Have you ever found yourself wondering how long it takes for your insurance claim to be processed? It can be a frustrating wait, especially when you're counting on those funds to move forward. In today's article, we'll explore the best ways to request an update on your claim's processing timeline and ensure that you're not left in the dark. So, if you're ready to take charge and get answers, keep reading to discover helpful tips and a handy letter template!

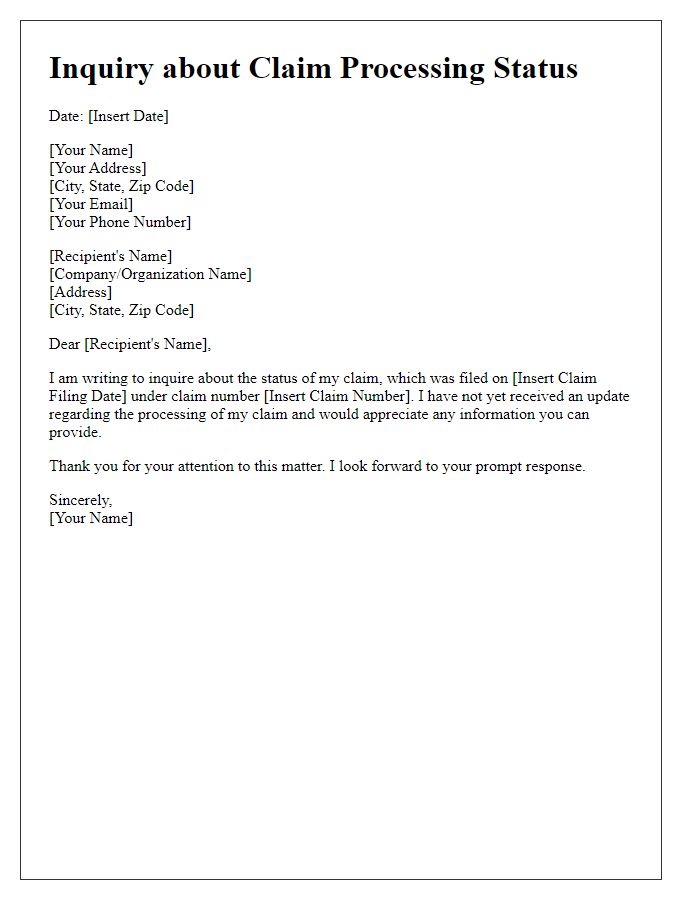

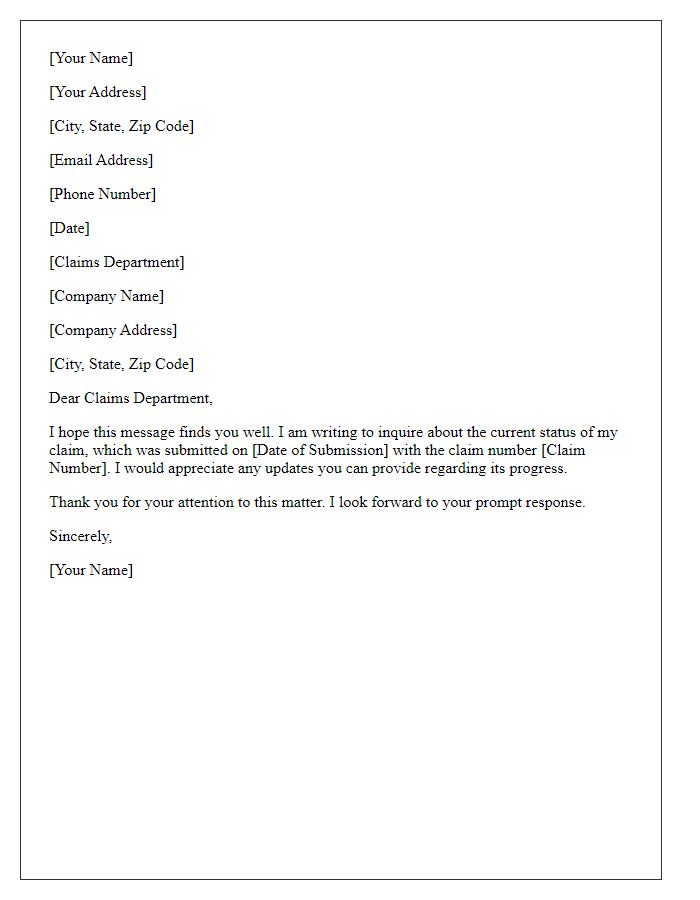

Contact Information

Claim processing timelines can vary depending on the insurance provider or claims department involved. Common timelines typically range from 15 to 30 business days, contingent on claim complexity and required documentation. Accurate contact information for reaching the claims department (such as phone number, email, and mailing address) is crucial for timely follow-up and inquiries regarding status. Properly formatted claim forms and supporting documents, including policy numbers and evidence of loss, can expedite processing. Understanding specific state regulations may also play a role in the timeline, particularly in areas with consumer protection laws governing insurance practices.

