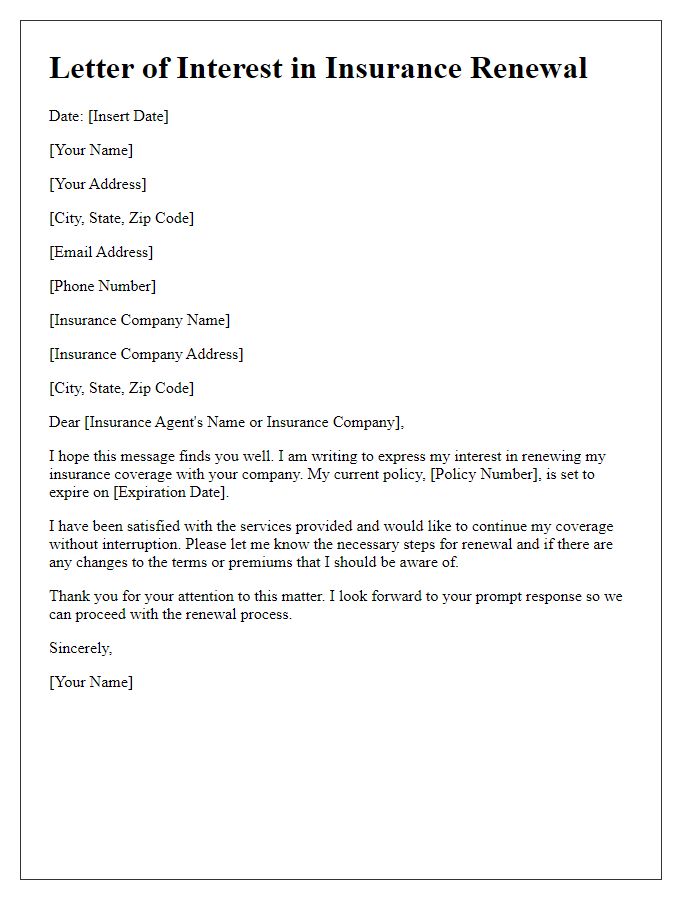

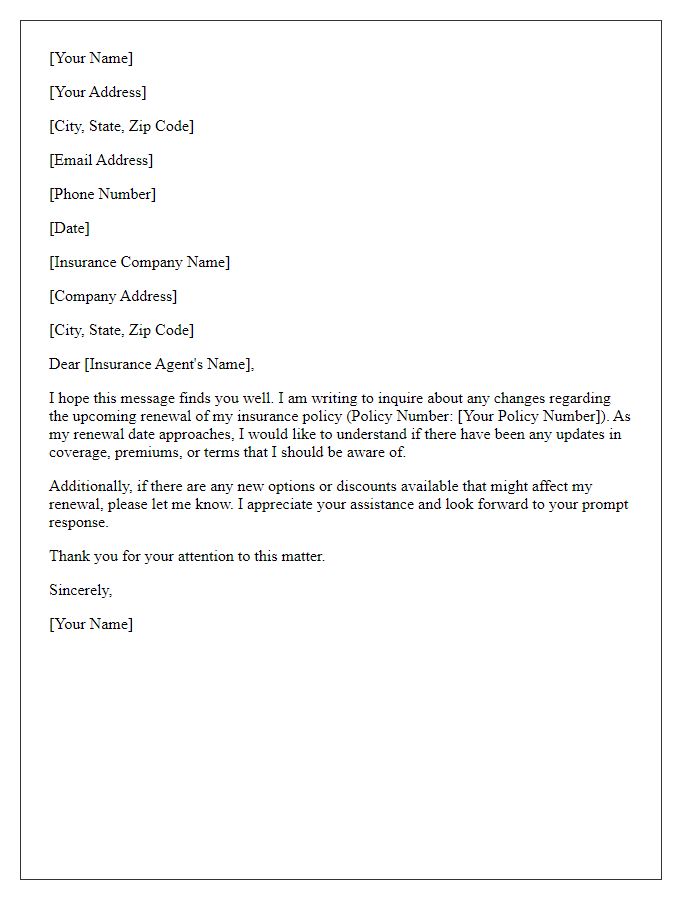

Are you wondering how to efficiently handle your insurance renewal? Many individuals find themselves navigating the intricacies of renewal inquiries, and it's essential to understand the process to secure the best coverage. By crafting a clear and concise letter, you can effectively communicate your needs to your insurance provider. Ready to learn more about creating the perfect inquiry letter? Let's dive in!

