Are you curious about how to maximize your savings on insurance? One often-overlooked opportunity lies in the world of excess coverage rebates, which can put money back in your pocket. By understanding the ins and outs of these rebates, you can take full advantage of available resources. Join me as we delve deeper into this topic and explore how you can benefitâkeep reading for more insights!

Purpose and Intention

Excess coverage rebate programs provide policyholders with financial relief when they have paid for more insurance coverage than necessary. Such rebates typically apply to various types of insurance, including auto, home, or health insurance, which often results in unutilized premium payments. Insurers in regions like California and New York, for instance, may conduct annual evaluations to determine which clients qualify for a refund based on their claims history and coverage needs. The intention is to promote fair pricing practices by returning excess funds to clients while rewarding responsible insurance use. This initiative highlights the insurer's commitment to customer satisfaction and ethical business practices, reinforcing the vital relationship between policyholders and insurance providers.

Policy Details and Identification

Excess coverage rebates can significantly benefit policyholders by providing financial returns on overpaid premiums after accounting for claims. Policy details include coverage type, such as comprehensive or collision, and the starting premium amount, often ranging from $500 to $2,000 annually depending on the insurer and vehicle type. Identification of policyholders typically involves unique policy numbers, often consisting of alphanumeric characters, and personal details like names and addresses to ensure accurate refunds and prevent fraud. Understanding the criteria for excess coverage can help recipients maximize their refunds, particularly if they maintained claims-free status throughout the policy period, which can span one year or more in many cases.

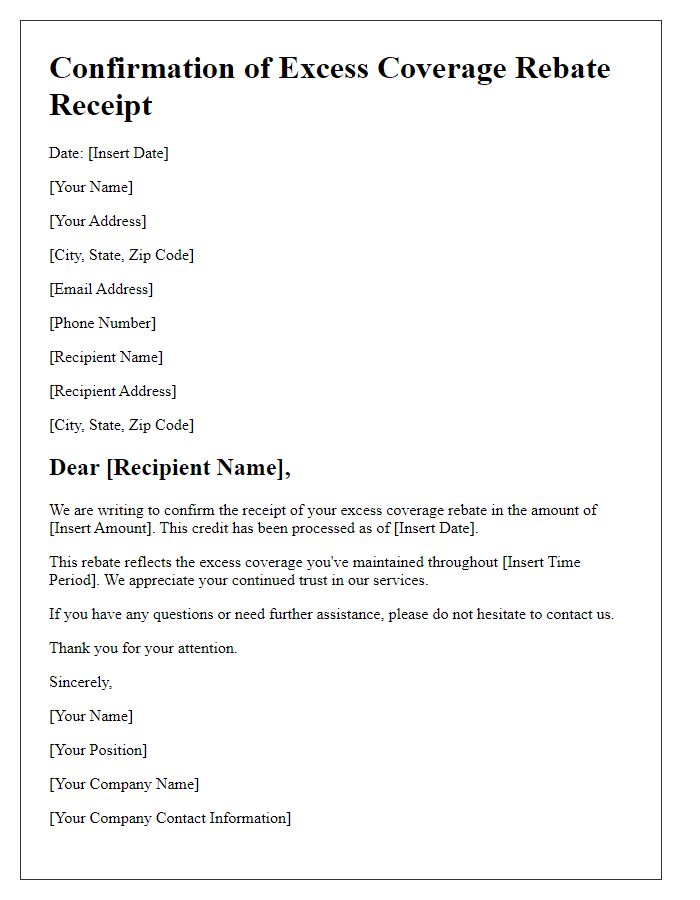

Rebate Calculation and Amount

This rebate calculation methodology applies to excess coverage scenarios, ensuring clients receive financial relief on premiums. For example, if a policyholder maintains coverage exceeding $100,000, the excess portion is assessed based on their premium payment history and the duration of the excess coverage period. An annual premium of $1,200 may qualify for a rebate, calculated as 10% of the excess amount for each year of maintained excess coverage. If the excess coverage lasted three years, the total rebate would be $1,200, thereby providing effective redress and incentivizing prudent financial management among policyholders. Adjustments may be made to ensure compliance with regional regulations applicable in jurisdictions where the policy is enforced.

