When it comes to addressing fraudulent claims, it's essential to approach the matter with care and precision. In today's world, understanding the intricacies of such investigations can save companies time and resources while ensuring fairness. With the right letter template, you can efficiently communicate your concerns and gather necessary information to proceed with the investigation. So, if you're ready to uncover the best practices for addressing fraudulent claims, read on for valuable insights!

Clear Introduction and Purpose Statement

Fraudulent claims often represent a significant threat to financial institutions and insurance companies, resulting in substantial monetary losses and rising premiums for honest policyholders. Investigations aim to discern the authenticity of submitted claims, particularly those that arise from suspicious circumstances or discrepancies. The purpose of this investigation is to rigorously analyze the claim submitted on [specific date] regarding [specific event, such as theft, damage, or medical treatment], under policy number [policy number], with the intention of determining whether the claim meets the necessary legal and contractual criteria for compensation. All findings will contribute to safeguarding resources and maintaining fair practices within the industry.

Detailed Investigation Steps and Methods

Fraudulent claim investigations require a systematic approach to uncover the truth behind questionable insurance claims. Investigators begin with a comprehensive background check on the claimant, utilizing databases to verify identity, history of previous claims, and any red flags such as litigation history. In-person interviews are conducted with the claimant, witnesses, and involved parties, often in locations relevant to the claim, such as the scene of an accident. Surveillance may be employed to gather evidence of the claimant's activities, especially if there are discrepancies in their reported injuries or circumstances. Document analysis includes scrutinizing medical records, police reports, and any photographic evidence submitted. Additionally, consultations with experts, like forensic accountants or medical professionals, provide insight into the legitimacy of the claims being made. The entire process is meticulously documented, ensuring that all findings are recorded to support any legal actions or decisions that may follow.

