Are you looking to update a policy beneficiary and unsure how to communicate it effectively? Writing a clear and informative letter is essential to ensure that your intentions are properly conveyed. In this article, we will guide you through a concise letter template, making the process straightforward and stress-free. Stick around to discover how to craft a letter that not only updates your beneficiary but also assures them of your thoughtful consideration!

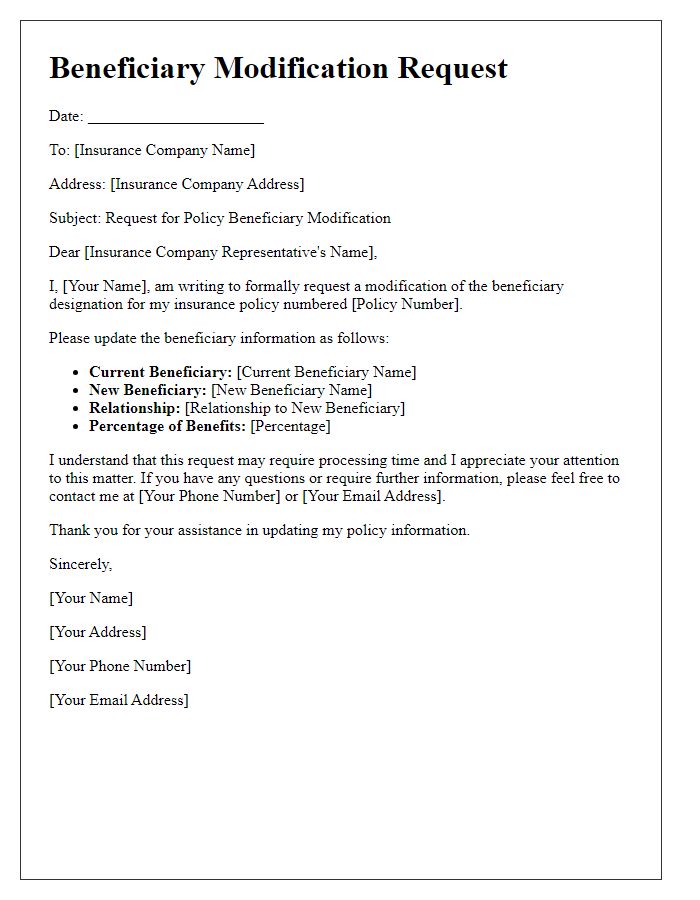

