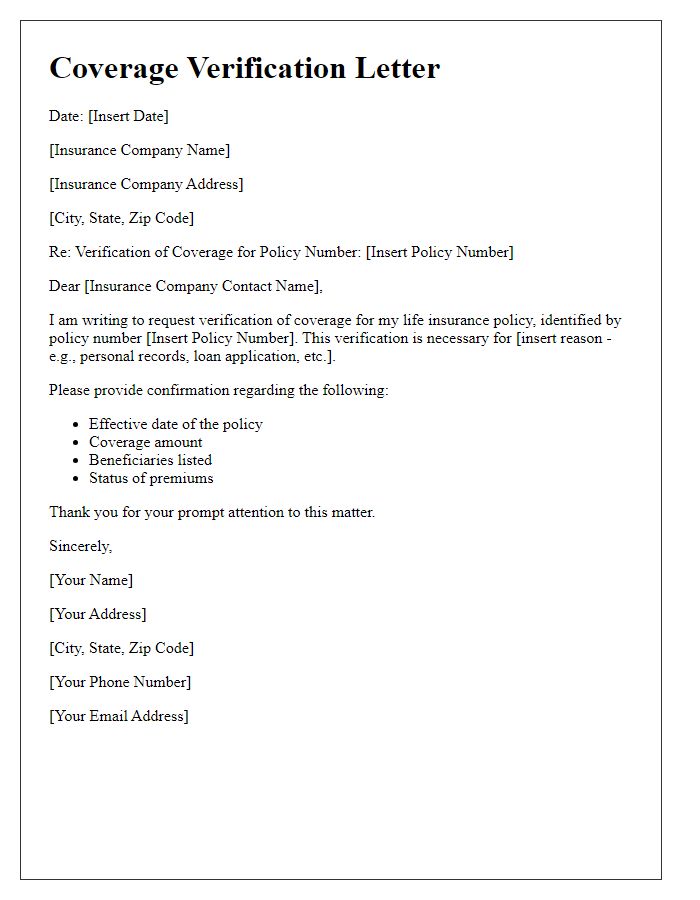

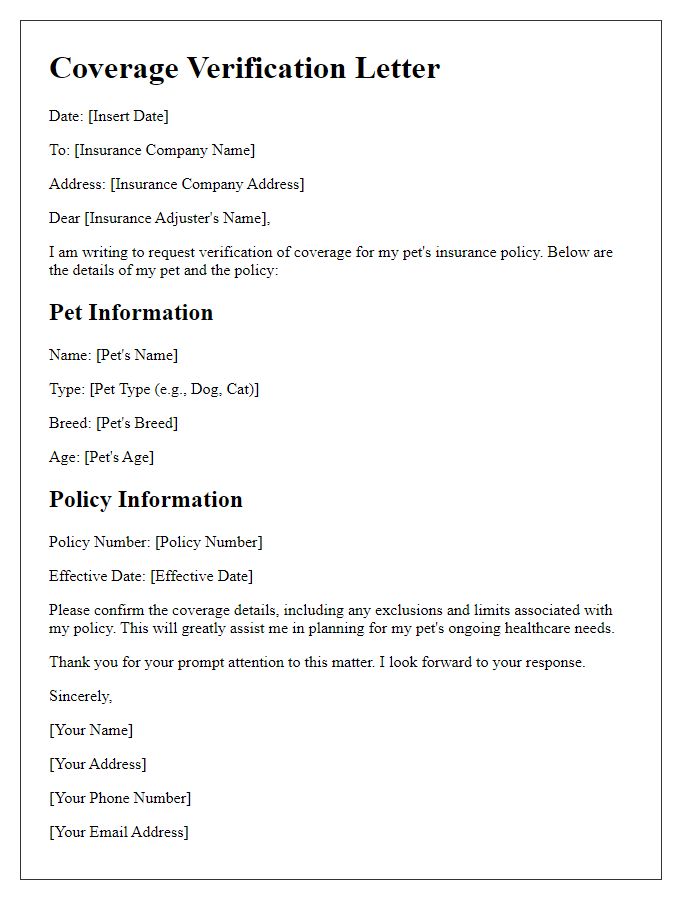

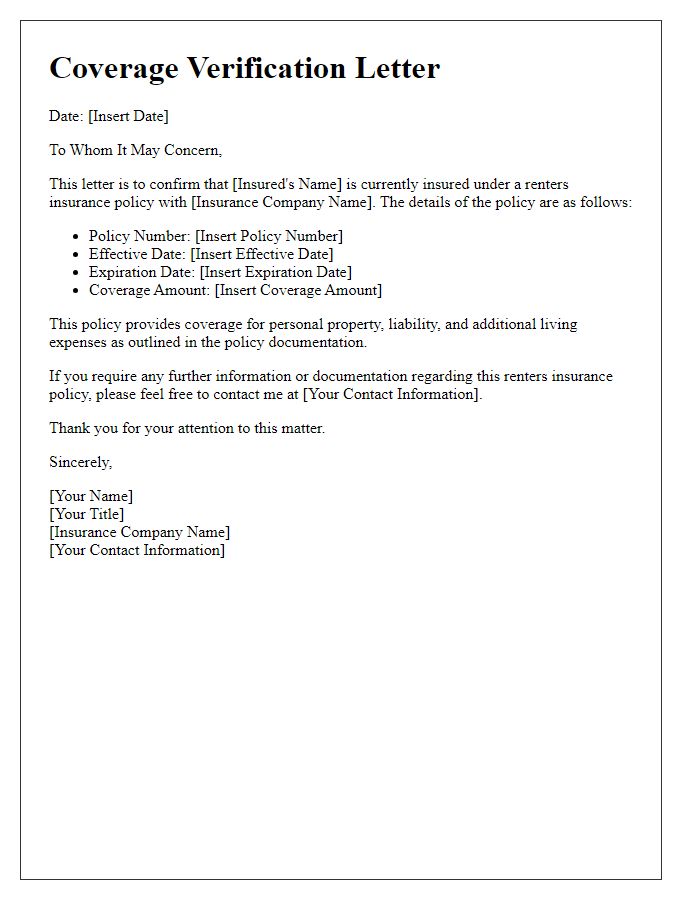

Are you looking to ensure that your insurance coverage is aligned with your needs? Sending a coverage verification request is a straightforward yet crucial step in maintaining peace of mind. By reaching out to your insurer, you can clarify any uncertainties and confirm the specifics of your policy. If you're unsure how to get started, keep reading for a helpful letter template to guide you!

