Are you feeling frustrated with your insurance provider and unsure of how to express your concerns? Drafting a formal complaint letter can be a daunting task, but it doesn't have to be. In this article, we'll guide you through crafting a concise and effective letter that clearly outlines your issues and sets the tone for resolution. So, grab a cup of coffee and let's dive into the tips and templates that will help you get your voice heard!

Policy Details and Reference Numbers

Submitting a formal insurance complaint often begins by detailing pertinent policy information. For instance, listing the policy number (such as 123456789) is crucial as it specifies the particular insurance agreement involved in the case. Including the reference number (like REF987654321) related to the most recent customer service interaction is significant, as it provides a traceable context for the complaint. Policy details should encompass the insurance type (for example, homeowner's, auto) and the coverage limits established by the insurance company, which could affect the nature of the dispute. It's essential to present dates of interactions, such as when claims were filed (e.g., January 15, 2023) and any correspondence received (for example, a denial letter dated February 5, 2023). All of these elements create a clearer picture for the insurance provider, facilitating a more efficient resolution process.

Clear Description of the Issue

Submitting a formal insurance complaint requires a clear description of the issue at hand, such as a denied claim involving a vehicle accident that occurred on March 15, 2023, while driving in downtown Chicago. Details include the policy number, 123456789, which pertains to comprehensive auto coverage provided by XYZ Insurance. The claim, numbered 987654, was denied on the grounds of insufficient evidence, despite the submission of an accident report, witness statements, and photographs confirming the incident. This decision has caused significant financial strain, as repairs to the vehicle, estimated at $3,500, remain unpaid. A prompt resolution is requested to address the unjust denial and to restore trust in the policyholder-insurer relationship.

Historical Context and Communication Logs

Submitting a formal insurance complaint requires a detailed understanding of historical context and clear communication logs to support your case. Documented interactions, such as dates of phone calls (e.g., June 15, 2023), emails, and in-person visits to the insurance company's office located at 123 Insurance Ave, New York, NY, can exhibit the timeline of issues faced. Prior incidents, including policy number changes, claim denials, and delays in claim processing over several months, should be thoroughly outlined. The complaint must reference specific terms from the insurance policy, highlighting sections such as coverage limits and claim procedures, ensuring a strong foundation of evidence. Emphasizing discrepancies in the company's responses based on documented communication can help substantiate the claim and prompt a thorough review.

Desired Resolution or Action

A formal insurance complaint requires clear articulation of the desired resolution or action to address the issue at hand. Specify any compensation sought, such as reimbursement for denied claims or coverage clarifications. Articulate expectations for timelines, ideally referencing policy guidelines (for example, the Standard Claims Processing Time of 30 days) to gauge responsiveness. Suggest additional investigations, like a review of underwriting procedures or customer service interactions, to improve handling of the case. Highlight the need for direct communication, preferably with a designated claims representative, to foster transparency and facilitate resolution.

Contact Information for Follow-up

To formally submit a complaint regarding an insurance policy, it is essential to include accurate contact information for efficient follow-up communication. Use a complete name, such as Jonathan Smith, including the policy number, for reference. Provide a current mailing address, for instance, 123 Main Street, Springfield, IL 62701, to ensure physical correspondence can be sent. Include a reliable email address, like jonathansmith@email.com, for digital communication. Additionally, a phone number, such as (555) 123-4567, allows for direct contact and speedy resolution of any issues related to the complaint. Clearly identifying these details aids in processing the complaint effectively.

