In the aftermath of a natural disaster, navigating the insurance claim process can feel overwhelming and stressful. Understanding your rights and knowing how to properly document your damages are crucial steps in ensuring that you receive the coverage you're entitled to. In this article, we will break down essential tips and provide a comprehensive letter template to help you submit your natural disaster coverage claim effectively. So, let's dive in and empower you with the knowledge you need to reclaim your peace of mind!

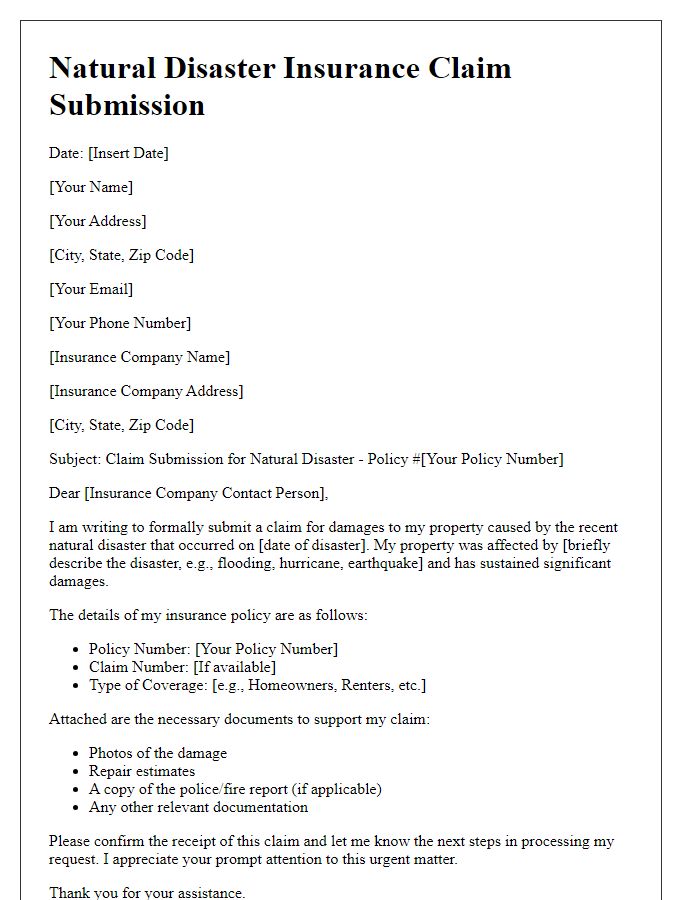

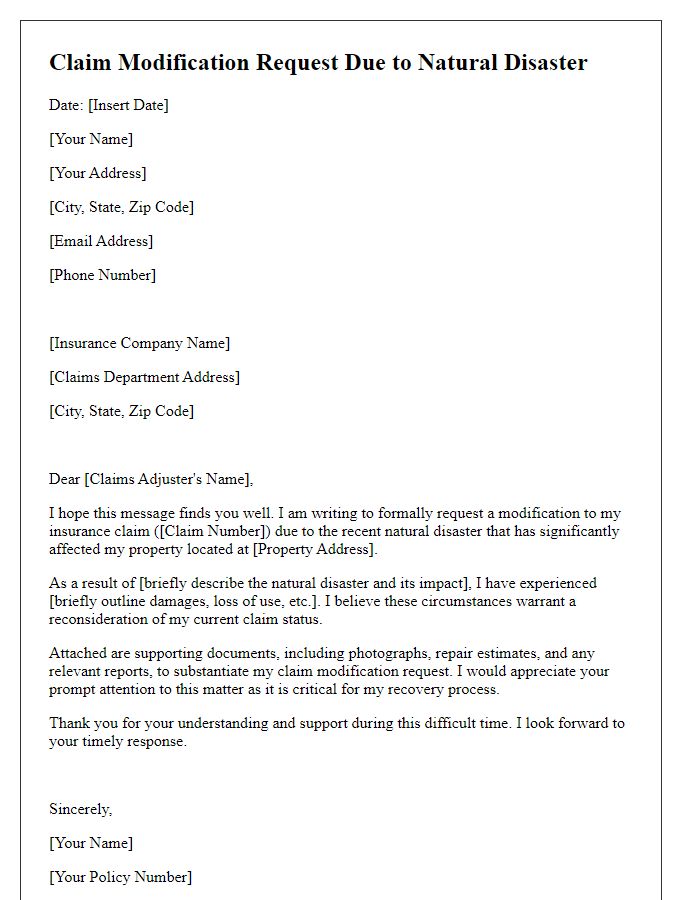

Policy Number and Personal Information

A natural disaster (such as hurricanes, earthquakes, or floods) can cause extensive damage to property and assets, necessitating coverage claims from insurance companies. Policy Number (unique identifier assigned by the insurance provider) plays a crucial role in expediting the claims process. Personal Information (including full name, contact number, and address) is essential for verification purposes, ensuring that the claim is processed for the correct policyholder. Documentation of the disaster's impact, such as photographs of damage, can support the claim and demonstrate the severity of the event, aiding the assessment by the insurance adjuster. Timeframe for claims submission is usually stipulated by insurance firms, often ranging from 30 to 60 days after the event occurs.