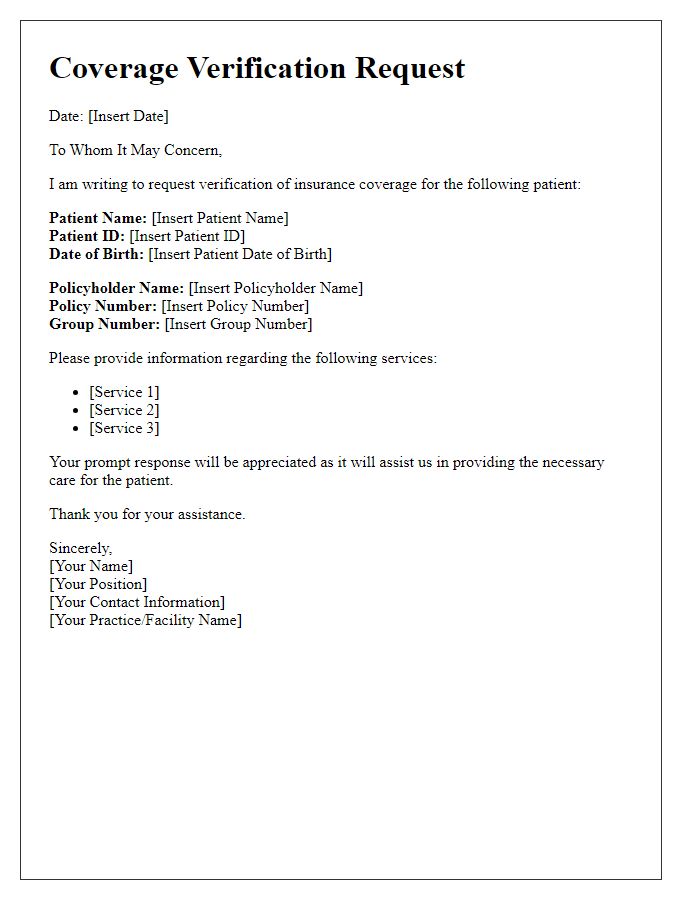

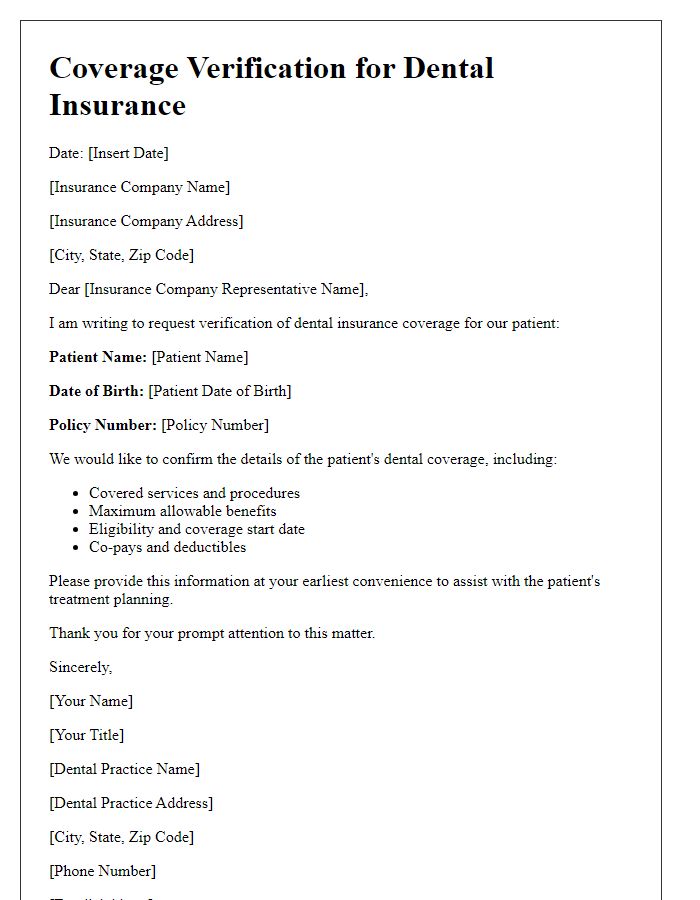

Accurate identification information

Accurate identification information is crucial in the process of coverage verification for insurance claims. This entails providing specific details such as the policyholder's full name, date of birth, policy number, and Social Security number to ensure efficient processing. Insurance providers rely on this information to verify coverage status, determine eligibility, and assess the nature of the claim within the relevant insurance framework. Precision in these details mitigates delays and prevents potential complications that may arise during the claims process. Additionally, having the correct address associated with the policy and contact information helps representatives reach the policyholder for clarifications or further information on the claim.

