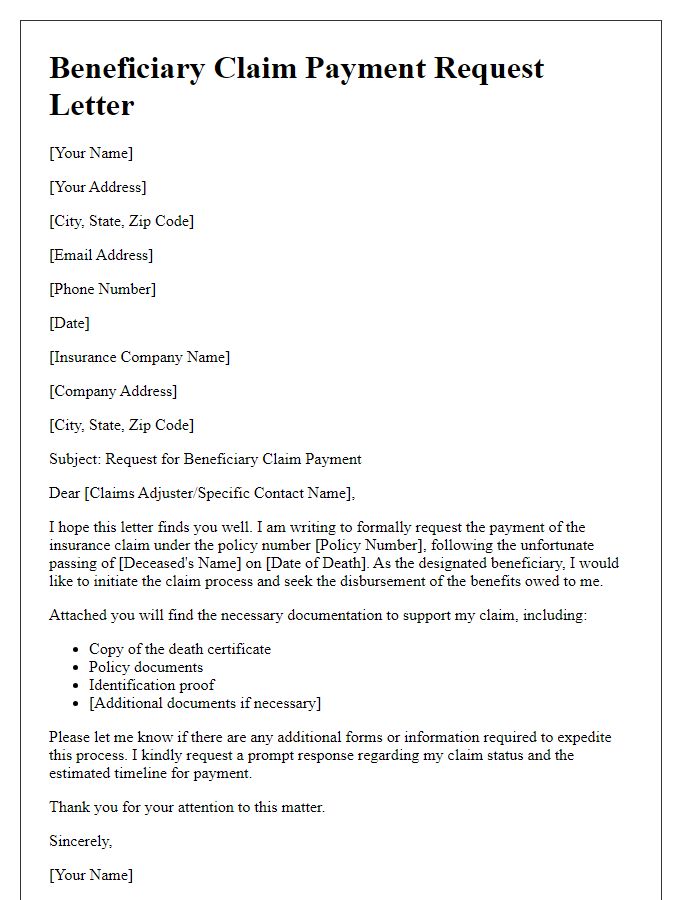

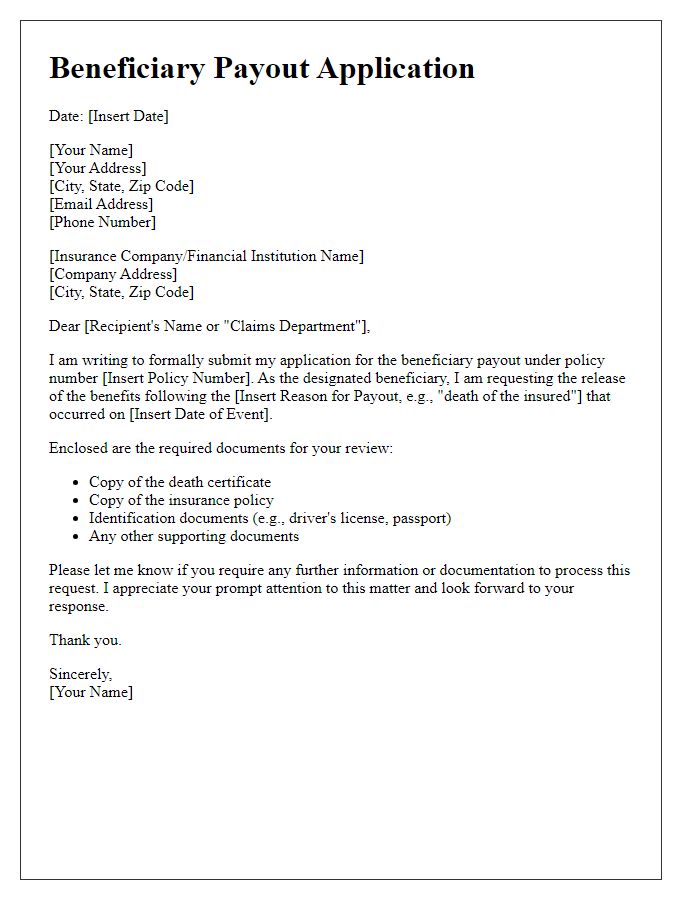

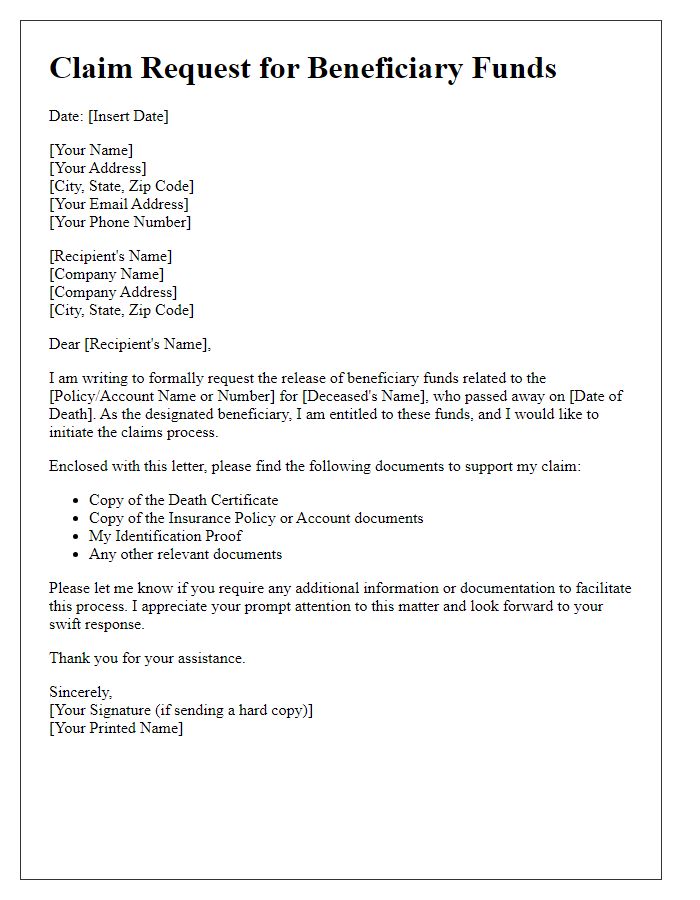

Are you looking to navigate the often complex process of filing a beneficiary claim for payment? You're not alone, and understanding what to include in your claim letter can make all the difference. From clearly stating your relationship to the deceased to providing essential documentation, each detail is crucial. Let's dive into the key elements of a well-crafted letter to ensure your claim is processed smoothlyâread on for a comprehensive guide!

