Hey there! If you've recently acquired credit life insurance, you might be wondering how to activate it and start enjoying the peace of mind it offers. The good news is that the process is usually straightforward, ensuring that your financial obligations are covered in the unfortunate event of a life-altering situation. In this article, we'll walk you through the essential steps and important details you need to know about activating your credit life insurance. So, let's dive in and get you all set up!

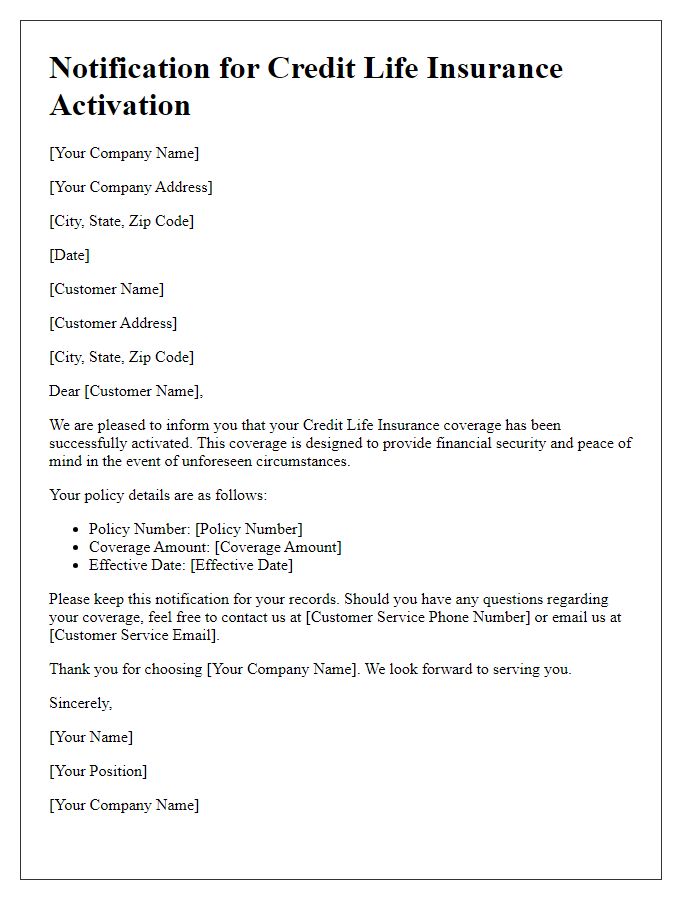

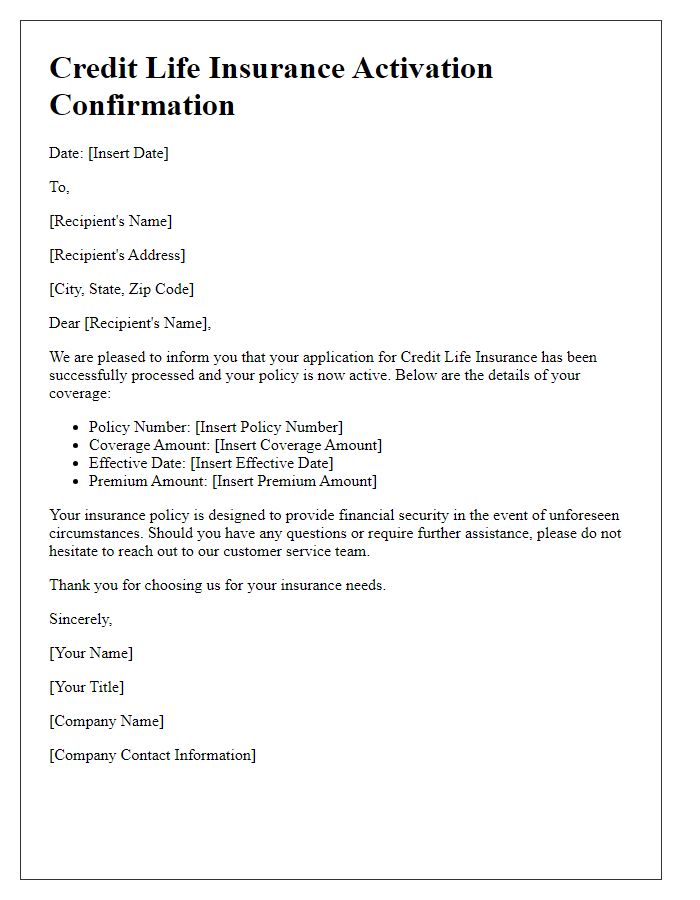

Policyholder Information

Credit life insurance provides financial protection to policyholders' beneficiaries in the event of the policyholder's death, ensuring that outstanding debts, such as loans or credit card balances, are covered. This type of insurance often includes terms specific to the individual's situation, such as the amount of coverage (typically equal to the remaining debt), premium rates (which vary based on age and health), and the duration of coverage (usually until the debt is repaid). Policyholders, like those in New York, must complete activation processes that may include submitting personal identification, loan documentation, and beneficiary details to initiate the coverage. This ensures a smooth transition of benefits during unforeseen circumstances, securing financial peace of mind for families.

