Hello there! Transitioning your health coverage can feel a bit overwhelming, but it's an important step towards ensuring your well-being. We understand that navigating through these changes might raise questions, and we're here to help clarify the process for you. So, if you're ready to learn more about what this transition entails and how you can effectively manage it, keep reading!

Personalization and Recipient Information

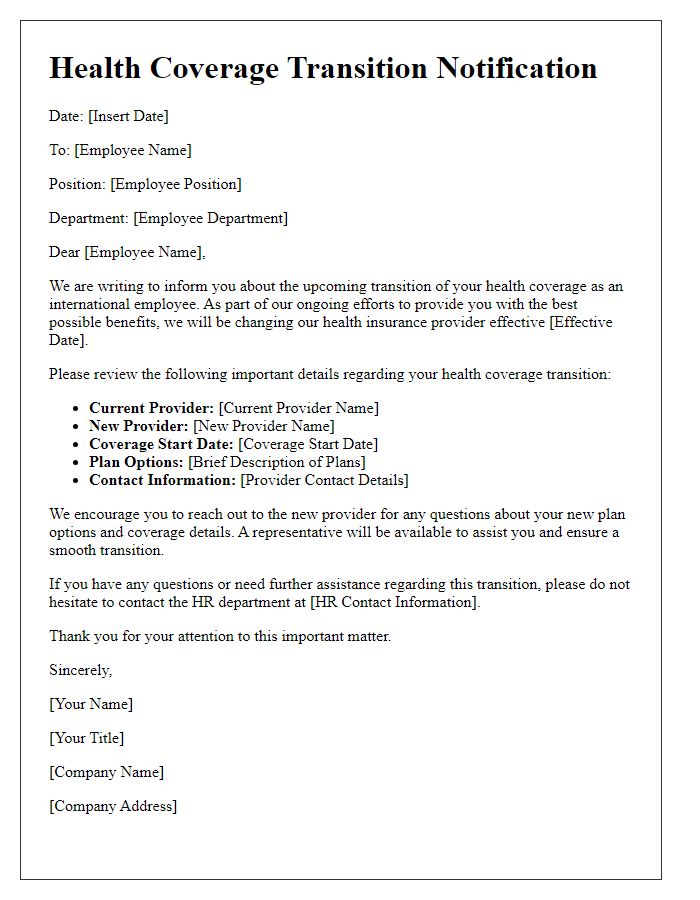

Health coverage transitions often occur due to significant life events, such as changing jobs, moving to a different state, or reaching the end of a specific plan duration. Transition notifications must be personal and clear to ensure understanding. For instance, the recipient, John Doe, residing at 123 Main Street, Springfield, needs detailed information regarding the effective date of the new health plan, premium costs, and coverage benefits. Furthermore, the notification should emphasize the importance of reviewing the new policy documents to avoid gaps in medical coverage during this adjustment period. Providing contact information for customer service representatives ensures immediate assistance with inquiries regarding the transition process.