Clear Identification Details

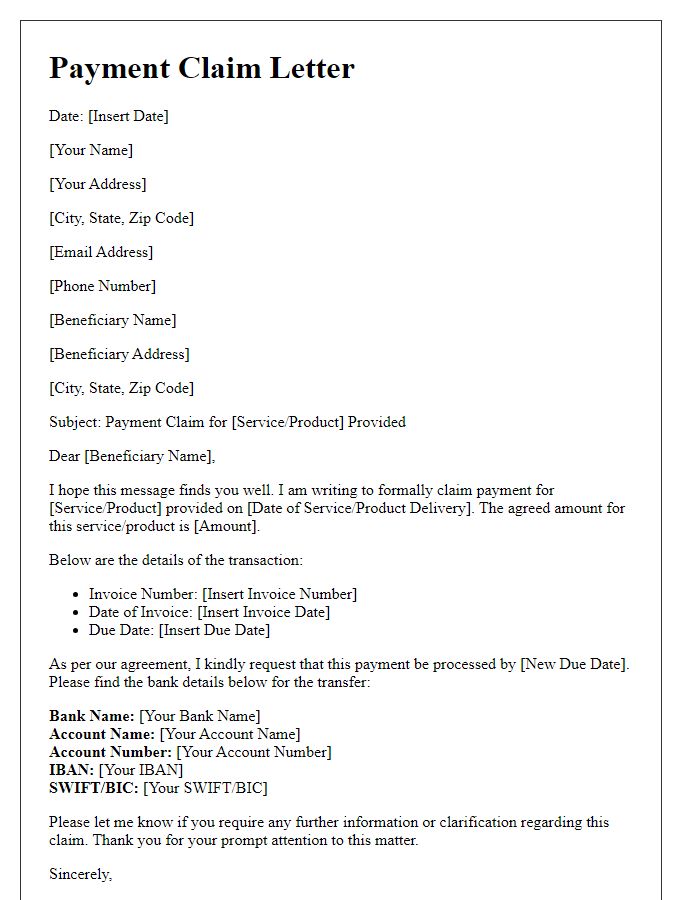

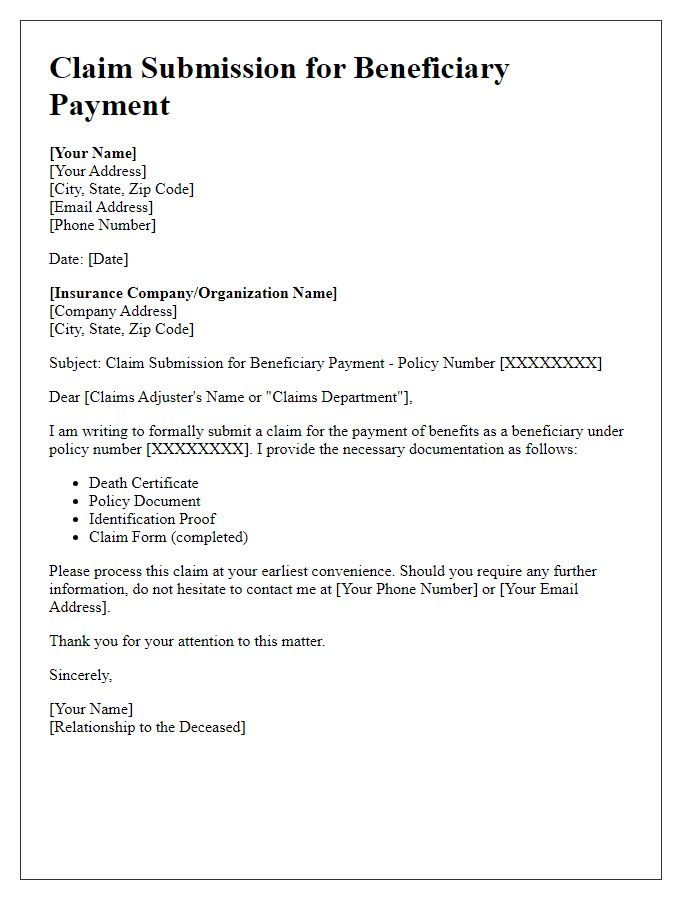

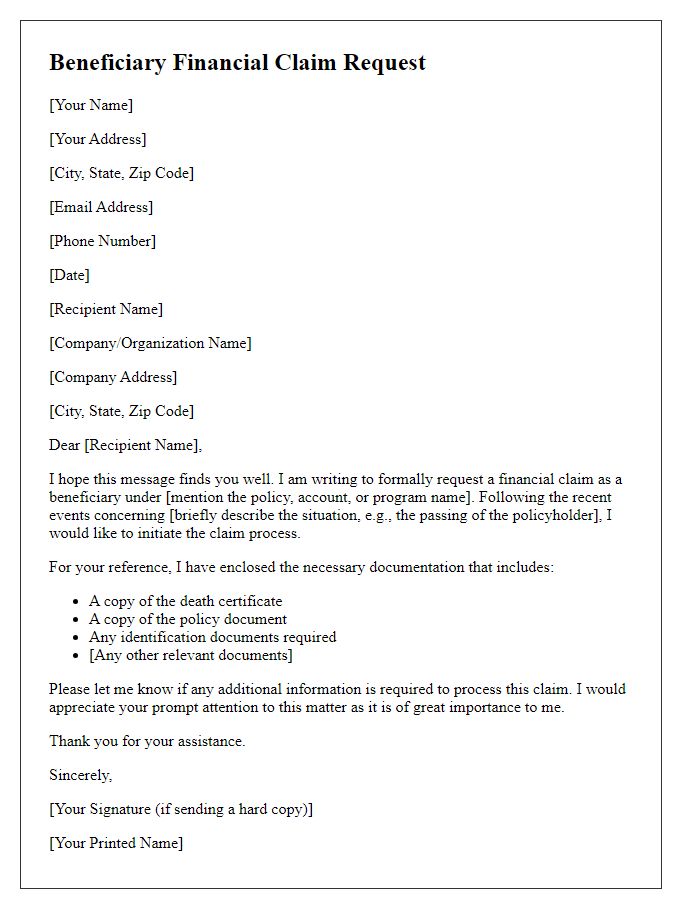

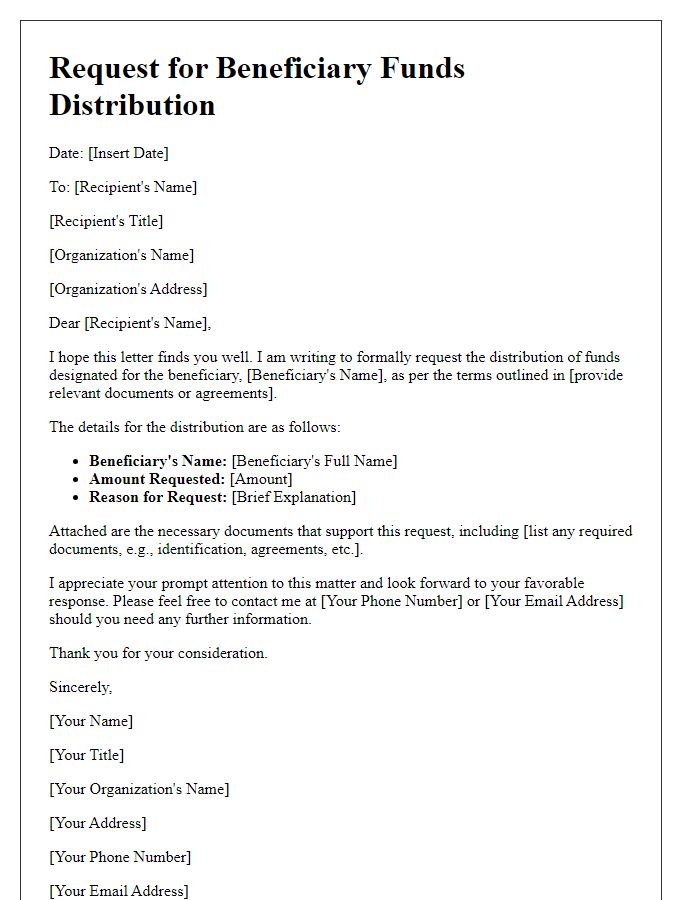

A beneficiary claim payment process requires clear identification details to ensure accurate disbursement of funds. Essential identification includes the beneficiary's full legal name, such as Johnathan Doe, along with government-issued identification number, like Social Security Number (SSN) or Driver's License Number. Address details must include the complete physical address, example: 123 Main Street, Springfield, IL 62701. Additionally, financial institution information is crucial, listing the bank name, account number, and routing number for direct deposit purposes. Claims often necessitate documentation, such as the death certificate, policy numbers, and any relevant claim forms, accompanied by a signature for authentication. Accurate and thorough submission of these details can expedite the claims process, ensuring timely compensation.