Full Policy Details

Insurance policy renewal inquiries often revolve around obtaining comprehensive policy details, which include various aspects such as coverage limits, exclusions, and premium amounts. For example, a car insurance policy, like those offered by Progressive or Geico, typically contains sections detailing liability limits (often expressed in figures such as $100,000/$300,000 for bodily injury coverage), collision coverage, and comprehensive coverage amounts. There may also be specific endorsements or riders that enhance coverage, such as rental car reimbursement or roadside assistance. Additionally, the policy number, effective dates (usually one year), and the insured vehicle's make and model (e.g., 2020 Toyota Camry) need to be confirmed to ensure accuracy in renewal discussions. It is vital to gather this information in advance for a smooth renewal process and to address any changes or updates that may be necessary based on personal circumstances or company policy adjustments.

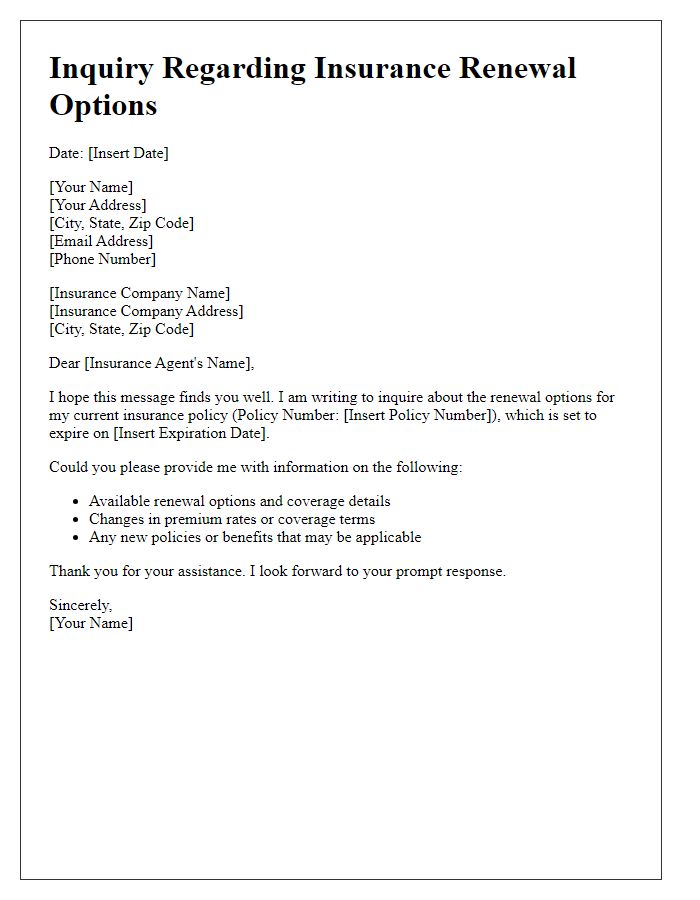

Current Coverage and Benefits

Insurance policies provide essential protection against unforeseen risks. Current coverage often includes various benefits, such as liability protection, collision coverage, and comprehensive protection. It's vital to understand specific details, such as limits on coverage amounts, deductibles, and exclusions. Reviewing policy documents can clarify terms and conditions applicable to different circumstances. Additionally, considering updates to personal situations, such as increased asset values or lifestyle changes, may warrant adjustments in coverage levels. Inquire about any new benefits or discounts available, ensuring the policy remains relevant to current needs. Insurance companies typically revise policies annually, reflecting evolving market standards and regulations.