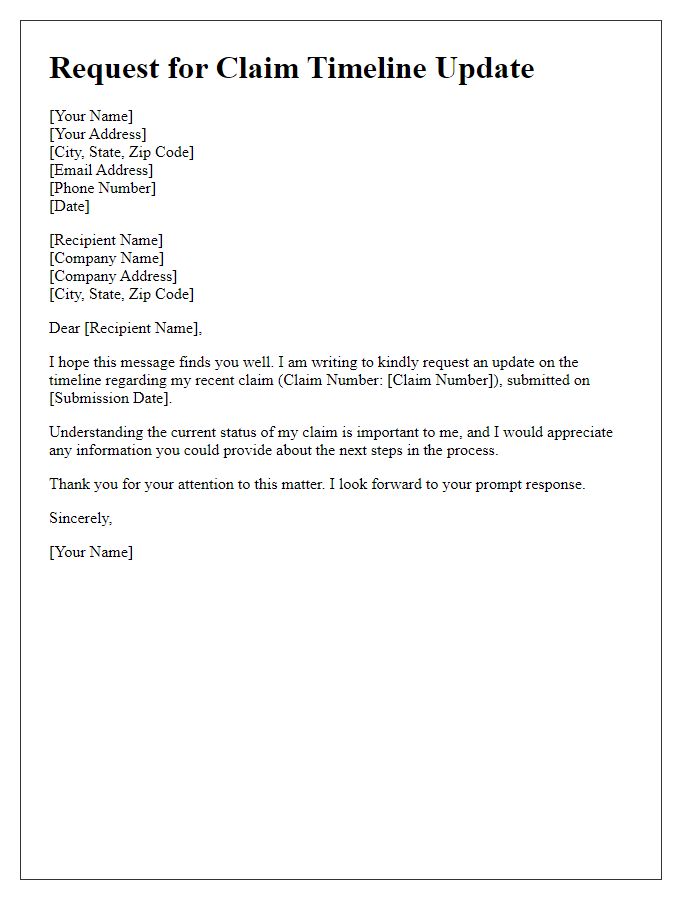

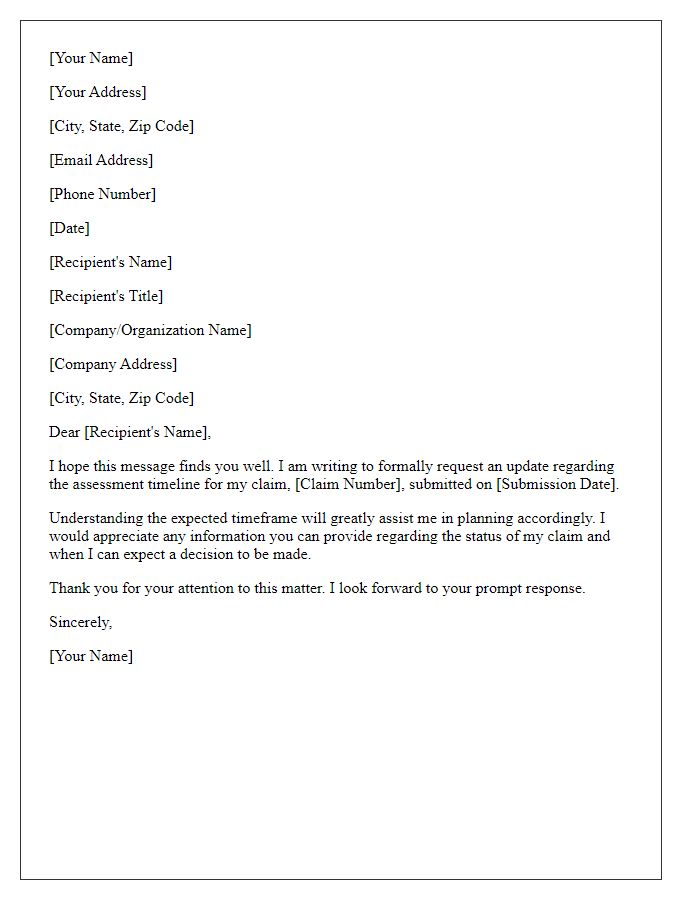

Policy or Claim Details

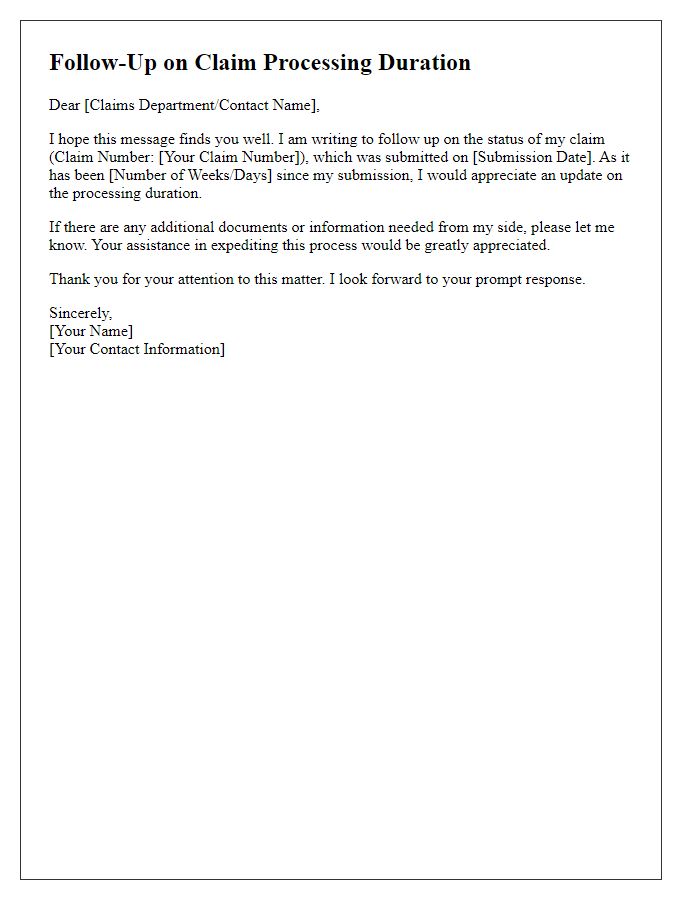

The insurance claim processing timeline greatly impacts policyholders' ability to manage financial expectations effectively. Average processing times for claims, particularly those involving health insurance or property damage, can range from 30 to 90 days based on insurer policies. For example, in New York, certain auto insurance claims may take longer due to state regulations requiring thorough investigations. Claims related to natural disasters, such as hurricanes or wildfires, can experience significant delays, often exceeding 120 days, as seen in the aftermath of Hurricane Sandy in 2012. Understanding these timelines assists policyholders in planning for potential expenses during the waiting period. Additionally, awareness of the claims department's contact information can expedite updates on claim status, ensuring timely communication throughout the process.