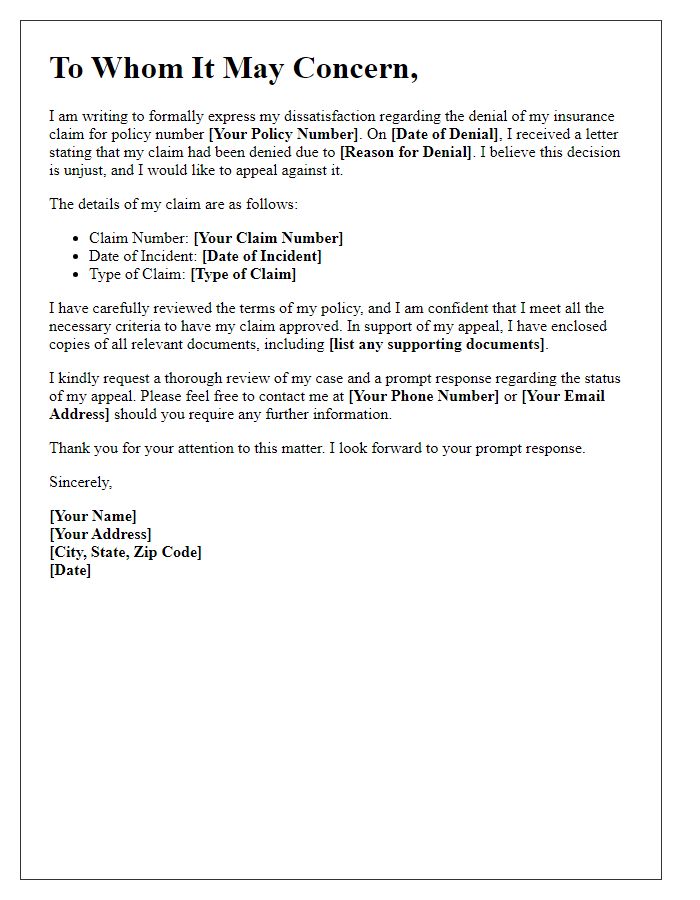

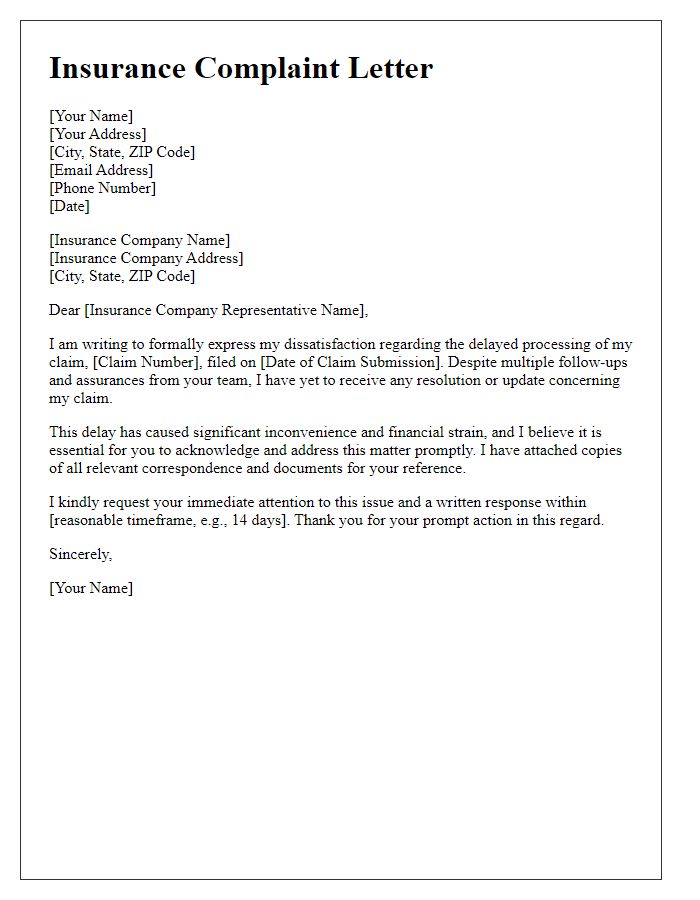

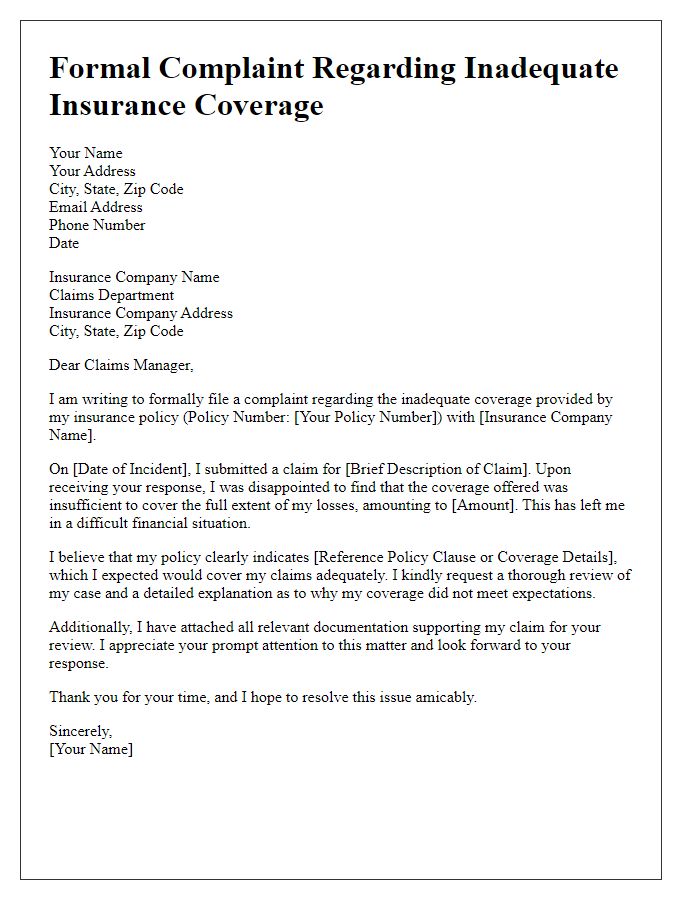

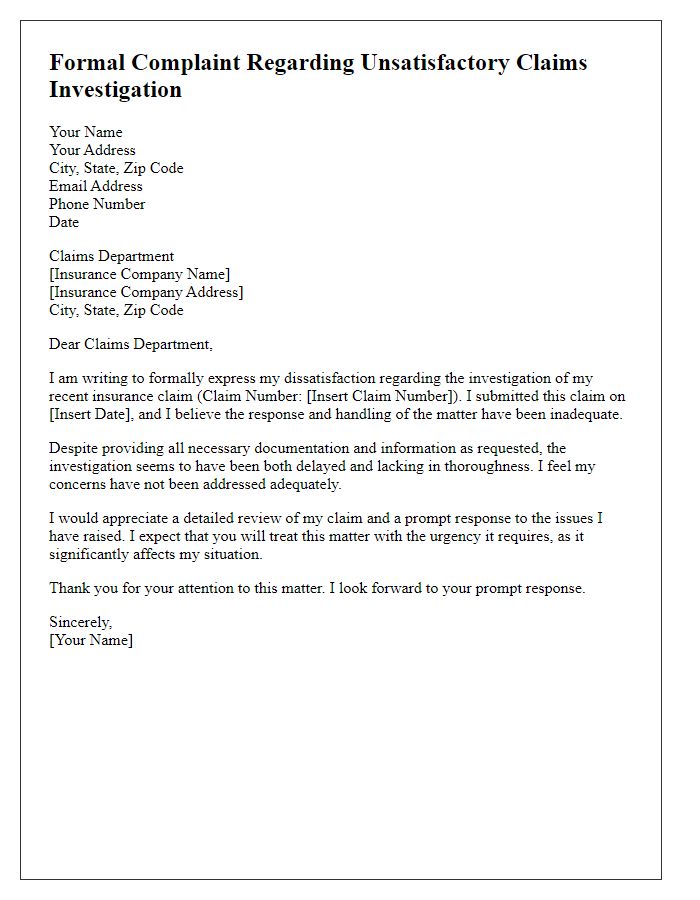

