Hey there! If you're looking to confirm your policy renewal details, you've come to the right place. Keeping track of those important dates and coverage changes can be a bit overwhelming, but we're here to help make it seamless for you. Dive into our article to discover everything you need to know about your policy renewal and ensure you're fully informed!

Personal Information Update

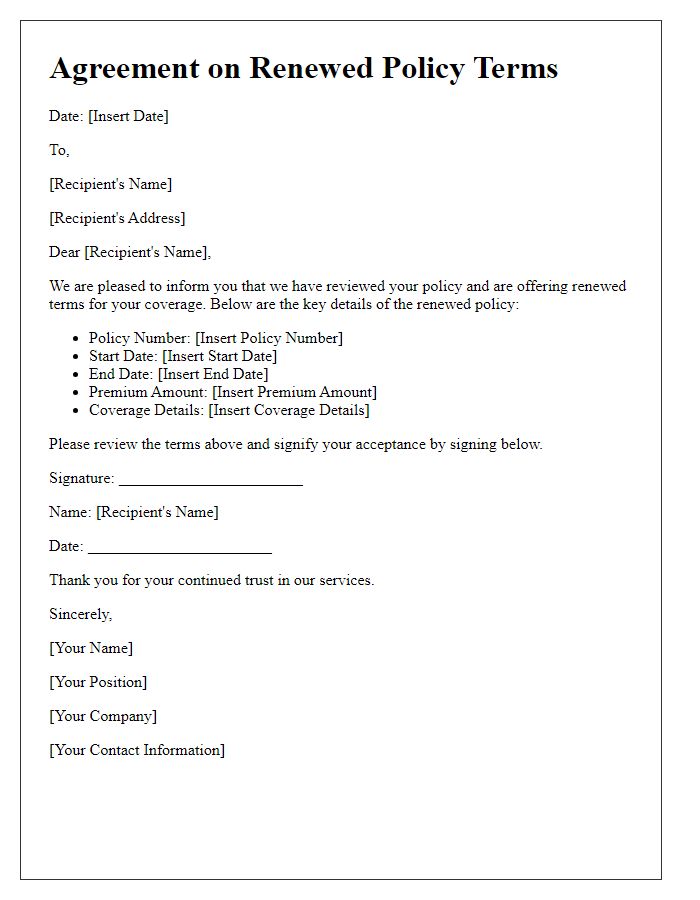

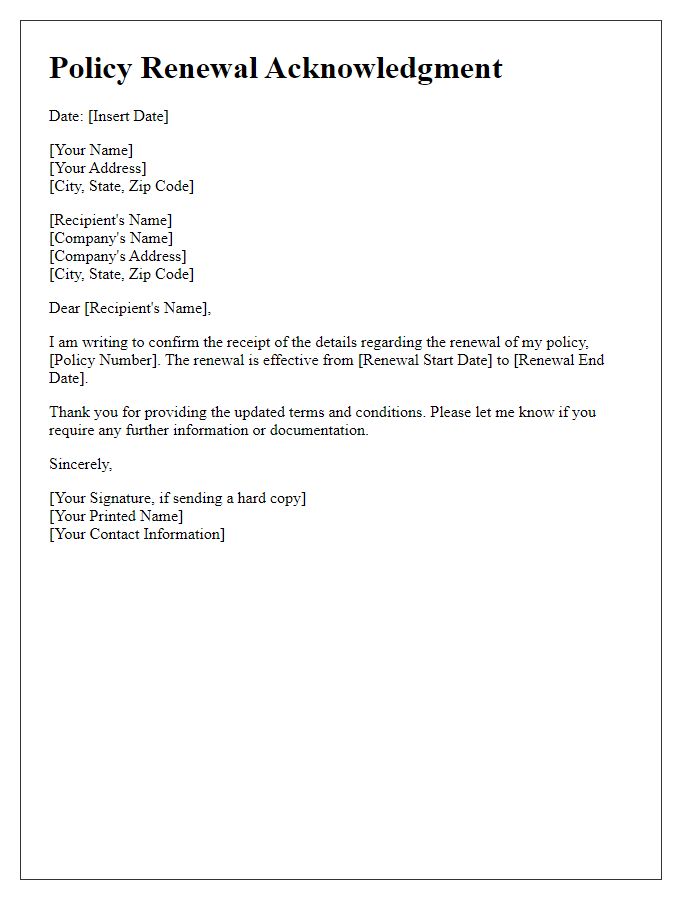

Policy renewal confirmation involves ensuring the accuracy of personal information related to insurance policies. Details such as the policyholder's name (for instance, John Doe), address (like 123 Elm Street, Springfield), and contact information (including phone number 123-456-7890 and email john.doe@email.com) must be current. Additional aspects include policy numbers (e.g., Policy #XYZ12345) and types of coverage (such as auto or home insurance) being renewed. Policy terms, renewal date (like January 1, 2024), and premium amounts also require validation. Maintaining updated personal information ensures efficient communication and compliance with insurance regulations.

