Are you curious about the benefits of comprehensive coverage for your vehicle? Understanding how this type of insurance can protect you in various scenarios is crucial for making informed decisions. From theft to natural disasters, comprehensive coverage offers a safety net that can save you from significant financial burden. Let's dive deeper into these benefits and help you choose the best protection for your needsâread on to find out more!

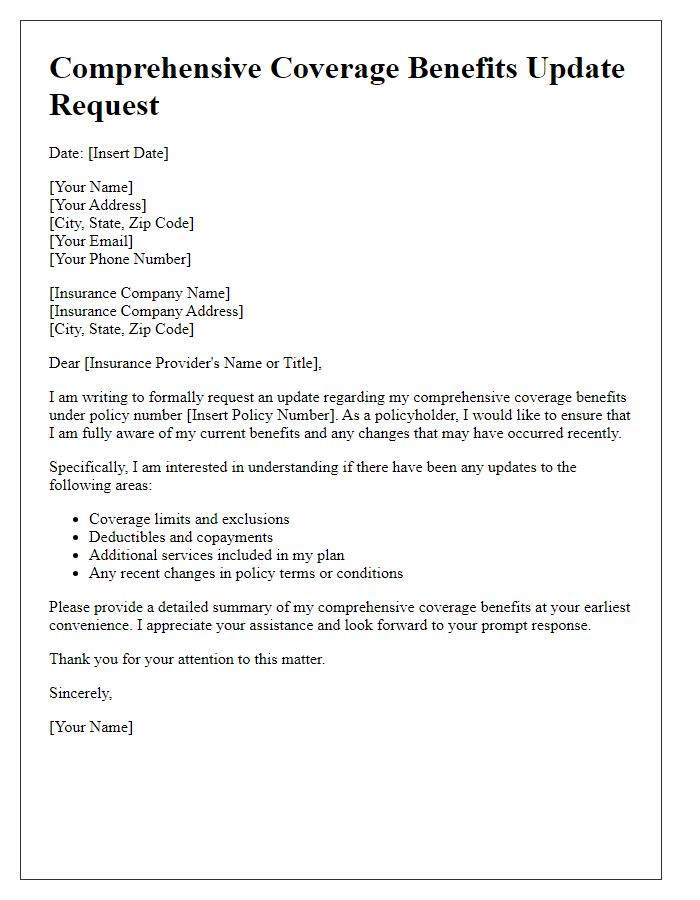

Personal Information (Name, Address, Policy Number)