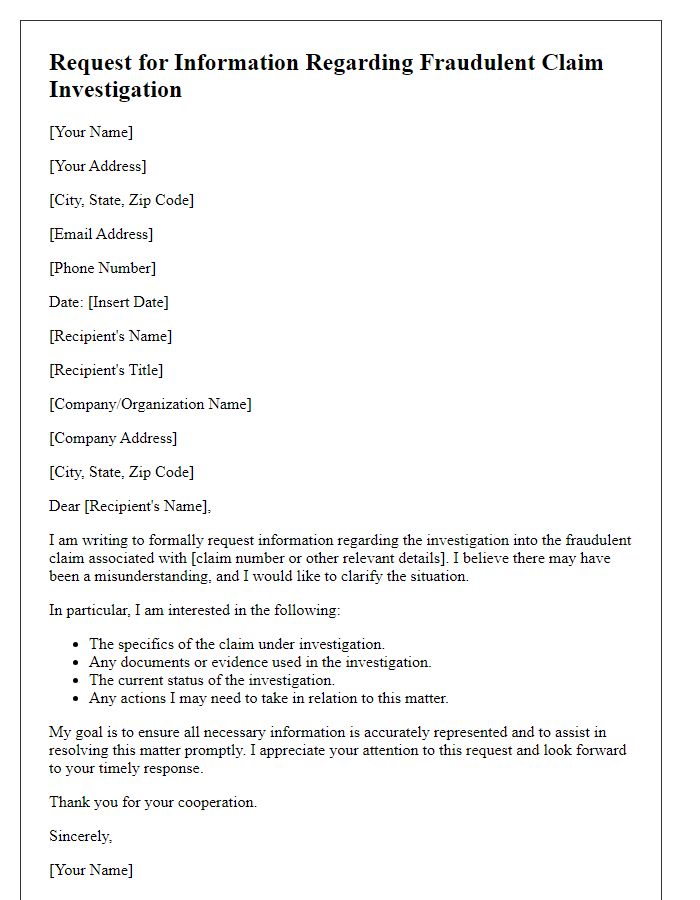

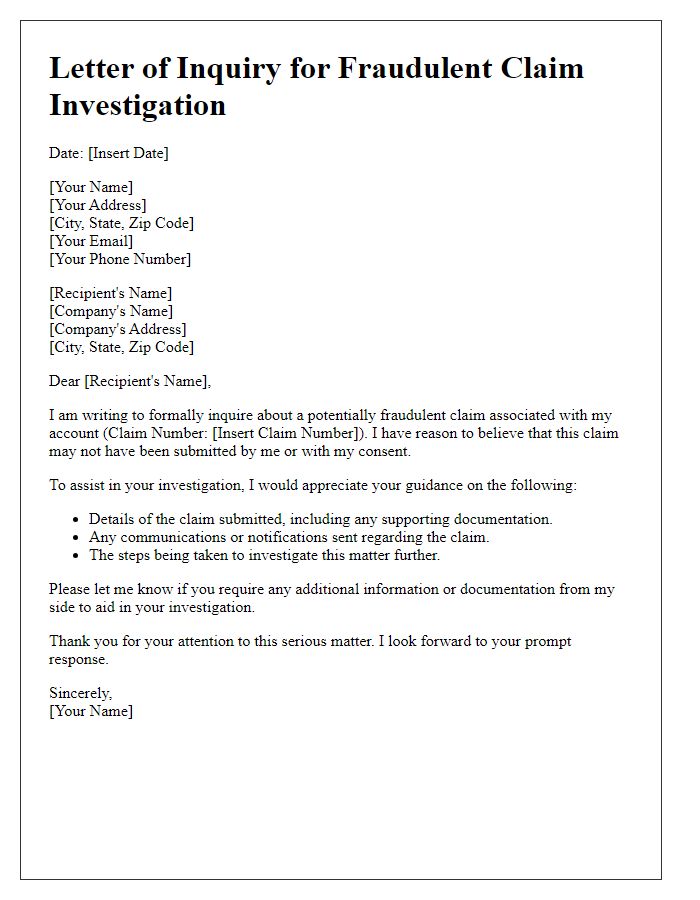

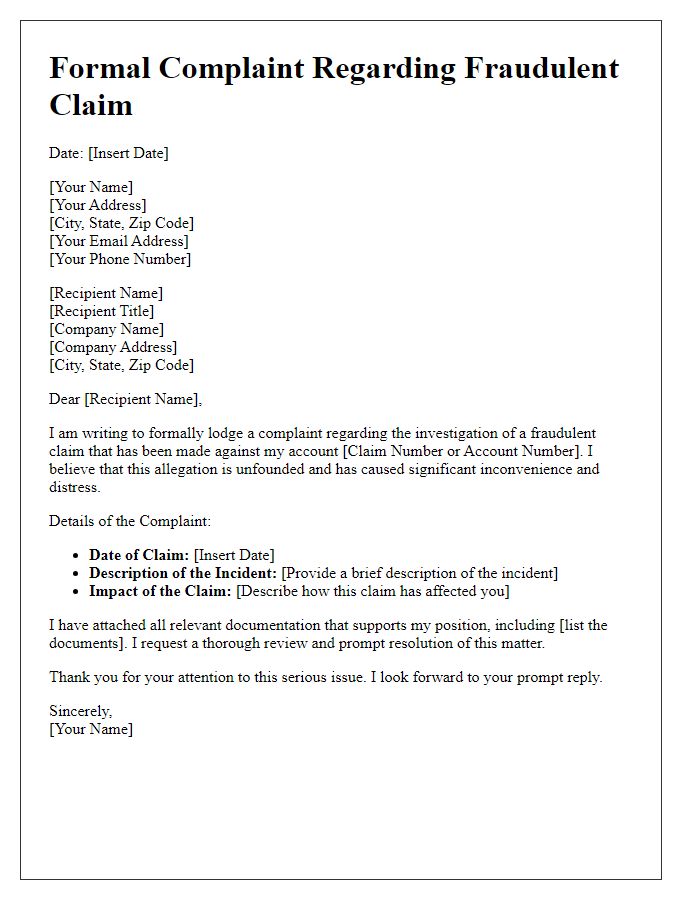

Request for Further Information or Documentation

Fraudulent claims investigations often require meticulous scrutiny of submitted documents and evidence. Entities such as insurance companies frequently engage in these investigations to uphold integrity and prevent financial losses. Specific types of fraudulent claims might encompass staged accidents, inflated bills, or exaggerated damages. In response to potential discrepancies in a claim, an investigator might send a communication requesting additional information, such as photographs of the incident, police reports (with incident numbers), or witness statements (including contact details). Such requests are vital to ensuring thorough evaluations and maintaining adherence to legal standards to mitigate fraudulent activities and protect both the insurer and honest claimants.

