Are you looking to understand the process of surrendering a policy? It can often feel overwhelming, but we're here to help demystify things for you. In this article, we'll walk you through the key steps and important considerations, ensuring that you feel confident in your decision. So, grab a cup of coffee and join us as we explore everything you need to know about policy surrender acknowledgment!

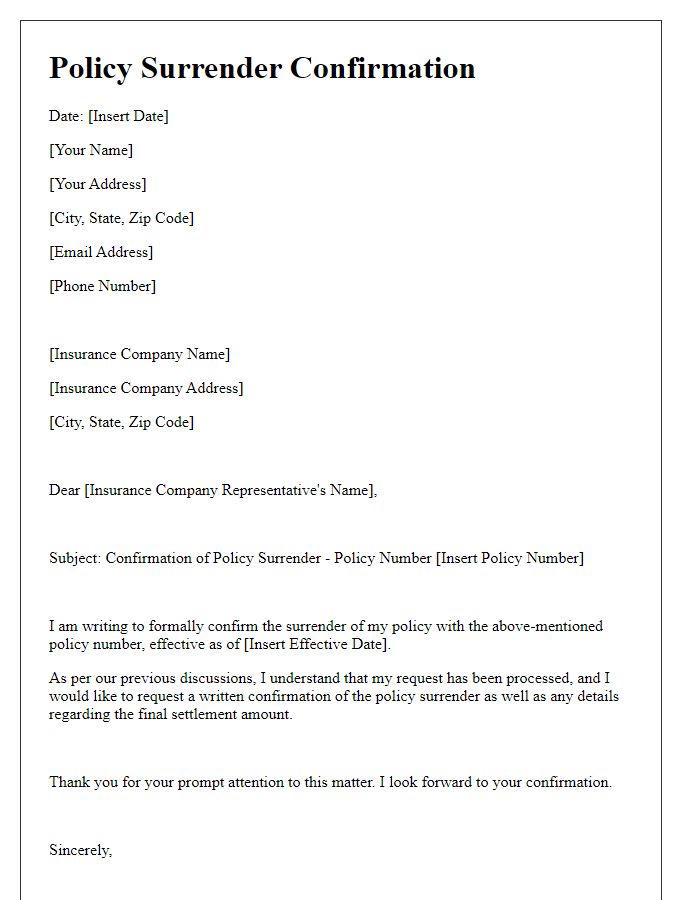

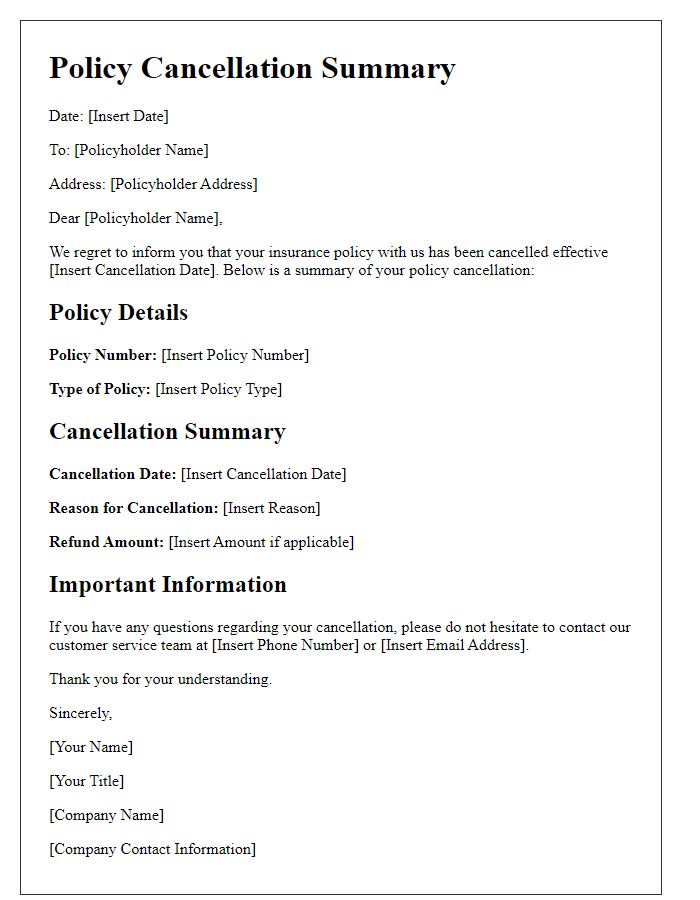

Sender and recipient details

Acknowledging the surrender of an insurance policy requires careful documentation of the sender and recipient information. The sender's name, such as the insurance company representative, includes the organization's name and address, ensuring clarity in communication. The recipient's details involve the policyholder's full name, current address, and policy number for proper identification. This acknowledgment serves as an official recognition of the receipt, documenting the date and policy