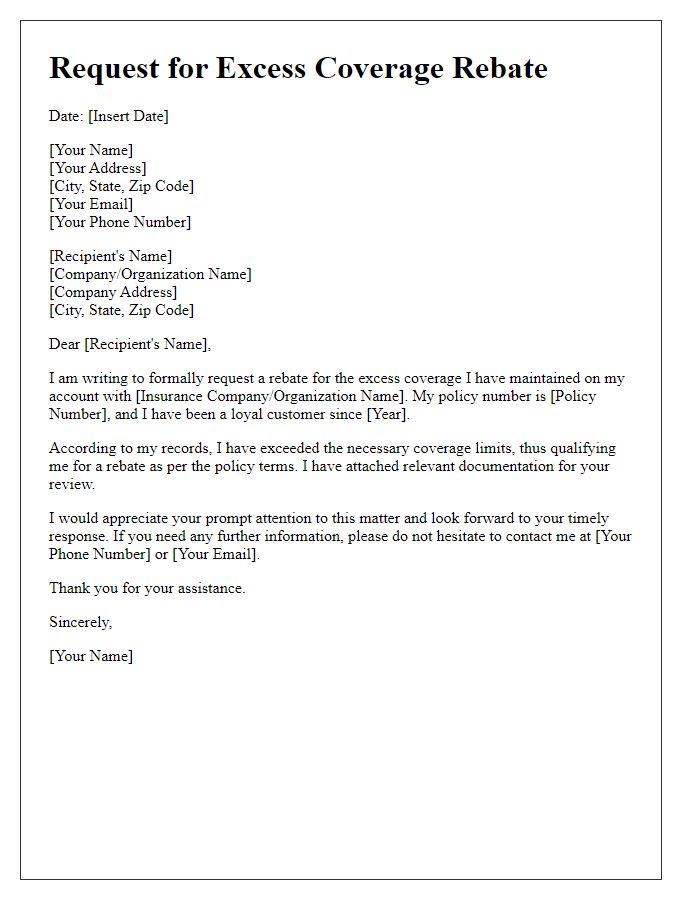

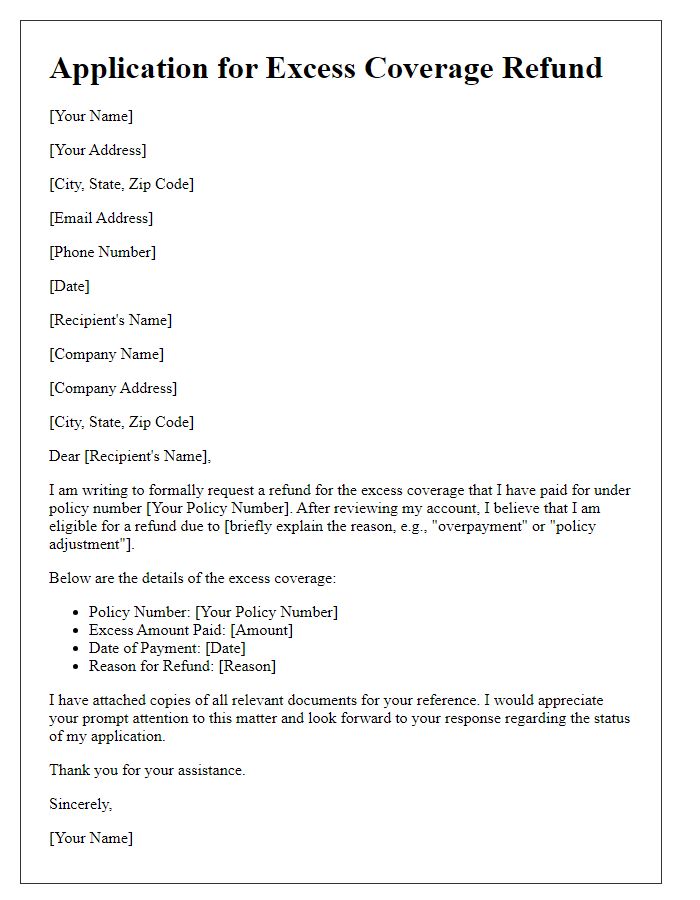

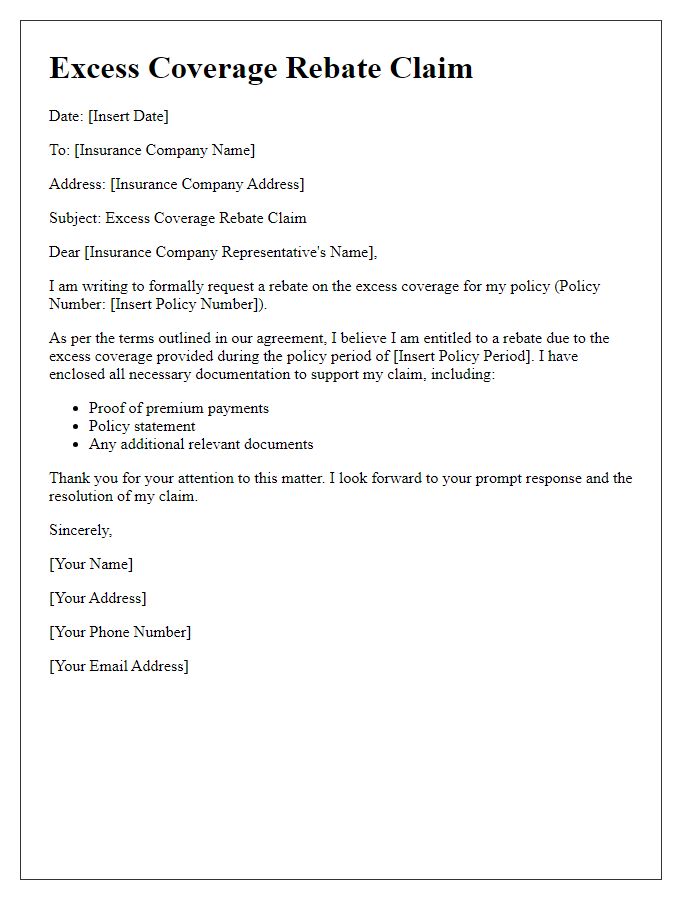

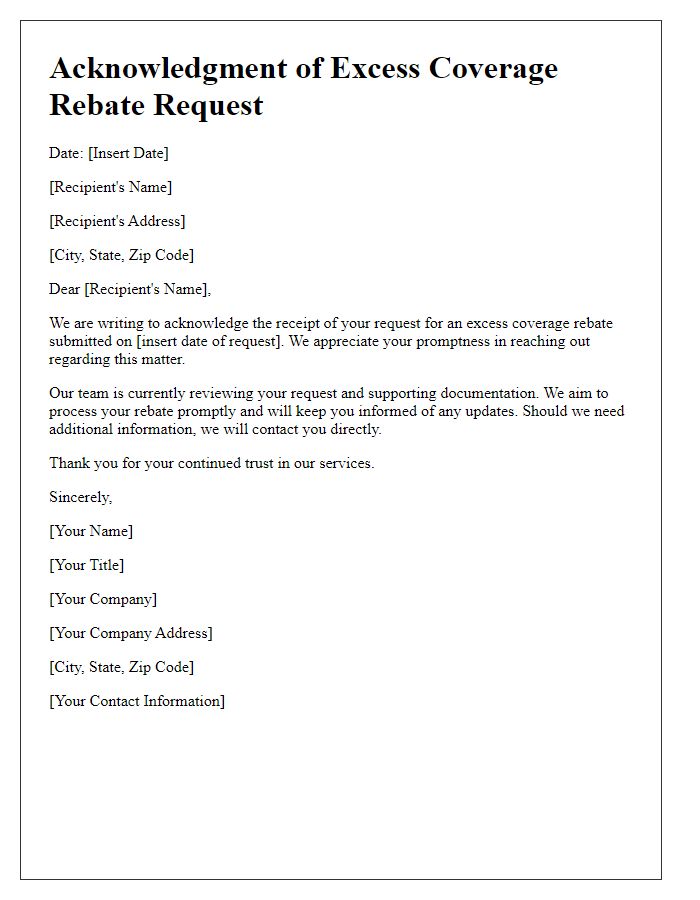

Instructions for Receipt or Claim

When requesting an excess coverage rebate, ensure you have all pertinent documentation ready. Gather your policy statement, including account details and coverage limits, to demonstrate eligibility. Collect receipts or invoices related to premium payments or additional coverage purchased, ensuring they are dated and itemized to reflect specific amounts. Look for any communication from your insurance provider