Letter Template For Submitting Formal Insurance Complaint Samples

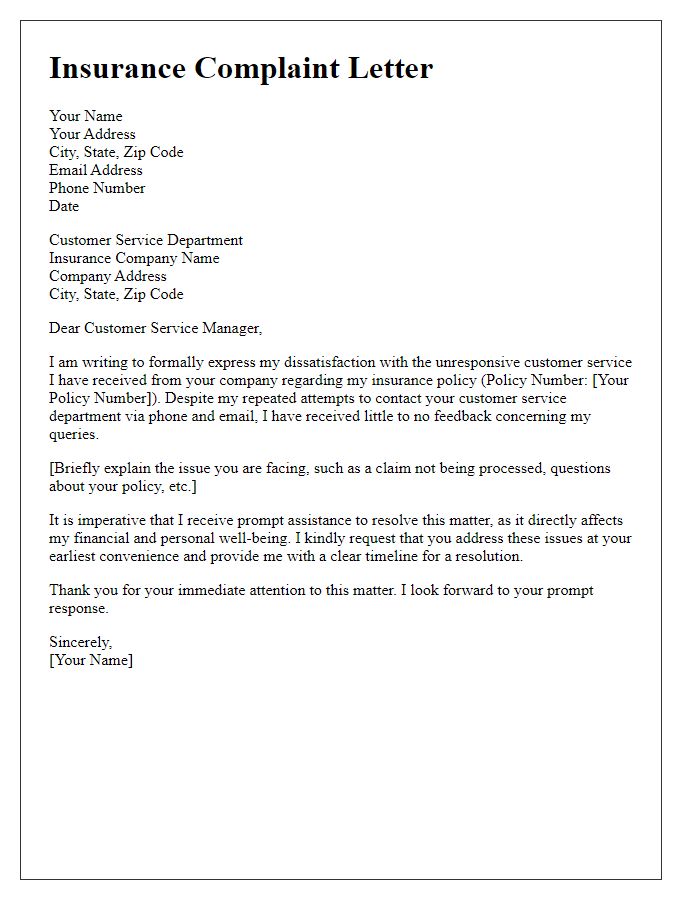

Letter template of insurance complaint