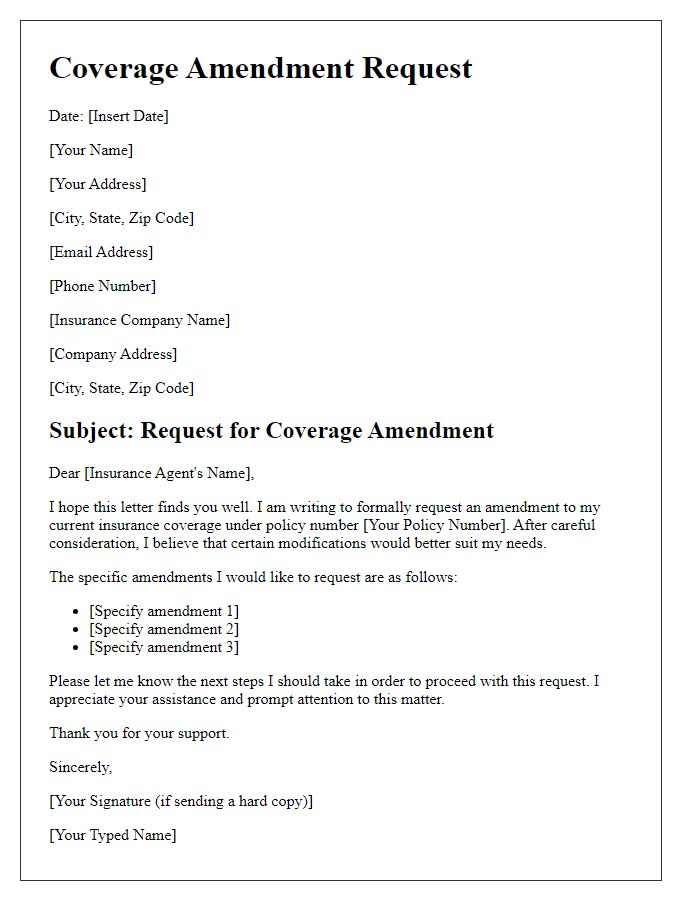

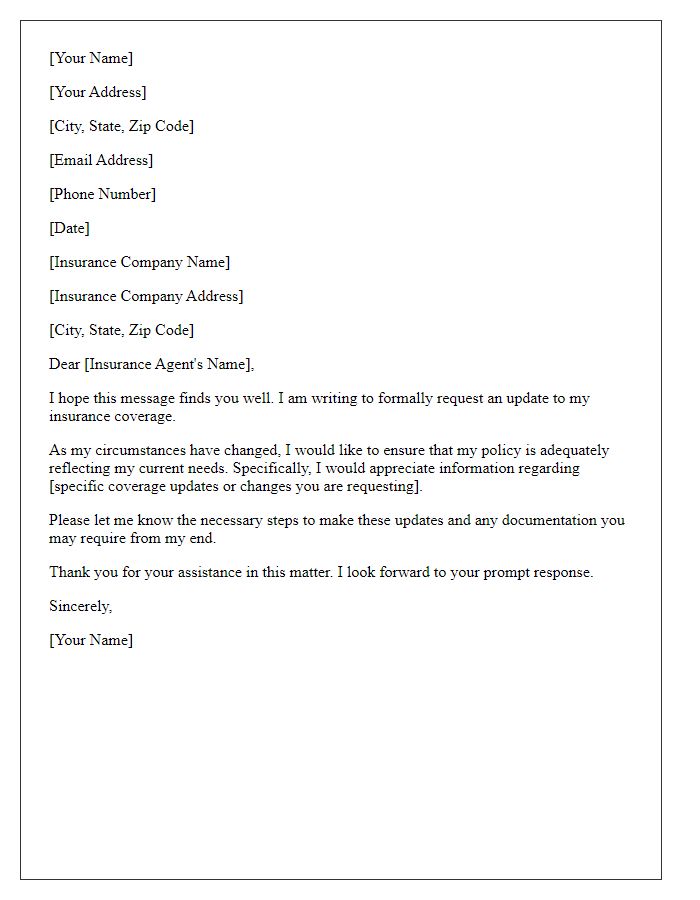

Policyholder Information

A coverage modification request entails adjusting existing insurance parameters, typically relevant for policyholders engaged with providers like State Farm or Allstate. Critical elements include the policyholder's full name, often accompanied by identification numbers like the policy number or Social Security Number, ensuring accurate identification within the insurer's database. Additionally, the specific modifications being requested should be articulated clearly; this may involve changes to coverage limits, adding endorsements, or removing certain exclusions. The submission date should also be noted for record-keeping purposes, and contact details such as a phone number or email address enable efficient communication between the policyholder and the insurer. Accurate and detailed information is essential in facilitating prompt review of the coverage modification request.