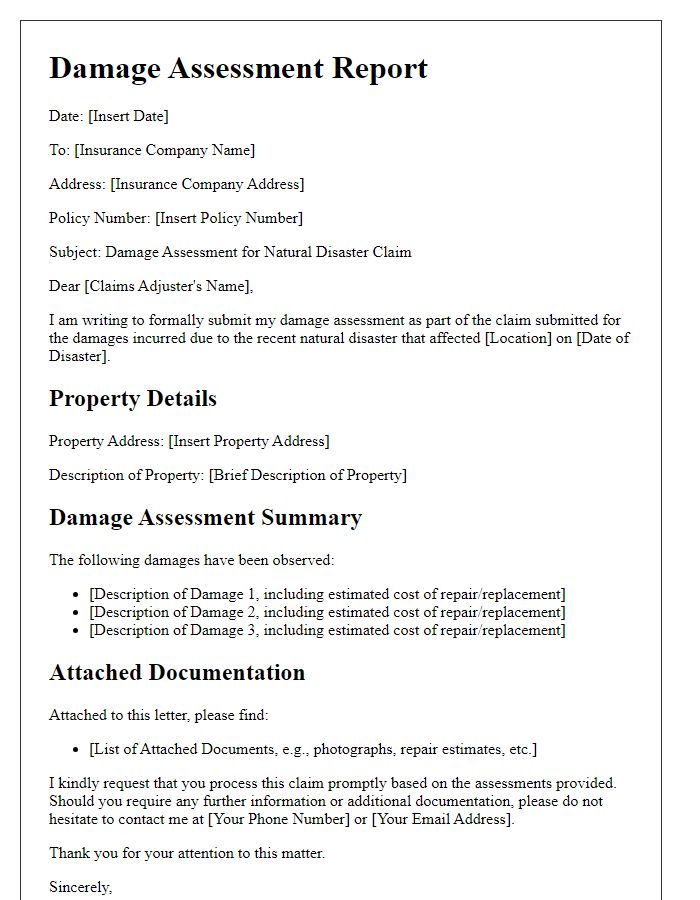

Detailed Description of Damage

In the aftermath of Hurricane Sandy that struck New Jersey in October 2012, severe damage occurred to residential properties in coastal towns like Atlantic City and Hoboken. Floodwaters, reaching heights of over 8 feet, inundated the first floors of homes, resulting in significant damage to walls, flooring, and personal belongings. Electrical systems, including wiring and outlets, suffered irreversible damage due to prolonged exposure to saltwater, leading to safety hazards. Roofs were compromised by high winds, with shingles torn off or entire sections blown away, exposing interiors to rainfall and further water damage. In addition, trees toppled over, crushing vehicles parked in driveways, and debris littered the neighborhood, complicating recovery efforts. Personal property losses were extensive, including furniture, electronics, and appliances, as many items were deemed unsalvageable. The total estimated damage in the region exceeded $36 billion, leading to a massive response and recovery effort from both state and federal agencies.