number associated with the surrender for future reference. The format may also include contact information for both parties to facilitate any further communications regarding the policy status or necessary next steps.

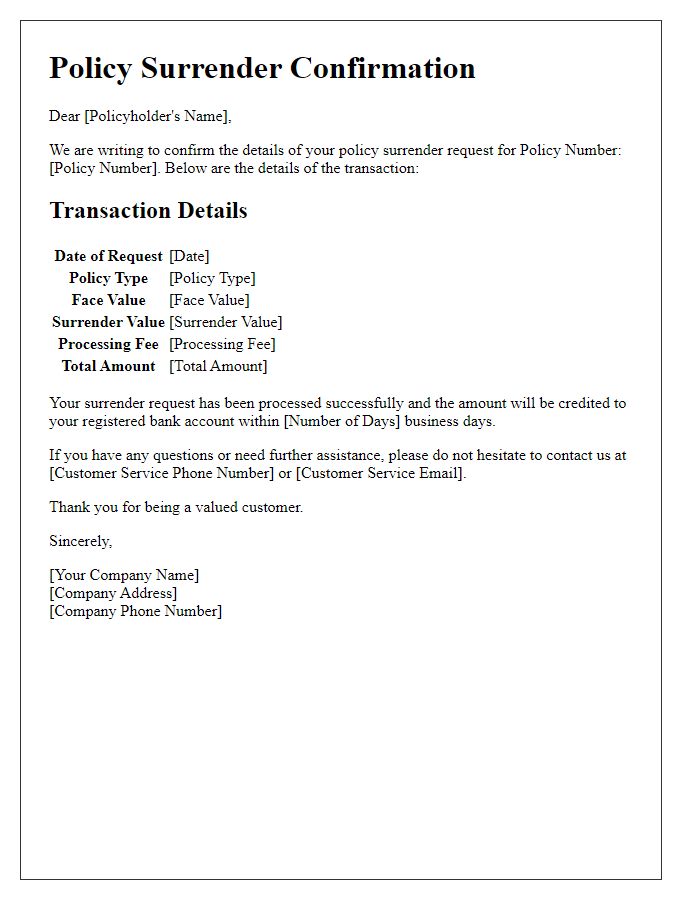

Policy information and reference number

The process of policy surrender acknowledgment is crucial for policyholders ending their insurance agreements. It typically includes a collection of vital elements that ensure clarity and transparency. An example of policy information would be "Life Insurance Policy Number: 123456789." Additionally, a reference number, such as "Acknowledgment Reference: ACK-2023-XYZ," facilitates the tracking of the surrender request. The acknowledgment details may also specify dates, including the submission date of the surrender request and the effective termination date of the policy. Such information assures the policyholder of the successful completion of their request and provides a record for future reference.