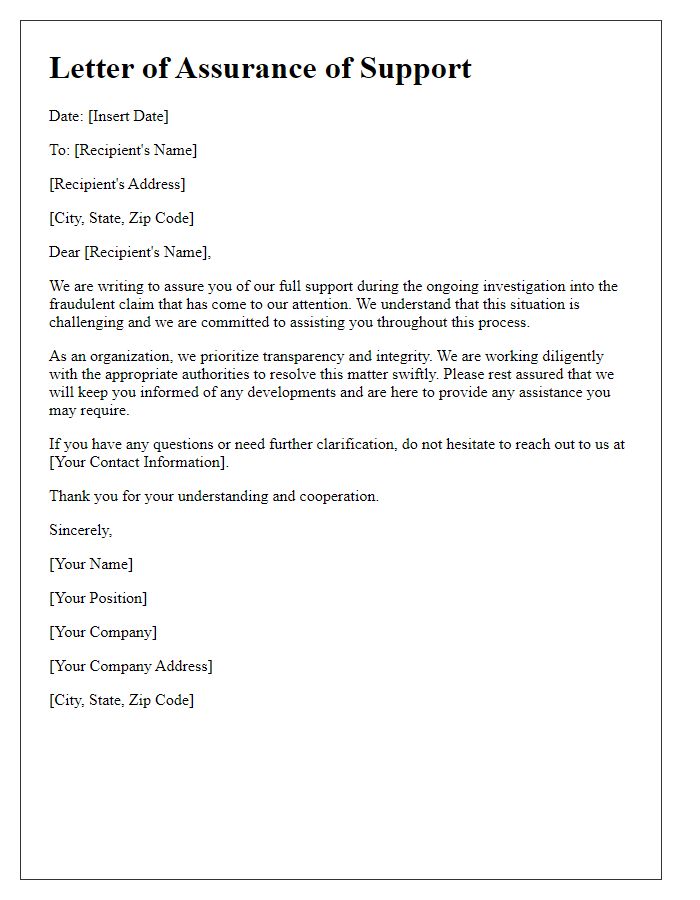

Contact Information for Inquiries or Clarifications

Fraudulent claim investigations require thorough documentation of contact information. Each claimant must provide full names, addresses, and telephone numbers. Investigators typically use dedicated hotline numbers or email addresses for secure communications, ensuring prompt responses to inquiries. Important notes include the need for specific references, such as claim numbers, dates of incidents, and policy numbers to assist in streamlining the investigation process. Additionally, having a designated contact within the claims department can facilitate clarification of any ambiguities and expedite resolution. Proper tracking of communications is vital to maintain a transparent record of all interactions during the investigation.