Claim Reference Number

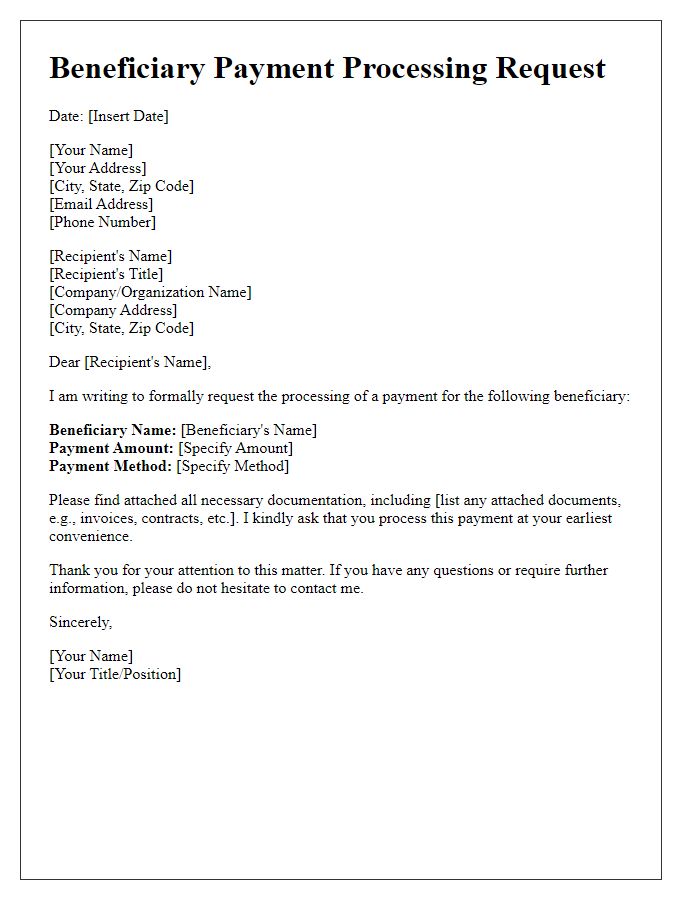

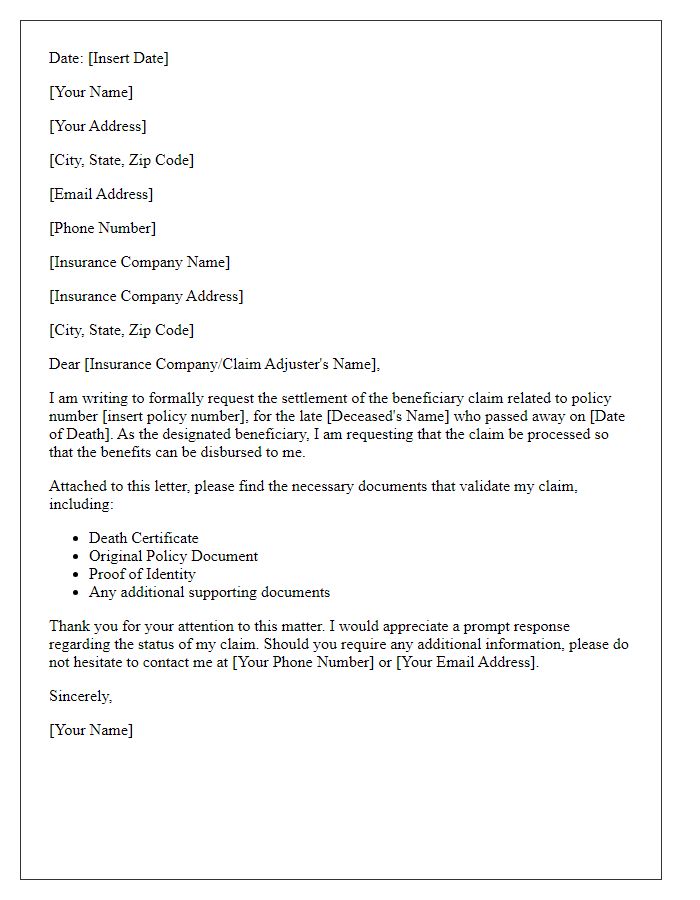

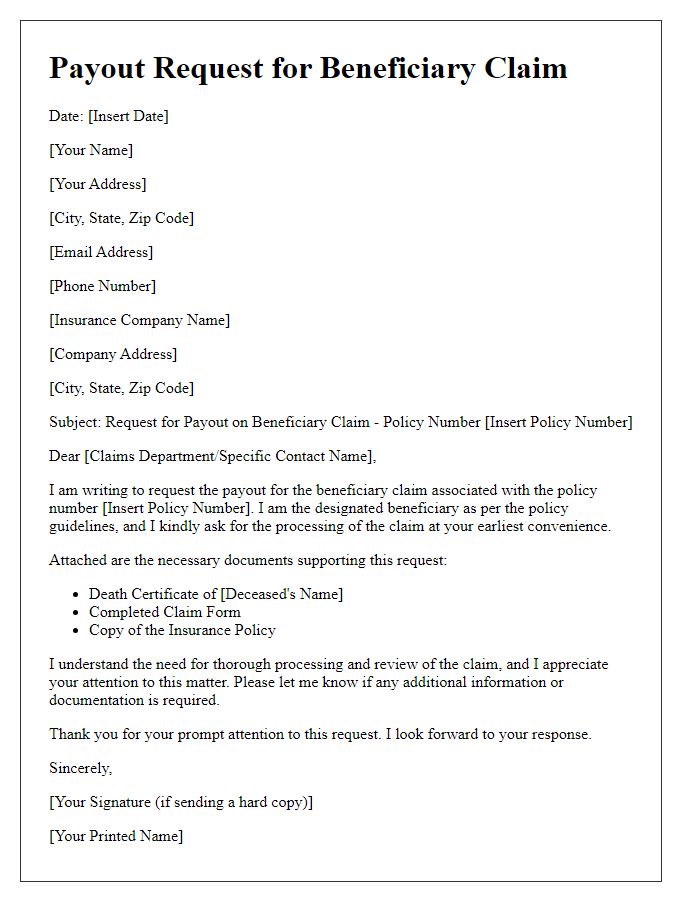

In the process of beneficiary claim payment, documentation plays a crucial role, particularly with respect to the Claim Reference Number (CRM, unique identifier). This number typically comprises alphanumeric characters that help streamline the processing within financial institutions, such as insurance companies or retirement plans. A beneficiary, usually designated in a will or insurance policy, may need to submit forms, identification (like Social Security Number or national ID), and other supporting documents to trigger the payout. Timely submission is essential, as delays can lead to complications, including potential disputes regarding the estate or policy. Clear communication with the financial institution helps ensure that all procedural requirements are met efficiently, allowing for a smooth transition of funds to the designated beneficiary.

Payment Amount and Currency

In financial transactions, the payment amount represents the specific sum of money being transferred, while the currency denotes the type of money being used, such as US dollars (USD), euros (EUR), or Japanese yen (JPY). Accurate specification of both elements is crucial in beneficiary claim payments to ensure that the correct amount is disbursed to the intended recipient. For instance, a claim payment of 5,000 USD must be clearly indicated to avoid miscommunication, particularly in cross-border transactions where exchange rates fluctuate. Furthermore, including details such as the date of the transaction and the method of payment (wire transfer, check, etc.) enhances clarity and ensures compliance with financial regulations.

Instructions for Next Steps

Beneficiary claim payments involve a structured process that requires specific documentation and compliance with guidelines set by the financial institution or insurance company. After the death of the policyholder, beneficiaries must submit required forms, such as the claim form and death certificate, to initiate the processing of the claim. Institutions like insurance companies may have distinct timelines, often ranging from 30 to 60 days, for reviewing claims. Beneficiaries should ensure all documentation is complete to prevent delays. Additional supporting documents might include identification and the policy number. Once the claim is approved, beneficiaries will be contacted regarding payment options, which can include direct deposit or check issuance, ensuring a seamless transfer of funds.

Contact Information for Support

Beneficiary claim payments require precise contact information for support to ensure smooth processing. Financial institutions, such as banks or insurance companies, typically provide dedicated customer service hotlines, often available 24/7, which can assist beneficiaries. It's crucial to provide a valid policy or account number, along with the claimant's full name and relationship to the deceased, to expedite the inquiry. Additionally, email support channels often facilitate documentation submission and claim tracking, usually hosted on secure websites, ensuring privacy compliance under regulations like GDPR. Prompt updates via automated systems usually confirm the progress of claims, enhancing transparency in the support process.

Comments