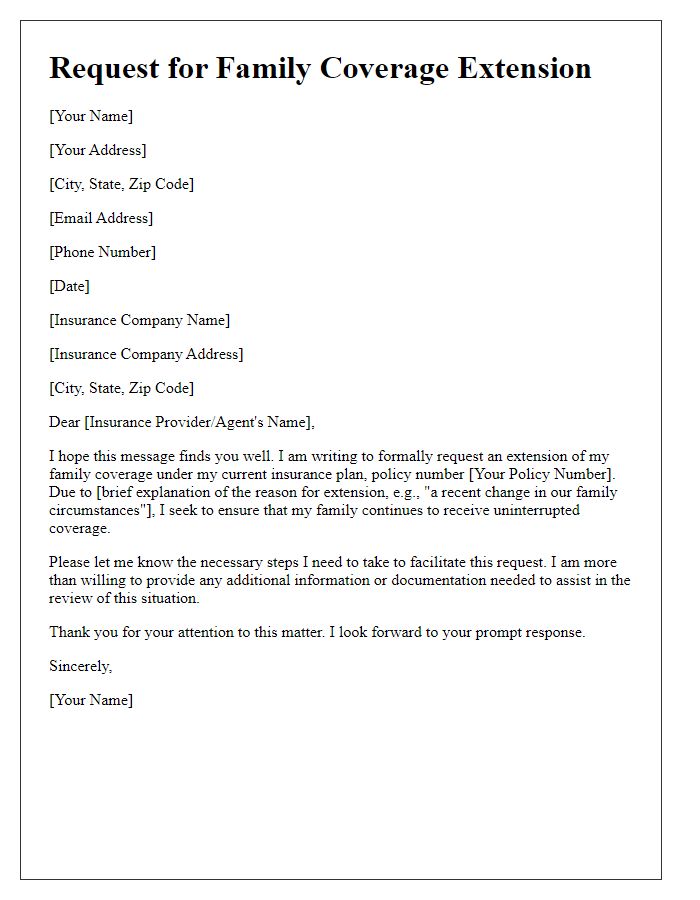

Are you considering extending your family's health coverage and wondering how to navigate the process? You're not alone; many families find themselves in need of additional support when it comes to their healthcare needs. Crafting the right letter for your insurance provider can be a key step in ensuring your loved ones stay protected. Let's dive into the essentials of writing an effective letter for family coverage extension, and feel free to explore more insights in our detailed guide!