Clarity and Transparency of Changes

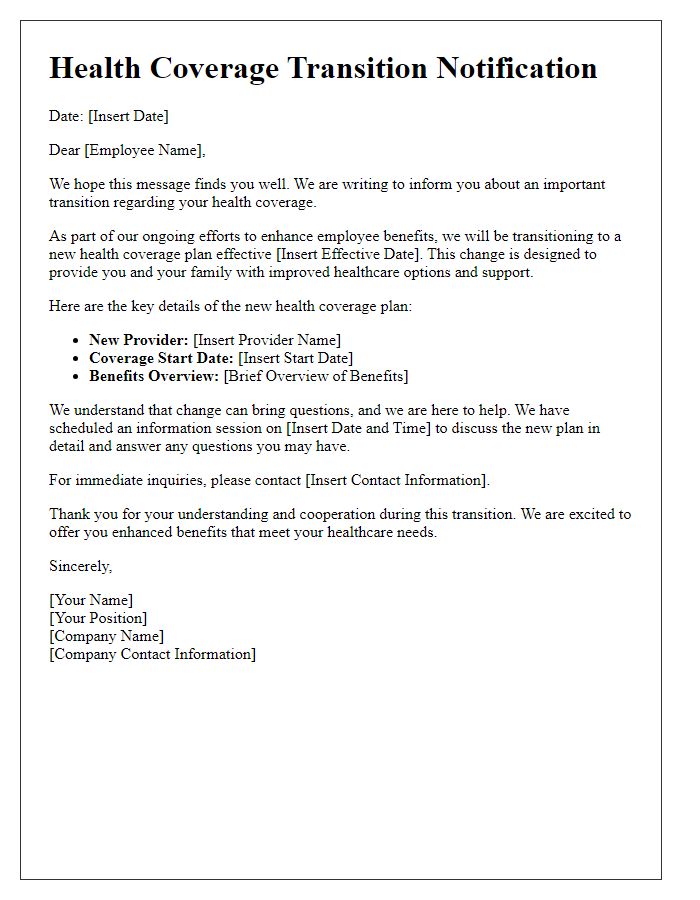

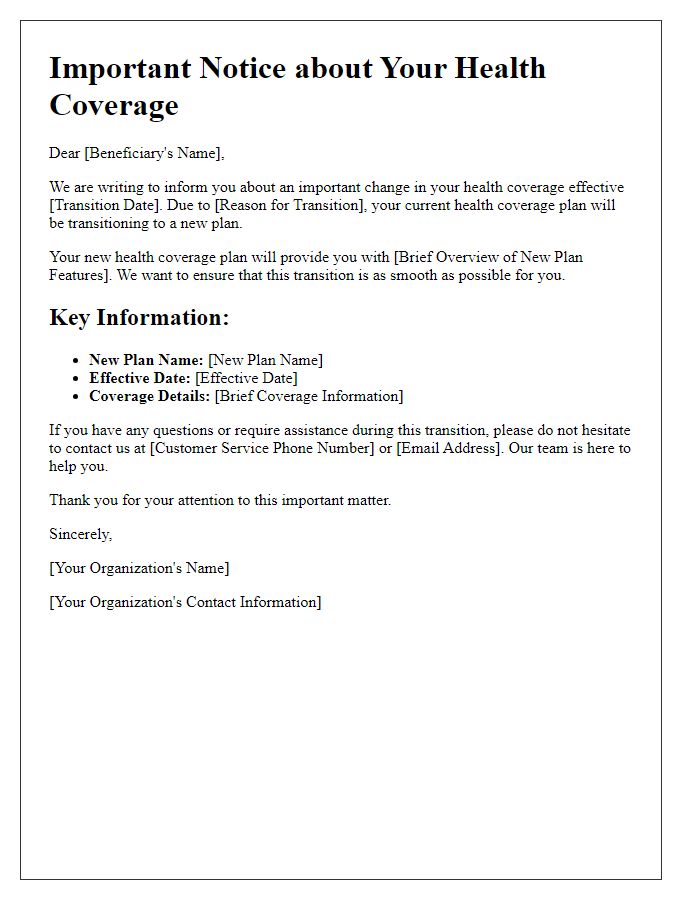

Health coverage transition notifications play a crucial role in informing beneficiaries about significant changes in their health insurance plans, especially during periods such as annual enrollment or mergers like UnitedHealthcare and Aetna. Beneficiaries may face adjustments in premiums, deductibles, co-pays, or covered services. Such notifications should be clear and easy to understand, detailing the specific changes to each plan, particularly for crucial services like preventive care or specialty medications. Including important dates, such as the transition period commencing January 1, 2024, and effective deadlines for enrolling in new plans, ensures that individuals are well-prepared. Additionally, a dedicated customer service hotline or website can offer ongoing support to address any questions or concerns about these transitions, ensuring that beneficiaries have the necessary resources to navigate their health coverage changes effectively.

Effective Dates and Coverage Details

Health coverage transitions often occur during significant life events or changes in employment status. Effective dates play a crucial role in ensuring continuous coverage during these periods. The new health plan, offered through a specific provider or employer, may include a variety of options such as individual, family, or group plans, with specific details on premiums, deductibles, and out-of-pocket maximums. Coverage details will outline the network of healthcare providers, including hospitals and specialists, as well as the scope of services such as preventive care, emergency services, and prescription drug benefits. Enrollees should be aware of any enrollment deadlines, grace periods, or required documentation to avoid lapses in coverage. Important notices or communications will typically highlight the importance of reviewing new benefit options, understanding costs associated with services, and familiarizing oneself with the new insurance card and policy number for efficient access to healthcare services.

Contact Information for Questions

Health coverage transition notifications are essential communications that inform individuals about changes in their insurance policies or coverage options. Providing contact information for questions is crucial for ensuring that individuals can seek clarification or assistance regarding their health coverage. Typically, dedicated hotline numbers (often toll-free), email addresses, or physical office locations are included in the notification. Effective communication can involve the inclusion of specific representatives' names or titles (such as Customer Service Manager or Health Benefits Coordinator) for personalized support. Additionally, online resources such as dedicated websites or mobile app summaries can enhance accessibility to information about coverage options, benefits, and enrollment processes. Clear, easily navigable contact methods empower individuals to make informed decisions during the transition period.

Legal and Compliance Disclosures

Health coverage transition notifications are essential documents informing individuals about changes in their insurance plans. These notifications must adhere to regulatory requirements set by federal agencies such as the Centers for Medicare & Medicaid Services (CMS). The communication should detail the transition date, typically set at the start of a new calendar year, such as January 1, to provide adequate preparation time for affected individuals. Important legal information regarding rights under the Health Insurance Portability and Accountability Act (HIPAA) should be included, emphasizing confidentiality. Compliance disclosures could involve pending claims processing and the impact on ongoing treatments, along with any necessary actions required from beneficiaries. Providing contact information for assistance, as well as links to resources such as the official Healthcare.gov website, is crucial for ensuring that individuals can navigate these changes smoothly.

Letter Template For Health Coverage Transition Notification Samples

Letter template of health coverage transition for international employees

Comments