Policy Number and Coverage Details

Policy number 987654321 serves as a reference for the comprehensive auto insurance coverage provided by Delta Insurance Company. This policy, effective from January 1, 2023, to December 31, 2023, includes liability coverage up to $250,000, collision coverage with a deductible of $500, and comprehensive coverage for theft or damage, with limits of $50,000. The renewal ensures uninterrupted protection against accidents and unforeseen events on roads across California. The next premium payment of $1,200 is due before midnight on December 15, 2023, to maintain active status. Failure to remit payment by this date may result in policy cancellation.

Premium Payment and Due Dates

Policy renewal confirmations outline vital details regarding premium payments and due dates for insurance plans, such as life insurance, health insurance, or auto insurance. The premium payment (the amount due for coverage) must be paid by the specified due date (often set annually, semi-annually, or monthly) to ensure uninterrupted coverage. For example, if the premium amount is $1,200 and the due date is January 15, 2024, timely payment is crucial to maintain policy benefits. Additionally, renewal notifications may include specifics about grace periods (typically 30 days) allowing policyholders a brief extension to make payments without losing coverage.

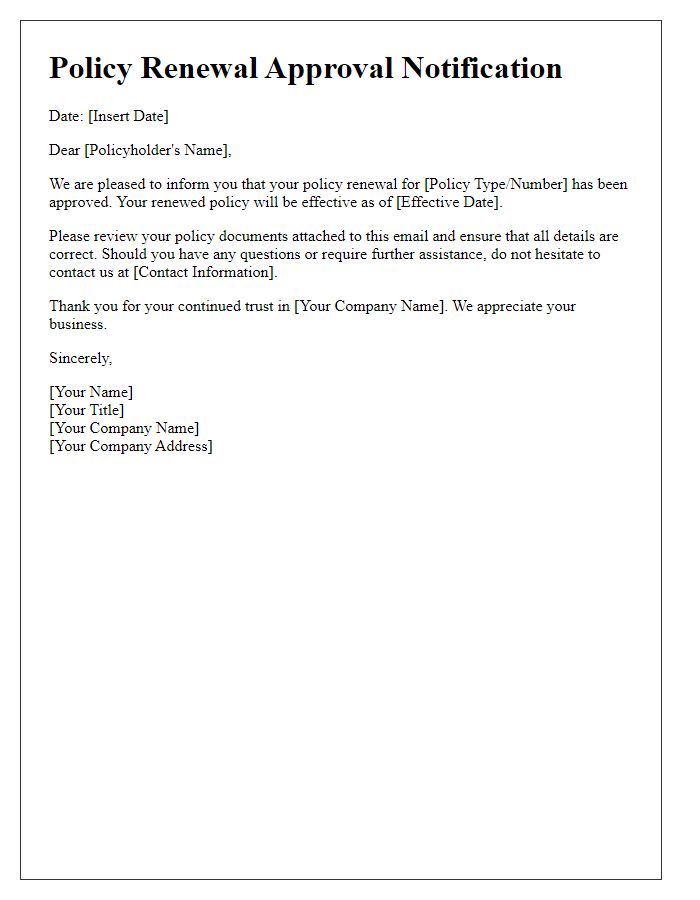

Terms and Conditions

Policy renewal details are crucial for understanding coverage continuity at XYZ Insurance Company. Customers must review the new terms and conditions thoroughly. Coverage limits may change; for example, personal property protection might adjust from $50,000 to $55,000. Premium amounts are subject to alterations based on recent risk assessments, which can include factors like claims history and property location within areas prone to natural disasters like hurricanes or floods. Deductibles could also shift, affecting the out-of-pocket expenses during claims. Policyholders should be aware of the grace period for paying the renewal premium, typically 30 days, to avoid lapses in coverage. Additionally, commitment to new endorsements or riders, such as identity theft protection or extended warranty services, requires acknowledgement of updated policy documents. Always consult with your insurance agent for personalized guidance.

Contact Information for Queries

Policy renewal confirmation is essential for maintaining continuous coverage and avoiding lapses in insurance. Customers typically receive a detailed statement outlining the terms of renewal, including premium amounts, effective dates, and any changes in policy conditions. Insurers encourage policyholders to review their information carefully and reach out with questions. Contact options usually include dedicated phone lines, email addresses, or online chat services available through company websites. These communication channels facilitate assistance regarding coverage specifics, billing inquiries, or claims support. Prompt engagement ensures clarity on policy details and peace of mind for the policyholder.

Comments