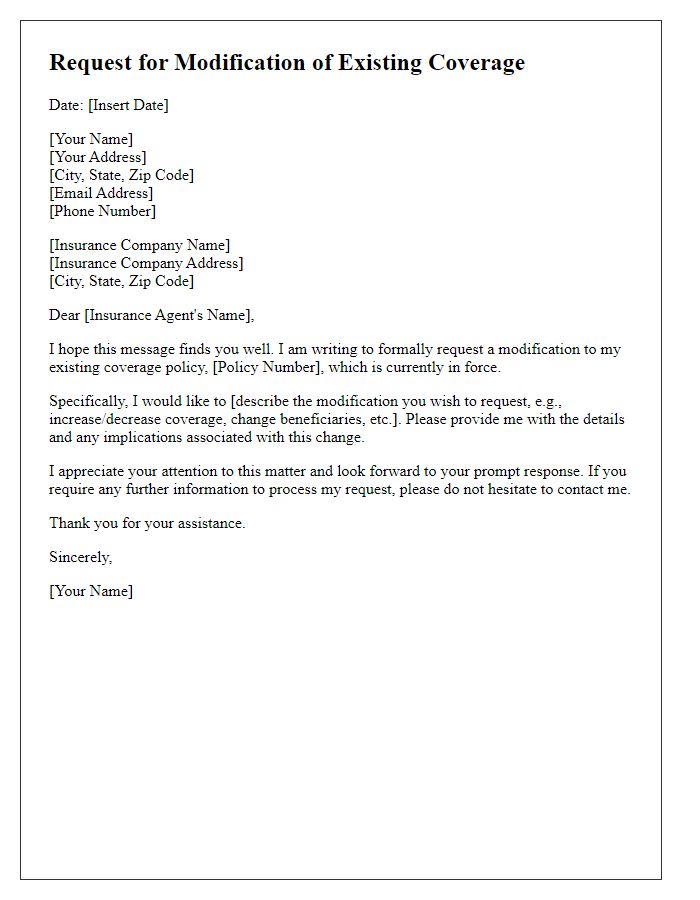

Policy Details

A coverage modification request involves adjusting an existing insurance policy, such as increasing coverage limits or adding specific types of protection. Policy details include the policyholder's name, unique policy number, type of insurance (like homeowners or auto), and effective dates. Coverage details specify existing coverages, such as liability limits (often expressed in thousands, e.g., $100,000), collision coverage, or property damage. Modification requests typically require justification, such as changes in property value, lifestyle changes, or new assets. Communication with insurance agents is crucial, ensuring that all changes adhere to state regulations and industry standards. Documentation, such as recent appraisals or evidence of new acquisitions, supports the request's validity.

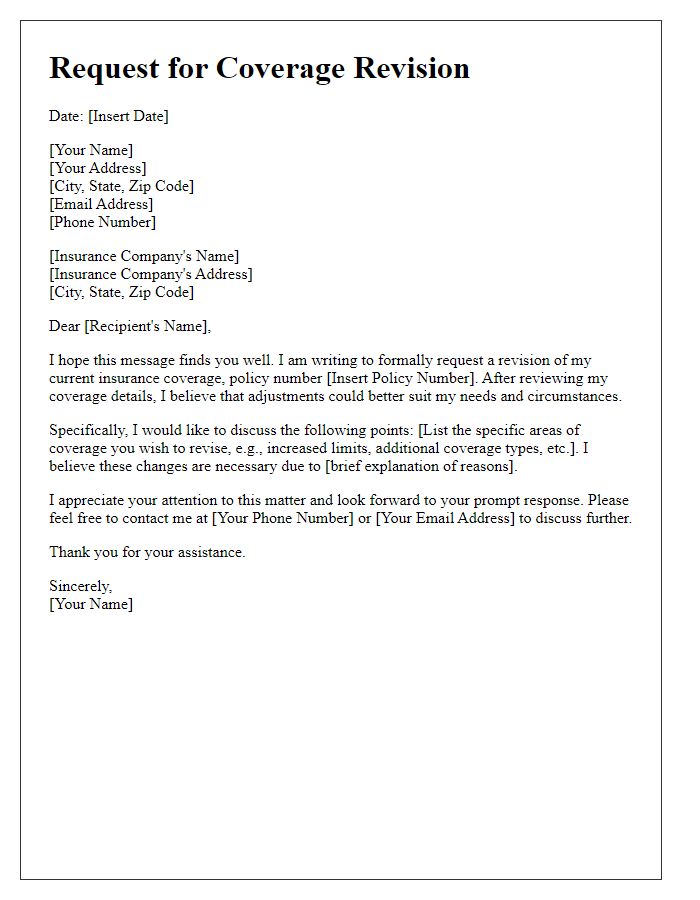

Requested Modifications

In the realm of insurance policies, a coverage modification request serves as a formal appeal to adjust existing terms and conditions. This request often outlines specific changes to be made in coverage limits, deductibles, or added protections. For instance, policyholders may seek to increase liability coverage from $500,000 to $1 million to better protect their assets, or to add endorsements for natural disaster coverage, such as flood or earthquake insurance. This adjustment process is especially pertinent when significant life events occur, such as purchasing a new home in flood-prone areas or acquiring valuable assets like expensive jewelry. Timely modification requests are essential for maintaining adequate protection and ensuring policies reflect the current risk landscape faced by the insured.

Justification for Changes

A coverage modification request is often prompted by critical factors such as changes in business operations, regulatory updates, or emerging risks that necessitate adjustments to insurance policies. For example, a manufacturing company may need to modify its liability coverage due to the introduction of new machinery or processes, which could elevate potential hazards and impact existing risk assessments. Additionally, evolving industry standards, such as those established by OSHA (Occupational Safety and Health Administration) or environmental regulations, may require enhancements in coverage to ensure compliance and protection. Claims history might indicate a pattern requiring increased limits, prompting the request for an assessment of higher coverage levels. Lastly, significant growth, such as expanding to new locations or launching new products, underscores the need for tailored insurance modifications to safeguard assets and operations effectively.

Contact Information

Coverage modification requests involve specific details about the insurance policy, relevant contact information, and any changes sought. Ensure clarity by including the policyholder's name, policy number, and email address. Date the request and specify the type of coverage, such as liability or property insurance, along with any specific modifications desired, such as increased limits or added endorsements. Communicate effectively by providing both a phone number for urgent inquiries and a mailing address if written confirmation is required. This structured approach enhances the likelihood of a prompt and accurate response from the insurance provider.

Comments