over unresponsive customer service.

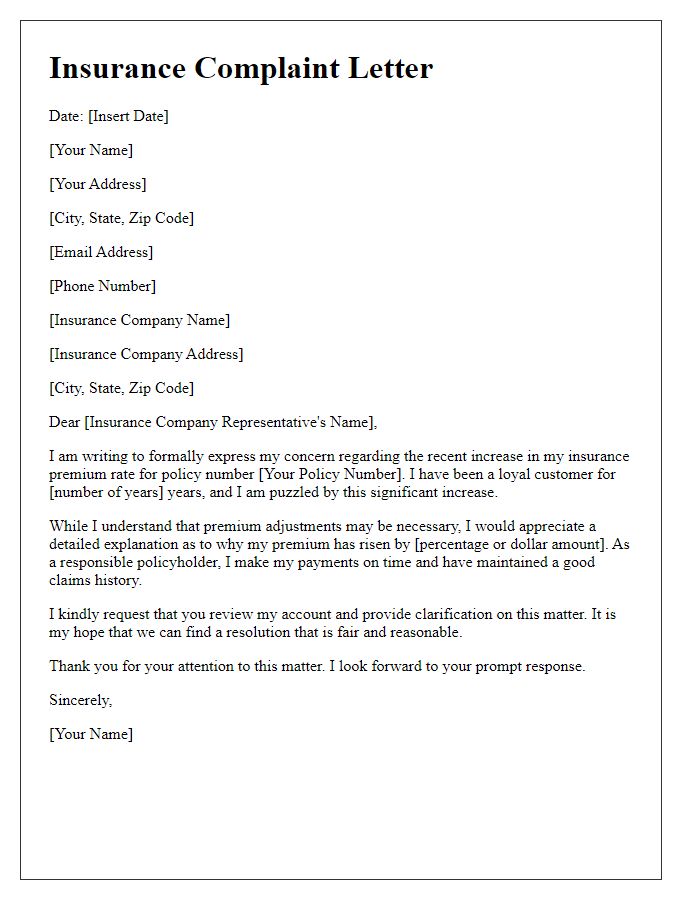

Letter template of insurance complaint concerning premium rate increase.