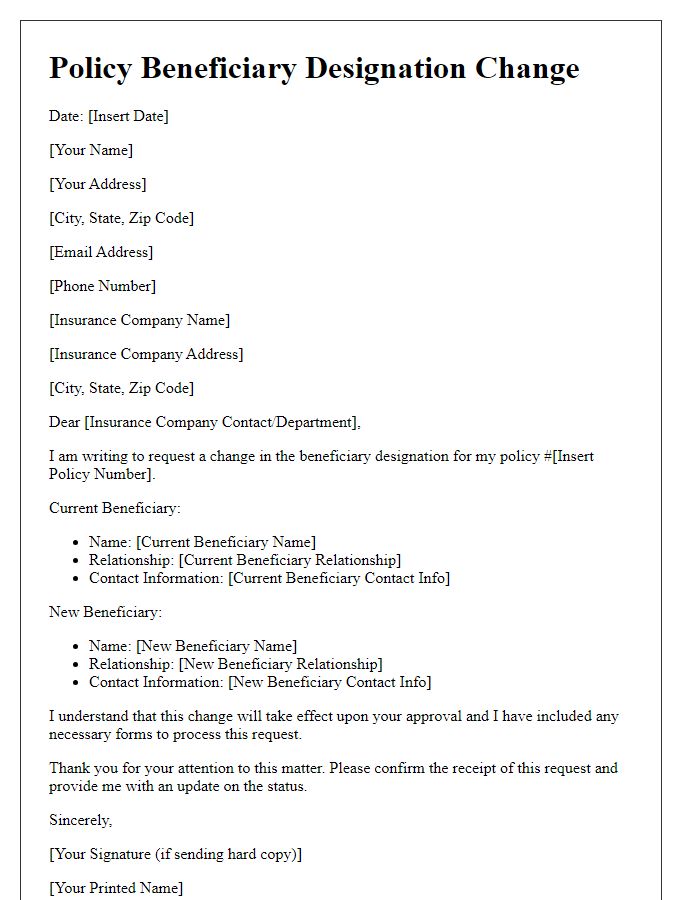

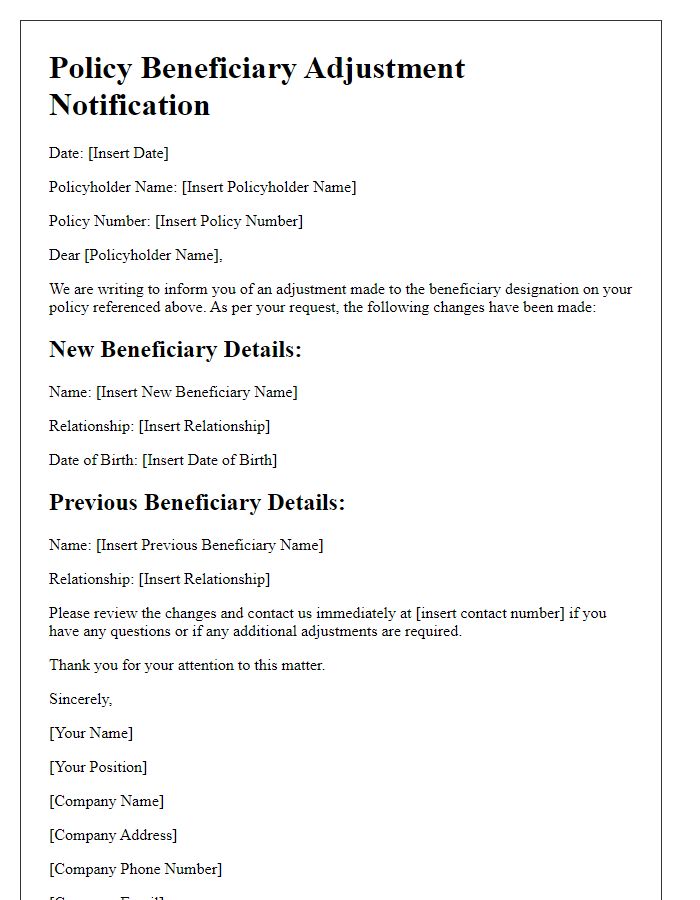

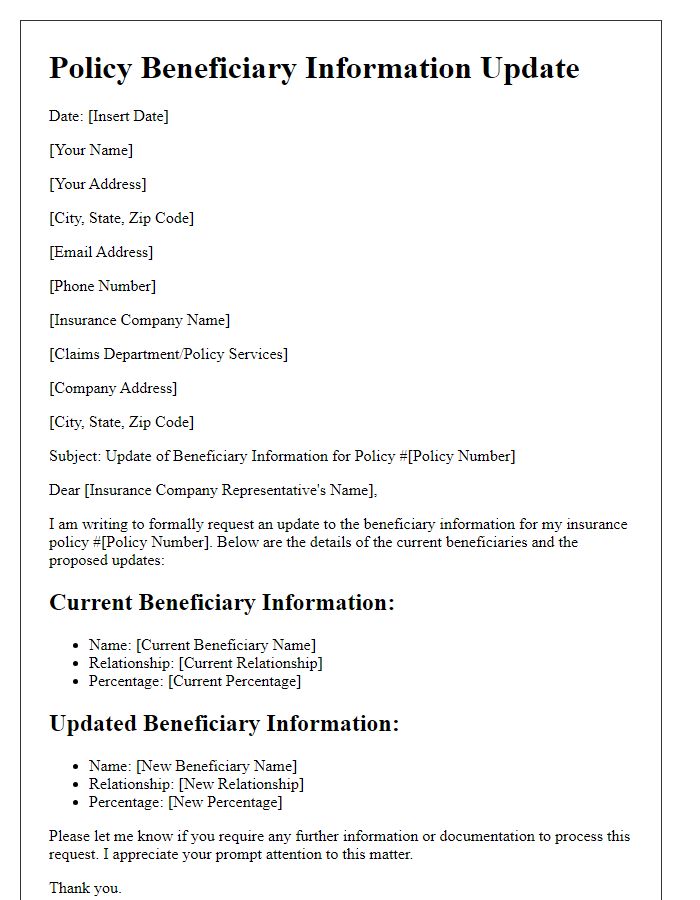

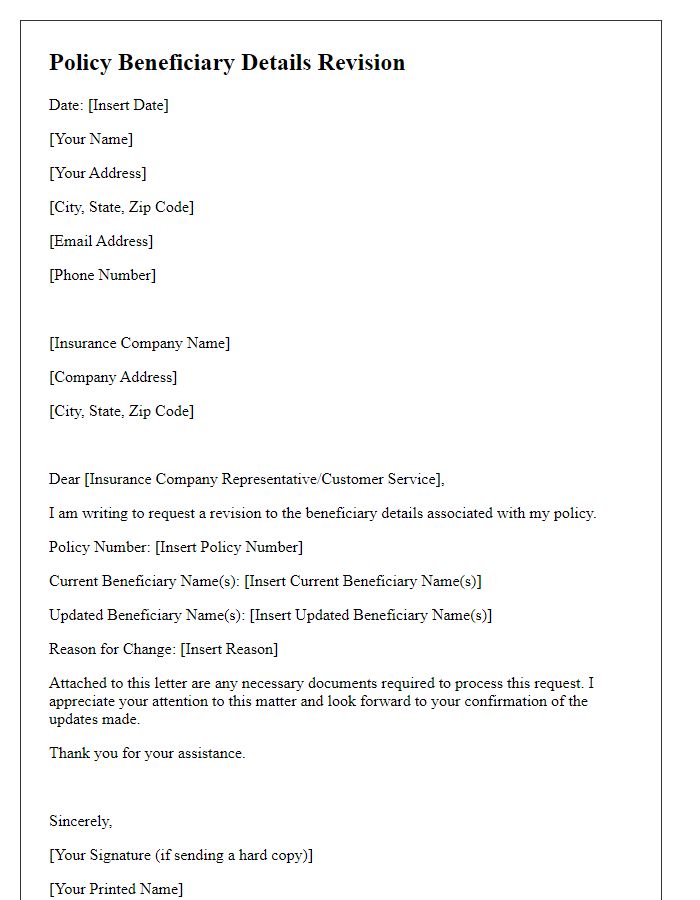

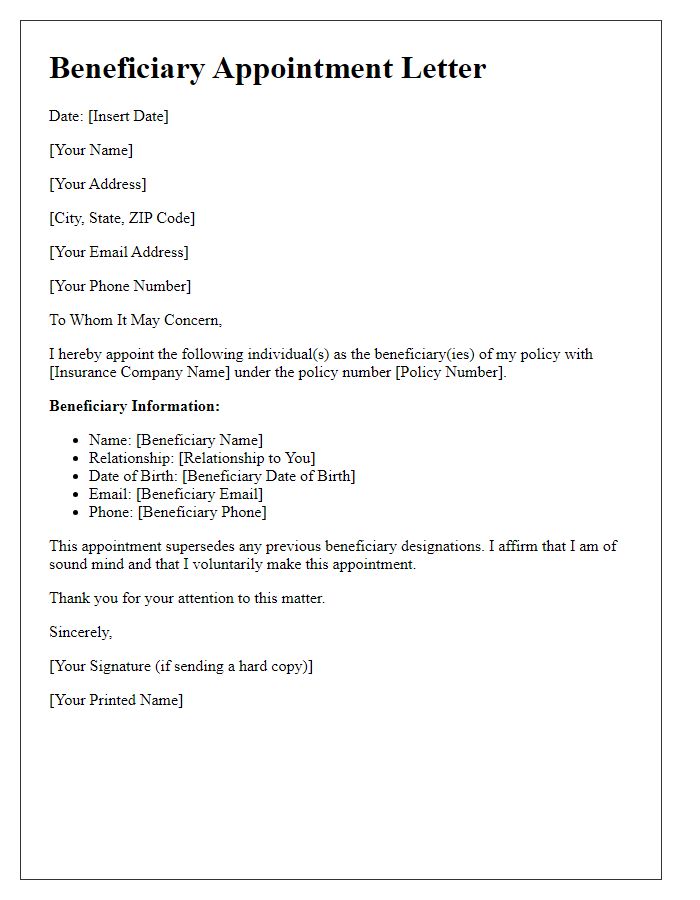

Policyholder Information

The policyholder information section consolidates critical data regarding individuals or entities holding an insurance policy. This section typically includes the full legal name of the policyholder, which can affect identification during claims (e.g., Johnathan Smith). Contact details such as phone number and email address facilitate immediate correspondence regarding policy updates or claims processing. The policy number serves as a unique identifier, ensuring accurate tracking and management by the insurance provider. Additionally, the policyholder's residential address is essential for delivering documents and notifications, which may be subject to verification. Accurate personal information ensures seamless communication and enhances the efficiency of claims resolution.