Date and Time of Incident

On August 29, 2021, at approximately 9:00 AM (Central Daylight Time), Hurricane Ida struck the coast of Louisiana, unleashing catastrophic winds exceeding 150 miles per hour. This severe weather event generated widespread flooding across New Orleans, exacerbated by storm surges reaching as high as 16 feet in some areas. Rescue operations were underway as emergency services responded to the unprecedented devastation, which left over one million residents without power. Significant property damage was reported in neighborhoods like the Lower Ninth Ward, and many were forced to evacuate their homes due to rising water levels.

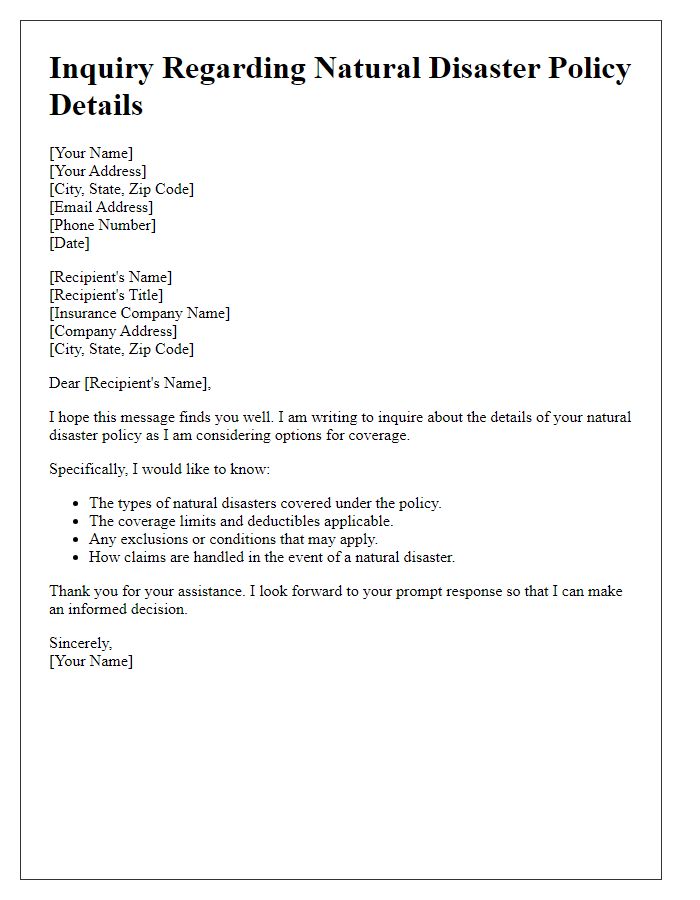

Supporting Documentation and Evidence

Natural disasters can leave devastating impacts on property, necessitating comprehensive coverage claims for recovery. Essential documentation includes detailed photographs of damage to structures and personal belongings, showing the extent of devastation from events such as hurricanes, floods, or wildfires. Each photograph should be timestamped and labeled with descriptions that indicate the specific areas affected. Accompanying these visuals, a copy of the official disaster declaration from local government or state agencies, such as the Federal Emergency Management Agency (FEMA), is critical as it validates the occurrence of the disaster. Including inventory lists of damaged items, along with their original purchase receipts and appraisals, helps establish the monetary value lost. Additionally, expert assessments from certified contractors regarding structural damage can substantiate claims, providing a professional evaluation of necessary repairs and costs. Documenting communication with insurance representatives, including policy numbers and claim numbers, ensures a clear record of interactions regarding the claim process.

