Navigating the world of aviation insurance can feel daunting, especially when it comes to understanding policy changes. Whether you're a seasoned pilot or a new aircraft owner, staying updated on your insurance coverage is crucial to ensuring your safety and peace of mind. In this article, we'll explore the recent updates in aviation insurance policies and what they mean for you. So, buckle up and dive in as we break down these important changes and how they can affect your flight plans!

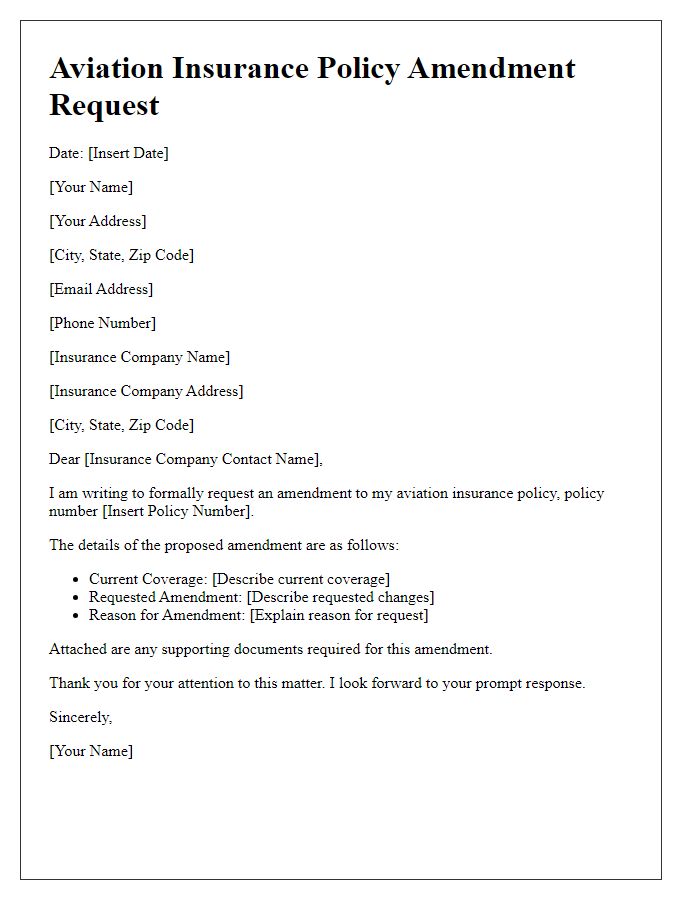

Policyholder Information

Policyholder details on aviation insurance are critical for maintaining accurate records and ensuring proper coverage. Key information includes names such as policyholder's full name (e.g., John Doe), contact details (such as phone number 555-123-4567 and email address john.doe@example.com), and address (e.g., 123 Skyway Ave, Aviation City, AC 98765). Aircraft details should include the make and model (e.g., Cessna 172), registration number (e.g., N12345), and current market value ($200,000). Premium payment schedules may outline specific amounts (for example, quarterly payments of $1,500), while policy limits specify maximum coverage amounts (for instance, liability coverage of $1 million). Claims history should document any previous claims filed with dates and outcomes. Maintaining updated records ensures timely communication regarding policy changes or adjustments based on these critical elements.