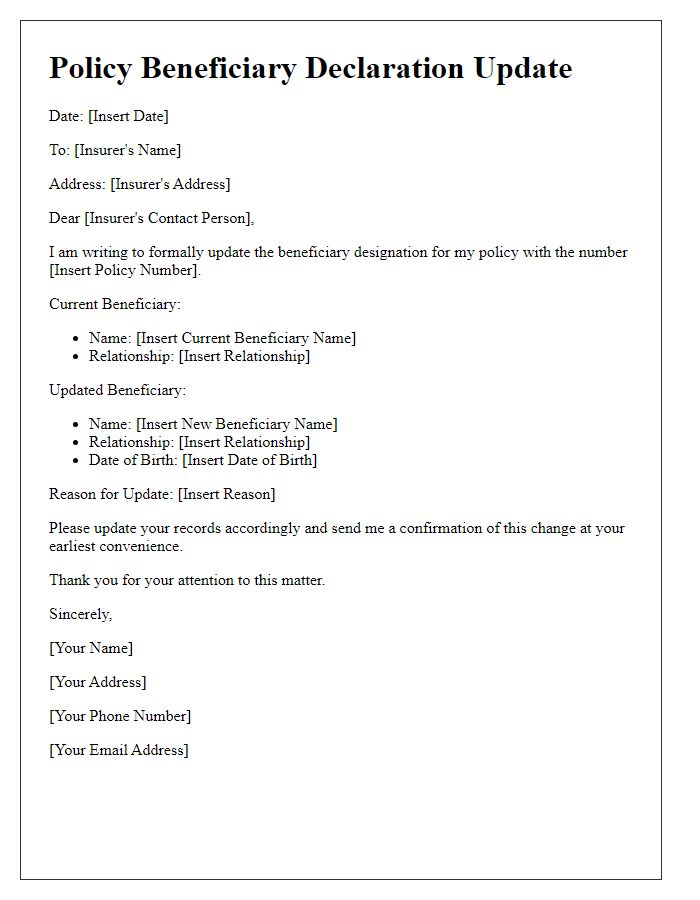

Beneficiary Details

Updating beneficiary details in an insurance policy is crucial for ensuring the correct individuals receive benefits after an event. Key elements include full names, birthdates, Social Security numbers, and relationship to the policyholder. Accurate information prevents complications during claims processing. Beneficiary designation should also indicate primary and contingent beneficiaries to establish order of benefit disbursement. It is advisable to review this information regularly, especially after significant life changes such as marriage, divorce, or the birth of a child, which might necessitate alterations in beneficiary status. Updating this information can usually be done through formal request forms provided by the insurance company.