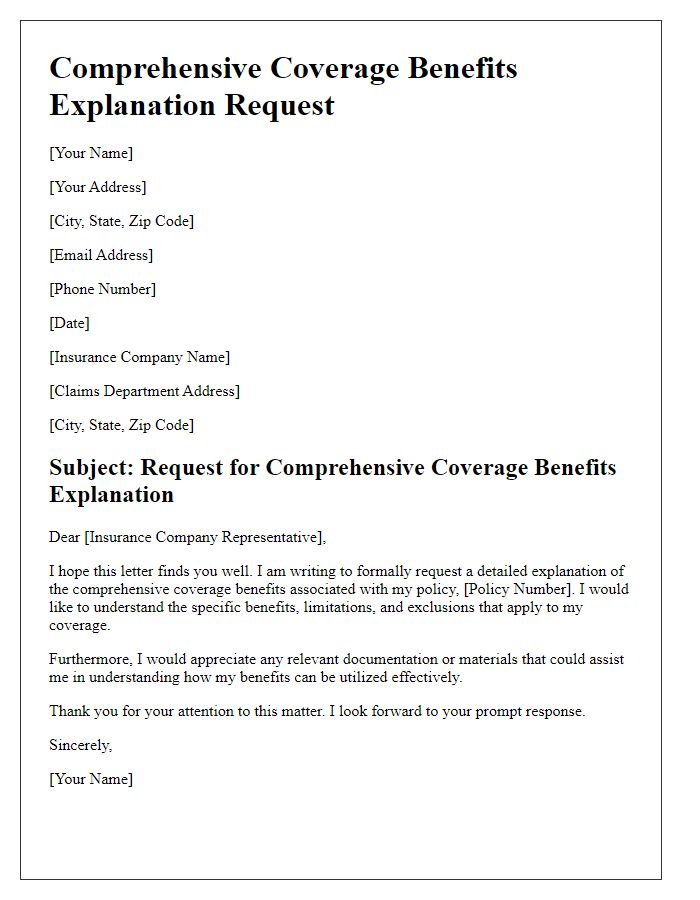

Comprehensive coverage benefits provide an extensive safety net for various types of damage or loss, particularly for automotive insurance policies like those offered by companies such as State Farm or Geico. This type of coverage typically protects against incidents like theft, vandalism, weather-related damage (such as hail storms or flooding), and collision with animals, which can occur in rural areas or densely populated cities alike. For example, a comprehensive plan may cover windshield repairs due to damage from road debris or pay to replace a stolen vehicle, enhancing peace of mind for policyholders. Effective from specific dates, usually aligned with the policyholder's start date, this coverage ensures financial protection against unexpected incidents, integral for maintaining the value and usability of one's automobile.

Coverage Details (Type, Extent, Benefits)

Comprehensive coverage benefits encompass a variety of types, including collision and comprehensive auto insurance, personal injury protection, and property damage liability. This insurance covers a range of incidents, such as theft, vandalism, natural disasters, and damages caused by animals, providing financial protection against unforeseen events. Key benefits include reimbursement for repair costs, replacement of stolen items, and coverage for medical expenses resulting from automobile accidents. Moreover, comprehensive coverage often includes features such as roadside assistance and rental car reimbursement, which enhance overall protection for policyholders. Understanding the extent of these benefits is crucial for making informed decisions regarding auto insurance policies.

Claim Procedure (Documentation, Deadlines, Contact Information)

Comprehensive coverage benefits for automobile insurance provide financial protection against damages outside of collision incidents, such as theft, vandalism, or natural disasters. To initiate a claim, policyholders must gather essential documentation including a completed claim form, photographs of the damages, and any police reports if applicable. Submission deadlines vary by insurance provider, typically requiring claims to be filed within 30 days of the incident. Ensure to contact the customer service department of your insurance company directly using the number listed in your policy documents, usually available 24/7, for guidance and to clarify any questions regarding the claims process. Adhering to these procedures will facilitate a smoother claims experience and prompt reimbursement for covered losses.

Exclusions and Limitations (Conditions, Restrictions)

Comprehensive coverage benefits provide essential protection for vehicles against various risks, including theft, vandalism, and natural disasters. However, certain exclusions and limitations may apply, impacting claim eligibility. Common exclusions encompass damages resulting from regular wear and tear, mechanical failures, and intentional acts such as reckless driving or fraud. Additionally, coverage may not extend to personal items stolen from the vehicle or damages occurring during organized races or unlawful activities. Limits on reimbursement can include cap amounts for specific incidents, such as a maximum payout for theft claims that could be as low as 80% of the vehicle's current market value, depending on the insurer's policy guidelines. Understanding these exclusions and limitations is crucial for policyholders to navigate their insurance coverage effectively.

Customer Service and Support (Contact Methods, Hours)

Comprehensive coverage benefits provide essential protection for various asset types, including vehicles and residential properties. Customer service support for inquiries about coverage specifics is available through multiple contact methods such as phone, email, and live chat. The customer service hotline operates from 8 AM to 8 PM EST, allowing for real-time assistance. Customers can also send emails or utilize the online chat feature during business hours to receive support. Comprehensive benefits encompass areas such as collision coverage, liability coverage, and personal injury protection, ensuring policyholders are well-informed regarding their entitlements and support options.

Comments