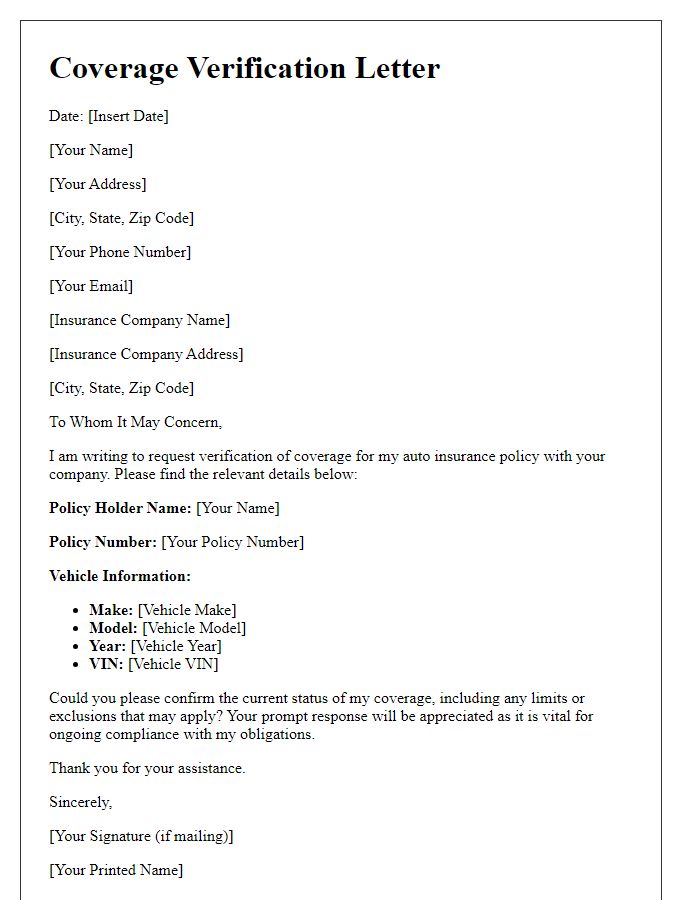

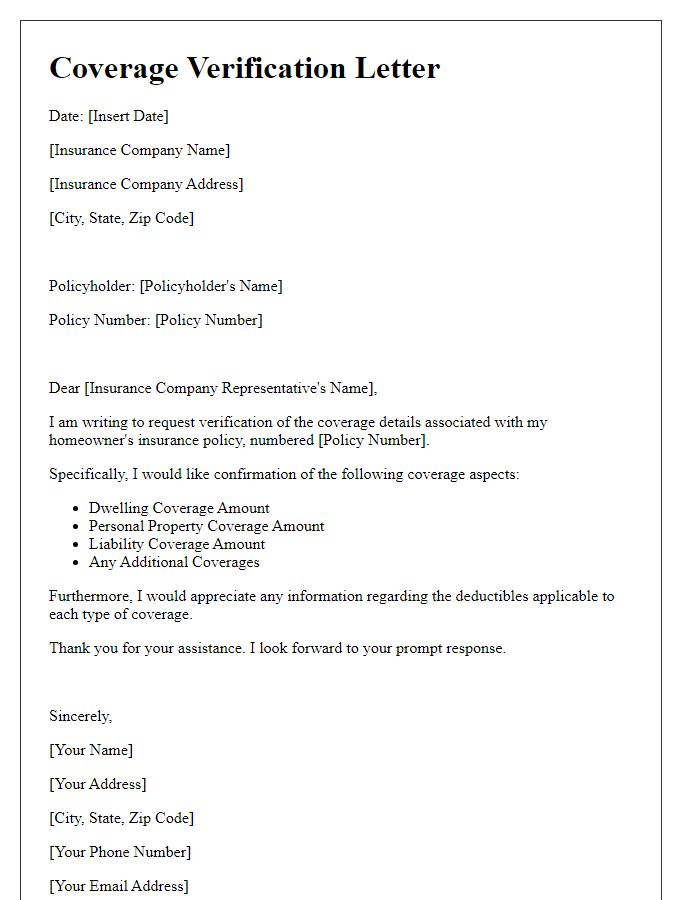

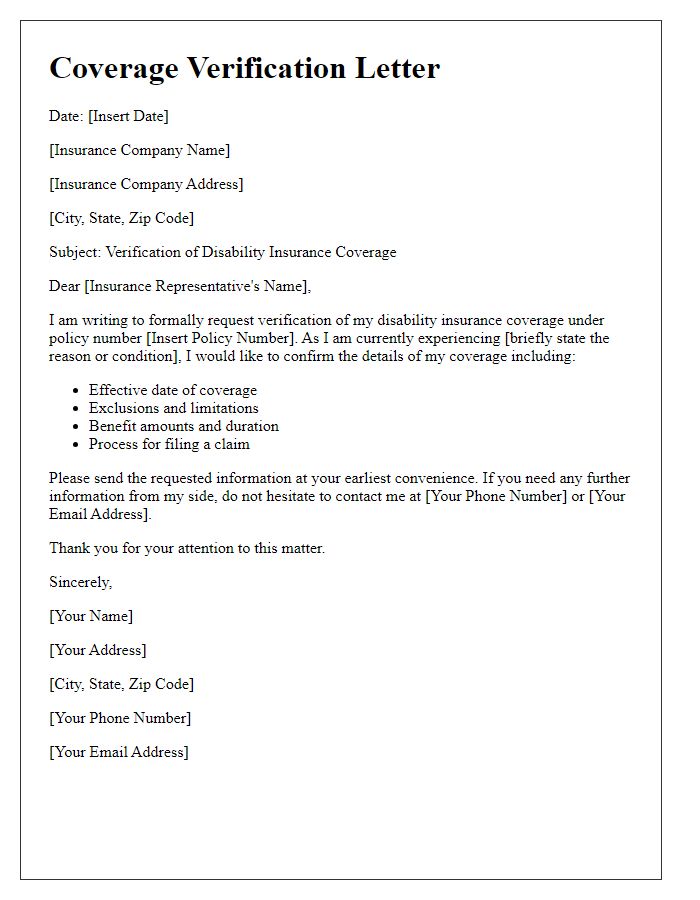

Comprehensive coverage details

Comprehensive coverage verification requests play a crucial role in the insurance industry, providing essential information about the specific details of insurance policies. Comprehensive coverage, often associated with auto insurance, typically includes protection against damages not related to collisions, such as theft, vandalism, and natural disasters. For instance, theft of a vehicle valued at $20,000 and damages incurred from a hailstorm can lead to significant financial loss if not properly covered. Accurate verification ensures both policyholders and insurers understand the extent of coverage offered, including deductibles, limits, and specific exclusions. Additionally, comprehensive coverage may encompass various endorsements that enhance protection, such as roadside assistance or rental car reimbursement, influencing the overall premium costs.