Statement of acknowledgment

Policy surrender acknowledgment provides essential confirmation for policyholders. Acknowledgment signifies that the insurance company has received and processed the request for surrendering the policy, typically related to life insurance or endowment plans. Key details include the policy number, the policyholder's name, and the date of request submission. This document reassures the policyholder about the successful completion of the surrender process. Additionally, any outstanding benefits or refunds should be clearly stated, such as the cash value determined upon surrender, which can significantly influence financial planning decisions. A well-structured acknowledgment promotes transparency and builds trust between the insurance provider and the customer.

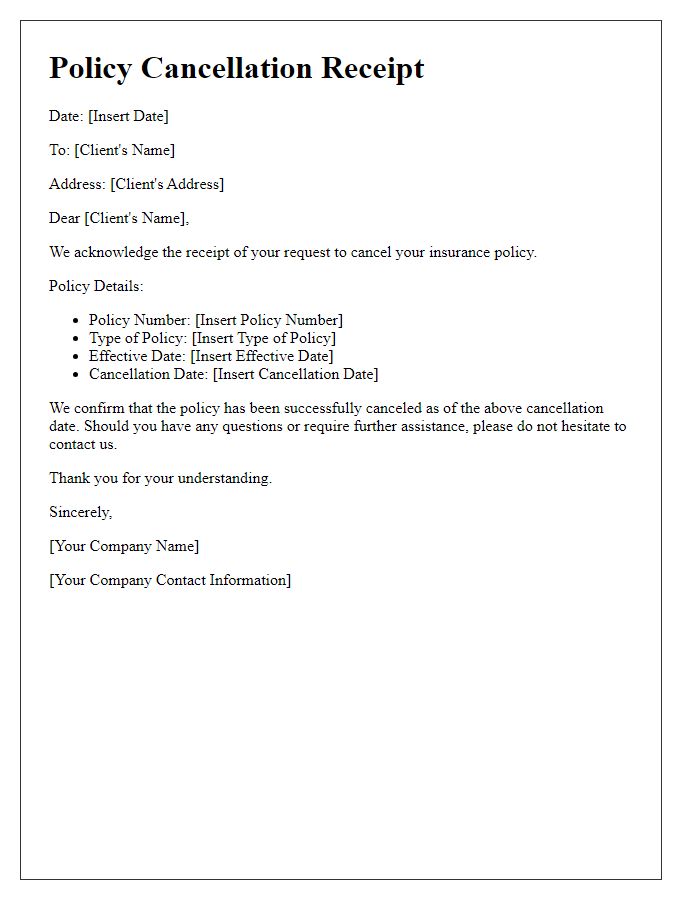

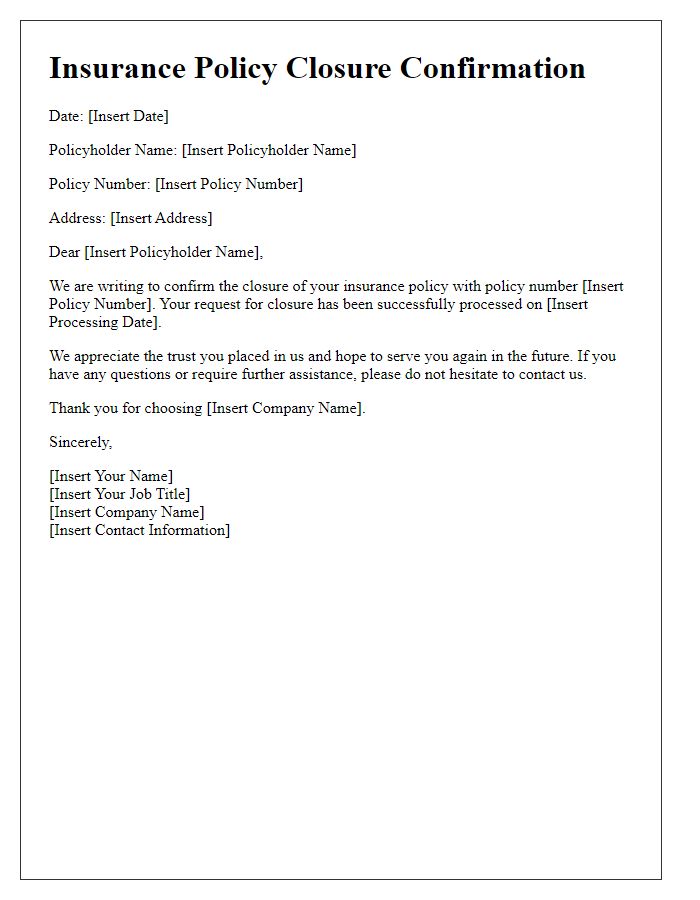

Instructions for further actions

Policy surrender acknowledgment provides essential information to policyholders regarding the cancellation process of their insurance or investment policies. It details the required documents, such as identification proof and the original policy document, to facilitate an efficient surrender. Policyholders must submit these items, within a specified time frame, typically 30 days, to the company's headquarters or designated