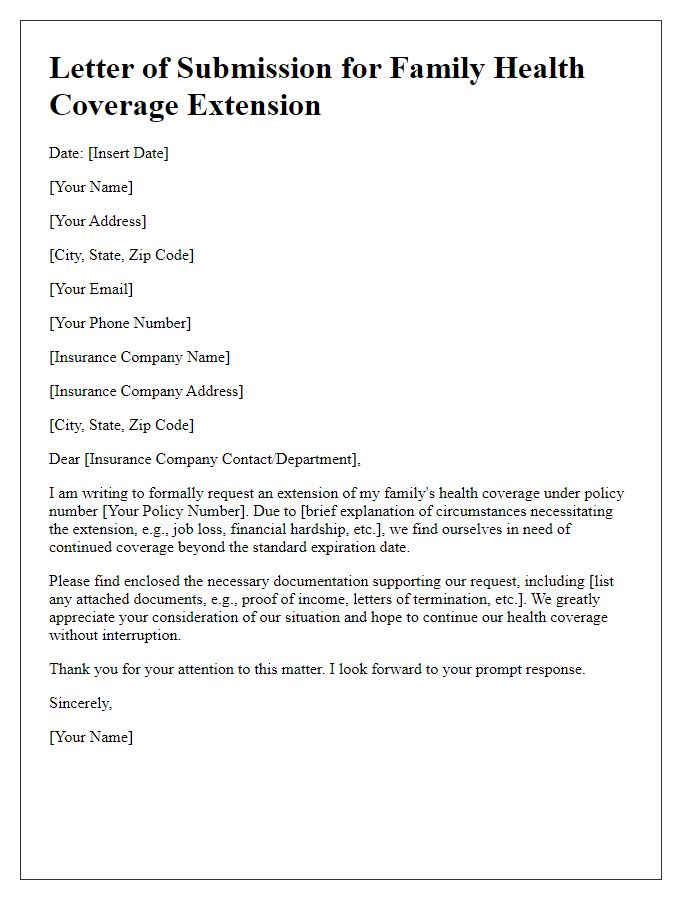

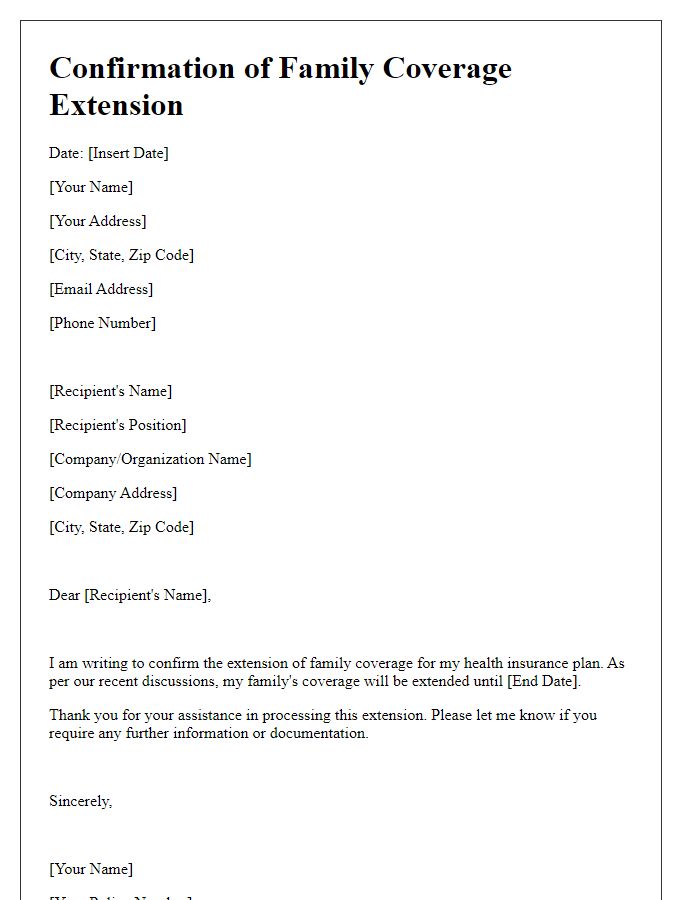

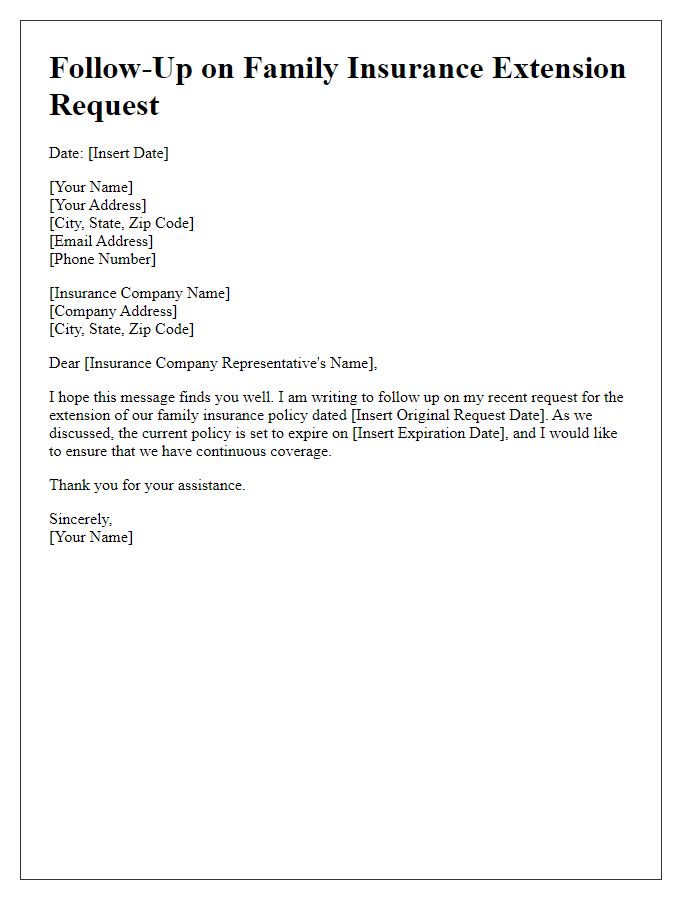

Recipient's Full Name and Contact Information

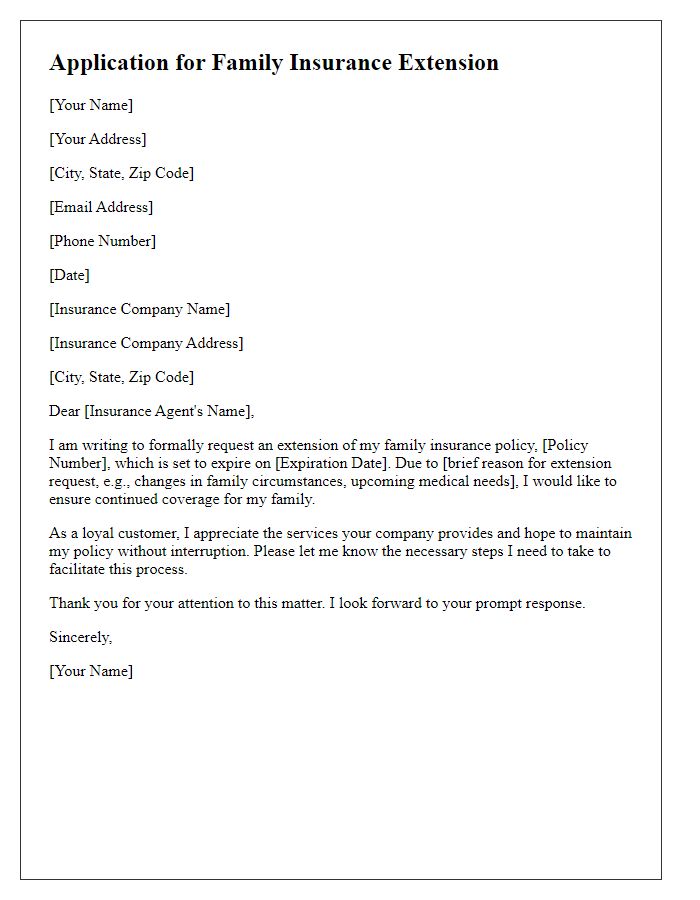

Family coverage extension provides essential benefits for dependents. Health insurance policies often include stipulations for extending coverage to spouses and children, ensuring access to medical services without interruption. Eligibility criteria might vary by provider, including age limits (typically up to 26 years for children) and marital status. Documentation like birth certificates or marriage licenses may be required for verification. Timely submission of requests, often within a 30-day window following a qualifying life event (like marriage or birth), is crucial to maintain seamless coverage. Understanding the specific terms of your plan can significantly impact the overall healthcare experience and financial stability of your family.