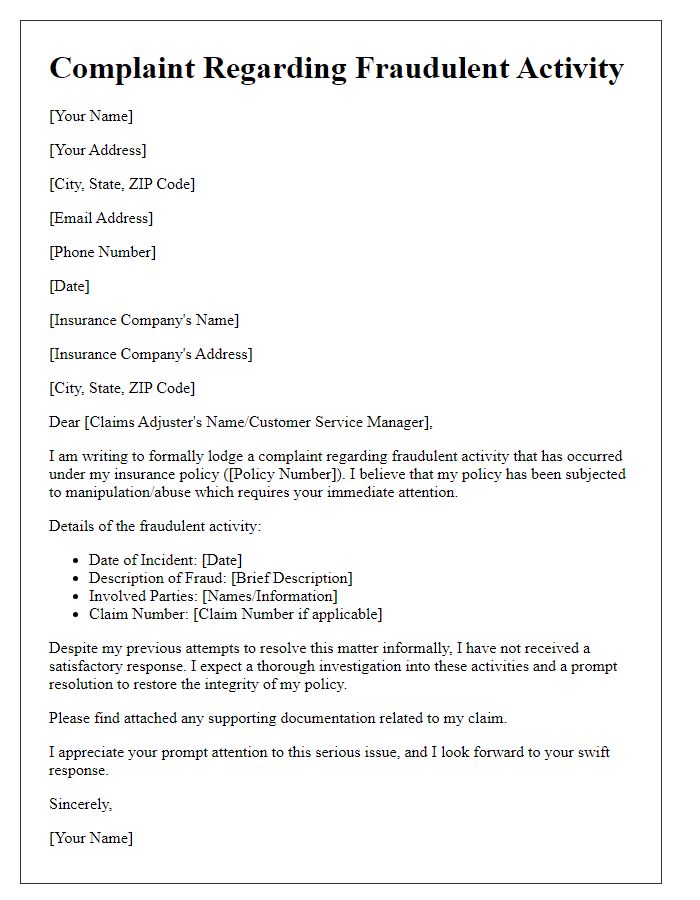

Letter template of formal insurance complaint related to fraudulent activity.

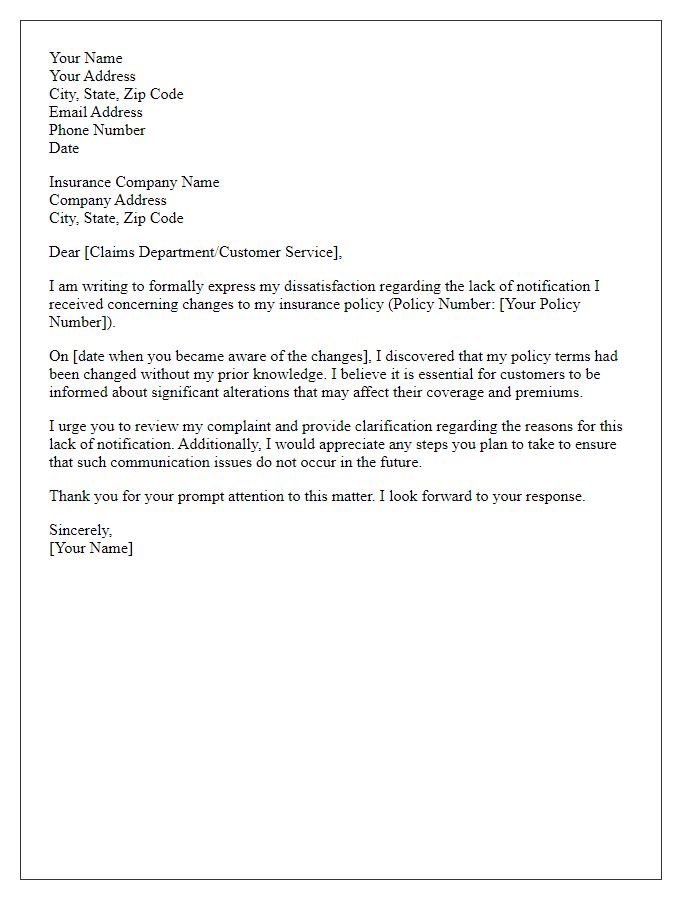

Letter template of insurance complaint about lack of notification on policy changes.

