Are you considering modifying your travel insurance policy to better suit your upcoming adventures? Whether you're planning a weekend getaway or a months-long expedition, adjusting your coverage can provide you with the peace of mind you need. It's important to ensure that your policy reflects any new activities or destinations on your itinerary. Dive into our comprehensive guide to learn how to efficiently navigate the process of modifying your travel insurance policy!

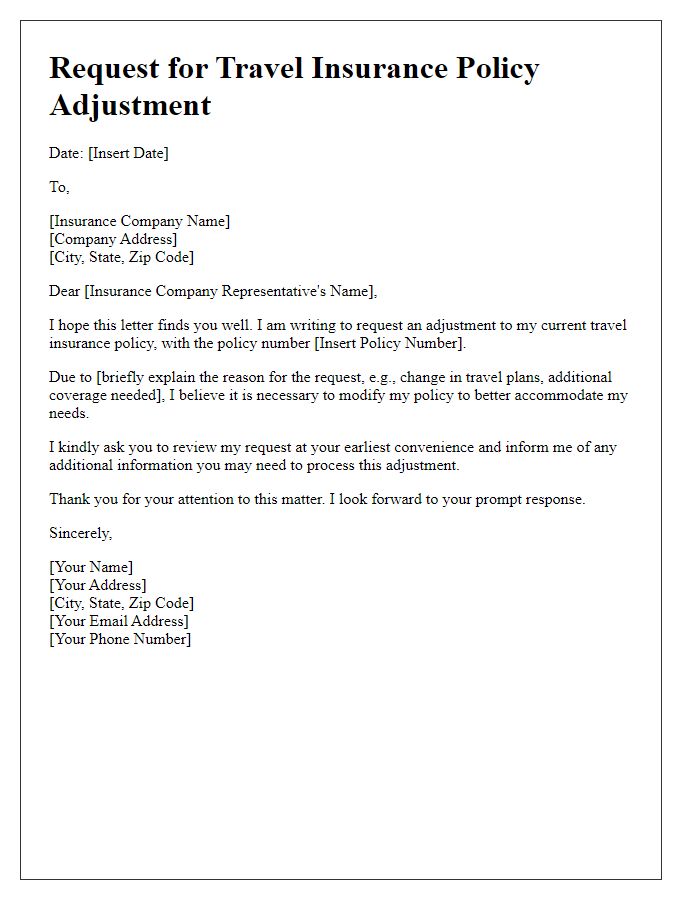

Policyholder Information

Travel insurance policy modifications can significantly impact coverage, particularly for travelers seeking assurance during journeys. Essential details, such as policyholder information, include names, addresses, and contact numbers, ensuring proper identification. Specifics about the trip, like destinations (e.g. Paris, France), travel dates, and activities (such as hiking or skiing), are crucial to assess coverage needs accurately. Additionally, updates on pre-existing medical conditions or necessary adjustments to family member inclusions may be required to tailor the policy effectively. Clear documentation aids in expediting the modification process, aligning insurance protections with individual travel plans.