regarding excess coverage conditions; these details can substantiate your claim. Fill out the rebate claim form accurately, referencing your insurance policy number and personal identification information for verification. Submit your claim through the designated channel, such as email or online portal, before the deadline specified in your policy agreement to avoid any delays. Keep copies of all submitted documents for future reference.

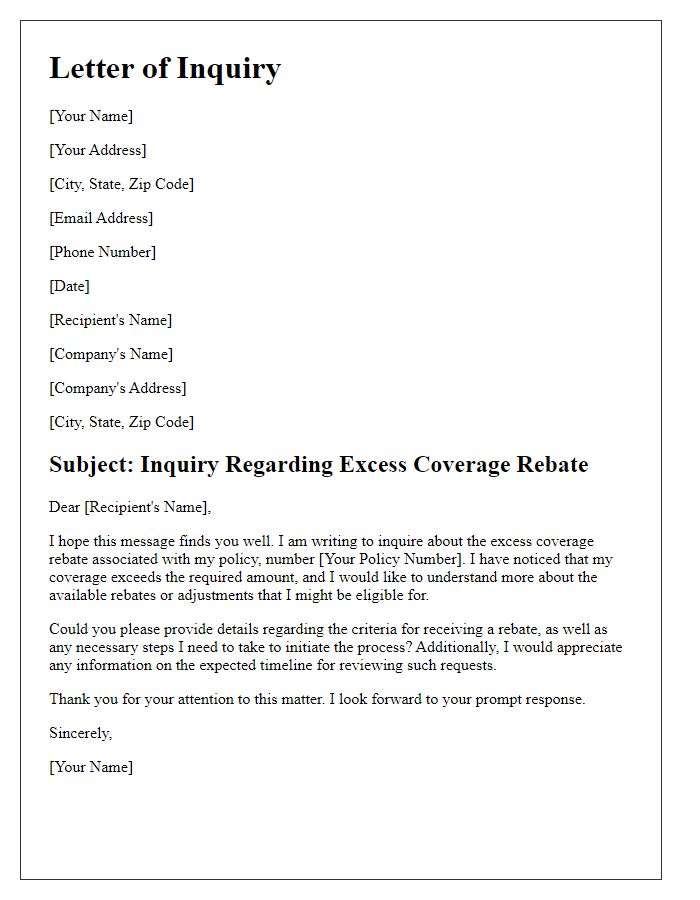

Contact Information for Queries

In cases of seeking information regarding the excess coverage rebate, it is essential to reach out through dedicated channels established by the insurance provider. Most insurance companies offer customer service lines available during business hours, typically from 9 AM to 5 PM, Monday through Friday. Additionally, email support is often accessible, allowing for queries to be submitted at any time; response times can vary, typically between 24 to 48 hours. Some providers may also maintain online chat services on their official websites, which provide immediate assistance from representatives and can help clarify the specifics of the excess coverage rebate that policyholders might be entitled to.

Comments