Are you gearing up to submit some supplemental documents for your application? It can be a daunting task, but having a clear and concise cover letter can make all the difference. In this article, we'll walk you through an easy-to-follow template that not only highlights your additional materials but also showcases your professionalism. Ready to take your submission to the next level? Let's dive in!

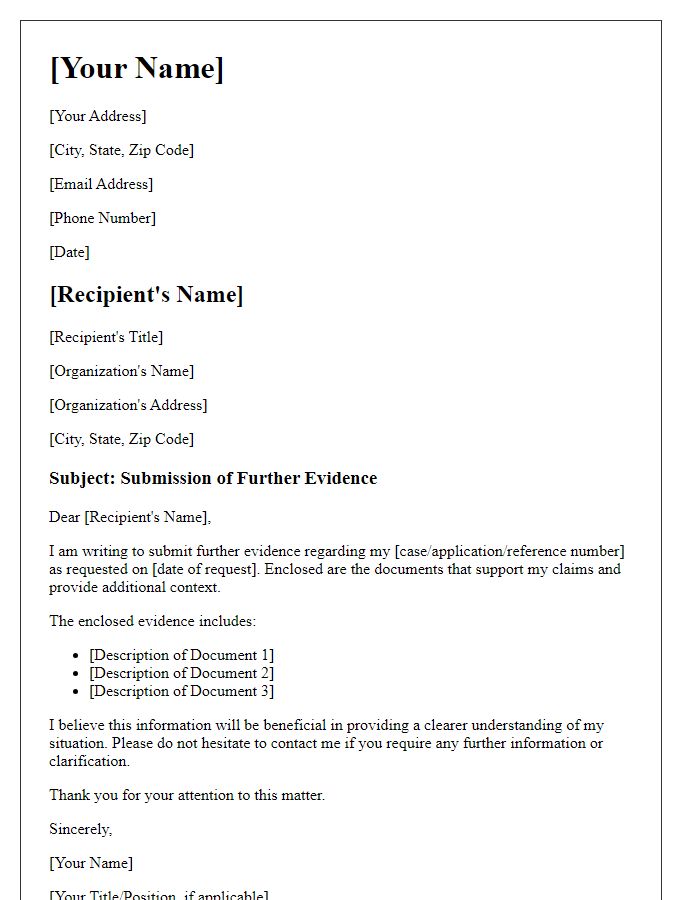

Recipient's contact information

Submitting supplemental documents is crucial for applications, ensuring completeness and accuracy. For example, including the recipient's contact information at the top of the cover letter aids in timely communication. The precise address (including street name, city, state, and zip code) serves as a guide for correct delivery within the institution or organization. A clear indication of the recipient's position, such as Admissions Officer or Human Resources Manager, ensures that documents reach the right individual responsible for processing. Furthermore, mentioning a direct phone number and email address boosts accessibility, facilitating any necessary follow-up queries regarding the supplemental materials submitted.

Date of submission

When submitting supplemental documents for an application process, it is essential to include the date of submission prominently to maintain an organized record. The date should reflect the day the documents are sent to the designated recipient or office, ensuring clarity in correspondence. For example, if the documents are submitted on March 15, 2024, this date can help track the timeline of the application or review process. Properly documenting the submission date aids both the applicant and the reviewing authority in maintaining accurate timelines and statuses regarding the application.

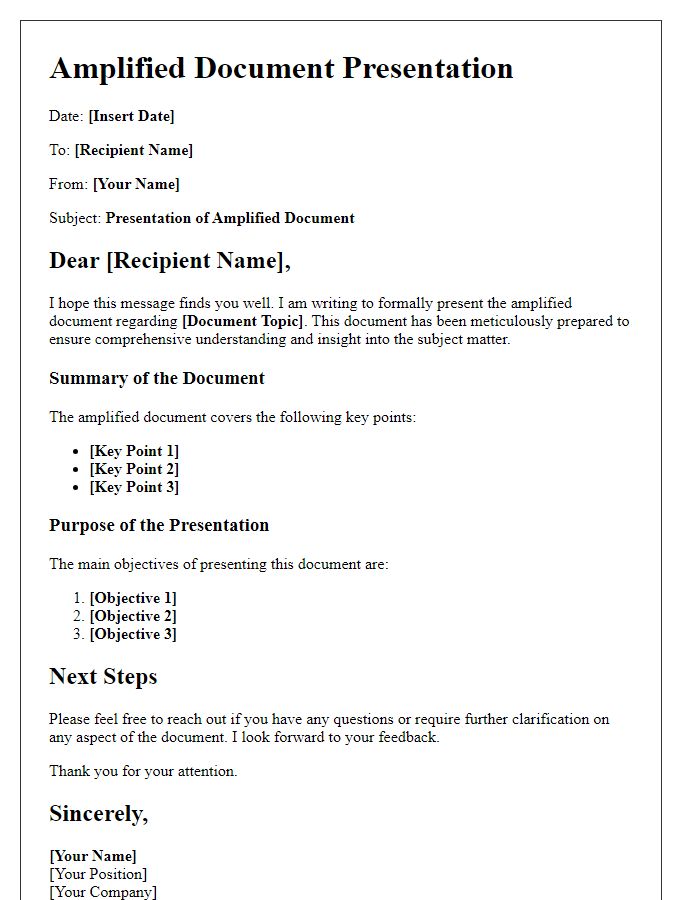

Purpose of letter

Submitting supplemental documents for a loan application requires careful articulation. A letter should clearly state the purpose (e.g., verification of income, additional identification) and specify the documents attached (such as tax returns, bank statements). Precise details regarding the loan type (e.g., FHA, conventional), application reference number, and applicant's full name contribute to clarity. Additionally, ensuring the letter is addressed to the appropriate party (like a loan officer or underwriting department) is essential, along with a professional tone. It's important to maintain a concise format while providing relevant information to facilitate timely processing of the loan application.

List of supplemental documents

Submitting supplemental documents involves providing additional materials to support an application or request. Essential items include a cover letter, detailing the purpose and contents of the submission, and supporting documents such as tax returns (IRS Form 1040 for the previous two years), bank statements (last three months showing financial activity), and letters of recommendation (from professional contacts or mentors). Include educational records, transcripts (official copies from accredited institutions), or certifications (e.g., professional licenses, diplomas) relevant to the application. If applicable, provide a statement of need or personal narrative to clarify the context for these documents. Organizing documents in a clear order and referencing them in the cover letter enhances clarity and facilitates the review process.

Closing statement and contact details

Submitting supplemental documents requires careful organization and clarity. A closing statement should summarize the key points presented while expressing gratitude for the consideration. Include contact details, such as a phone number and email address, ensuring they are accurate for prompt communication. Furthermore, a physical address may also be beneficial for any future correspondence related to the submission. Make sure to finalize with a professional sign-off, reinforcing readiness for further discussion or questions regarding the documents provided.

Comments