Premium Payment Information

Insurance renewal inquiries require detailed attention to premium payment information, including due dates, payment methods, and account numbers. Insurance policies, such as auto or home insurance, may have specific premium amounts due (like $1500 annually) that can vary depending on coverage levels. Renewal dates often coincide with initial policy effective dates, creating a consistent timeline for customers. Payment methods, such as credit card, bank transfer, or automated deductions, enhance convenience for policyholders. Additionally, it's crucial to verify account numbers to ensure accurate processing of payments, which can prevent delays in coverage renewals.

Renewal Terms and Conditions

Insurance policy renewal involves understanding specific terms and conditions that protect both the insurer and the policyholder. Renewal terms generally include premium adjustments based on risk assessment (e.g., claims history or market changes). Conditions may cover periods of coverage (typically one year) and changes to policy limits or deductibles. Exclusions often apply, relating to specific events or circumstances that may not be covered in the renewed policy. Policyholders should verify the accuracy of personal information and inquire about any discounts for claims-free years or bundled policies. Understanding these elements ensures that the coverage meets the policyholder's needs, especially in diverse areas such as health, auto, or property insurance.

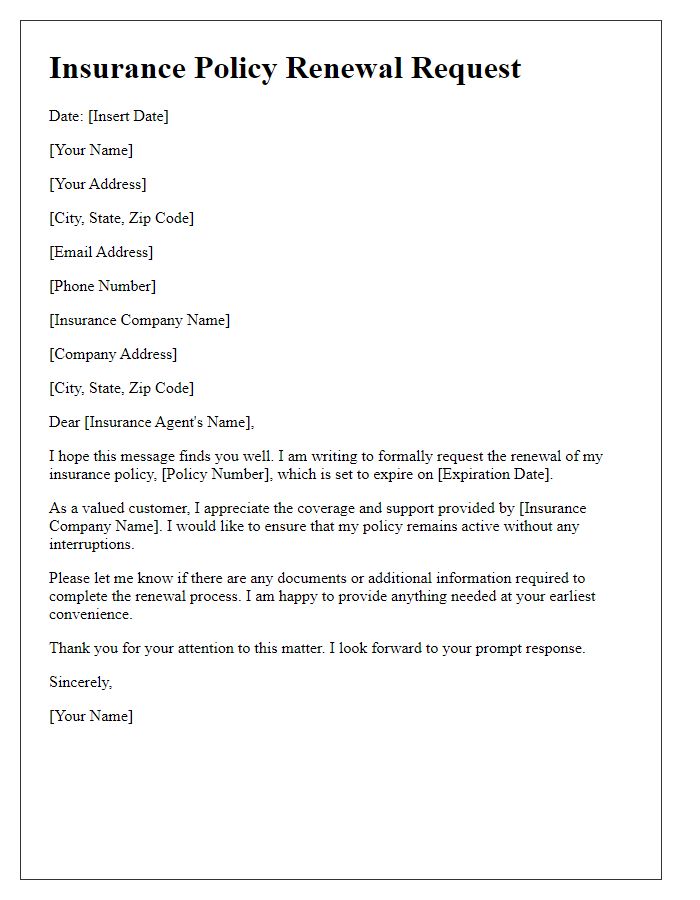

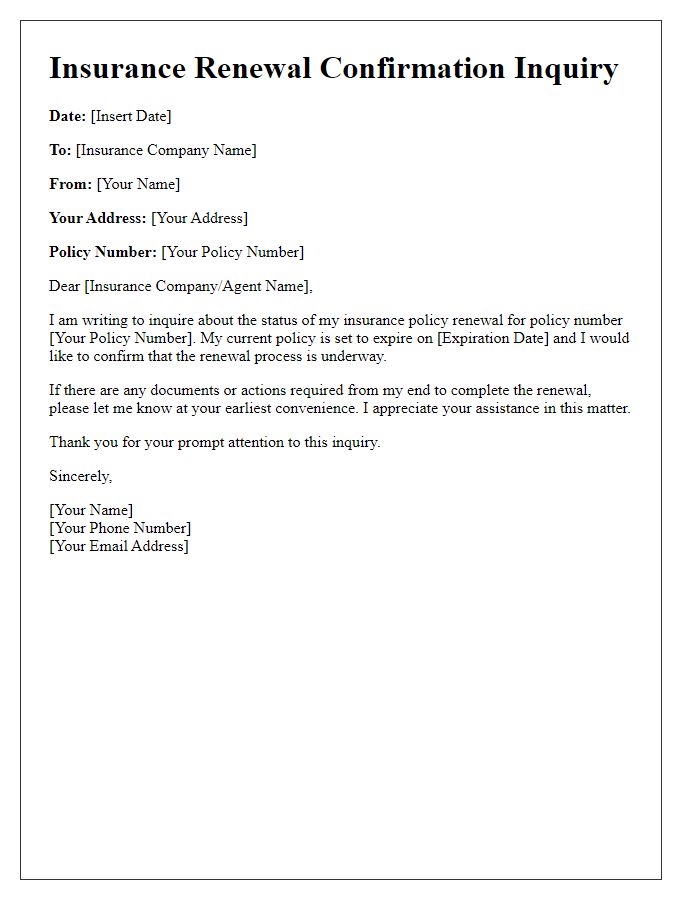

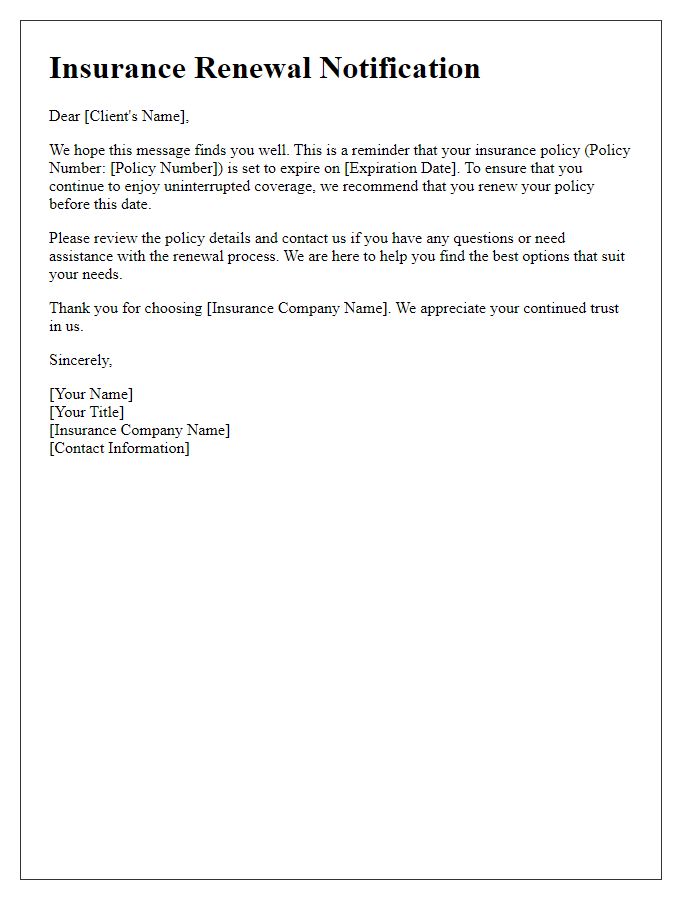

Contact Information for Further Assistance

Insurance renewal inquiries often require clear communication of key details to ensure smooth processing. Include critical information such as policy number, expiration date, and contact details (name, phone number, email address) for immediate assistance. Policies may cover various aspects like auto, home, or health insurance, each having specific renewal conditions and deadlines. Providing complete information facilitates timely responses from insurance representatives, allowing for any questions about coverage changes or premium adjustments. Essential for accountability, detailed records of past communication with insurers can also support effective follow-up inquiries.

Comments