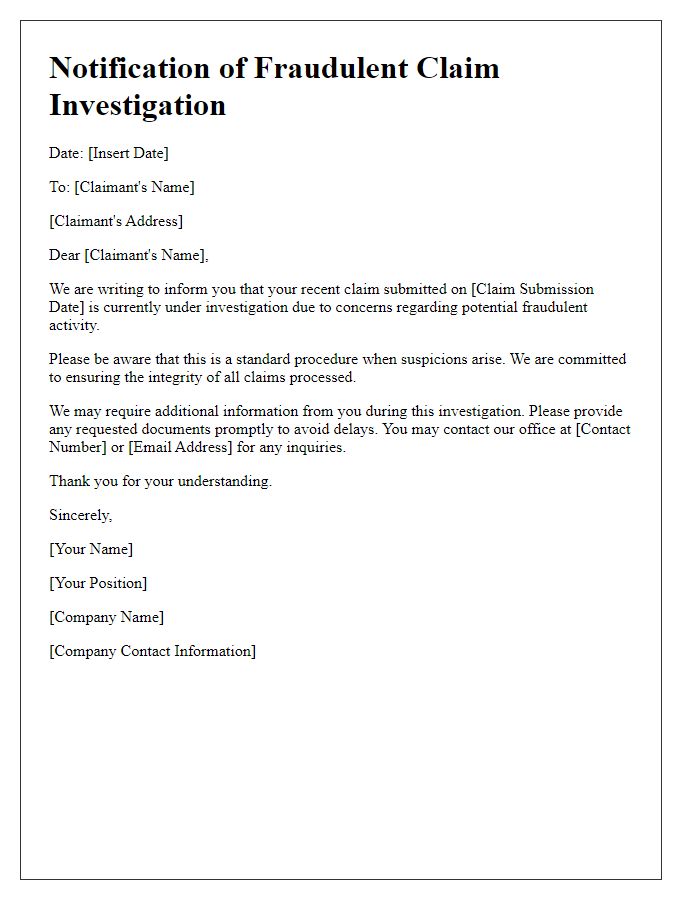

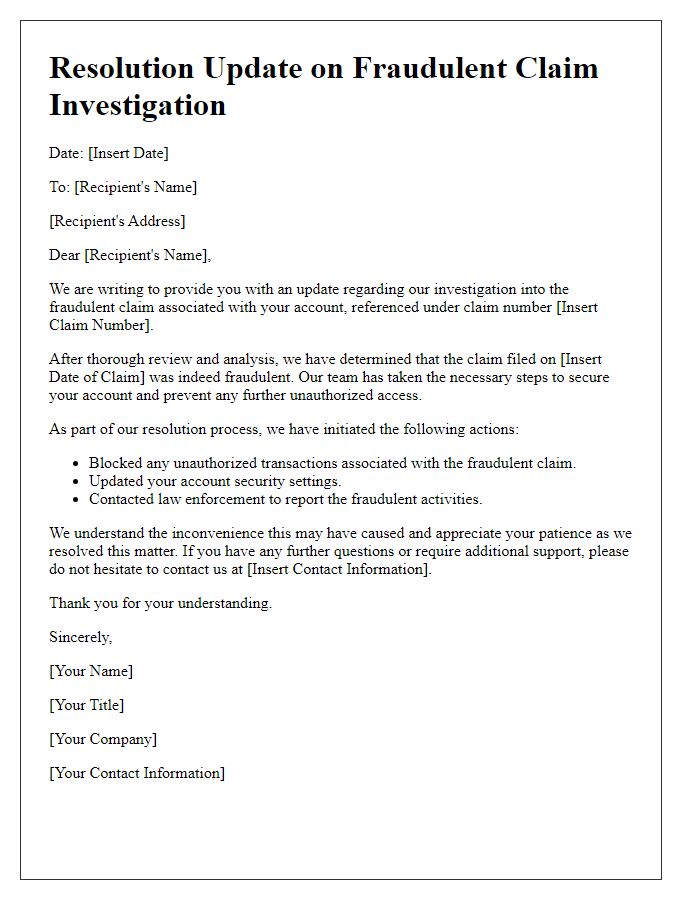

Closing Remarks and Next Steps

Fraudulent claim investigations often involve meticulous reviews of the information submitted, such as financial records, witness statements, and communication logs. In the concluding remarks of an investigation, the findings must be clearly documented, citing any discrepancies found in the claim, such as inflated expenses or unverifiable incidents. Next steps typically involve notifying the claimant of the outcome, legal ramifications of fraudulent activities under state laws, and potential penalties, which can include fines or criminal charges. Documentation such as case numbers, dates of investigation completion, and contact information for follow-up should also be included to ensure transparency and provide a clear pathway for addressing any disputes or appeals regarding the investigation conclusions.

Letter Template For Fraudulent Claim Investigation Samples

Letter template of request for information regarding fraudulent claim investigation

Comments