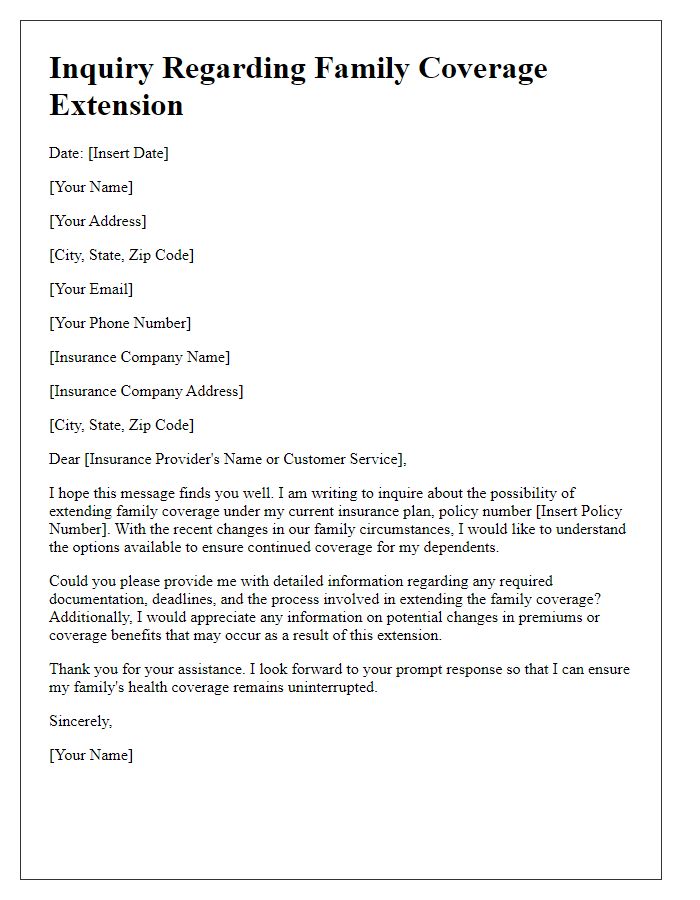

Policy Details and Reference Numbers

Family coverage extension policies typically involve specific details relevant to the insurance provider and the policyholder. An insurance policy, such as Health Insurance (Provider Name) with policy number (Policy Number), can provide coverage for family members under certain conditions. The extension might be referenced under the term Family Add-On, offering benefits such as expanded coverage for dependents (spouse and children) to age (specific age limit), often available through local insurance regulations. Important dates, including the renewal date (MM/DD/YYYY), ensure seamless coverage continuation. Additionally, reference numbers (Claim Reference Number, Customer Reference Number) can facilitate tracking and inquiries about the extension process and assist in managing documentation effectively. Always refer to the policy documentation for specific eligibility requirements and potential waiting periods associated with new dependents.

Reason for Extension Request

Requesting a family coverage extension often arises due to significant life changes, including job loss, the birth of a child, or unforeseen medical expenses. These life events can create gaps in financial resources, necessitating continued access to health insurance benefits. Extended coverage ensures that all family members remain protected against medical costs, safeguarding physical and mental health during transitions. Insurers may offer specific extensions, often referred to as COBRA (Consolidated Omnibus Budget Reconciliation Act) continuation coverage, allowing families to maintain their existing health plans for a limited time, typically up to 36 months, depending on circumstances. This extension is crucial for families to navigate their changing situations without the added burden of unexpected healthcare costs.

Supporting Documentation

A family coverage extension, particularly in health insurance, often requires supporting documentation to ensure all members listed for coverage meet eligibility criteria. This includes proof of relationship such as marriage certificates or birth certificates for children. Additional documents may include Social Security numbers for all dependent members, recent pay stubs or tax returns to verify income eligibility, and any existing insurance information to avoid duplication of benefits. Accurate submission of these documents is crucial in facilitating the extension process, preventing delays that could leave family members without necessary coverage.

Clear and Polite Language

The request for family coverage extension often arises due to significant life events, such as marriage or the birth of a child. Ensuring all eligible family members maintain uninterrupted health insurance is crucial for both financial stability and access to medical services. In many cases, companies offer family health plans under guidelines provided by the Affordable Care Act (ACA), which outlines coverage requirements. Typically, extensions must be communicated within specific time frames, often within 30 days of the qualifying event, to avoid any gaps in coverage. Relevant documentation, including marriage certificates or birth certificates, may be required to process the request effectively.

Comments