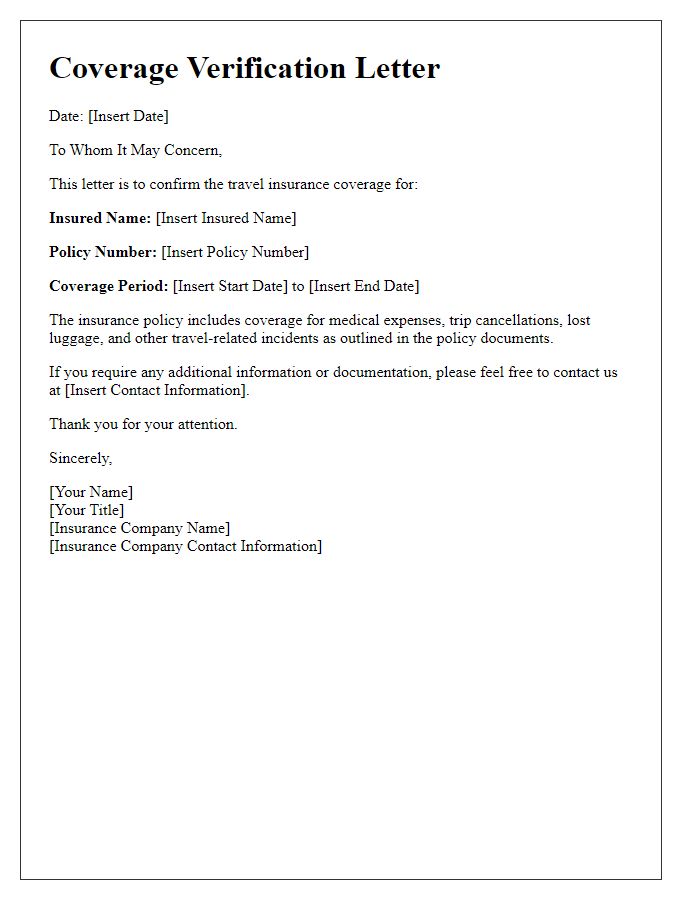

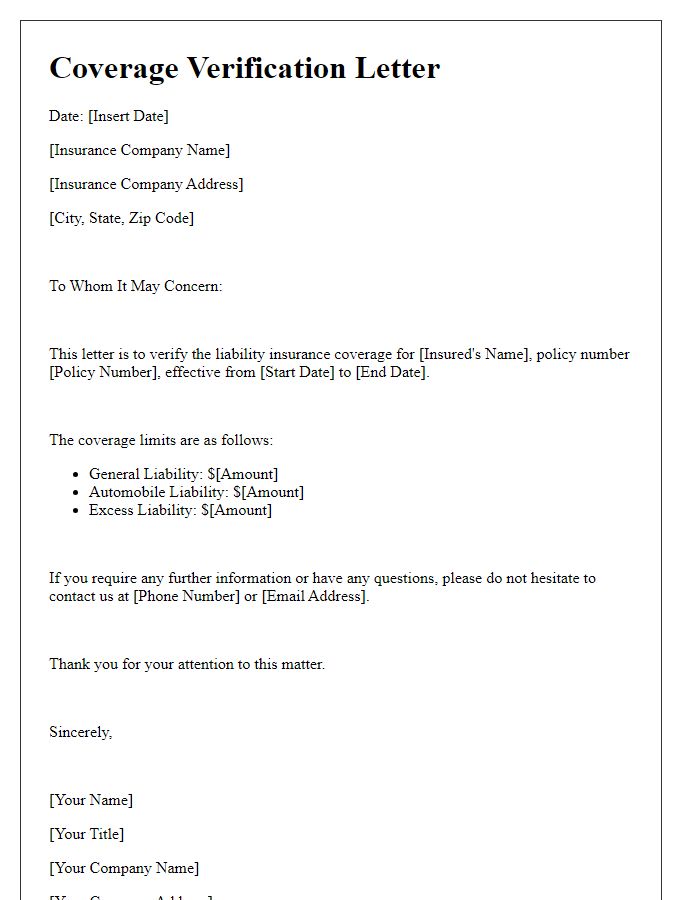

Specific policy numbers

Coverage verification requests for specific policy numbers require precise documentation. Policy numbers, which serve as unique identifiers for insurance contracts, facilitate the identification of the relevant policies. Insurers such as State Farm, Geico, or Progressive often utilize systems that streamline these verification requests, ensuring timely responses. Verification may include checking coverage limits, ensuring compliance with state regulations, and confirming active status. Policyholders must provide essential details, including the policyholder's name, effective dates, and pertinent vehicle information as necessary to expedite the process.

Request for confirmation and updates

Coverage verification is crucial for ensuring adequate insurance protection, especially in the healthcare sector. Patients must establish whether their health insurance plans, such as those from Blue Cross Blue Shield or UnitedHealthcare, will cover specific procedures or services. Extended wait times can result from delays in verifying coverage, impacting patient care and planning. Insurance representatives often require detailed patient information, such as policy numbers or procedure codes, to provide accurate coverage confirmations. Regular updates on coverage status alleviate uncertainties for patients and healthcare providers, fostering better communication and informed decision-making regarding treatment options.

Contact information for follow-up

A coverage verification request involves contacting an insurance provider for information regarding policy details. Essential components of this process include having the provider's name, contact number, and email address readily available for efficient communication. It is important to specify pertinent information such as policy number, type of coverage in question, and any relevant dates (e.g., policy effective dates). This streamlined information aids in expediting the verification process, ensuring a swift response from the insurance company's customer service team. Accurate and up-to-date details enhance follow-up efforts, facilitating a smooth resolution.

Comments