Clear Request for Timeline

A clear request for a claim processing timeline is essential for understanding the duration of a claim review, particularly in insurance or warranty contexts. Claimants need to know estimated timelines to manage expectations and plan accordingly. Claim processing timelines can vary widely; for instance, auto insurance claims may take anywhere from a few days to several weeks, depending on the complexity of the case and the volume of claims being handled. Monitoring the status of different types of claims, such as health insurance, home insurance, or warranty claims, is crucial since each type may follow different internal protocols and prioritize differently. Providing accurate information can help claimants seek assistance when required and ensure they remain informed during the review process.

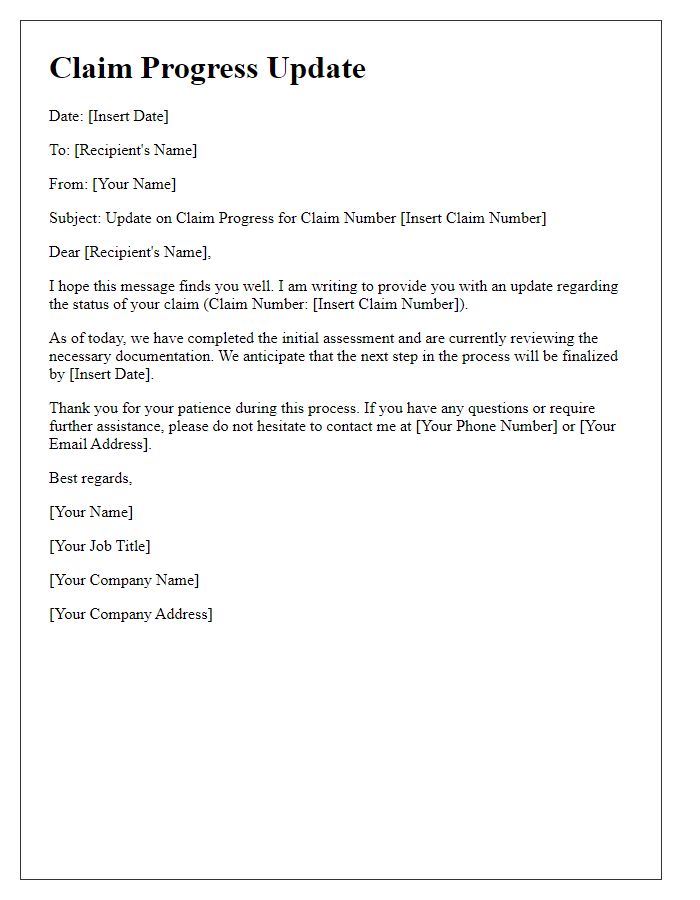

Polite Closing Statement

When seeking information regarding a claim processing timeline, it is important to express appreciation and maintain professionalism. A polite closing statement could include expressions of gratitude for the recipient's attention to the matter and a courteous request for timely feedback. Ensuring that the tone remains respectful will reinforce the importance of the inquiry while also fostering positive communication. For example: "Thank you for your attention to this matter. I appreciate your assistance and look forward to your prompt response regarding the timeline for the processing of my claim.

Reference to Policy or Terms

The claim processing timeline can significantly impact the financial stability of policyholders. Insurers are mandated to adhere to specific guidelines outlined in the Insurance Regulatory and Development Authority (IRDA) regulations. Delays may occur due to various factors such as inadequate documentation or complex claim assessments. Timeliness is especially crucial for significant events like natural disasters or unexpected accidents, which may necessitate rapid financially supportive measures. Policy Number (insert specific number) outlines the expected turnaround times, typically ranging from 30 to 60 days, depending on the claim complexity. Stakeholders should regularly review claim updates to ensure adherence to the stipulated timeframes outlined in the policy terms.

Comments