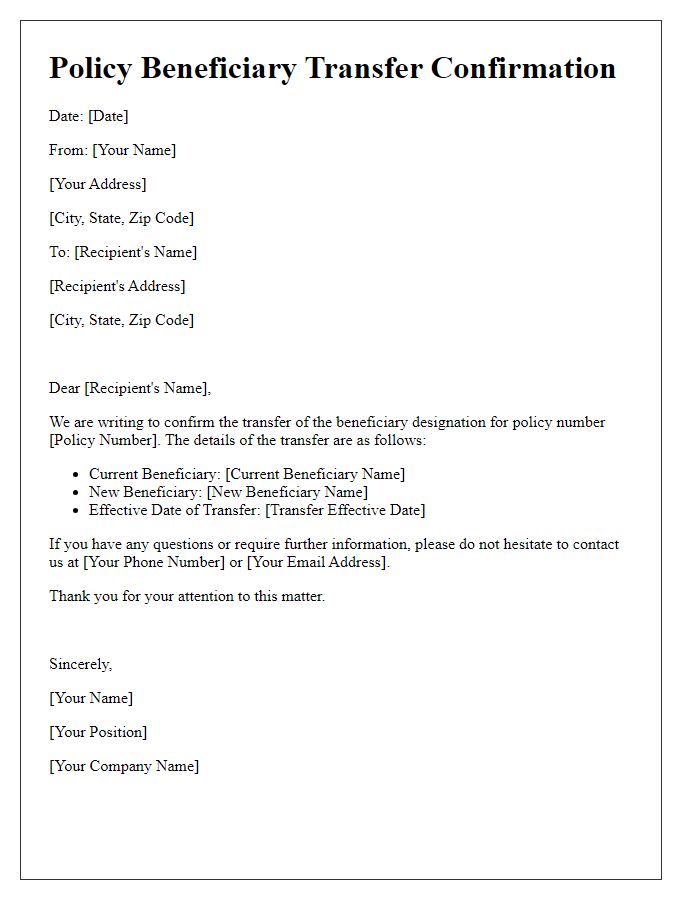

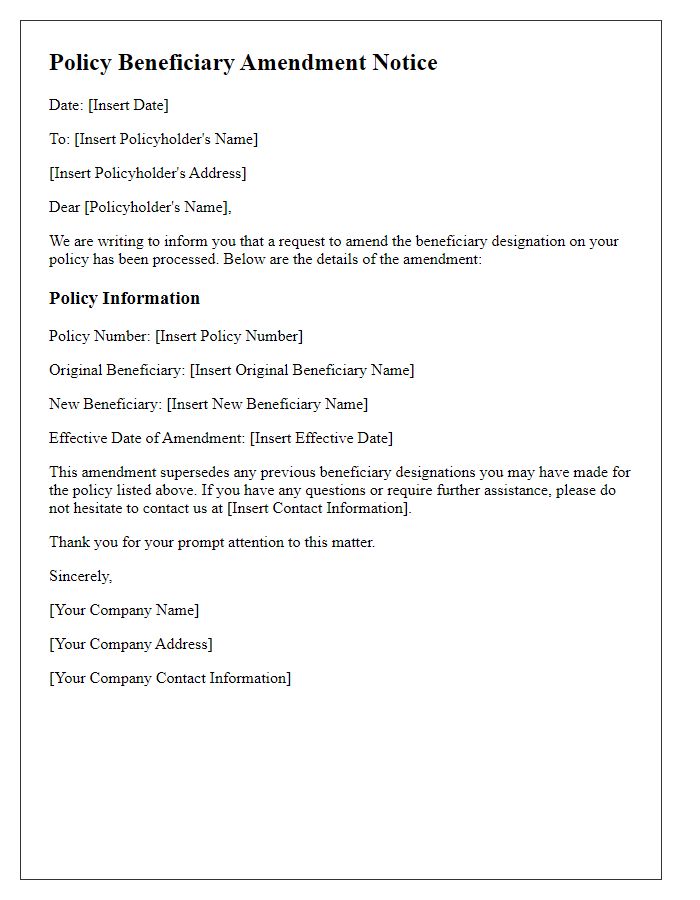

Effective Date

Policy beneficiary updates are critical for ensuring that your insurance or financial benefits reflect your current wishes. The effective date, often determined at the time of submission, signifies when the changes take effect. For example, an insurance policy with an effective date of January 1, 2024, will update the designated beneficiaries on that date, impacting payout instructions. Maintaining accurate records with financial institutions, such as banks or insurance companies, can prevent potential disputes in the event of a claim. Furthermore, it is advisable to review beneficiary designations periodically, especially after life events, such as marriage, divorce, or the birth of children, to guarantee alignment with your intentions.

Authorization Signature

Updating the policy beneficiary requires an official authorization signature to ensure validity. This process typically involves accessing the insurance provider's designated forms, often available on their website or through customer service. Affected individuals must provide pertinent information, including the policy number, the full name of the policyholder, and the intended beneficiary's details. It's crucial to review the specific rules of the insurance provider (such as those of Aetna, MetLife, or State Farm) regarding beneficiary updates, as different companies have varying requirements. The completed form should be submitted according to the specified submission methods, whether by mail or electronically, to finalize the update. Always retain copies of all submitted documents for future reference.

Contact Information

Updating contact information for policy beneficiaries is vital for ensuring seamless communication and effective management of insurance policies. Accurate data, such as current phone numbers, email addresses, and residential addresses, enhance the ability of insurers to provide essential notifications regarding policy changes, claims, and annual updates. Timely updates can lead to better customer service experiences, especially during critical events like natural disasters or health emergencies. Insurers often require specific formats for submitting these changes, which prioritizes clarity and accuracy in the documentation provided. Establishing designated points of contact within insurance firms can optimize the processing of contact updates and minimize delays.

Comments