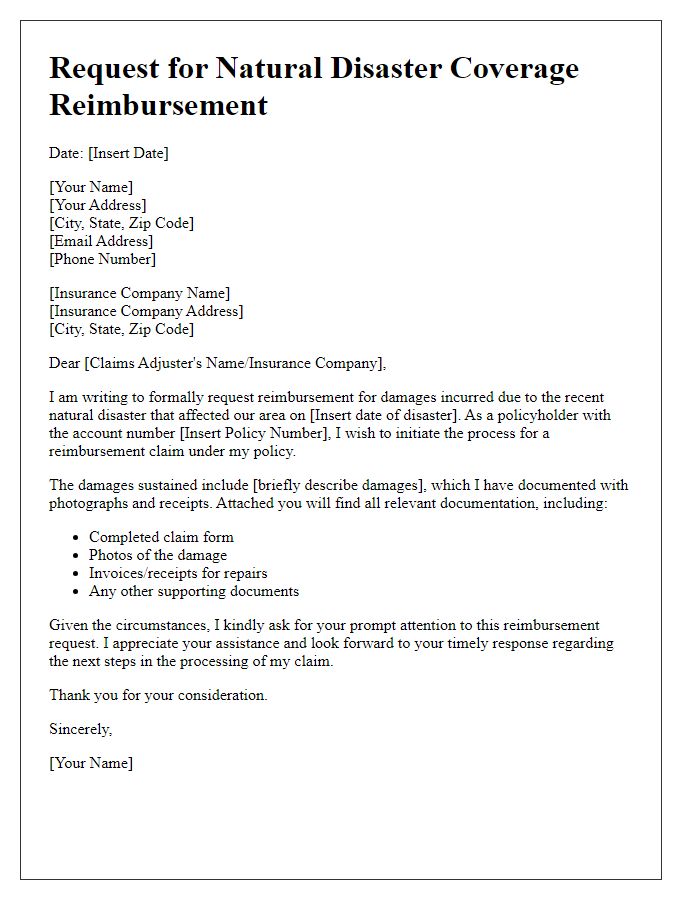

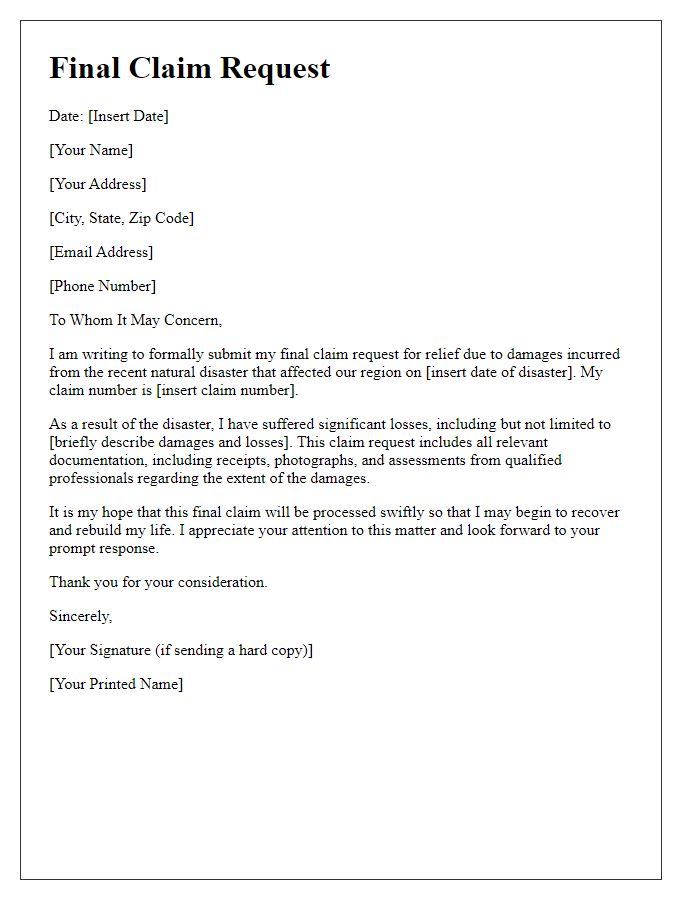

Contact Information for Follow-up

Natural disaster coverage claims require detailed documentation and clear communication. Essential contact information includes the claimants' full name, a physical address (including city, state, and zip code), and a primary phone number (preferably a mobile number for timely responses). Email address serves as an additional point of contact, ensuring quick correspondence. Insurance policy number is critical for identifying the specific claim within the insurer's system. Include a brief summary of the disaster (e.g., Hurricane Ida in August 2021), property damage specifics (like damage to roofs or flooding), and any previous correspondence dates with the insurance company for efficient follow-up.

Comments