branch office. Upon processing, a refund or surrender value, which may be adjusted for applicable deductions such as processing fees, will be issued. It is crucial for policyholders to retain a copy of this acknowledgment for future reference and tracking. The surrender process also indicates potential impacts on future insurability or investment opportunities, advising individuals to consider these factors carefully before proceeding.

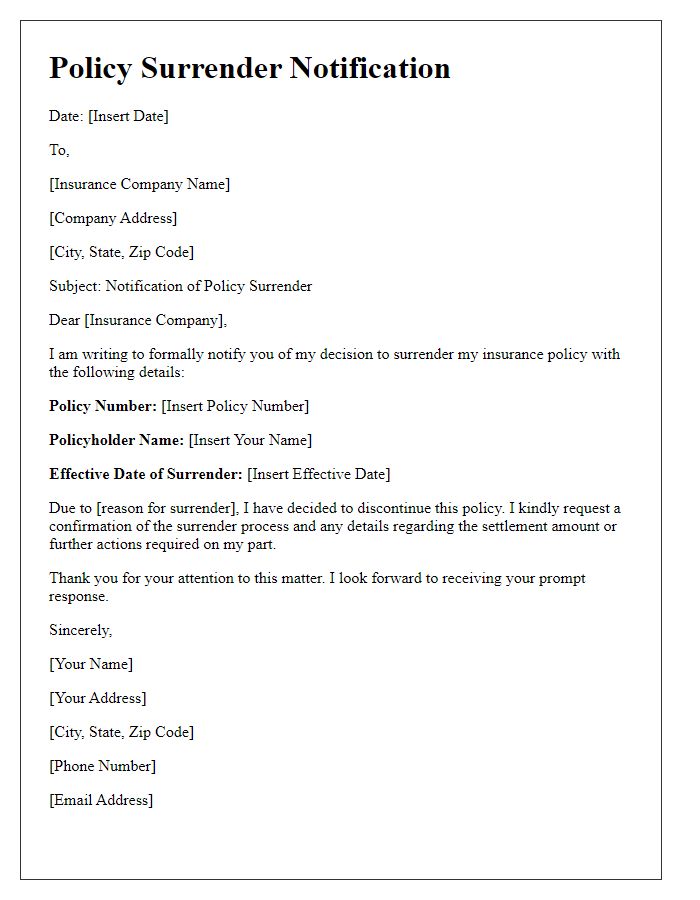

Contact information for queries

Policy surrender acknowledgment serves as an essential document in insurance processes, specifically addressing the termination of insurance policies. This acknowledgment typically includes unique identifiers such as Policy Number (#123456), insured party details including name and address, along with the date of surrender (e.g., January 15, 2023). Additionally, it outlines the amount of any payable surrender value, enhanced by specific calculations based on policy terms and accrued bonuses. For any inquiries regarding this process or further clarifications, contact information is crucial, including a dedicated customer service email (support@insurancecompany.com) and a telephone number (1-800-555-0199), providing assistance from trained representatives during business hours (9 AM to 5 PM, Monday to Friday).

Comments