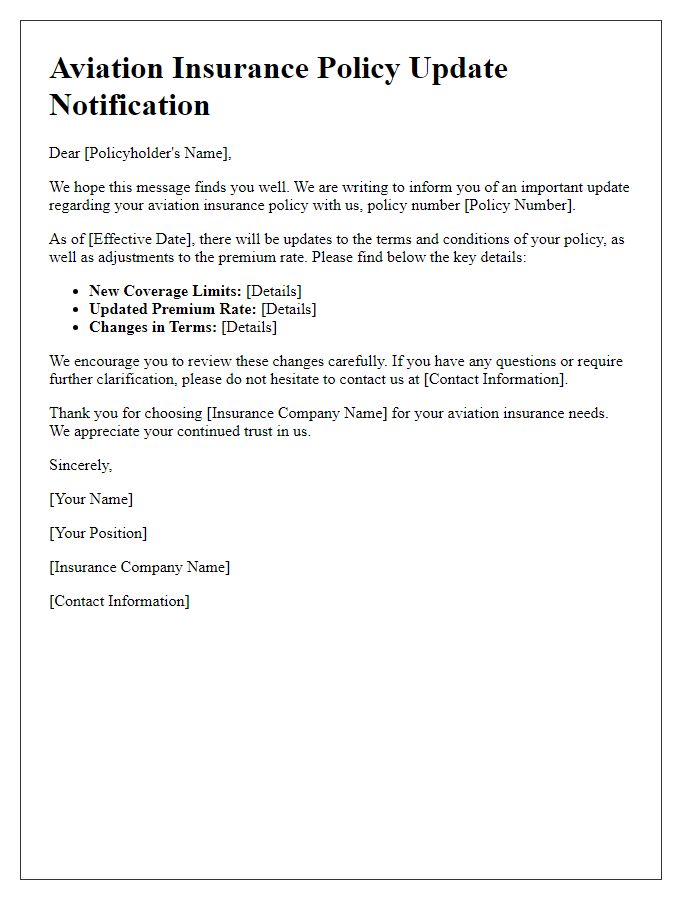

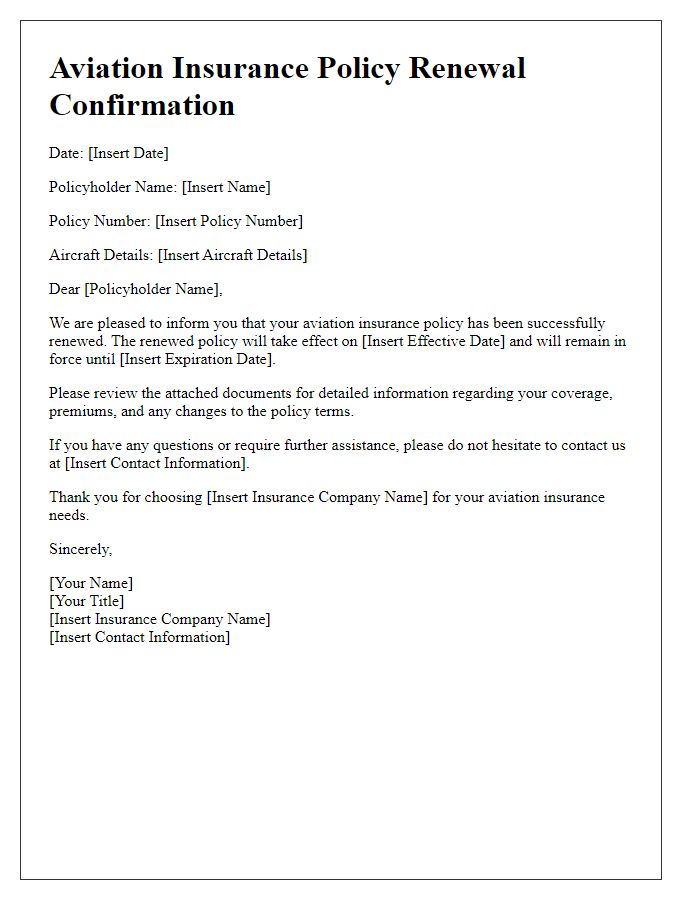

Policy Number and Details

Aviation insurance policy modifications require careful consideration of critical elements, such as the unique Policy Number assigned (for instance, POL123456), which serves as a reference for all transactions and claims. Changes may encompass adjustments in aircraft specifications, pilot qualifications, or coverage limits (typically measured in millions of dollars). Additionally, events like newly acquired aircraft (such as a Bombardier Global 7500) or changes in operational territory (expanding from local to international flights) can necessitate policy updates. Thorough review of terms, conditions, and endorsements is essential for compliance and optimal coverage tailored to the specific needs of aviation operations.

Description of Changes Requested

Aviation insurance policy changes often involve detailed adjustments to coverage terms and conditions that can impact premiums and liability limits. For instance, modifications may include increasing the hull coverage amount for an aircraft, necessitating a valuation reassessment based on current market conditions or enhancements made to the aircraft. Details like the aircraft's registration number, insurer's reference number, and specific policy clauses require clarity to ensure agreement and adherence to regulatory standards set by aviation authorities. Special events, such as international travel or extended flights, might also require adjustments to coverage to comply with additional liability requirements or geographical limitations. Furthermore, changes to pilot qualifications, including specific ratings required for certain operations, must be documented to confirm compliance with aviation safety regulations and insurance stipulations.

Effective Date of Changes

Aviation insurance policy modifications often necessitate a clear communication regarding effective dates for changes. Such modifications might include adjustments in coverage limits, alterations in premium rates, or updates to insured aircraft specifications. The effective date typically marks the commencement of these changes, ensuring that policyholders are aware of when the new terms and conditions apply. For example, an aviation policy that updates its coverage limits from $5 million to $10 million might specify an effective date of January 1, 2024, ensuring clarity on when the higher coverage kicks in. Timeliness in communication about these dates is crucial for compliance with legal obligations and for maintaining adequate protection against potential aviation risks.

Contact Information for Queries

Aviation insurance policy changes require clear communication to ensure all parties understand their coverage. Contact information for queries should include the insurance provider's dedicated customer service number, typically available from 9 AM to 5 PM on weekdays, along with an email address for direct inquiries. Policyholders may refer to the official website for additional resources, including FAQs and live chat support options. It is crucial to have the policy number available when reaching out for assistance, as this will expedite the verification process and enable representatives to address specific concerns effectively.

Comments