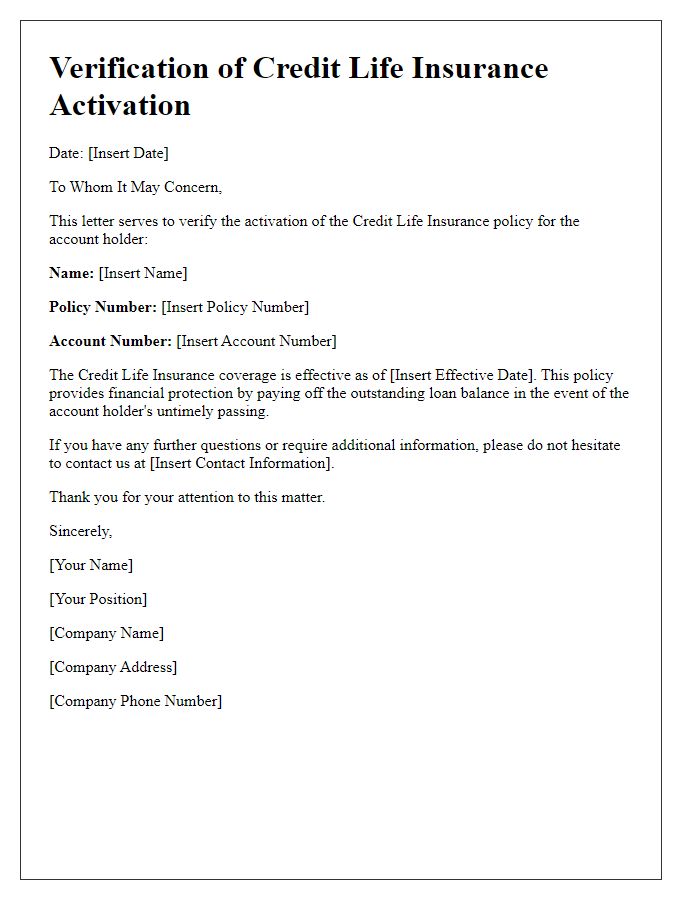

Policy Details

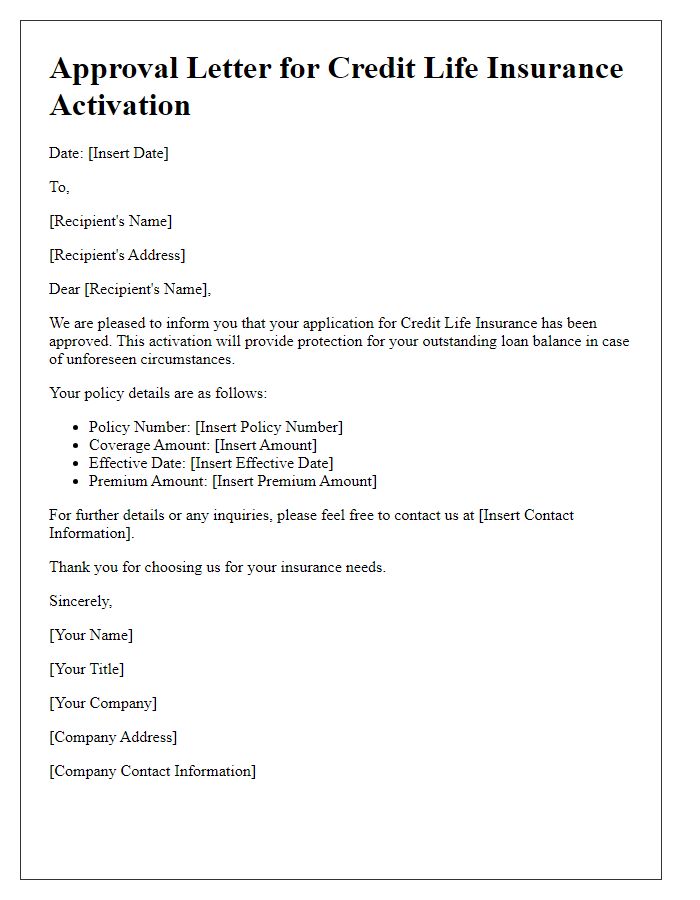

Credit life insurance activation requires specific policy details that ensure the coverage aligns with the borrower's financial obligations. Policy number serves as the unique identifier for the insurance coverage, facilitating tracking and management of claims. Insured amount indicates the total sum the policy will pay in case of the borrower's untimely demise, often equivalent to the outstanding loan balance. Premium payment frequency, such as monthly or annually, outlines how often payments are made to maintain coverage. Beneficiary designation specifies who receives the payout upon the borrower's death, which can include family members or estate executors. Activation date marks the commencement of coverage, typically aligned with the loan disbursement date to provide immediate protection. Understanding these elements is crucial for both borrowers and lenders in managing the risks associated with personal loans.

Beneficiary Information

Credit life insurance activation requires detailed beneficiary information to ensure proper disbursement of benefits. The primary beneficiary, often the policyholder's spouse or dependents, must be clearly identified with full legal name, relationship to the insured, and contact information. Additional secondary beneficiaries may be designated, providing alternate recipients in the event the primary beneficiary cannot be reached. The policy number, issued by the insurance company such as MetLife or Prudential, along with the insured's full name and date of birth, is crucial for accurate processing. This information protects the financial interests of loved ones during unforeseen circumstances, offering peace of mind and security in times of need.