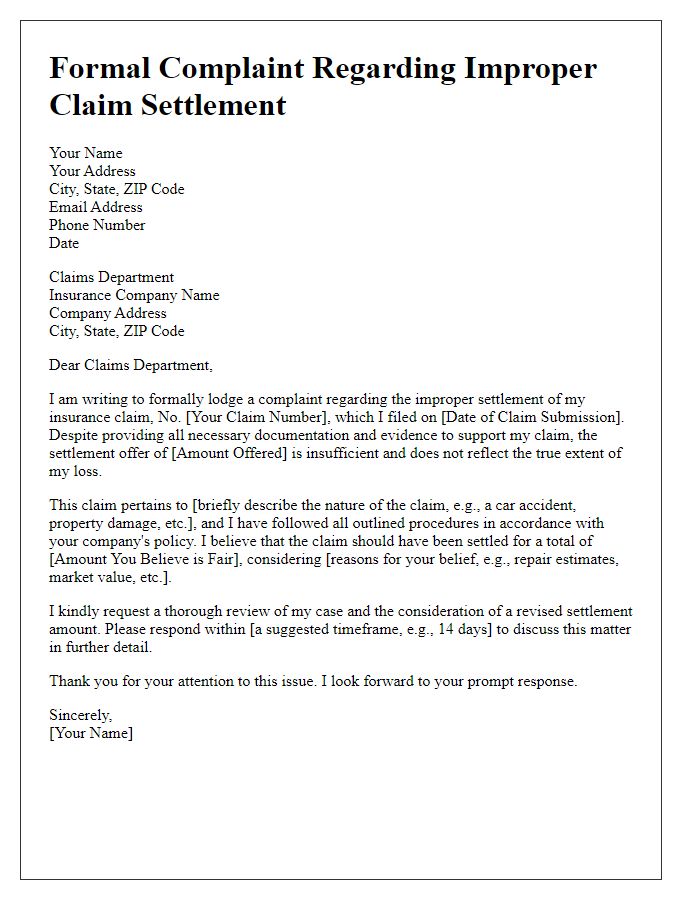

Letter template of formal insurance complaint for improper claim settlement.

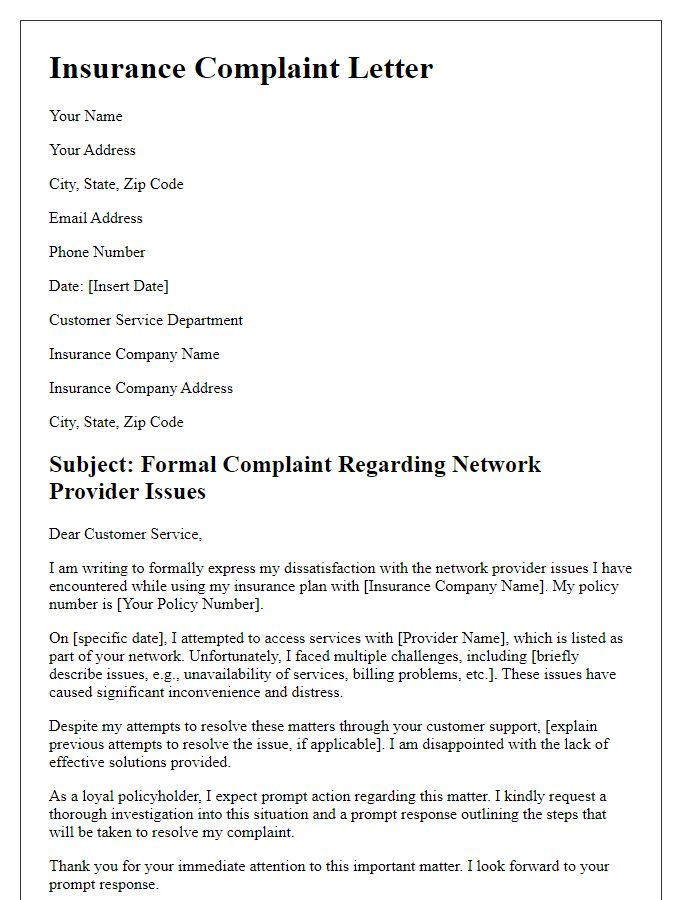

Letter template of insurance complaint regarding network provider issues.

Comments