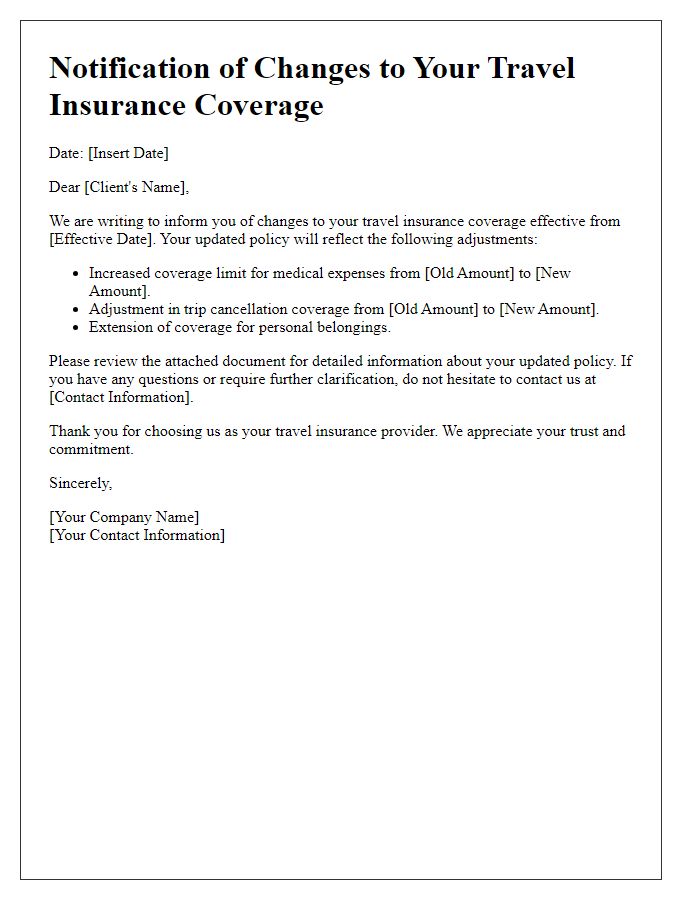

Current Policy Details

Travel insurance policies provide crucial protection for travelers against unforeseen events. Current policy details typically include essential information such as the policyholder's name, which identifies the individual covered by insurance, the policy number that serves as a unique identifier for claims and inquiries, and effective dates indicating the coverage period (from the start date to the expiration date). Coverage categories may encompass trip cancellation, medical emergencies, lost luggage, and travel delays, each denoting specific circumstances under which the insurer offers compensation or assistance. Premium amounts, determined by various factors like age, travel destination, and duration, reflect the policyholder's investment in their safety during travel. Furthermore, understanding exclusions in the policy is fundamental, as they outline specific situations or events not covered, shaping the overall protections offered to the traveler.

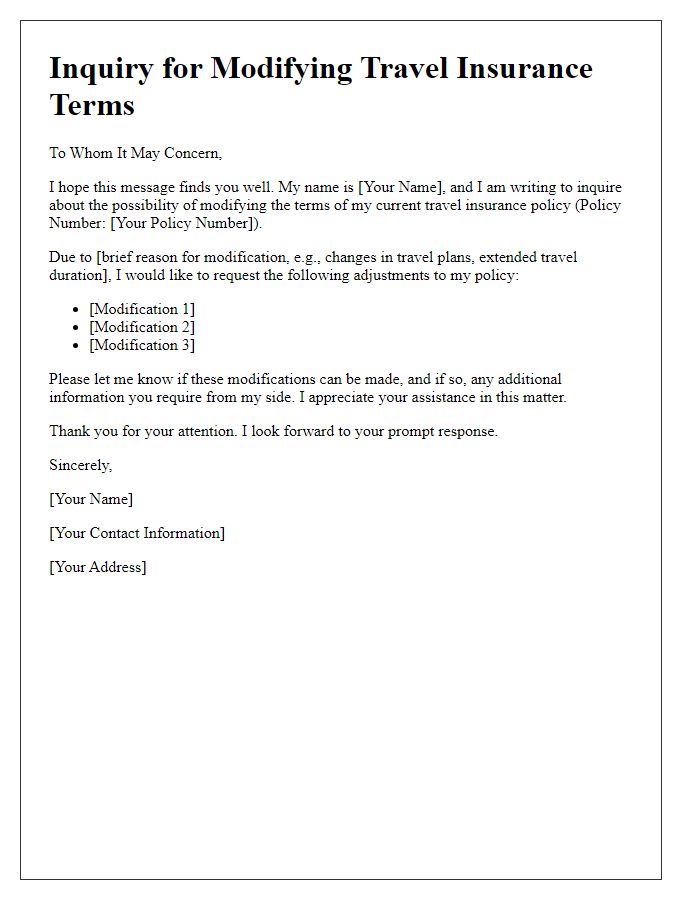

Requested Modifications

Travel insurance policies often require modifications to ensure adequate coverage. Policyholders may need to adjust limits on medical expenses, particularly in high-cost regions like North America where medical care can exceed $50,000 for serious injuries. Specific adjustments might include adding coverage for adventurous activities such as skiing in Aspen, Colorado, or scuba diving in the Bahamas, where higher risk factors are involved. Policyholders might also request trip cancellation coverage, especially relevant during unpredictable seasons like hurricane season in the Caribbean, affecting travel plans due to natural disasters. Additionally, updating personal information, such as adding a newly planned trip to Europe that includes multiple countries with varying healthcare standards, can enhance the policy's relevance and effectiveness.

Reason for Changes

Travel insurance policy modifications often arise due to various reasons necessitating adjustments. Travelers might experience changes in trip dates, requiring coverage extensions or reductions. Destinations may shift, prompting an update to include regions with different risk assessments, such as natural disasters or health advisories. Additionally, alterations in personal circumstances, like the addition of family members joining the trip or changes in medical conditions, may necessitate a review of coverage limits and exclusions. Lastly, policyholders may want to enhance their coverage based on recent travel experiences or new available options, ensuring adequate protection against unforeseen events during their journey.

Contact Information for Follow-up

Travel insurance policy modifications often require clear communication to ensure accurate updates. The policyholder should provide updated contact information, including a current phone number and email address, for efficient follow-up. This can facilitate timely responses from the insurance provider located at the headquarters in New York, specializing in comprehensive travel coverage. In case of claims or inquiries, having an accessible contact channel is essential for smooth communication, ensuring that any adjustments to the policy, such as extending coverage periods or adjusting personal information, are addressed promptly and accurately.

Comments