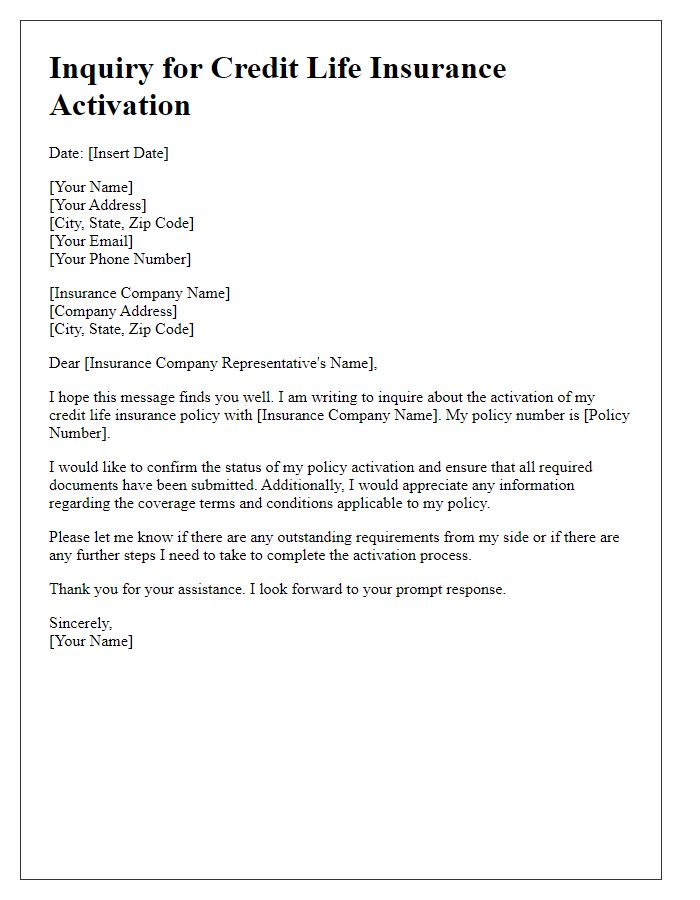

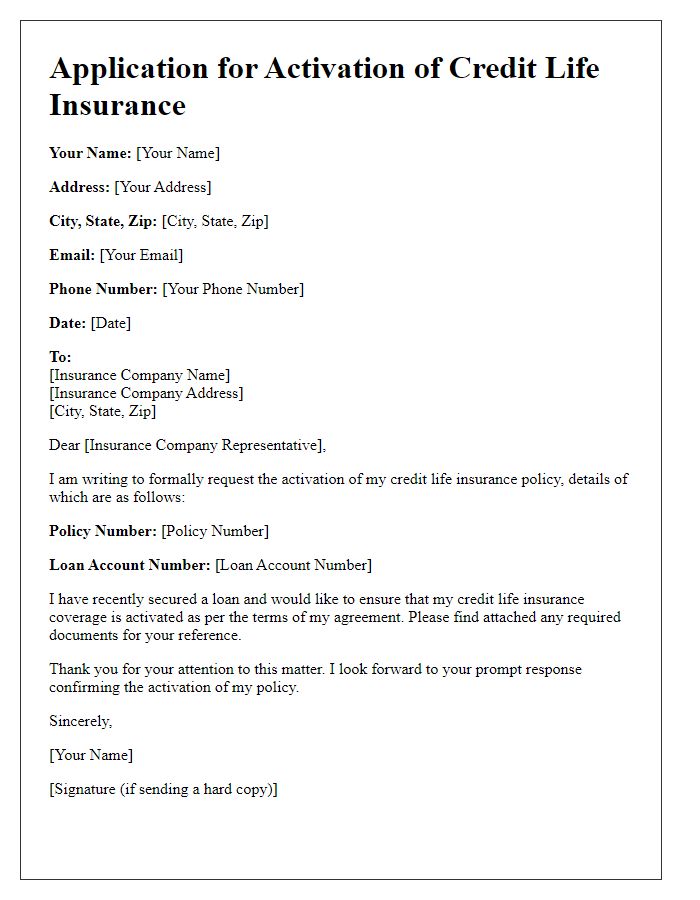

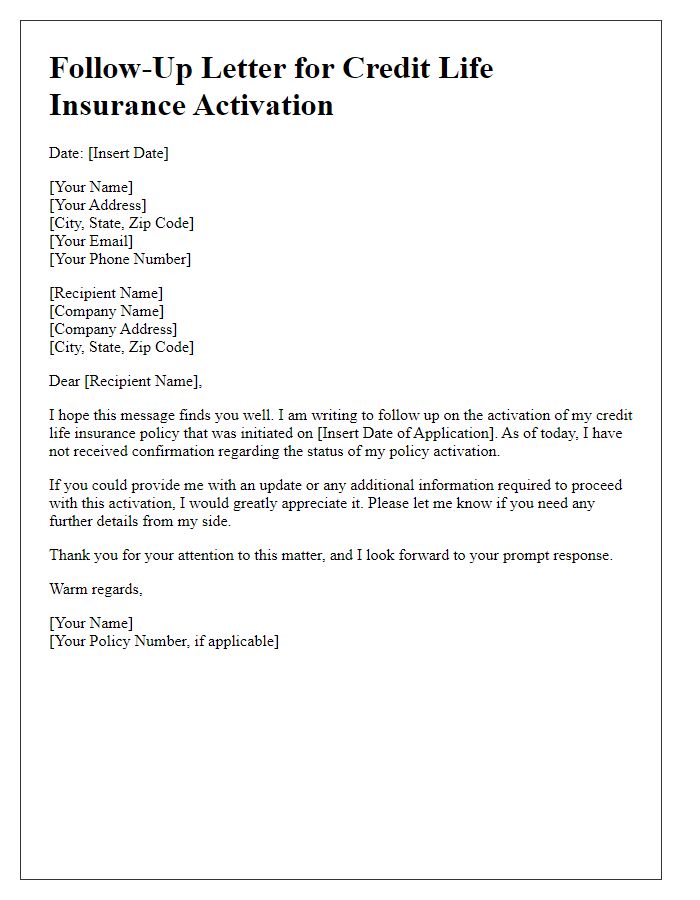

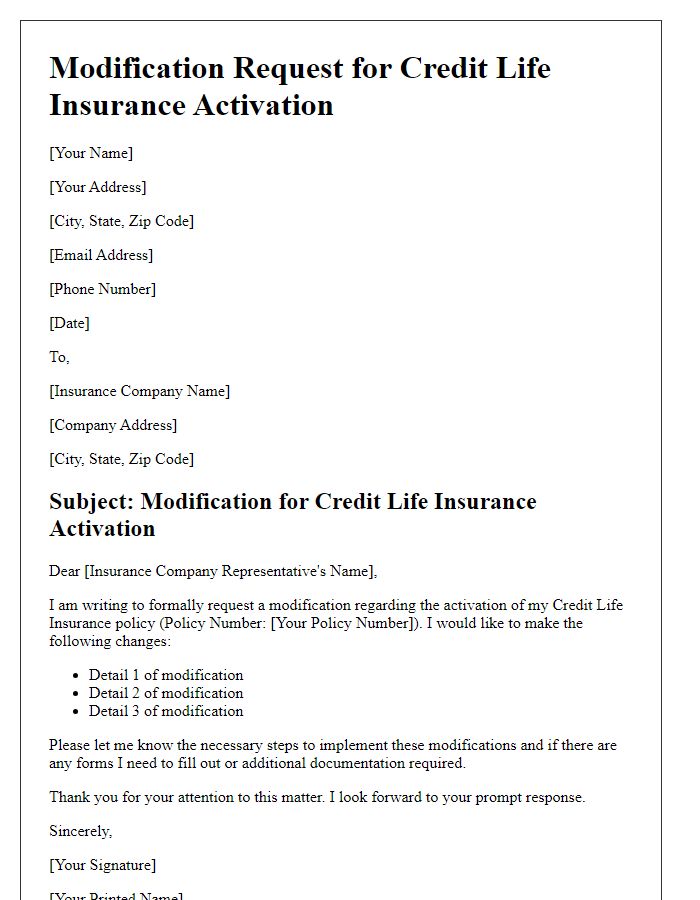

Activation Request Statement

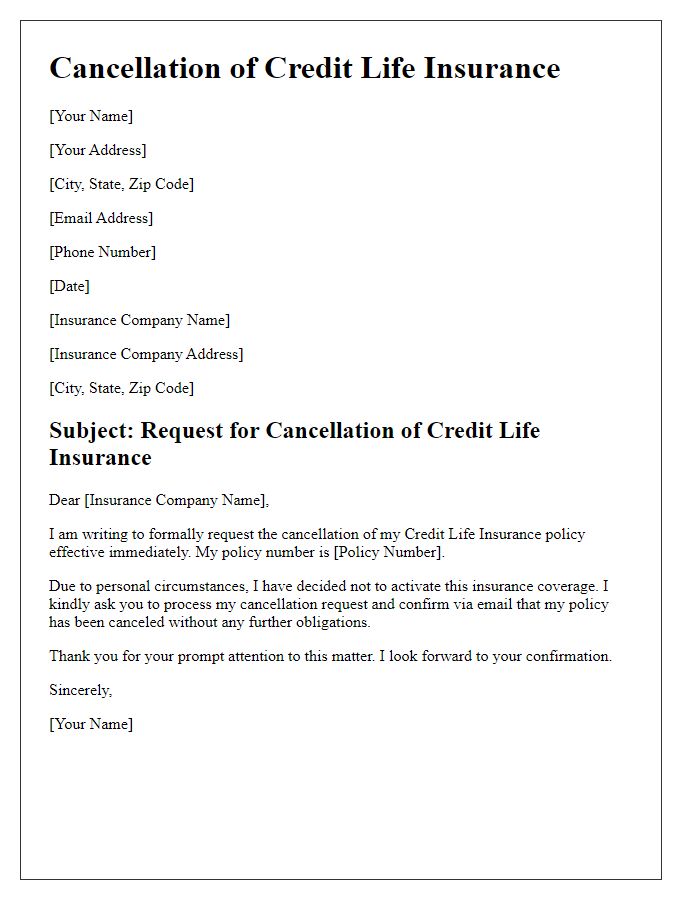

Credit life insurance provides financial protection for borrowers in the event of death, ensuring that outstanding debts are settled without burdening the family. This type of insurance typically covers personal loans, mortgages, and credit card balances, offering peace of mind. Activation requests often require specific personal information, including full name, account numbers, and the insurance policy number. In many cases, lenders might require a signed statement to confirm the request, providing an extra layer of verification. The process may vary based on the lending institution, with some offering online activation options for convenience.

Signature and Date

Credit life insurance provides financial protection by paying off a borrower's debt in the event of their death. Typically, policies cover loans such as personal loans, mortgage debts, or credit card balances, ensuring that beneficiaries are not burdened with repayment. Activation of this insurance often necessitates specific documentation, including a signed application form. It must include the borrower's details and the lender's information, along with the policy number for reference. Completion of this document signifies acceptance of terms and conditions, which may include the effective date of coverage. The signature must be dated to establish the time the policy becomes active, ensuring compliance with regulatory standards and financial institutions' requirements.

Comments